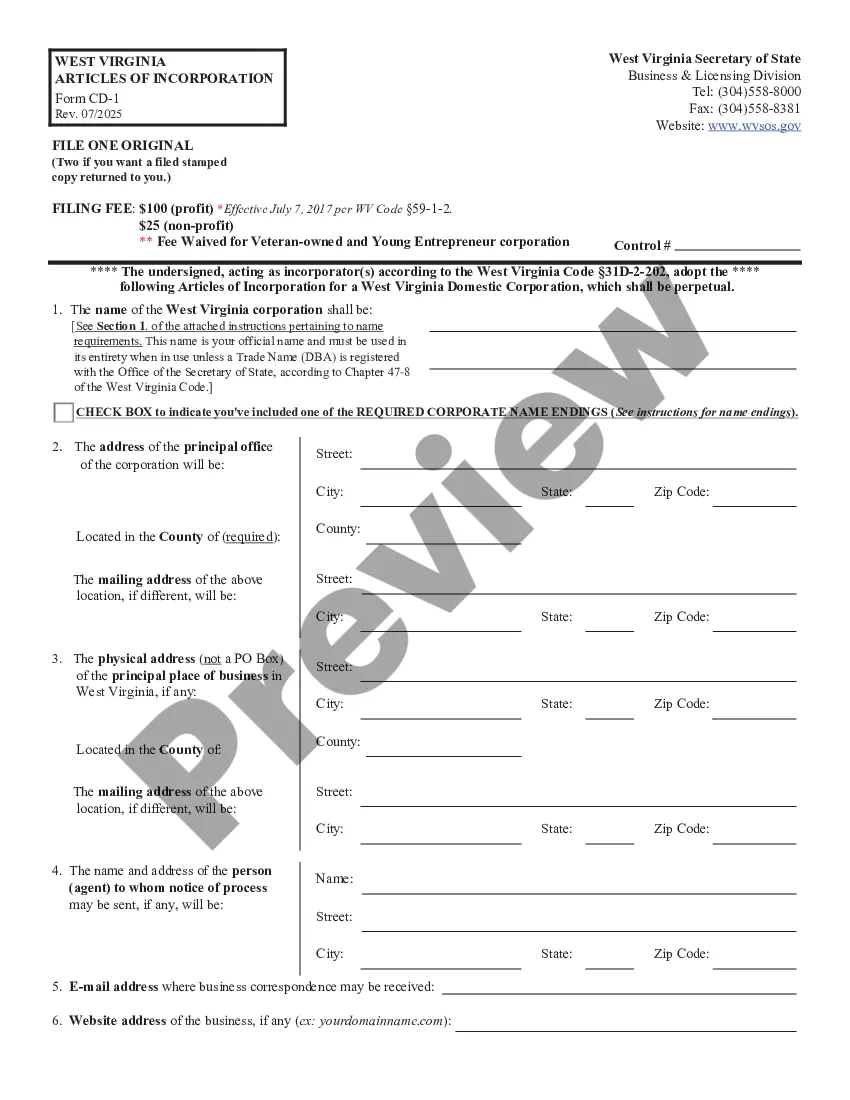

This Articles of Incorporation for Domestic Non-Profit Corporation in West Virginia state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

