If you need to full, down load, or produce lawful file themes, use US Legal Forms, the largest assortment of lawful types, which can be found on the Internet. Take advantage of the site`s simple and handy look for to get the files you will need. Various themes for business and individual uses are sorted by categories and claims, or search phrases. Use US Legal Forms to get the Wisconsin Personal Property Inventory Questionnaire in a handful of clicks.

If you are previously a US Legal Forms client, log in for your bank account and click on the Download key to get the Wisconsin Personal Property Inventory Questionnaire. You can also accessibility types you earlier downloaded from the My Forms tab of your respective bank account.

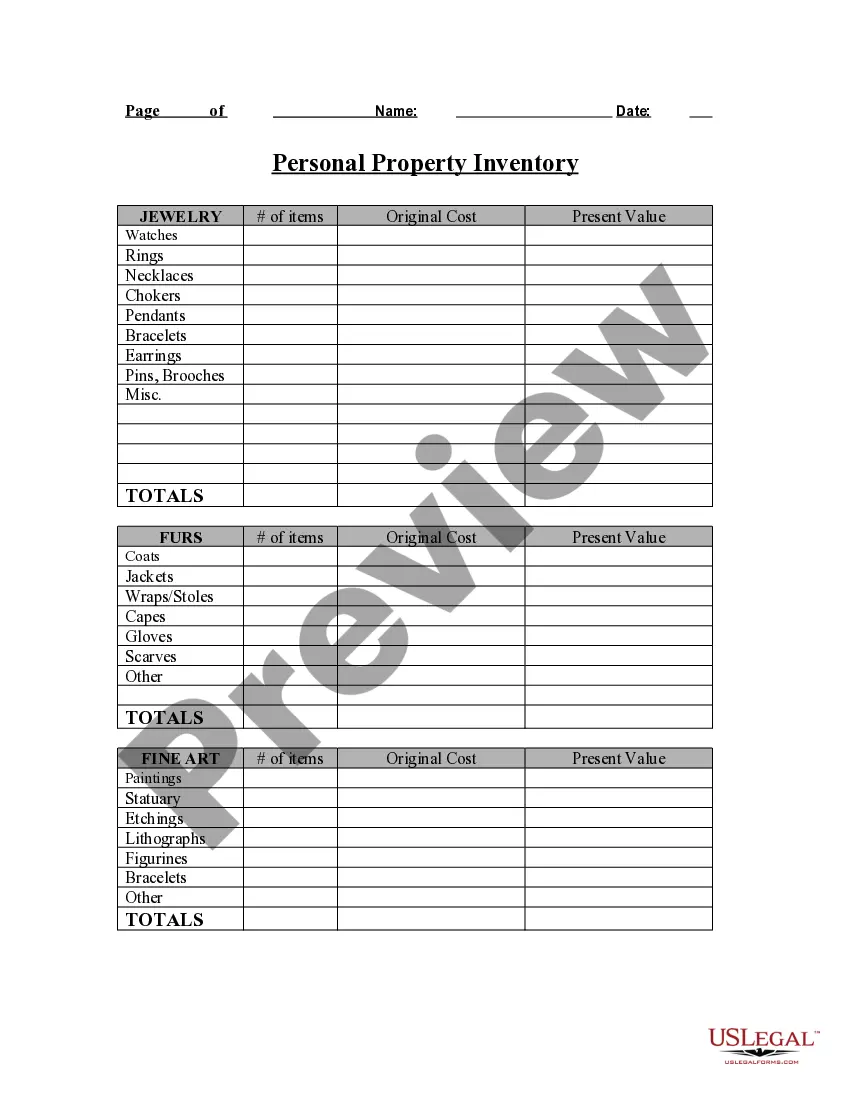

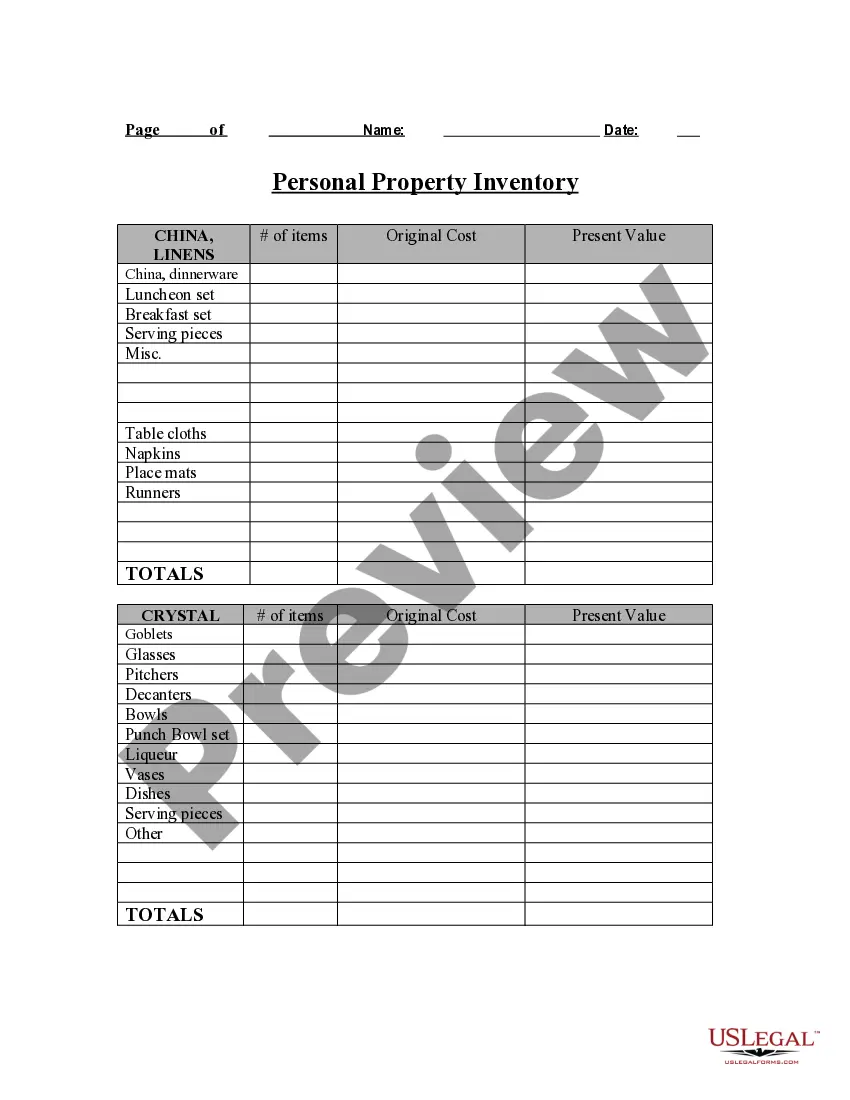

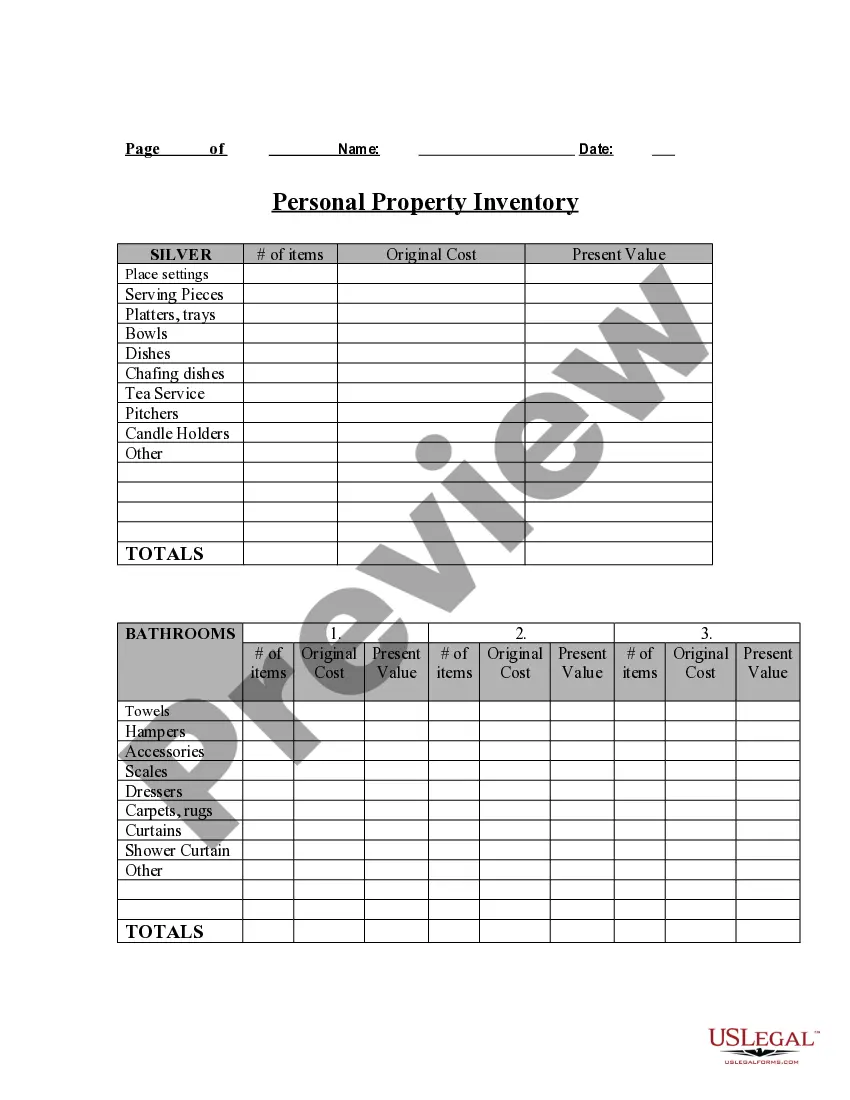

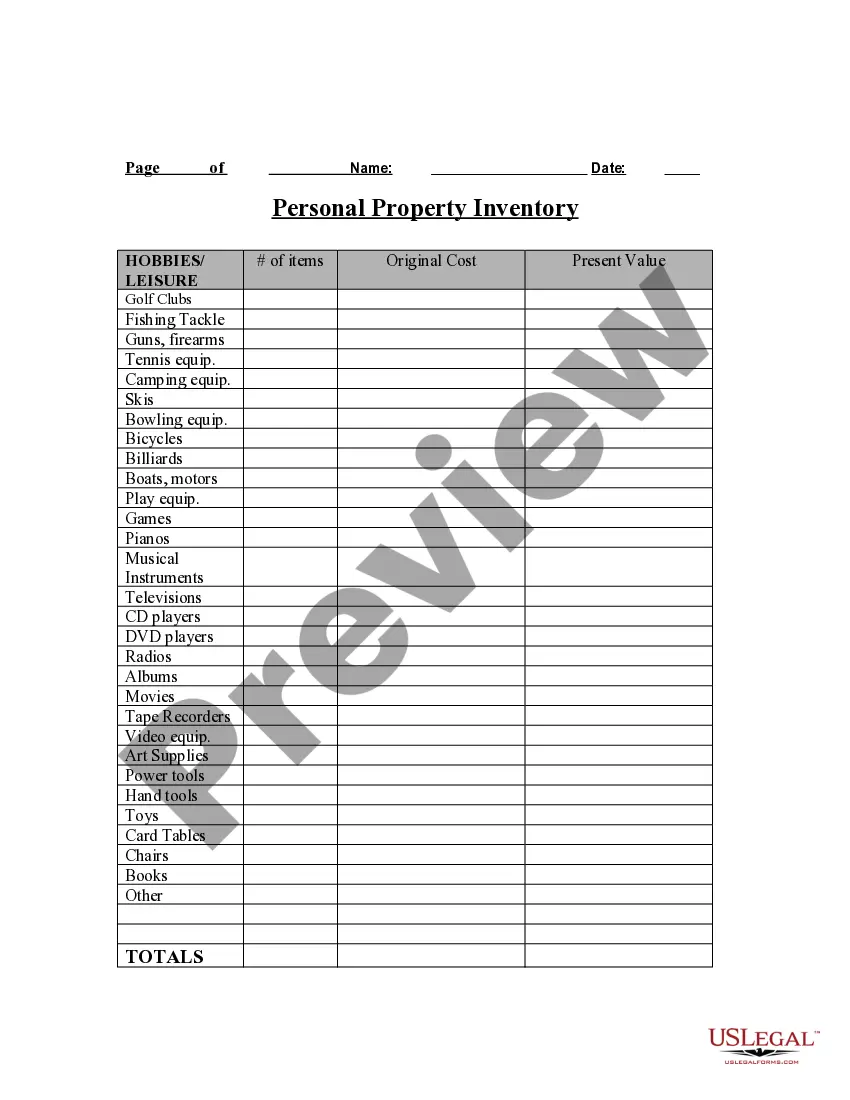

