Wisconsin Clawback Guaranty refers to a legal concept utilized in the state of Wisconsin, specifically in financial and real estate transactions. It serves as a protective measure for lenders and creditors by providing them with a remedy to recover funds or assets in case of default or certain specified circumstances. The main purpose of the Wisconsin Clawback Guaranty is to ensure that lenders have a fallback option if the borrower fails to fulfill their obligations as agreed upon in a loan or credit agreement. This guarantee gives lenders the ability to seek repayment not only from the primary borrower but also from designated guarantors. The Wisconsin Clawback Guaranty is typically included as an additional provision to the loan agreement, whereby a person or a business entity agrees to become a guarantor for the borrower's obligations. The guarantor is legally bound to pay back the borrowed funds, along with any accrued interest, fees, or penalties, if the borrower defaults on the loan. There are different types or variations of Wisconsin Clawback Guaranty that can be utilized depending on the specific circumstances and requirements. Some common types include: 1. Full Recourse Guaranty: This type of guaranty holds the guarantor fully responsible for the full amount of the loan or credit facility, including principal, interest, and other expenses, in case of borrower default. The lender can go after the guarantor's personal assets to satisfy the debt. 2. Limited Recourse Guaranty: This guaranty imposes limitations on the guarantor's liability. It specifies a maximum dollar amount, beyond which the guarantor is not obligated to repay. This type provides a level of protection for guarantors, limiting their financial exposure. 3. Notional Guaranty: In this type, the guarantor's obligations are not immediately enforceable and only come into effect under certain circumstances or events specified in the agreement. It offers flexibility by enabling the guarantor to avoid immediate liability while still acting as a backup option for lenders. 4. Conditional Guaranty: This type of guaranty comes into effect when the borrower fails to meet specific conditions outlined in the loan agreement, such as missing certain repayment deadlines or breaching certain terms. It allows lenders to enforce the guarantor's obligations under those specific conditions. 5. Continuing Guaranty: This form of guaranty remains in effect throughout the entire term of the loan or credit facility, even if there are changes in the borrower's circumstances. It offers lenders ongoing protection, ensuring that the guarantor remains liable until the loan is fully repaid. Overall, the Wisconsin Clawback Guaranty is an essential legal tool that provides lenders with an added layer of protection by holding guarantors responsible for potential losses resulting from borrower default or specific breach of loan terms. By understanding the different types of guaranty available, borrowers, lenders, and guarantors can negotiate and establish agreements that suit their specific needs and risk tolerances.

