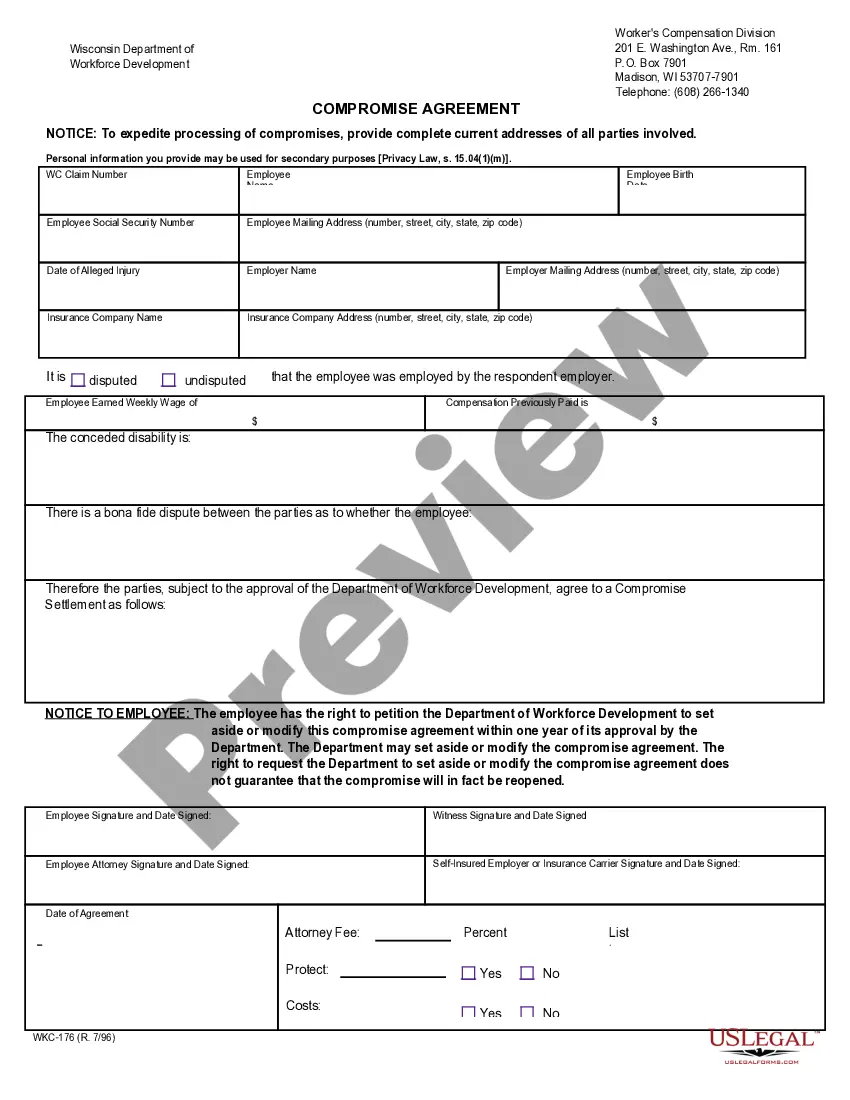

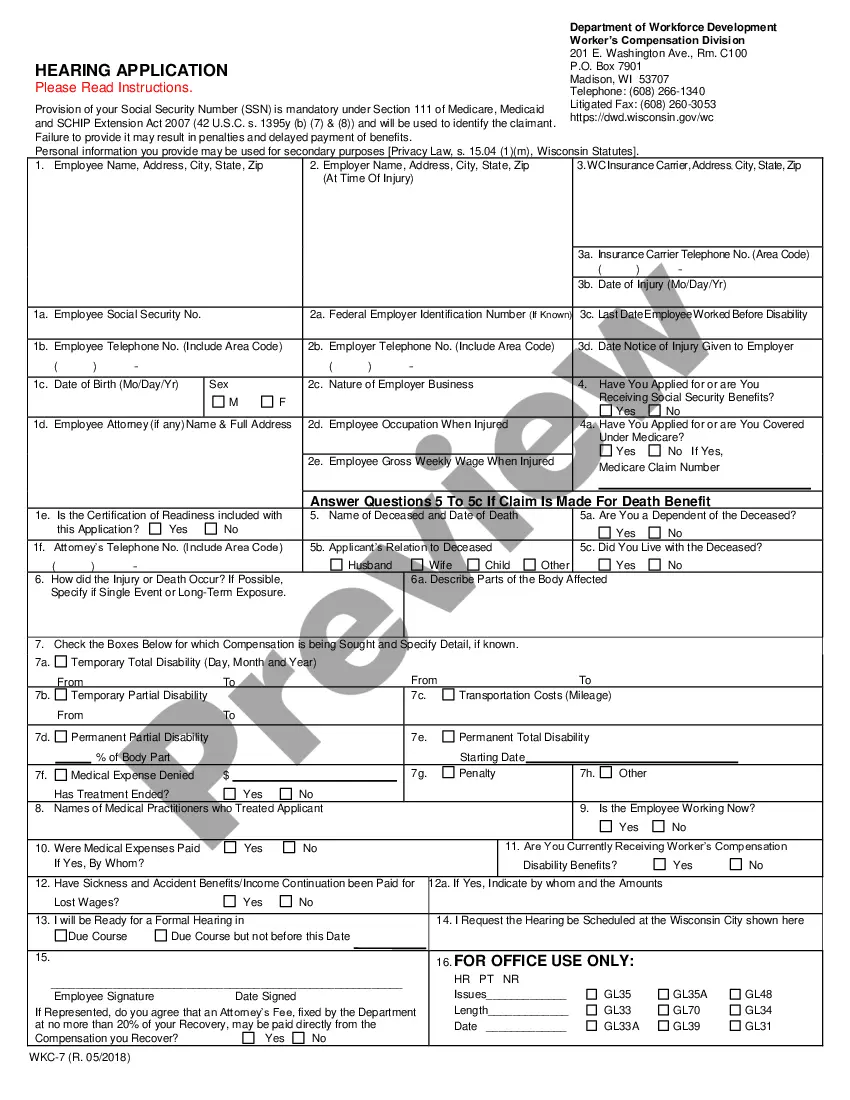

This Compromise and Review Application is one of the official workers' compensation forms for the the state of Wisconsin. This Official Workers' Compensation form is fillable in pdf and Word format. This Compromise and Review Application conforms with all applicable statutory requirements.

Wisconsin Compromise and Review Application for Workers' Compensation

Description

How to fill out Wisconsin Compromise And Review Application For Workers' Compensation?

Out of the large number of platforms that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates before buying them. Its complete catalogue of 85,000 samples is categorized by state and use for efficiency. All the forms on the service have already been drafted to meet individual state requirements by certified legal professionals.

If you already have a US Legal Forms subscription, just log in, look for the template, click Download and obtain access to your Form name in the My Forms; the My Forms tab keeps all your saved forms.

Follow the guidelines listed below to get the form:

- Once you find a Form name, make certain it is the one for the state you need it to file in.

- Preview the form and read the document description before downloading the template.

- Look for a new sample through the Search field in case the one you’ve already found is not appropriate.

- Click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

Once you’ve downloaded your Form name, you are able to edit it, fill it out and sign it in an online editor of your choice. Any document you add to your My Forms tab might be reused multiple times, or for as long as it continues to be the most updated version in your state. Our service provides fast and easy access to samples that fit both lawyers as well as their customers.

Form popularity

FAQ

To date, the largest settlement payment in a workers' comp case came in March of 2017, with a $10 million settlement agreement.

