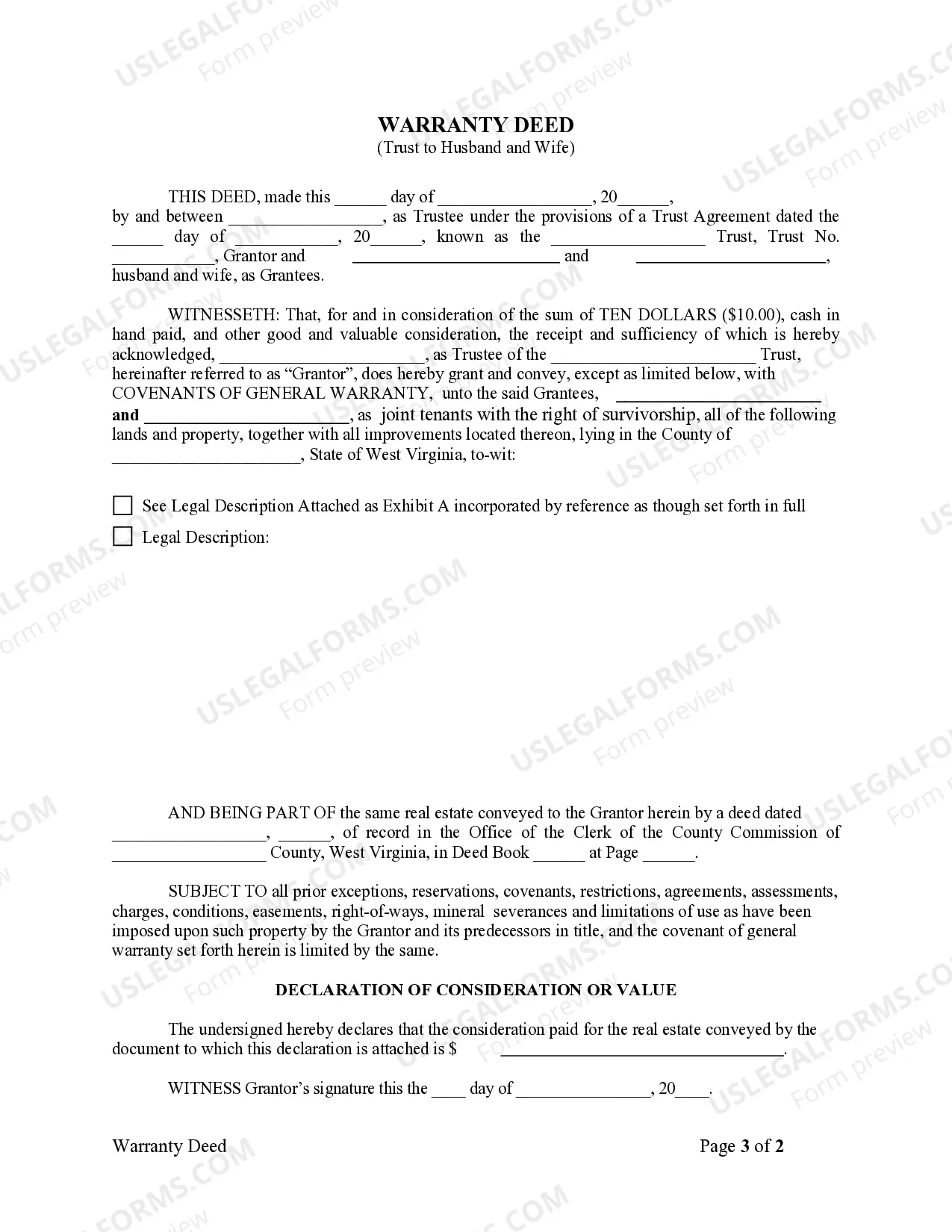

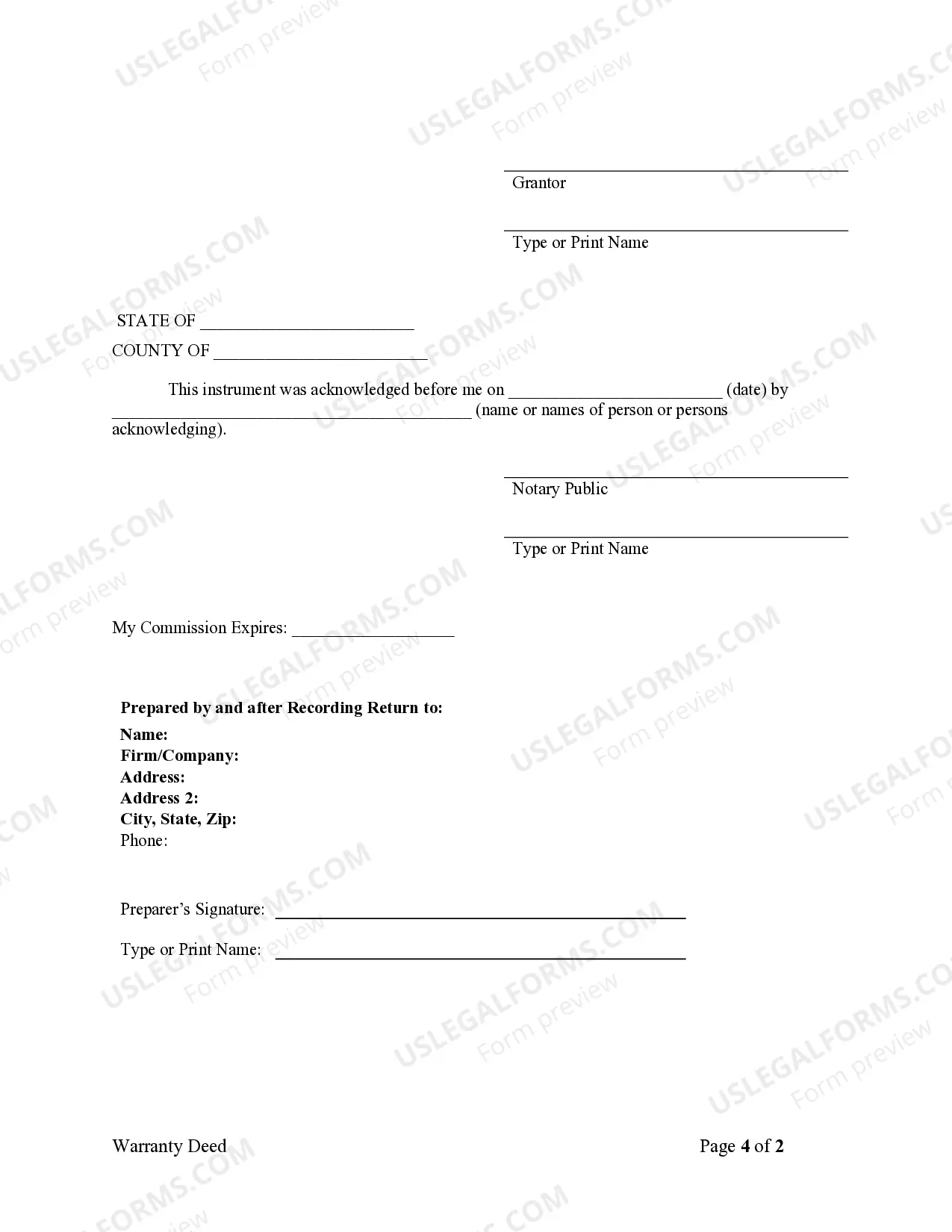

This form is a Warranty Deed where the grantor is a trust and the grantees are Husband and Wife. Grantor conveys and warrants the described property to the grantees. Grantees can take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

West Virginia Warranty Deed - Trust to Husband and Wife

Description

How to fill out West Virginia Warranty Deed - Trust To Husband And Wife?

Out of the large number of platforms that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms before buying them. Its extensive library of 85,000 samples is grouped by state and use for efficiency. All the forms on the platform have been drafted to meet individual state requirements by qualified legal professionals.

If you already have a US Legal Forms subscription, just log in, look for the form, hit Download and obtain access to your Form name in the My Forms; the My Forms tab keeps all your saved forms.

Stick to the tips listed below to obtain the document:

- Once you see a Form name, ensure it is the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Look for a new template via the Search engine if the one you have already found is not appropriate.

- Just click Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

After you’ve downloaded your Form name, you can edit it, fill it out and sign it with an web-based editor that you pick. Any form you add to your My Forms tab can be reused many times, or for as long as it remains the most updated version in your state. Our service offers easy and fast access to samples that suit both attorneys and their clients.

Form popularity

FAQ

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.

A deed conveys ownership; a deed of trust secures a loan.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

A Declaration of Trust (also known as a Deed of Trust) is a legally binding document in which the legal owners of the property declare that they hold the property on trust for the beneficial owners and sets out the shares in which the beneficial interests are held.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.