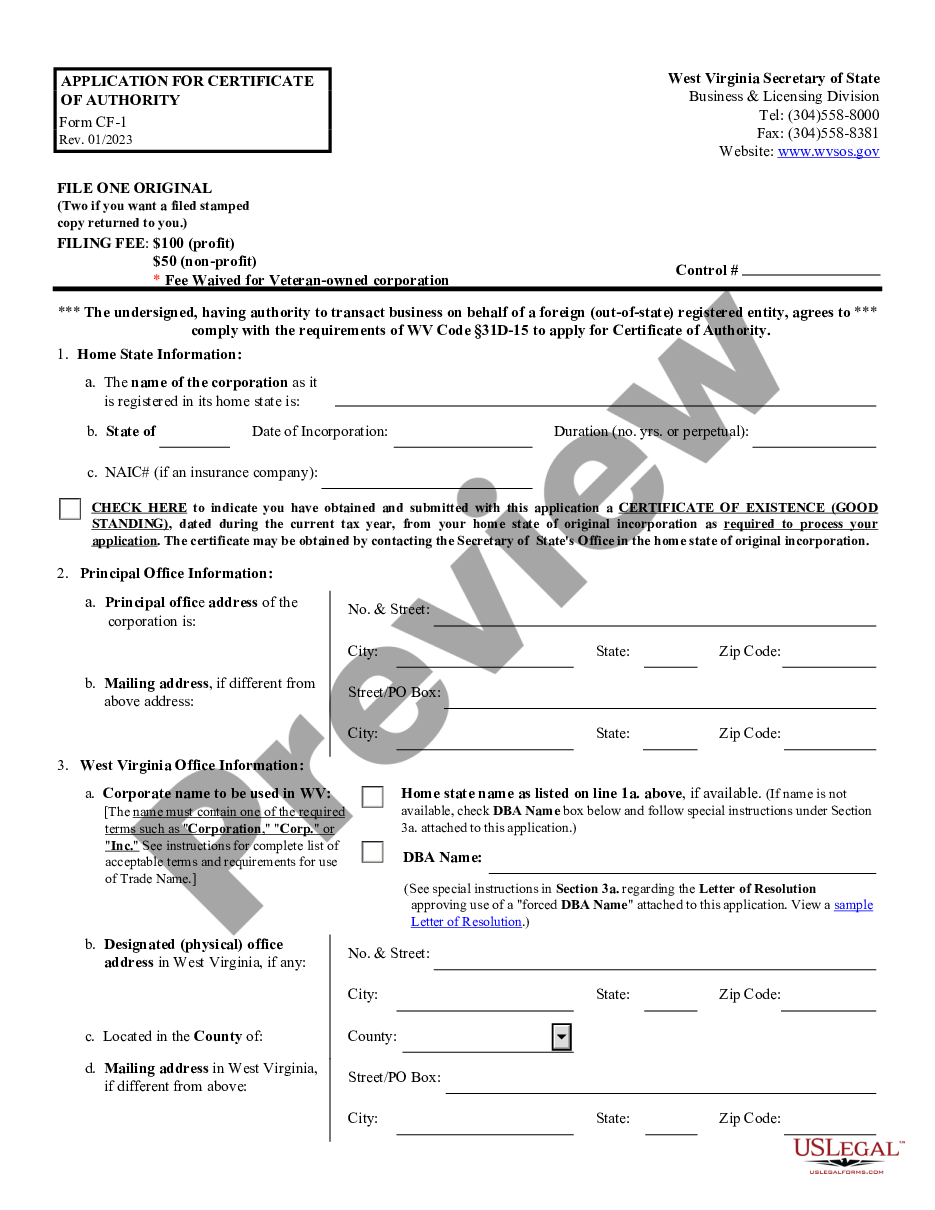

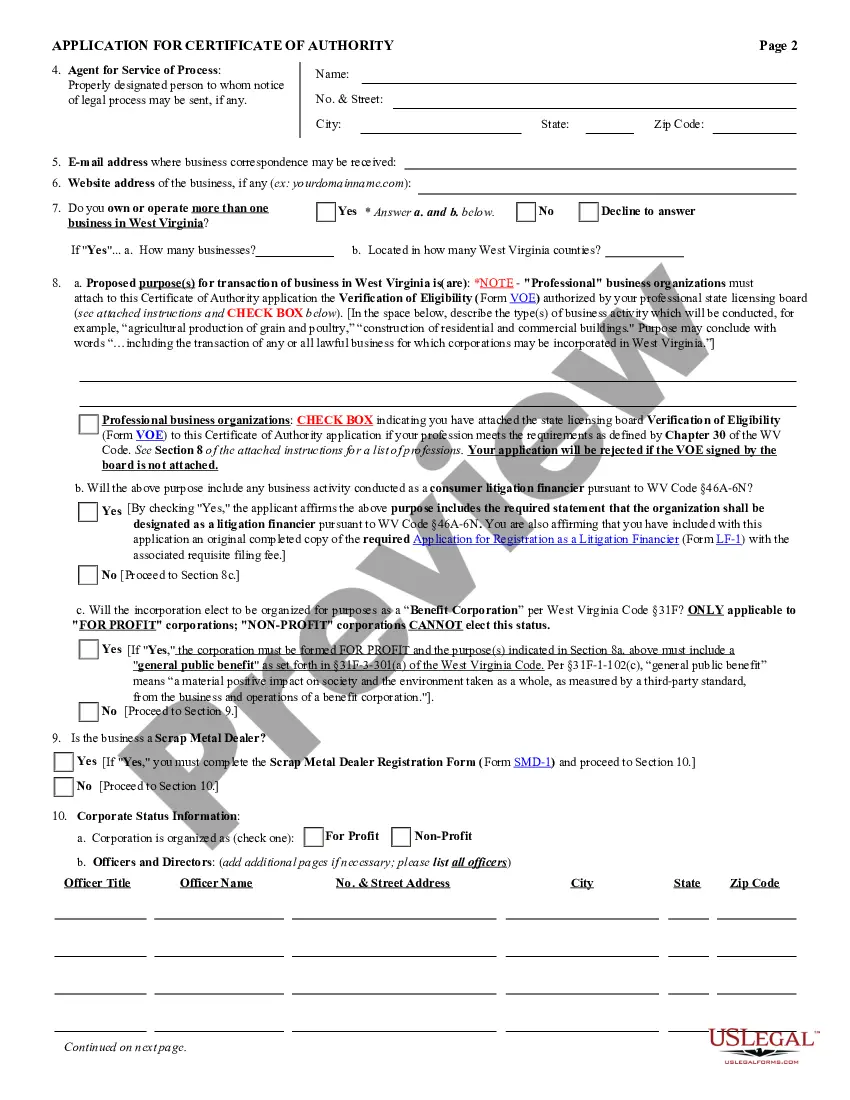

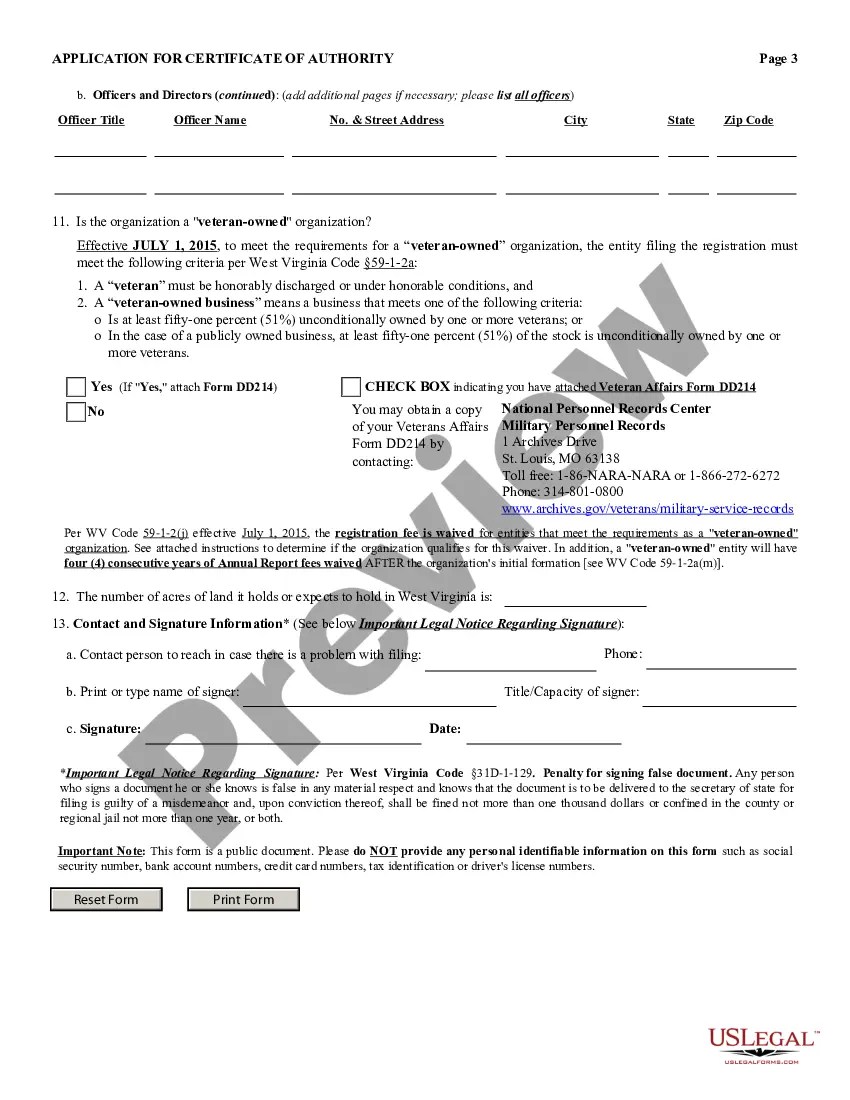

West Virginia Registration of Foreign Corporation

