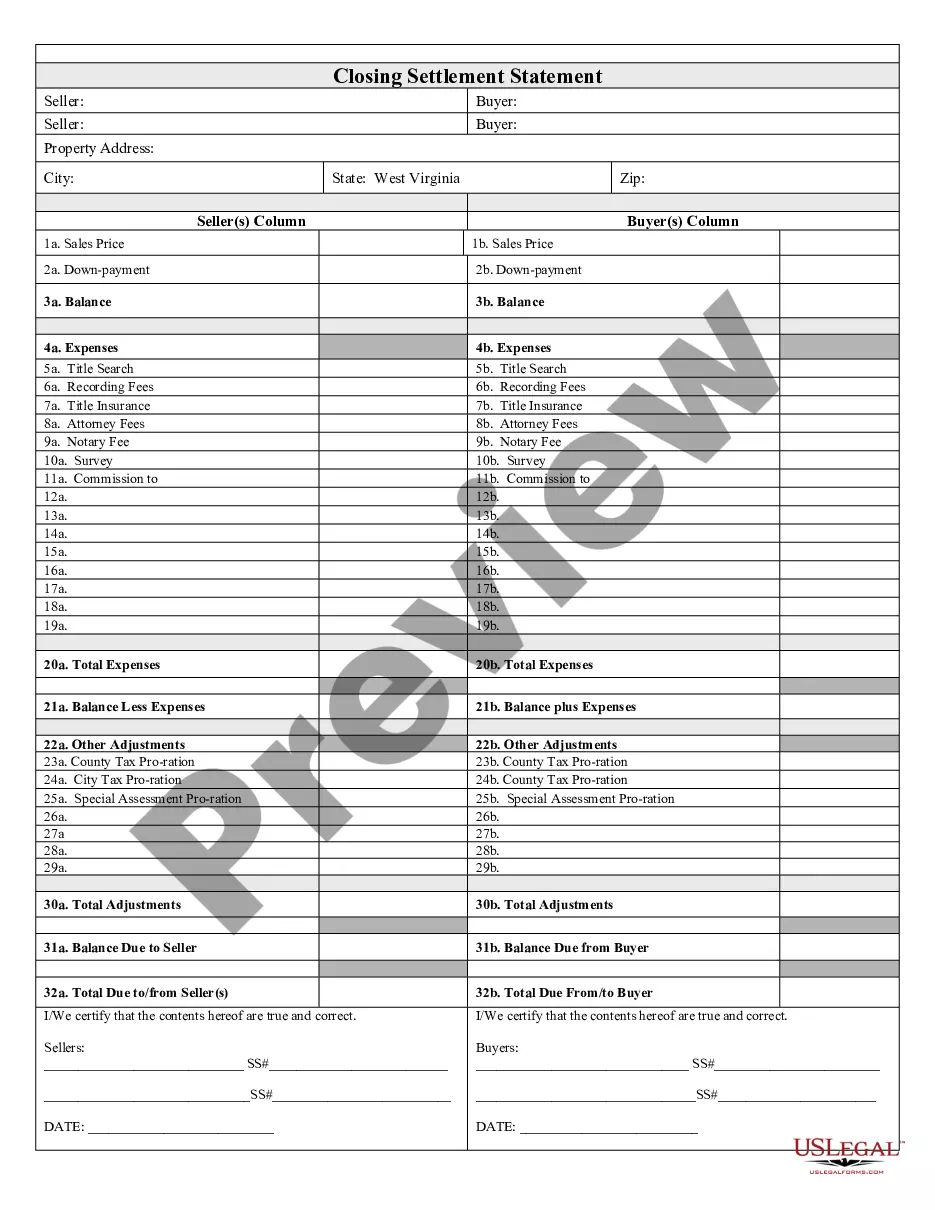

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

West Virginia Closing Statement

Description Settlement Statement Form Fillable

How to fill out Wv Settlement Statements?

Out of the multitude of platforms that offer legal templates, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates before purchasing them. Its comprehensive catalogue of 85,000 templates is grouped by state and use for efficiency. All the forms available on the service have already been drafted to meet individual state requirements by accredited legal professionals.

If you already have a US Legal Forms subscription, just log in, look for the template, press Download and obtain access to your Form name in the My Forms; the My Forms tab keeps all of your saved documents.

Stick to the guidelines listed below to get the document:

- Once you find a Form name, ensure it’s the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the template.

- Look for a new template using the Search engine in case the one you have already found is not proper.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the document.

After you’ve downloaded your Form name, it is possible to edit it, fill it out and sign it in an web-based editor that you pick. Any document you add to your My Forms tab might be reused many times, or for as long as it remains to be the most up-to-date version in your state. Our service provides quick and easy access to templates that suit both lawyers and their clients.

Residential Closing Forms In West Virginia Form popularity

West Virginia Closing Settlement Form Other Form Names

How Much Are Closing Costs In Wv FAQ

Closing costs are paid according to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.

Owner's Title Insurance Premium: While some lenders may not require it, consider getting an owner's title insurance policy to protect yourself from any defects on the property title. This insurance coverage may cost more than $1,000 depending on your property value.

In West Virginia, the buyer traditionally pays for the items listed below, in addition to their lender's mortgage application costs, and other fees and closing costs. It is not unusual for buyer's closing costs to run between $3,000 and $6,000, PLUS their down payment.

One of the big differences is that, in West Virginia, buyers rarely purchase Buyer's Title Insurance (also known as Owner's Title Insurance, or an Owner's Title Policy) at closing. In Florida, virtually all buyers are provided with owner's title insurance, which is customarily paid for by the seller.

Who pays closing costs? Typically, both buyers and sellers pay closing costs, with buyers generally paying more than sellers. The buyer's closing costs typically run 5 to 6 percent of the sale price, according to Realtor.com.

According to data from ClosingCorp, the average closing cost in West Virginia is $3,384 after taxes, or approximately 1.69% to 3.38% of the final home sale price.

Generally, sellers can pay any of your settlement charges. This includes the amounts necessary to set up your escrow account. For sellers, offering, or at least being open to paying a buyer's closing costs, can increase the number of potential buyers.

How much are closing costs in West Virginia? While both you and the buyer will be shelling out for closing costs, typically the buyer takes the brunt of closing costs. For the buyer, they'll pay around 3% to 4% of the sales price. As the seller, you'll typically pay around 1% to 3% in closing costs.