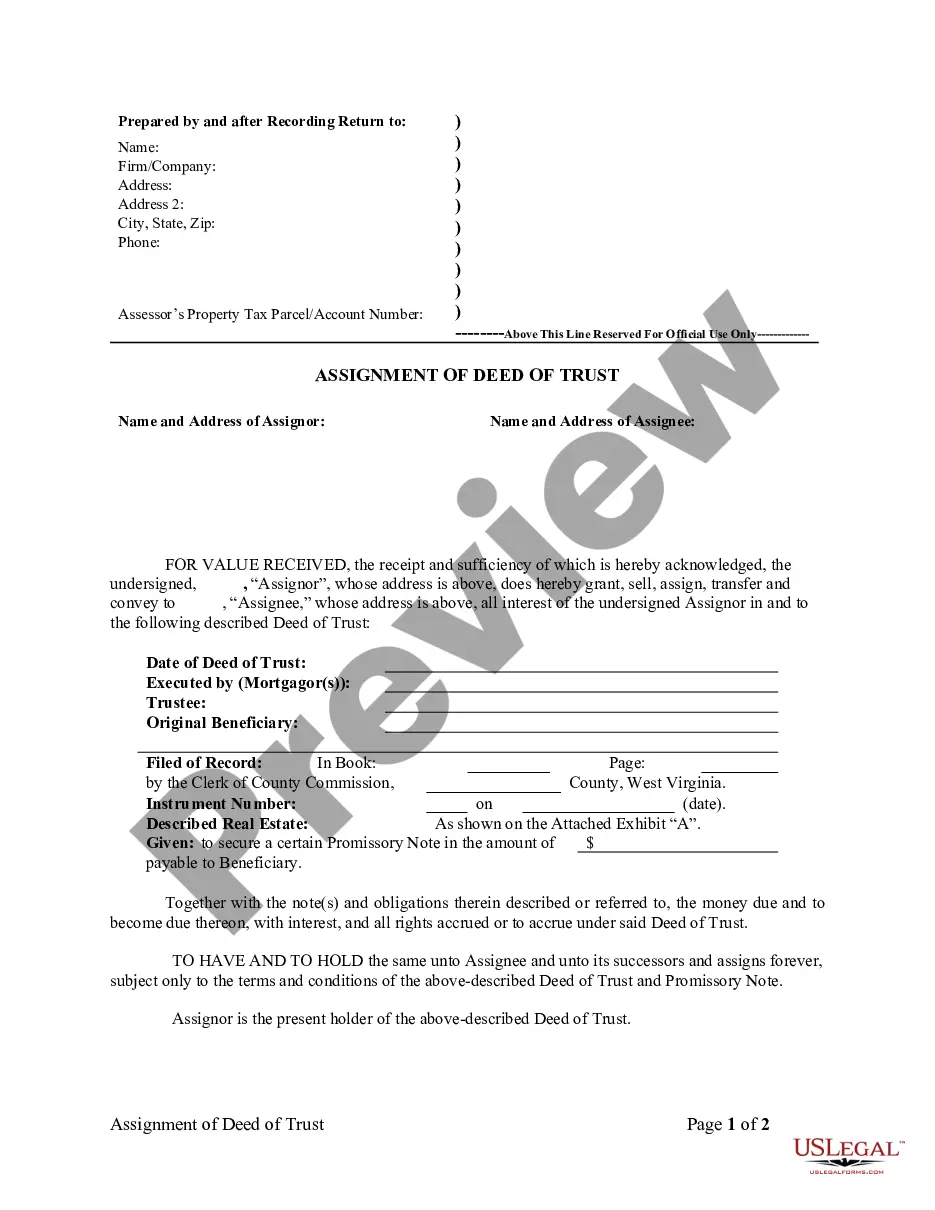

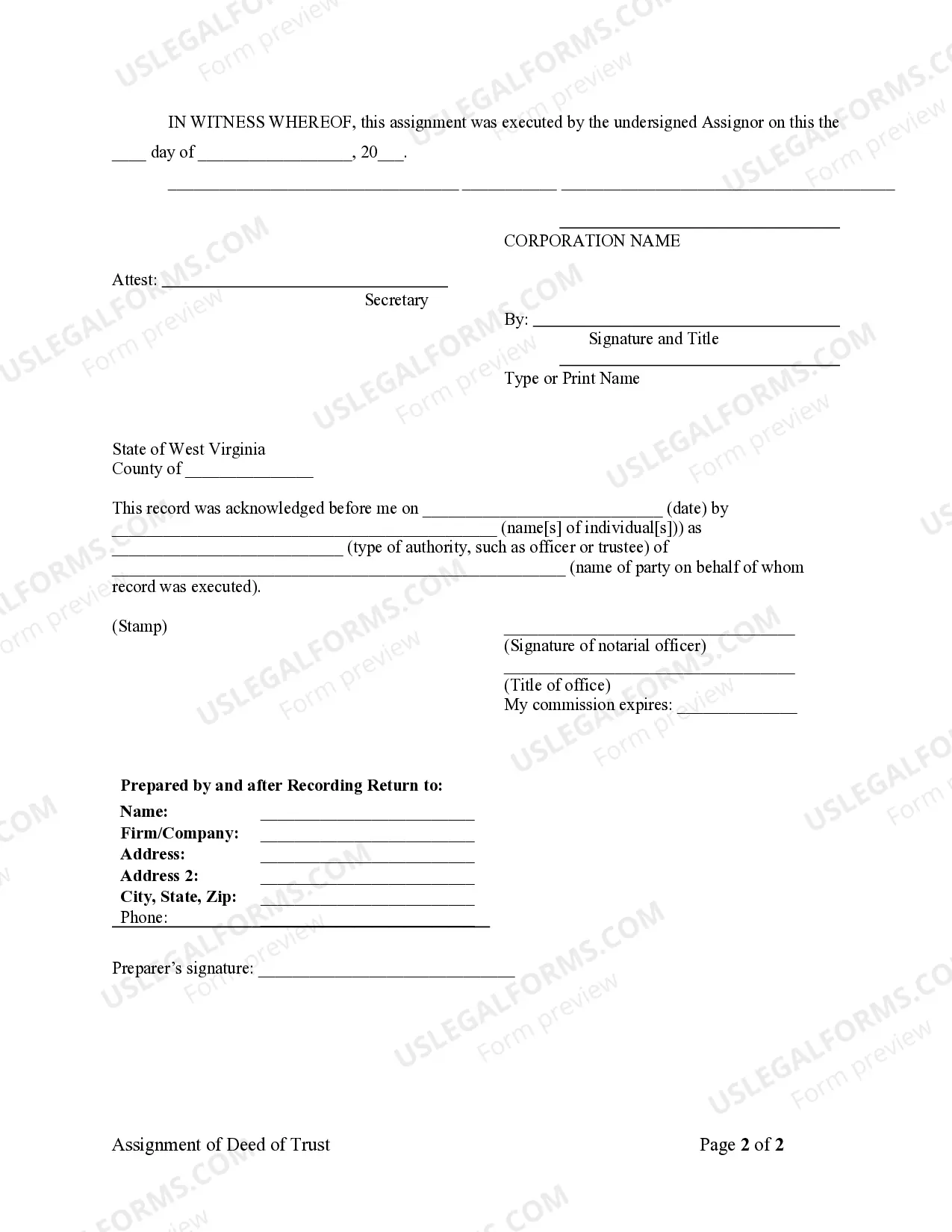

This Assignment of Deed of Trust by Corporate Mortgage Holder is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

West Virginia Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out West Virginia Assignment Of Deed Of Trust By Corporate Mortgage Holder?

Out of the multitude of platforms that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey while previewing forms before buying them. Its complete library of 85,000 templates is categorized by state and use for efficiency. All the documents on the platform have been drafted to meet individual state requirements by qualified lawyers.

If you have a US Legal Forms subscription, just log in, look for the form, press Download and access your Form name from the My Forms; the My Forms tab holds all of your downloaded documents.

Keep to the guidelines below to get the form:

- Once you see a Form name, ensure it is the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the template.

- Search for a new sample through the Search engine if the one you’ve already found is not correct.

- Click on Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the document.

After you’ve downloaded your Form name, you are able to edit it, fill it out and sign it with an online editor that you pick. Any form you add to your My Forms tab can be reused many times, or for as long as it remains the most updated version in your state. Our platform provides easy and fast access to templates that suit both attorneys as well as their clients.

Form popularity

FAQ

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

Essentially, the Deed of Assignment (DOA) is a legal document that transfers the ownership of a property from one party to another.

The basic difference between the mortgage as a security instrument and a Deed of Trust is that in a Deed of Trust there are three parties involved, the borrower, the lender, and a trustee, whereas in a mortgage document there are only two parties involved, the borrower and the lender.

An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note. Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party.