Description

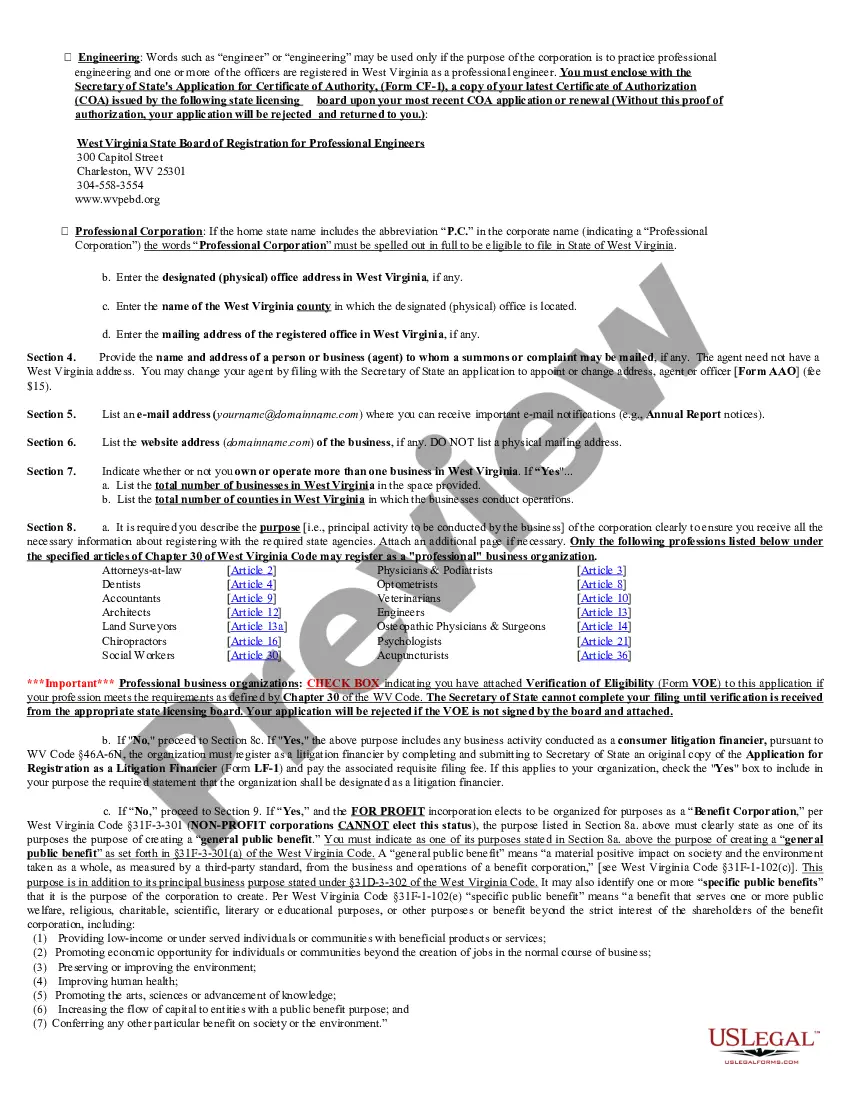

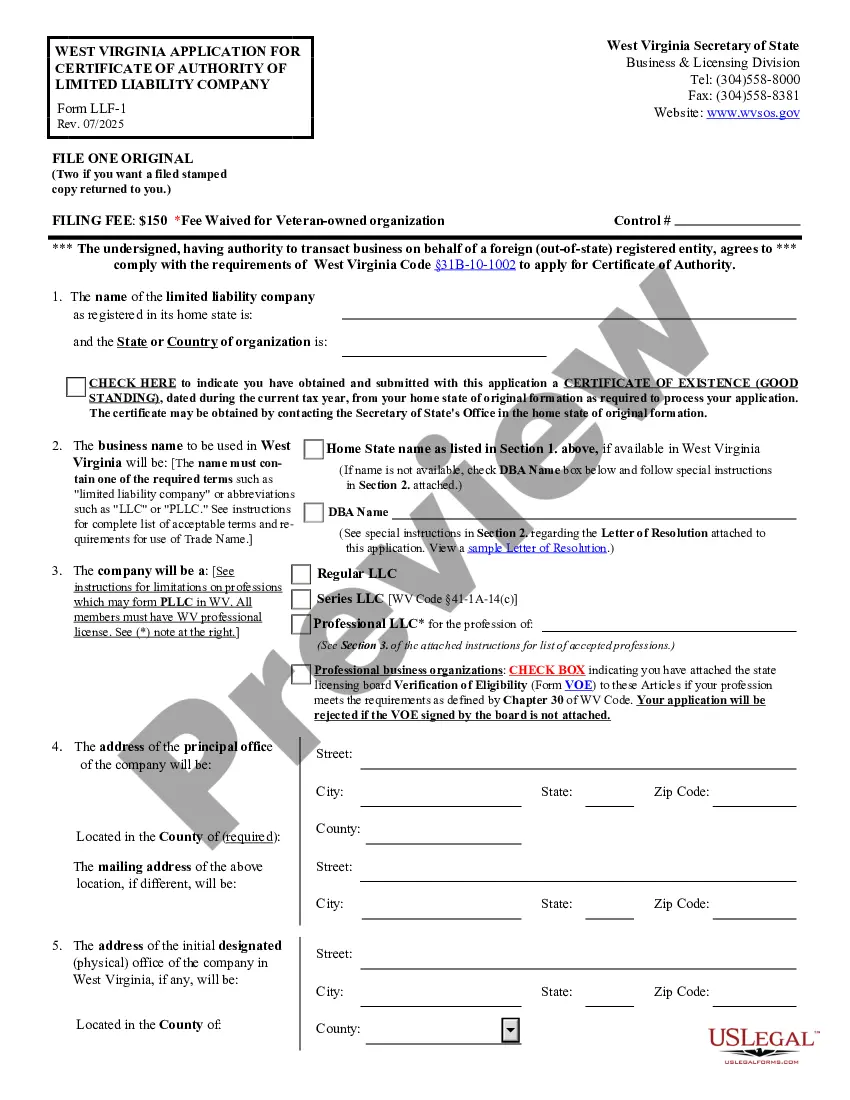

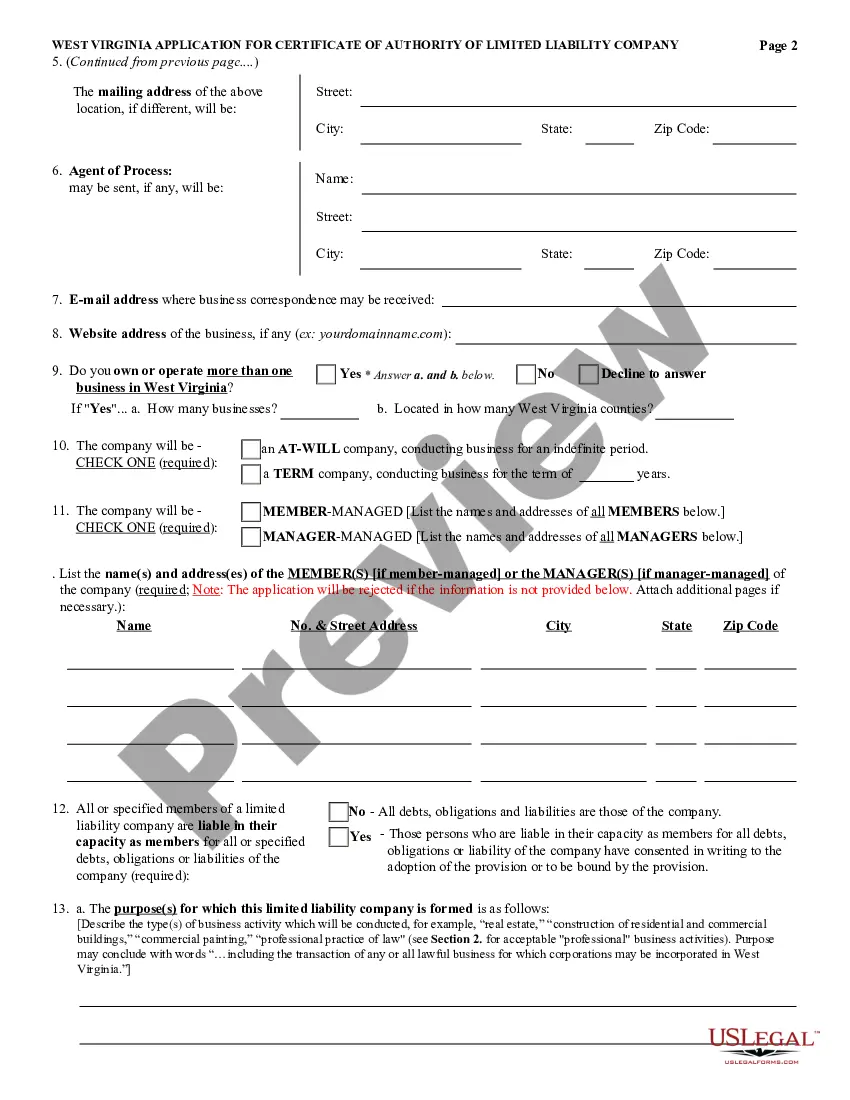

How to fill out West Virginia Registration Of Foreign Corporation?

Out of the great number of platforms that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates before buying them. Its extensive library of 85,000 templates is grouped by state and use for simplicity. All of the forms on the service have been drafted to meet individual state requirements by licensed lawyers.

If you already have a US Legal Forms subscription, just log in, look for the form, hit Download and access your Form name from the My Forms; the My Forms tab holds all of your downloaded documents.