Wisconsin Clawback Guaranty

Description

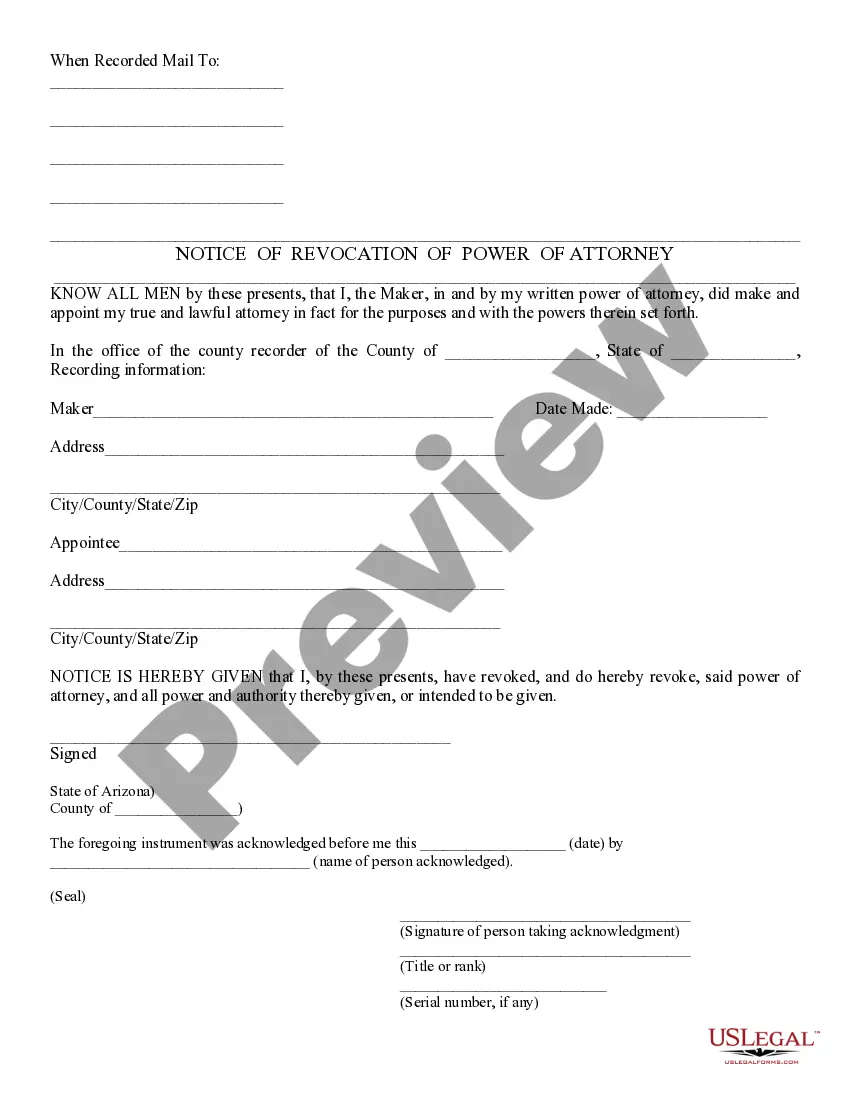

How to fill out Wisconsin Clawback Guaranty?

If you want to comprehensive, download, or print out legitimate document templates, use US Legal Forms, the most important assortment of legitimate kinds, that can be found online. Take advantage of the site`s basic and convenient lookup to get the documents you require. Various templates for company and specific purposes are sorted by types and says, or keywords. Use US Legal Forms to get the Wisconsin Clawback Guaranty in just a few click throughs.

Should you be already a US Legal Forms buyer, log in for your profile and click on the Obtain switch to have the Wisconsin Clawback Guaranty. You can even gain access to kinds you earlier delivered electronically inside the My Forms tab of the profile.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for the right metropolis/land.

- Step 2. Take advantage of the Review solution to look over the form`s articles. Don`t overlook to read through the description.

- Step 3. Should you be unhappy with all the form, use the Research field near the top of the monitor to get other versions from the legitimate form web template.

- Step 4. When you have located the form you require, go through the Acquire now switch. Pick the rates strategy you favor and add your credentials to register for the profile.

- Step 5. Procedure the transaction. You should use your bank card or PayPal profile to perform the transaction.

- Step 6. Choose the structure from the legitimate form and download it on your device.

- Step 7. Comprehensive, edit and print out or sign the Wisconsin Clawback Guaranty.

Each legitimate document web template you acquire is yours forever. You possess acces to every single form you delivered electronically within your acccount. Go through the My Forms area and choose a form to print out or download yet again.

Contend and download, and print out the Wisconsin Clawback Guaranty with US Legal Forms. There are millions of expert and state-certain kinds you can utilize for your personal company or specific requirements.

Form popularity

FAQ

The elements of unjust enrichment are: (1) a benefit conferred upon the defendant by the plaintiff; (2) knowledge or appreciation of the benefit by the defendant; and (3) acceptance and retention by the defendant of such benefit under such circumstances that it would be unfair for him or her to retain it without paying ...

Wisconsin Legislature: 805.08. (2) Subpoena requiring the production of material. (a) A subpoena may command the person to whom it is directed to produce the books, papers, documents, electronically stored information, or tangible things designated therein.

Subpoenas shall be issued and served in ance with ch. 885. A subpoena may also be issued by any attorney of record in a civil action or special proceeding to compel attendance of witnesses for deposition, hearing or trial in the action or special proceeding.

Parties may use a subpoena to order their requested witnesses to appear. They must arrange to have the subpoena served on the witness. Parties can do this themselves as long as they prepare an affidavit of service. They also can have it served by the sheriff's office or a private process-server.

Choosing to try and avoid a subpoena is not an easy process. The person will need to hire an attorney, pay attorney fees in most cases, and will need to prepare a motion. If the motion fails, or if there are other reasons that a party may need the person to testify, they may not be excused.

A subpoena is typically requested by an attorney on behalf of the court and issued by a court clerk, notary public or justice of the peace. A subpoena may be served on an individual either through personal delivery, email, certified mail or even by reading it out aloud.

A court must quash or modify a subpoena if it does not allow a reasonable time to comply, requires travel of more than 100 miles, requires disclosure of privileged information, or creates an undue burden.