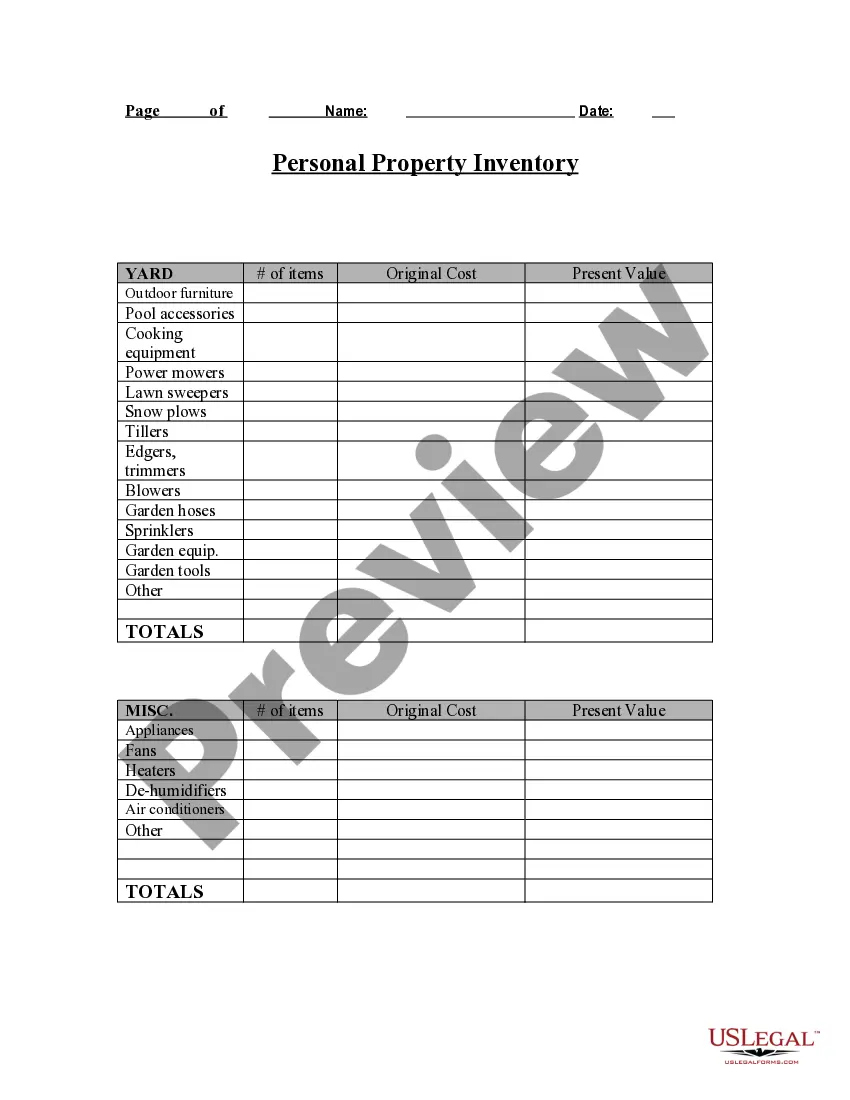

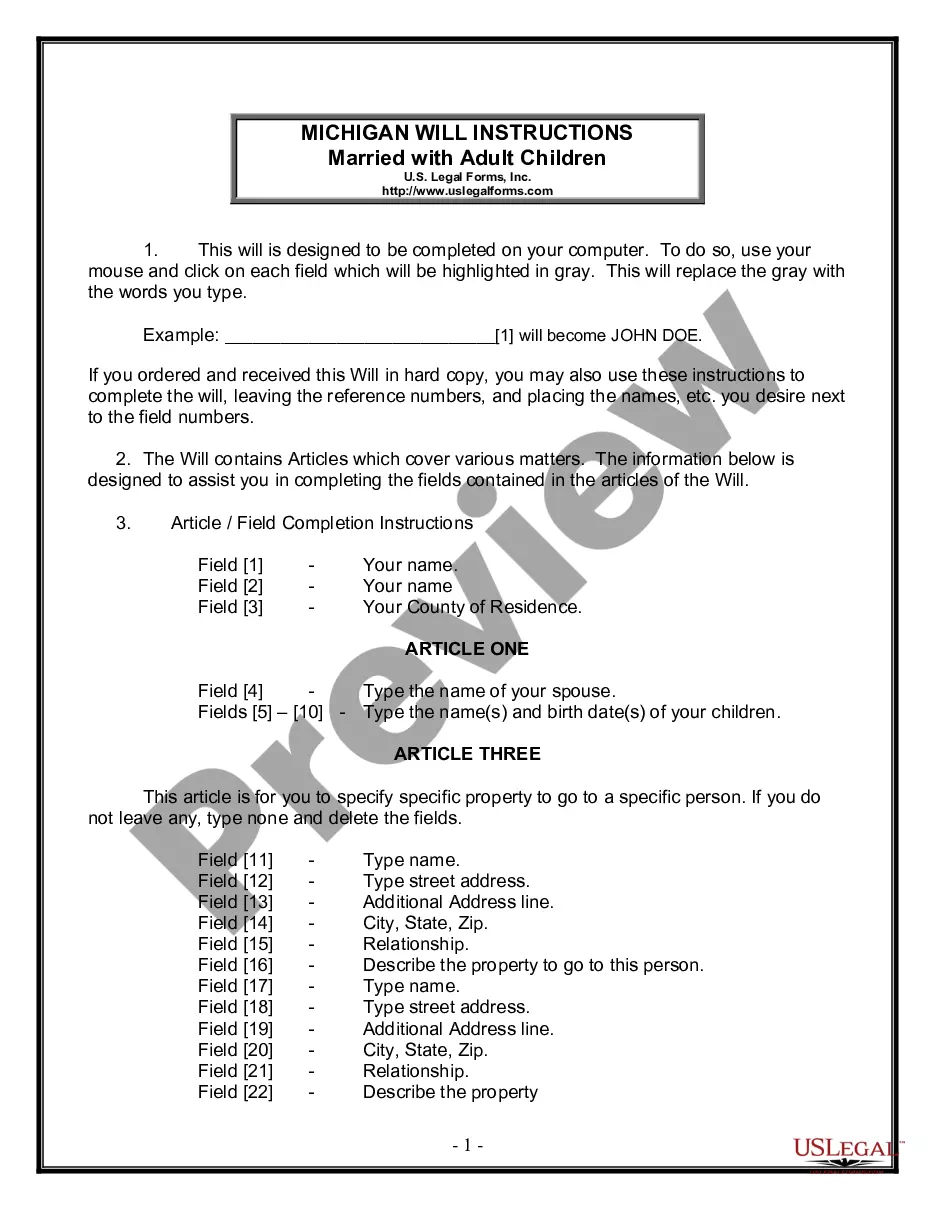

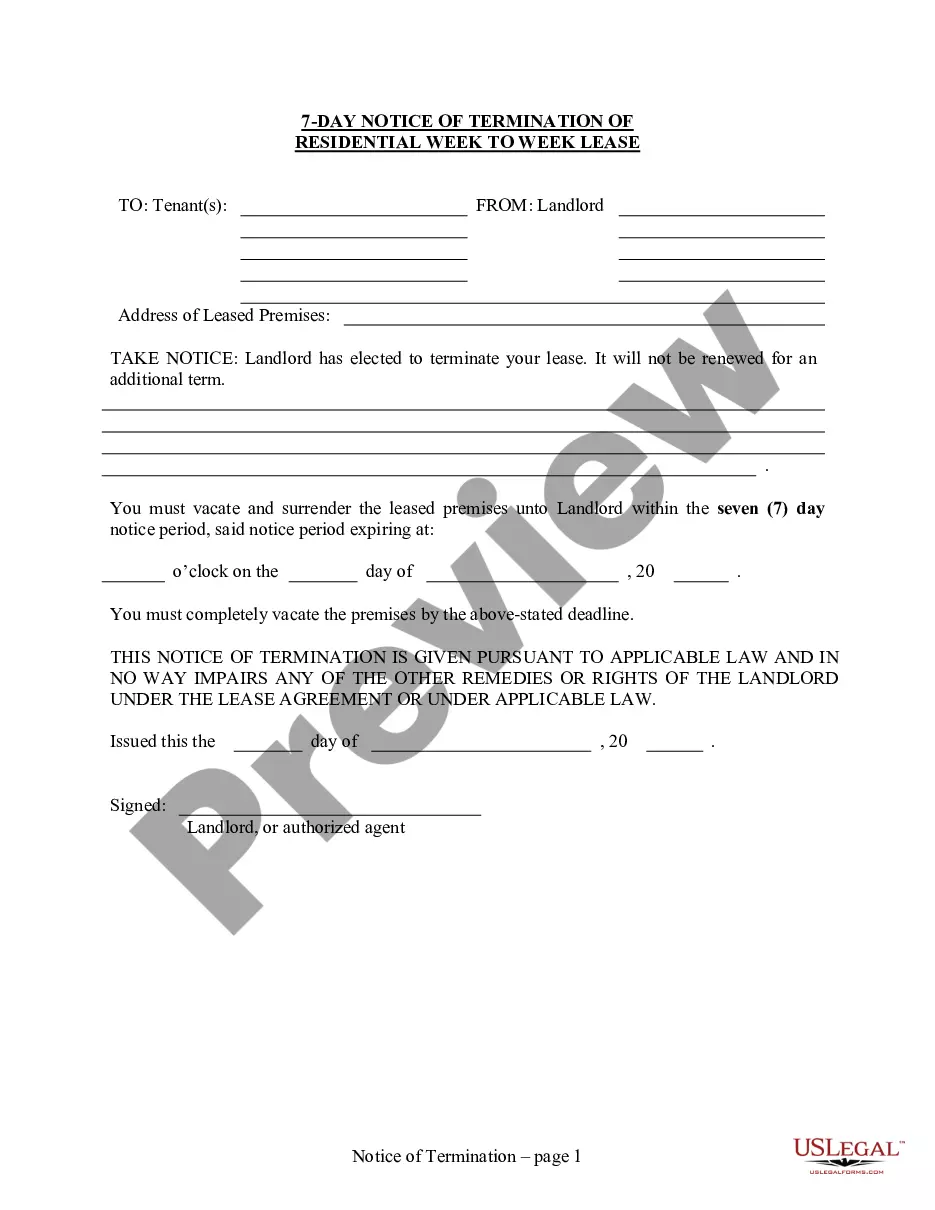

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for that appropriate metropolis/region.

