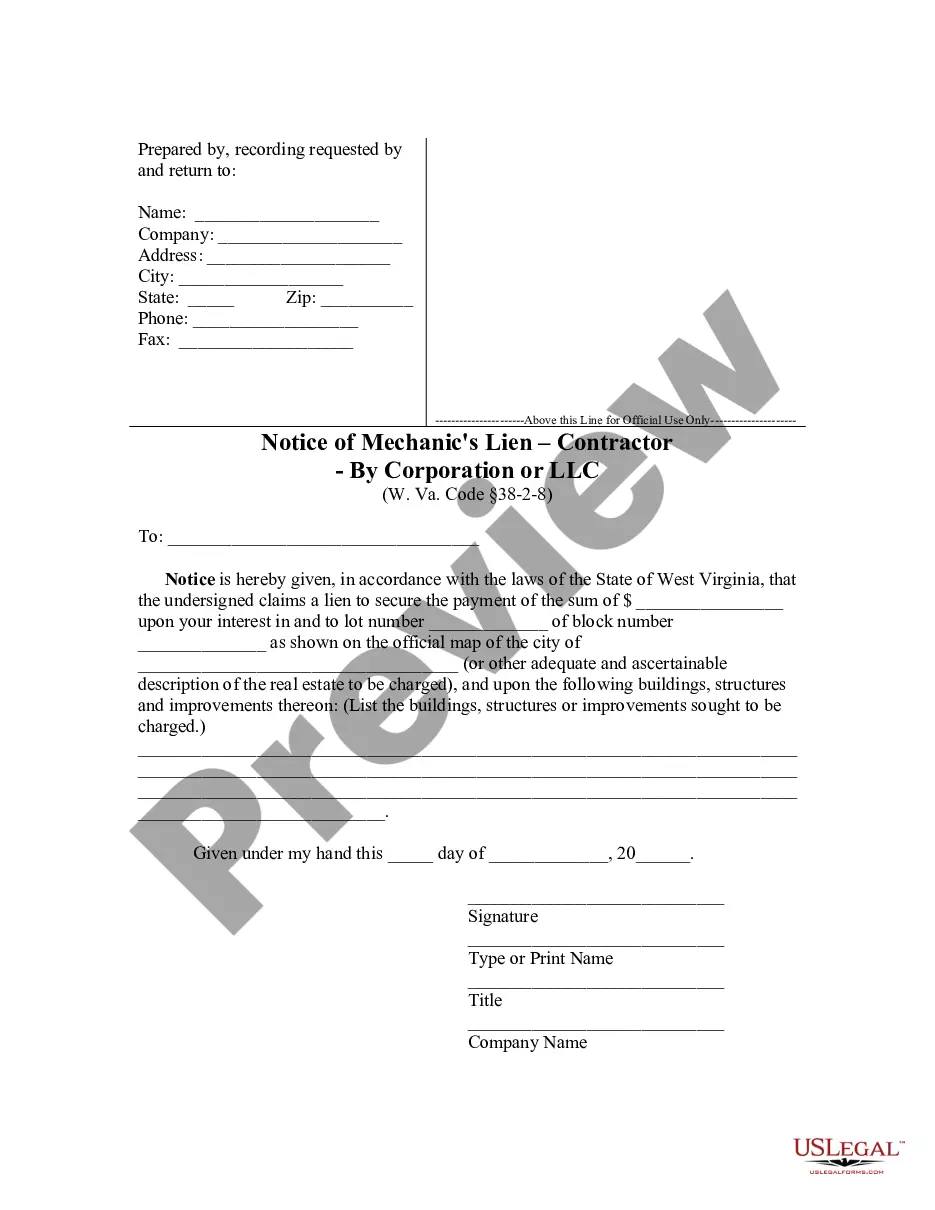

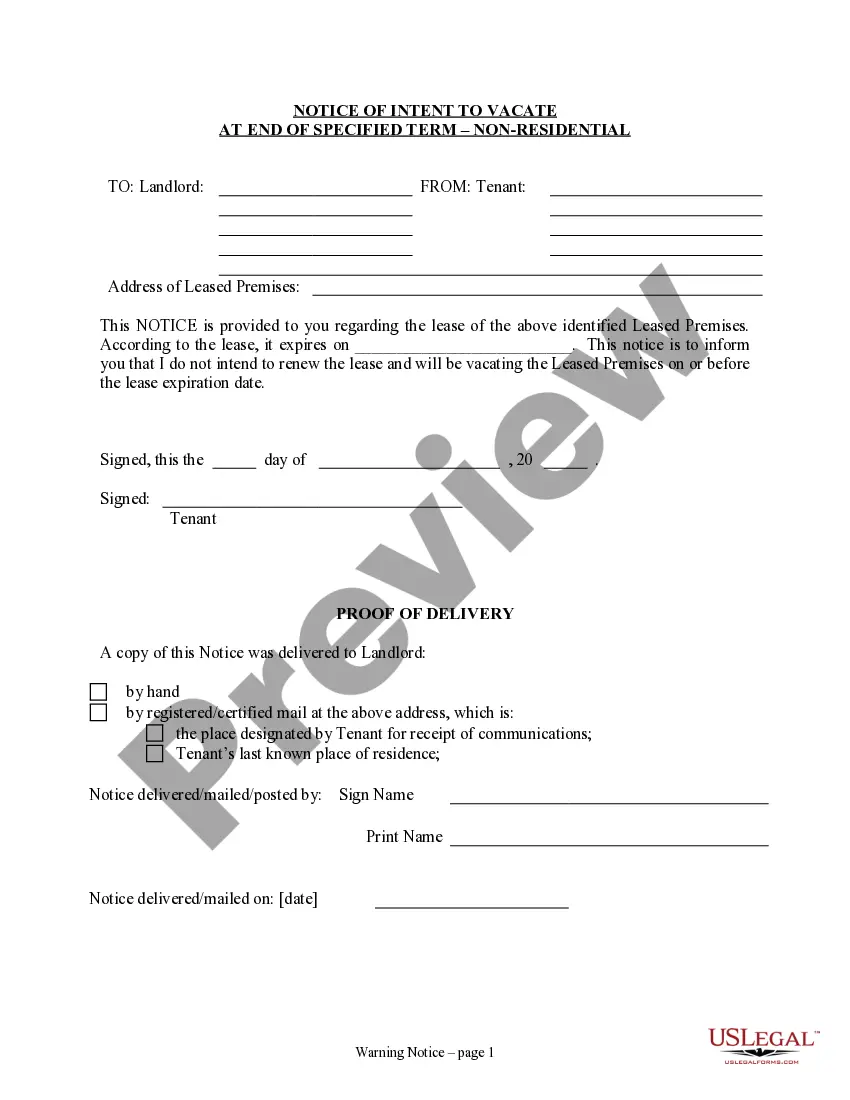