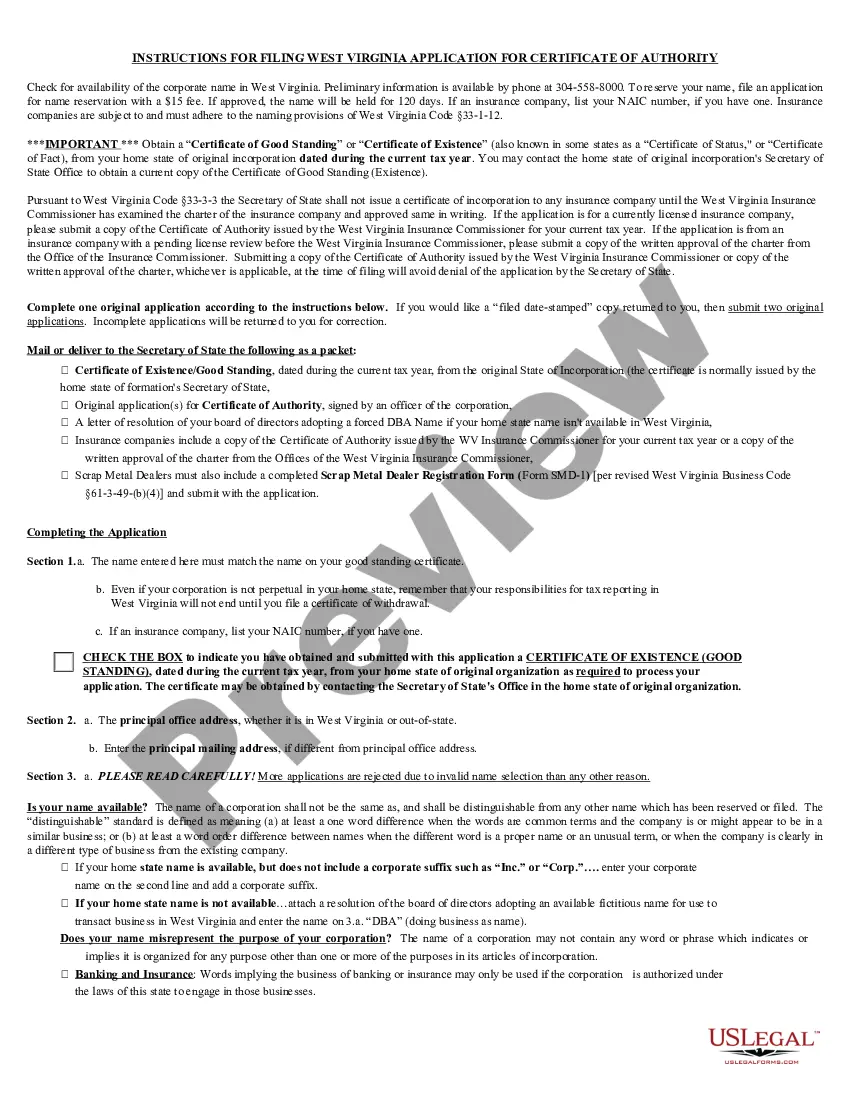

Follow the tips below to obtain the form:

- Once you discover a Form name, make certain it’s the one for the state you really need it to file in.

- Preview the form and read the document description before downloading the template.

- Look for a new template using the Search engine in case the one you have already found is not appropriate.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

After you’ve downloaded your Form name, you may edit it, fill it out and sign it in an web-based editor of your choice. Any form you add to your My Forms tab can be reused many times, or for as long as it continues to be the most updated version in your state. Our platform offers quick and simple access to templates that suit both legal professionals and their clients.