West Virginia Articles of Incorporation for Domestic Nonprofit Corporation

Description

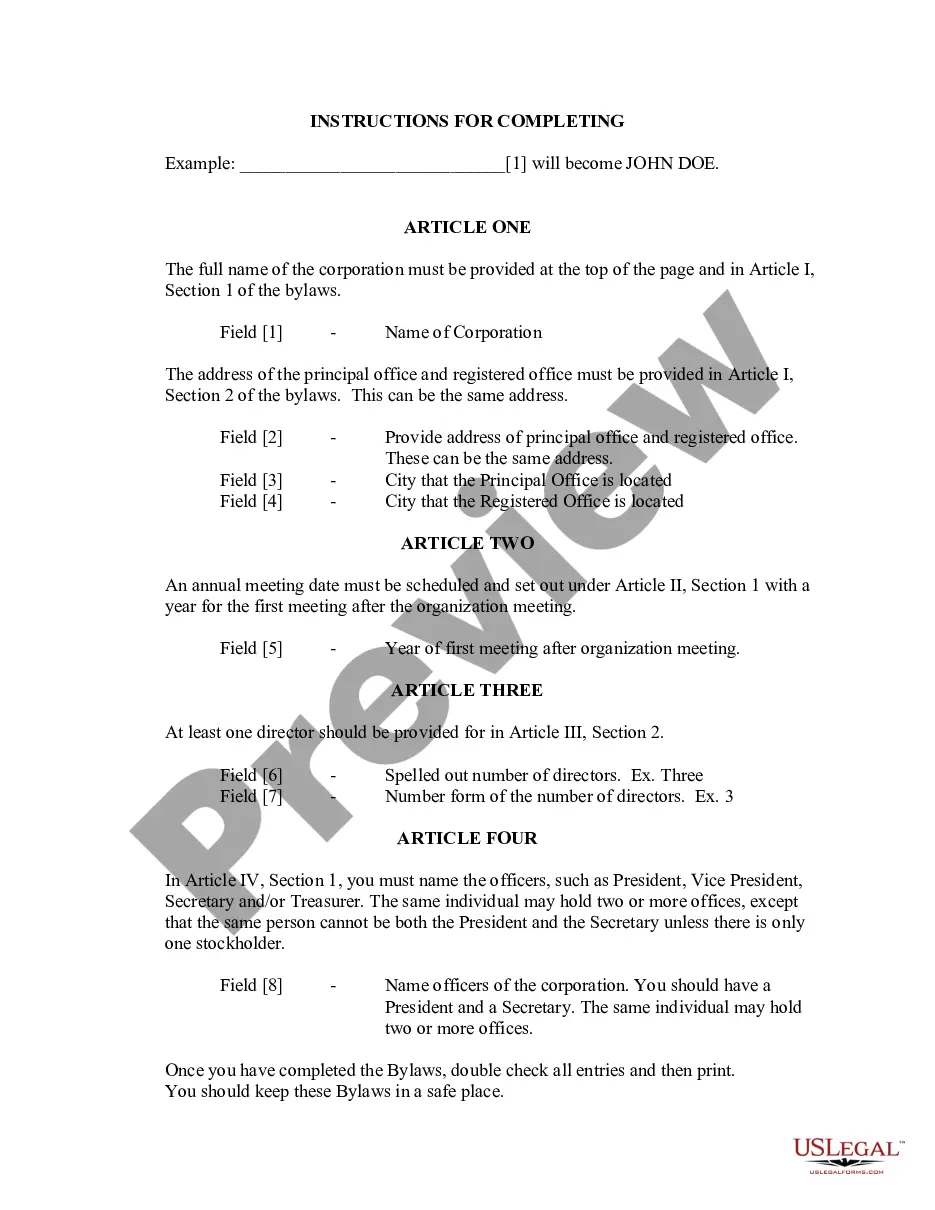

How to fill out West Virginia Articles Of Incorporation For Domestic Nonprofit Corporation?

Out of the great number of platforms that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates before purchasing them. Its complete catalogue of 85,000 samples is categorized by state and use for efficiency. All of the documents on the service have already been drafted to meet individual state requirements by accredited legal professionals.

If you have a US Legal Forms subscription, just log in, look for the template, hit Download and obtain access to your Form name in the My Forms; the My Forms tab holds all of your saved forms.

Keep to the guidelines listed below to obtain the form:

- Once you see a Form name, make certain it’s the one for the state you really need it to file in.

- Preview the form and read the document description before downloading the template.

- Search for a new template using the Search field if the one you have already found isn’t proper.

- Click Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

Once you’ve downloaded your Form name, it is possible to edit it, fill it out and sign it with an web-based editor of your choice. Any form you add to your My Forms tab might be reused many times, or for as long as it continues to be the most updated version in your state. Our platform provides quick and simple access to templates that fit both lawyers and their clients.