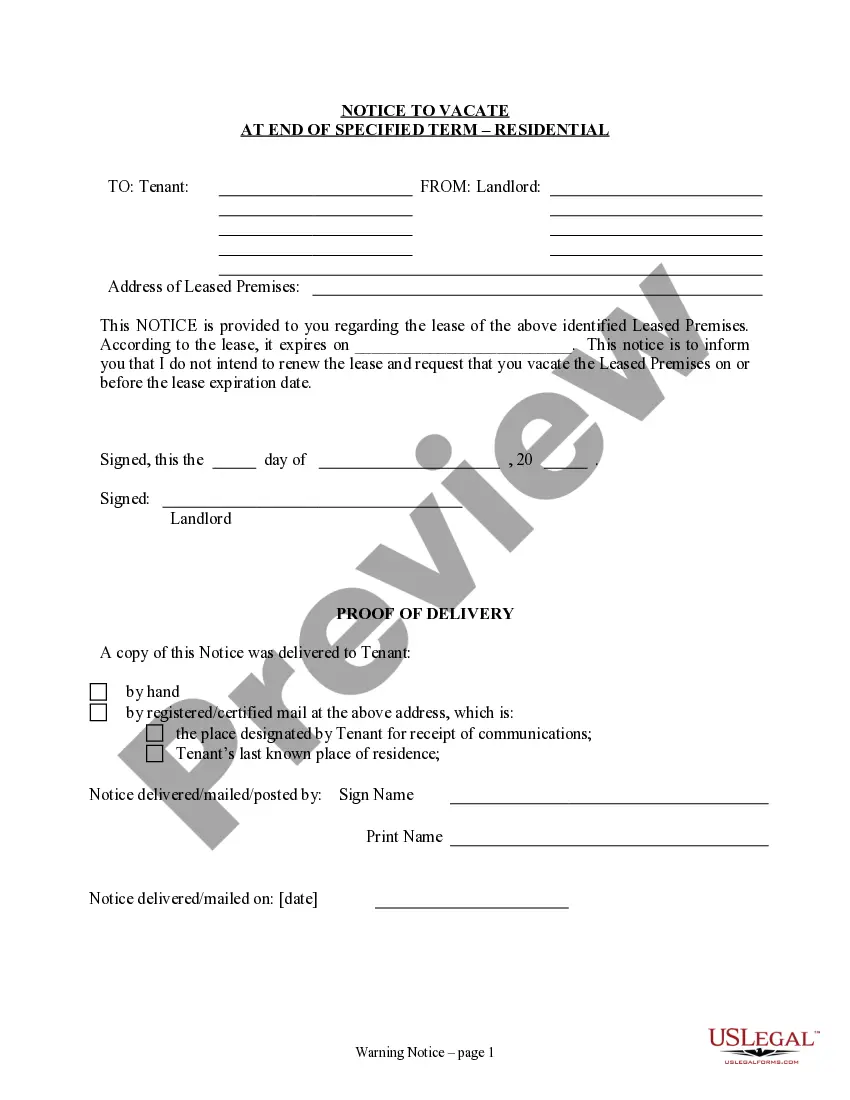

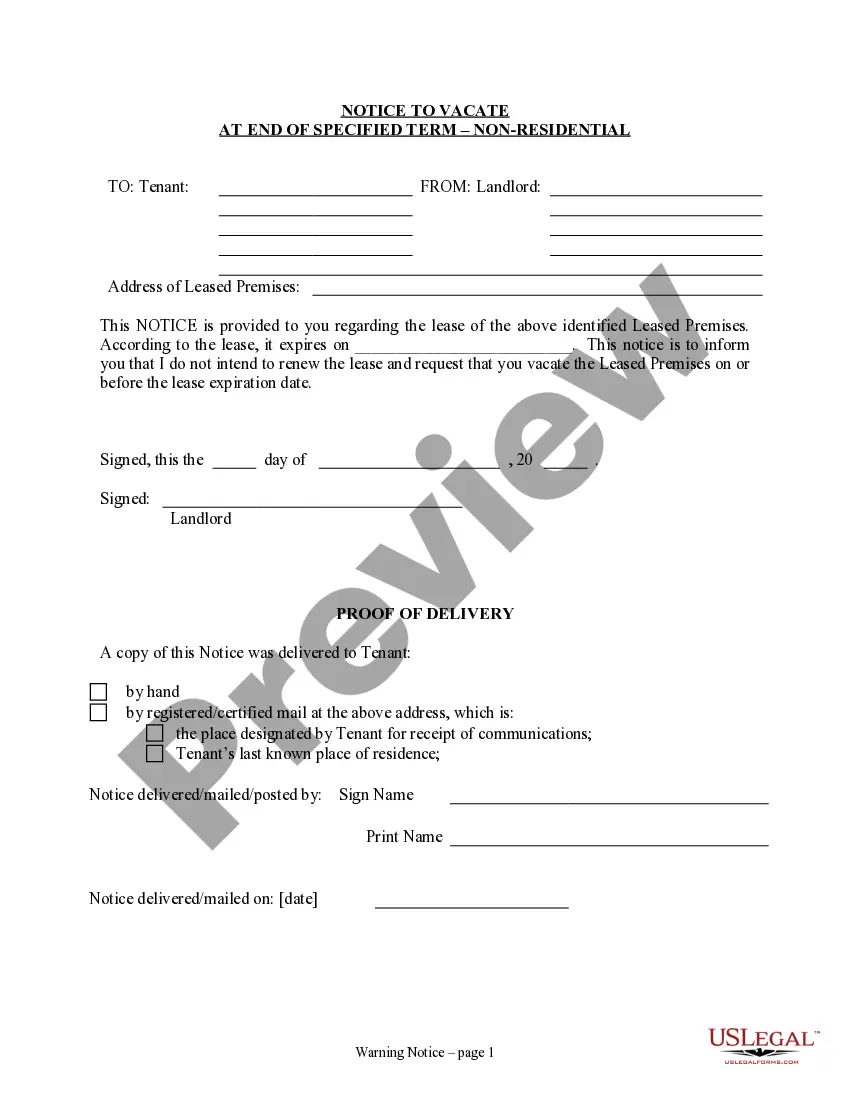

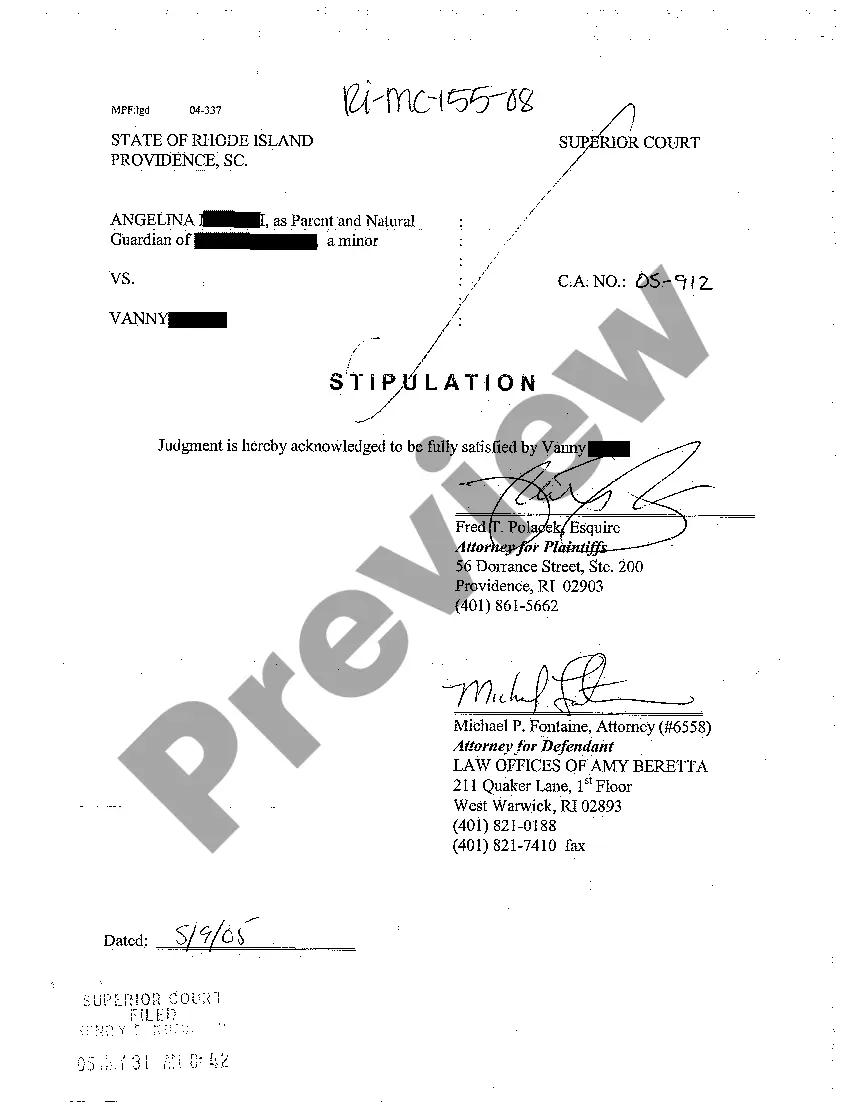