Form popularity

FAQ

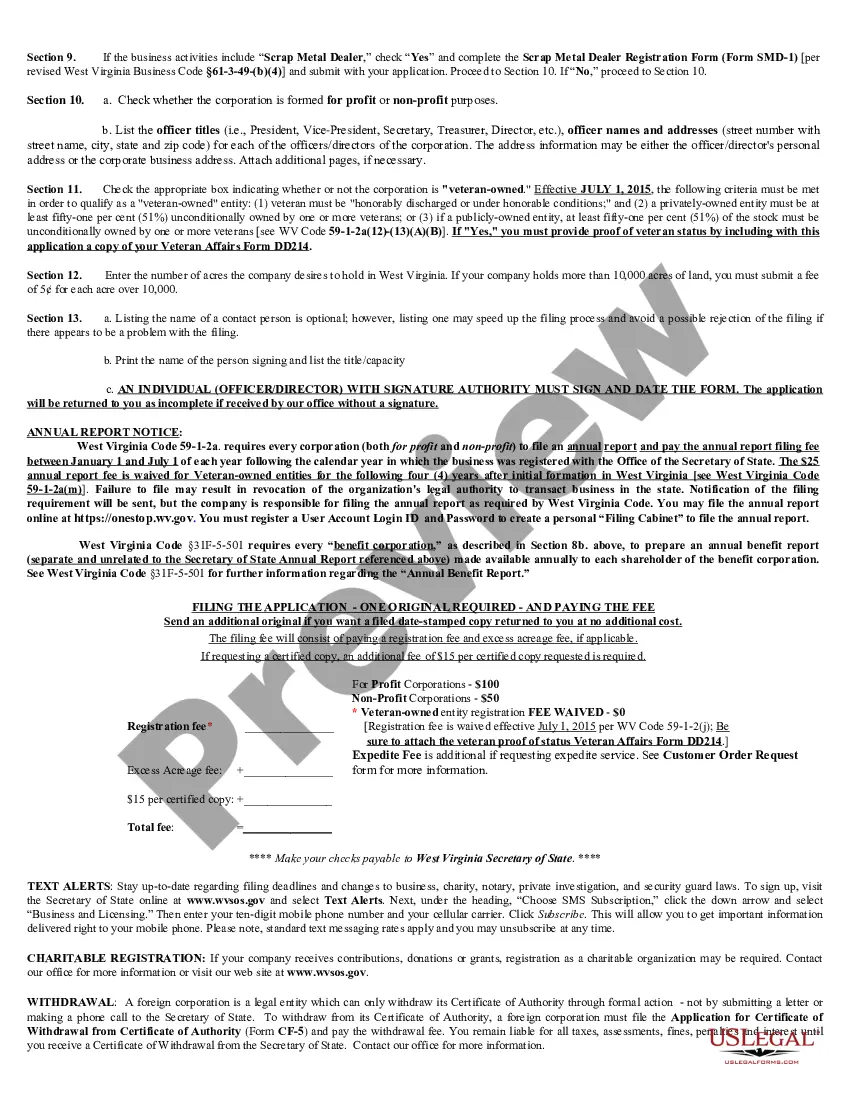

A domestic corporation is one formed in the state in which it is doing business. A foreign corporation is one incorporated in another state or country and does business across state lines. The process of setting up a company in a foreign state is called foreign qualification.

Essentially, a foreign legal entity is similar to a foreign corporation. In America, it refers to an established corporation that is legally registered to operate in a state or jurisdiction outside of its original location.

Foreign Entity - Any business organization that transacts business outside of its state of formation is recognized as foreign in the states in which it obtains a certificate of authority. Foreign Qualification - Refers to registering your business or nonprofit outside its state of formation.

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

Business Licenses The state of West Virginia doesn't have a general business license; however, many cities require a business license to operate.Zoning Before starting to operate a business (even if it's home-based), be sure to check local zoning regulations before starting to operate out of a location.

Yes, a US LLC can be owned entirely by foreign persons.United States Tax laws require that foreigners pay taxes on any earnings made in the United States. Regardless of immigration status, the United States will allow foreigners to form a company as long as they have registered for a Taxpayer Identification Number.

To register your business in Virginia, you must file an Application for a Certificate of Registration (Form LLC-1052) with the Virginia State Corporation Commission (SCC). You can download a copy of the application form from the SOS website.

To register your business in Virginia, you must file an Application for a Certificate of Registration (Form LLC-1052) with the Virginia State Corporation Commission (SCC). You can download a copy of the application form from the SOS website.