Form popularity

FAQ

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

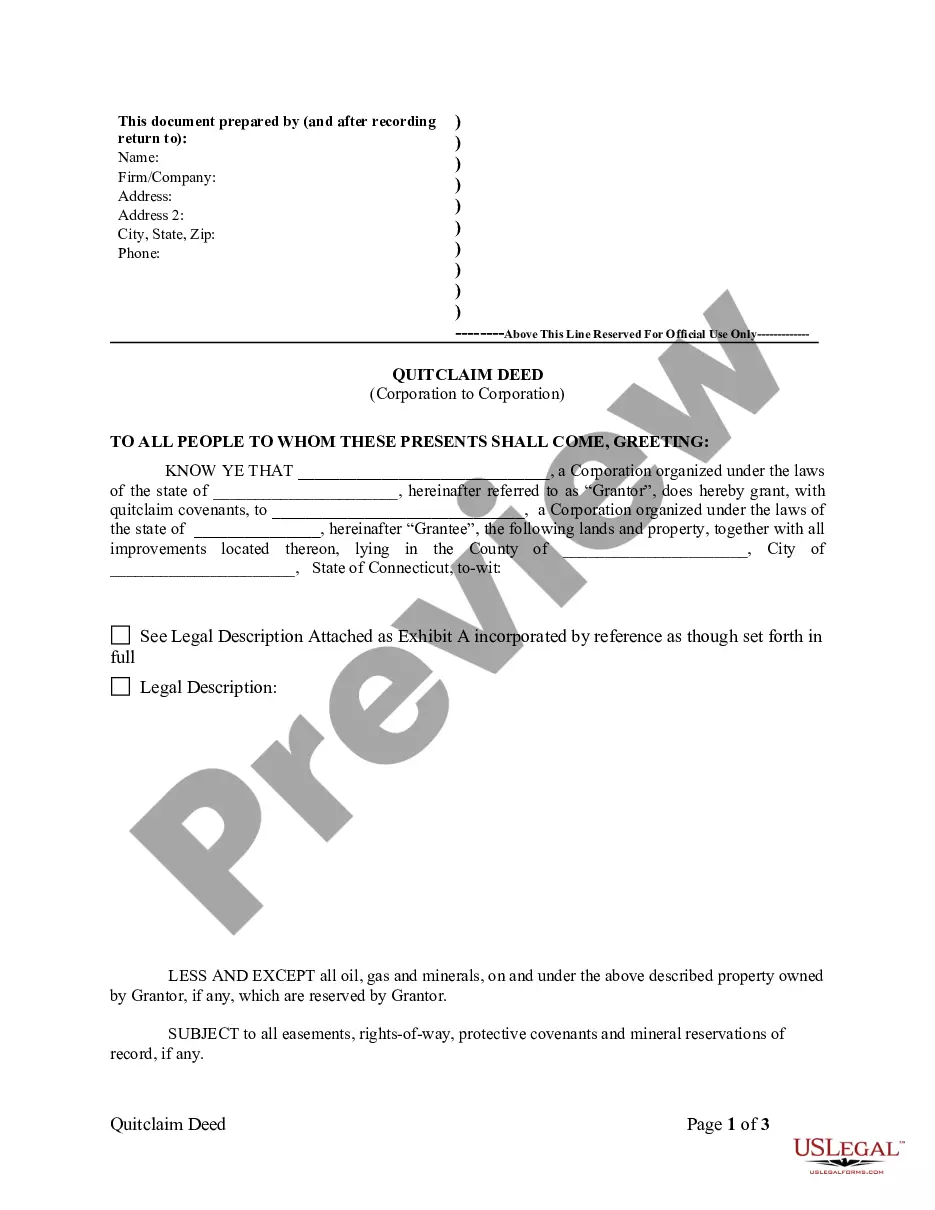

In order to form a nonprofit corporation, you must file articles of incorporation (sometimes called a "certificate of incorporation" or "charter document" or "articles of organization") with the state and pay a filing fee.

Your nonprofit articles of incorporation is a legal document filed with the secretary of state to create your nonprofit corporation. This process is called incorporating. In some states, the articles of incorporation is called a certificate of incorporation or corporate charter.

Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization.

501(c)(3) organization. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

Within the United States, you should find the 501(c)(3) tax code. When determining the nonprofit status of an organization, begin by using the IRS Select Check database. The IRS provides an Exempt Organization List on its website. You can also ask the nonprofit for proof of their status.

The nonprofit corporation definition is an organization that is legally incorporated and also recognized by the IRS as tax-exempt based on business activity. The vast majority of nonprofits are classified as 501(c)3 organizations by the IRS. However, that is not the only designation for a nonprofit.

Both of them exempt organizations from paying corporate income taxes. However, a 501(c) organization may not allow its donors to write off donations while a 501(c)(3) organization lets its donors take tax deductions on their contributions.

All states require nonprofit corporations to have a registered agent in the state of formation. The registered agent is responsible for receiving legal and tax documents, must have a physical address (no P.O.Note that supplying the nonprofit's principal office address is optional in many states, but some require it.