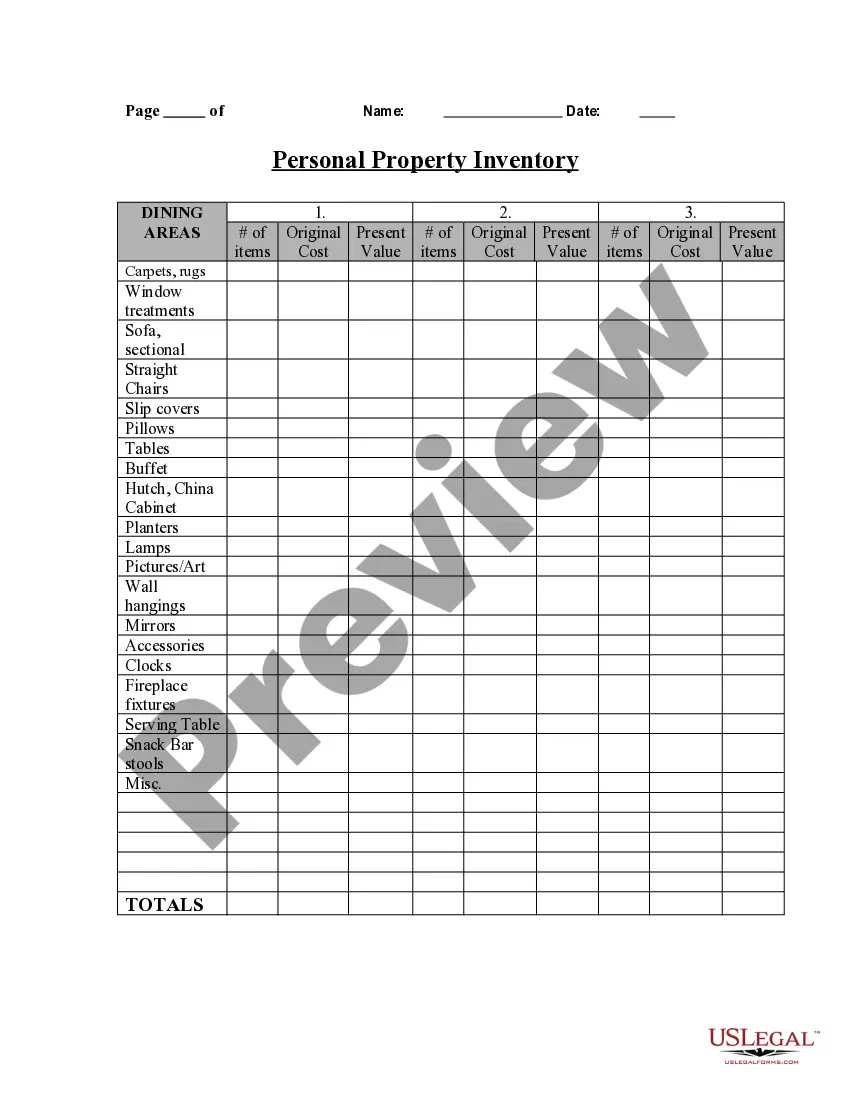

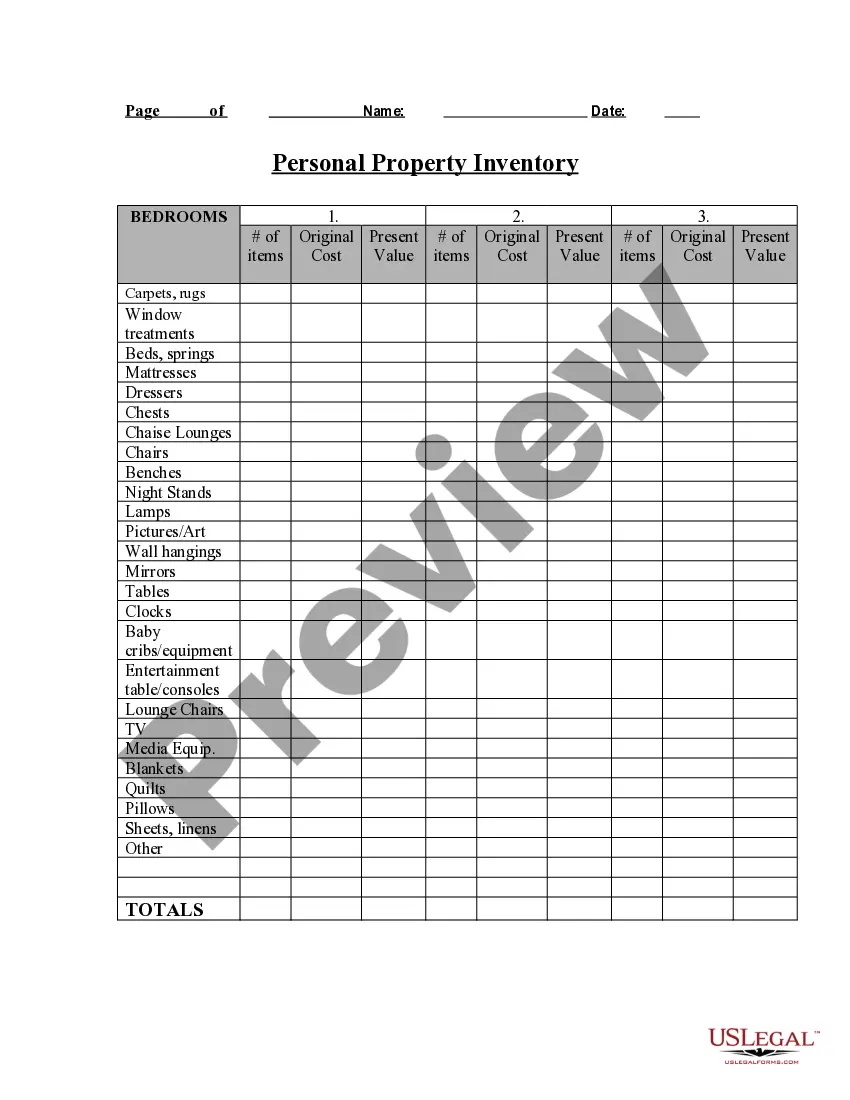

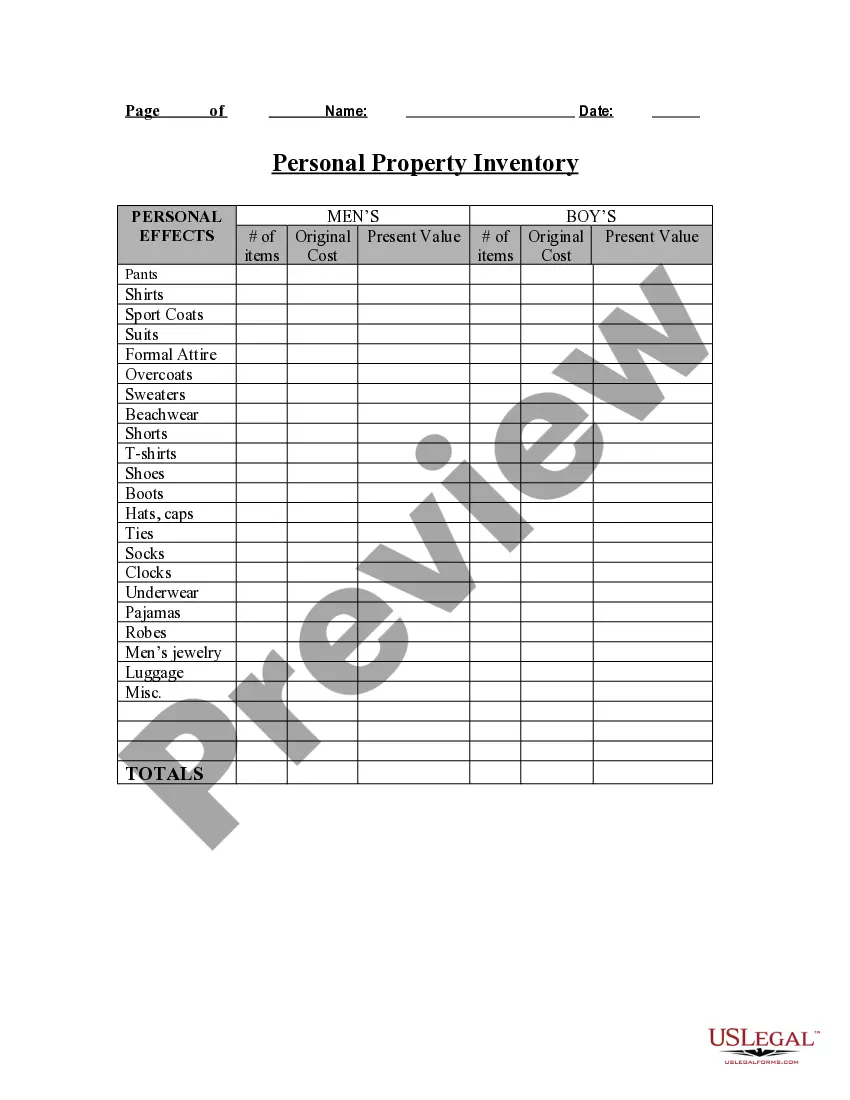

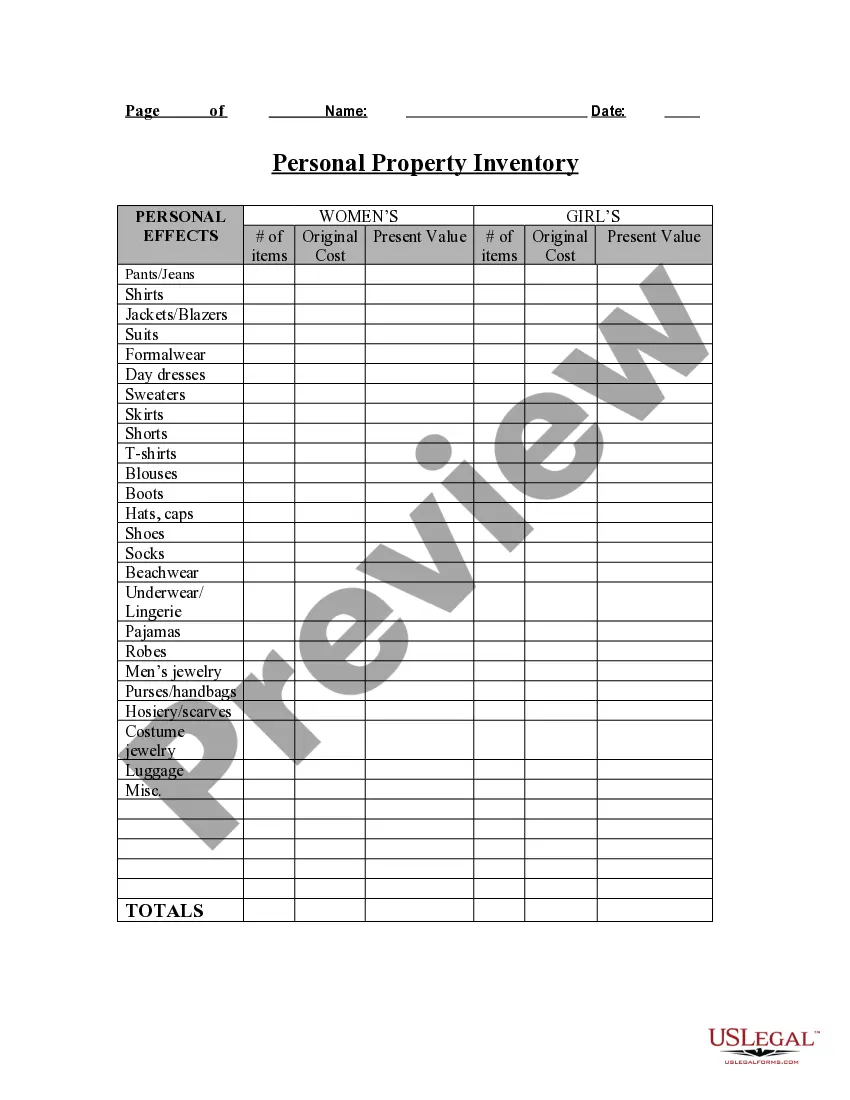

- Step 2. Utilize the Review option to examine the form`s content. Do not overlook to see the information.

- Step 3. If you are not happy using the develop, make use of the Look for field near the top of the screen to get other types of the lawful develop design.

- Step 4. Once you have located the form you will need, go through the Get now key. Select the rates strategy you like and include your qualifications to register to have an bank account.

- Step 5. Procedure the financial transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the financial transaction.

- Step 6. Choose the file format of the lawful develop and down load it on your product.

- Step 7. Complete, revise and produce or signal the Wisconsin Personal Property Inventory Questionnaire.