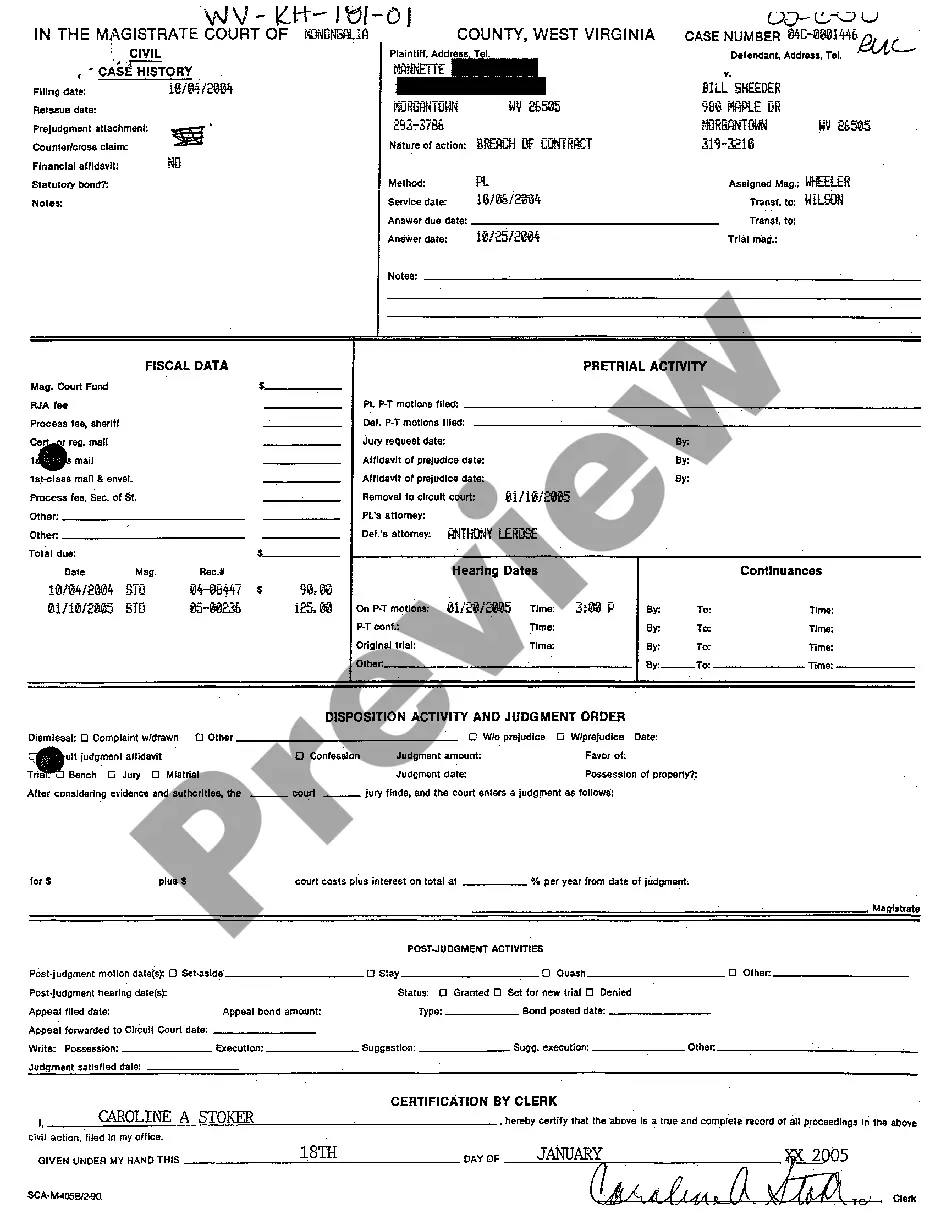

Notice of Mechanic's Lien: Laborer is providing notice to owner that he/she is placing a mechanic's lien on the property as a contractor and buildings that are the subject of the repairs, improvements, construction etc.