Your workers' comp policy requires audits to verify your estimated payroll. These audits help make sure you're paying the right amount for the right coverage. Depending on your state, workers' compensation audits can also be a legal requirement.

Payroll journal and summary. Your check book (if it's your only means of keeping records. Federal Tax Report- 941's that cover the period. State Unemployment Tax reports or individual earnings records. All overtime payroll records (charged at reduced rates)

Report these payments as wages on Line 7 of Form 1040 or Form 1040A, or on Line 1 of Form 1040EZ. If your disability pension is paid under a statute that provides benefits only to employees with service-connected disabilities, part of it may be workers' compensation. That part is exempt from tax.

A worker is disqualified where the injury: (1) is caused by the worker's own intoxication (alcohol or other controlled substance as defined by the Health and Safety Code; (2) is intentionally self-inflicted; (3) occurs out of an altercation (mutual combat) where the claimant was the initial physical aggressor; (4)

At the end of your annual policy period, a final premium audit is conducted to determine if you paid the appropriate amount for your workers' compensation insurance. Your final premium audit is based on actual payroll, operations and job classifications for the expired coverage period.

Be factual with the information you provide. Be concise with the information you provide. Keep descriptions simple and to the point. Be sure to monitor your audit results.

Get your weekly disability check started, if you're not receiving it already. Maximize your weekly benefit check. Report all super-added injuries. Seek psychological care, when appropriate. Seek pain management care, when appropriate. Don't refuse medical procedures. Be very careful what you tell the doctor.

The cancellation of any current workers compensation coverage. If an employer is not compliant with their audit the insurance company will take that as a sign of being uncooperative and will cancel or set for non-renewal their current policy. The application of a monetary penalty.