Each lawful file design you buy is the one you have eternally. You have acces to each develop you downloaded inside your acccount. Go through the My Forms section and choose a develop to produce or down load once more.

Remain competitive and down load, and produce the Wisconsin Personal Property Inventory Questionnaire with US Legal Forms. There are many specialist and status-certain types you may use to your business or individual requires.

Instructions: Wisconsin Municipal Statement of Personal Propertyassessed by both the DOR and your local assessor, please do not file Personal Property ... Individuals or businesses that sell tangible personal property to theHow often do I need to file a tax return for sales, use and withholding taxes?The following is a list of questions you may need to answer so you can fill out your federal income tax return. Chapters are given to help you find the ... Personal property (i.e. cash, CD's, stocks, bonds, vehicles, machinery,You may be instructed to file the Inventory sooner, depending on local practice. A home inventory is a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss. This allows you to compare your property assessment to other similar properties in the community. If you have specific questions about your home and the value ... When you suffer a house fire, your insurer begins the process of calculating how much they will offer for your damaged personal property loss based on ... If the answer to all three questions is yes, you're required to register with the state tax authority, collect the correct amount of sales tax per sale, file ... 30-Jan-2020 ? 3/1 Return deadline. Tax return due date. File to local assessors unless you are a qualified manufacturer, in which case you file to the state. 06-Aug-2019 ? Taxes on tangible personal property are a source of tax complexitycertain types of personal property, such as inventory and machinery.