West Virginia Notice of Mechanic's Lien by Contractor - Corporation

Description Block Lot Prepared

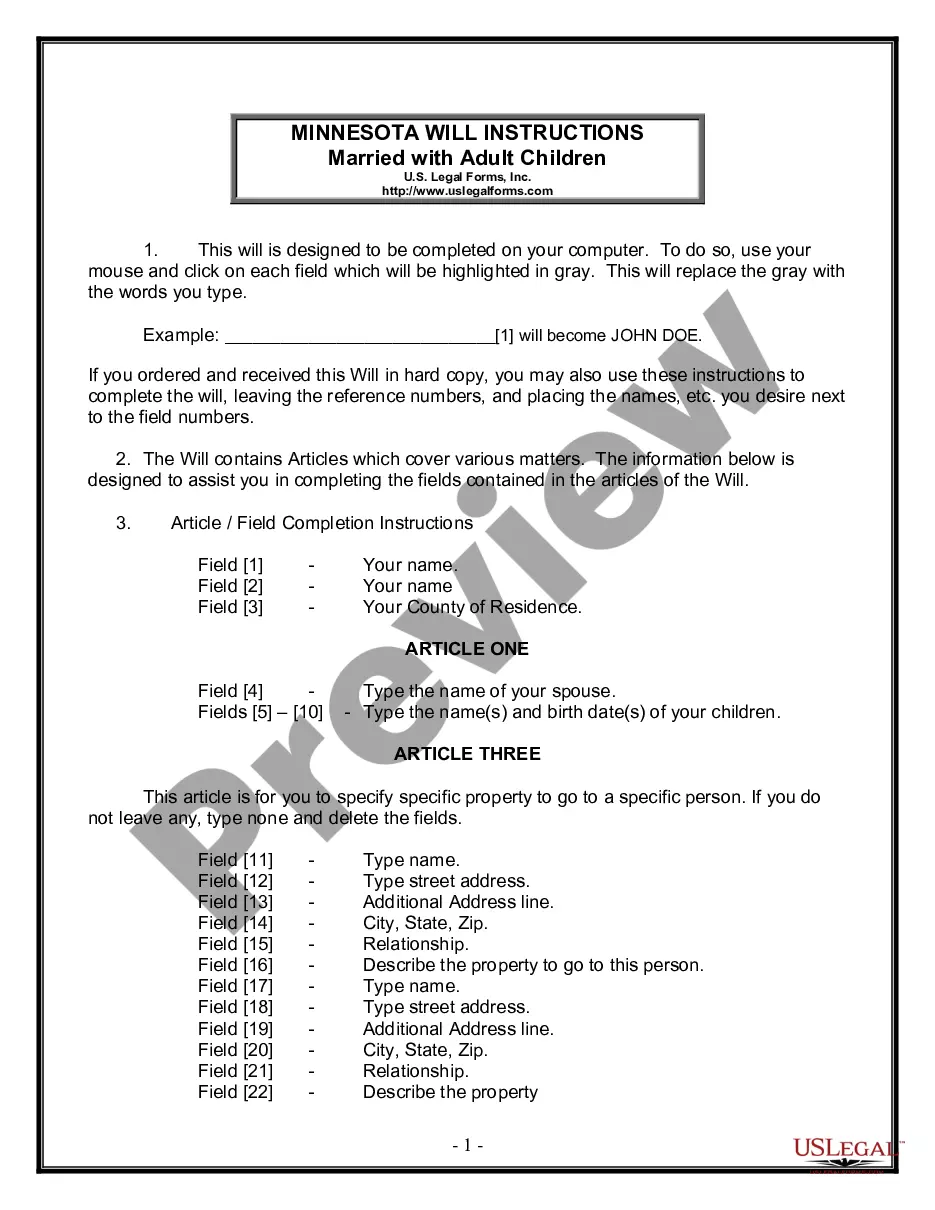

How to fill out Name Prepared Lien?

Out of the multitude of platforms that offer legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates before purchasing them. Its complete library of 85,000 samples is categorized by state and use for simplicity. All the documents on the platform have been drafted to meet individual state requirements by certified legal professionals.

If you have a US Legal Forms subscription, just log in, search for the form, hit Download and access your Form name from the My Forms; the My Forms tab holds your downloaded forms.

Follow the tips listed below to get the document:

- Once you find a Form name, ensure it’s the one for the state you really need it to file in.

- Preview the template and read the document description prior to downloading the template.

- Look for a new template using the Search field if the one you have already found is not appropriate.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

After you have downloaded your Form name, you may edit it, fill it out and sign it in an web-based editor of your choice. Any form you add to your My Forms tab can be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our service offers quick and simple access to samples that fit both attorneys and their customers.

Prepared Company Lien Form popularity

Name Corporation Official Other Form Names

Attest Va Prepared FAQ

Call the Business Division - call (304) 558-8000 to speak with a Business Specialist for a non-binding check. File the application - Submit the Name Reservation (form NR-1) application and filing fee to the Business Division. Once approved, the name is reserved exclusively for the applicant for 120 days.

If you need to change or amend an accepted West Virginia State Income Tax Return for the current or previous Tax Year, you need to complete Form IT-140. Form IT-140 is the Form used for the Tax Amendment.Check the "Amended return" box to report that it's an amended tax return.

Nonresidents must file a West Virginia tax return if their federal adjusted gross income includes income from West Virginia sources. Part-year residents of West Virginia must file a tax return, even if only to receive a refund.

According to West Virginia Instructions for Form IT 140, you must file a West Virginia tax return IF: You are a full year resident or part year resident of West Virginia.You had West Virginia income tax withheld from your wages and are due a refund.