West Virginia Dissolution Package to Dissolve Corporation

What is this form?

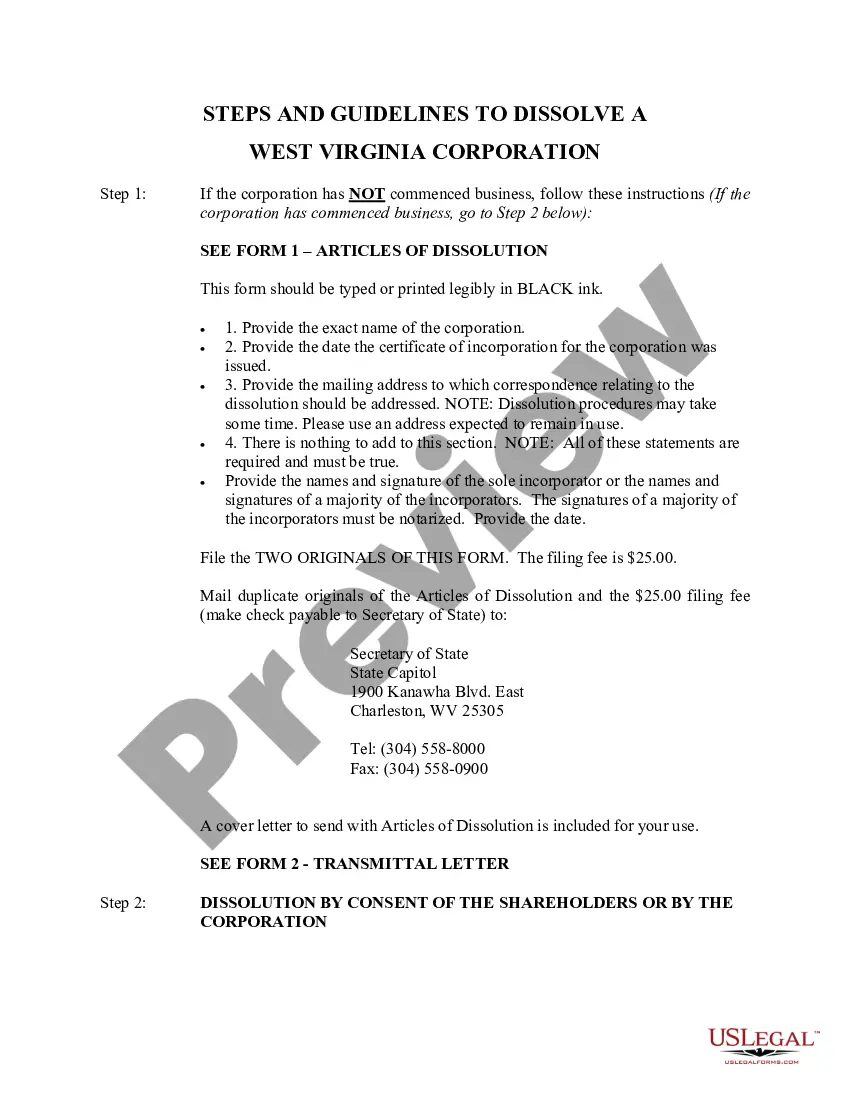

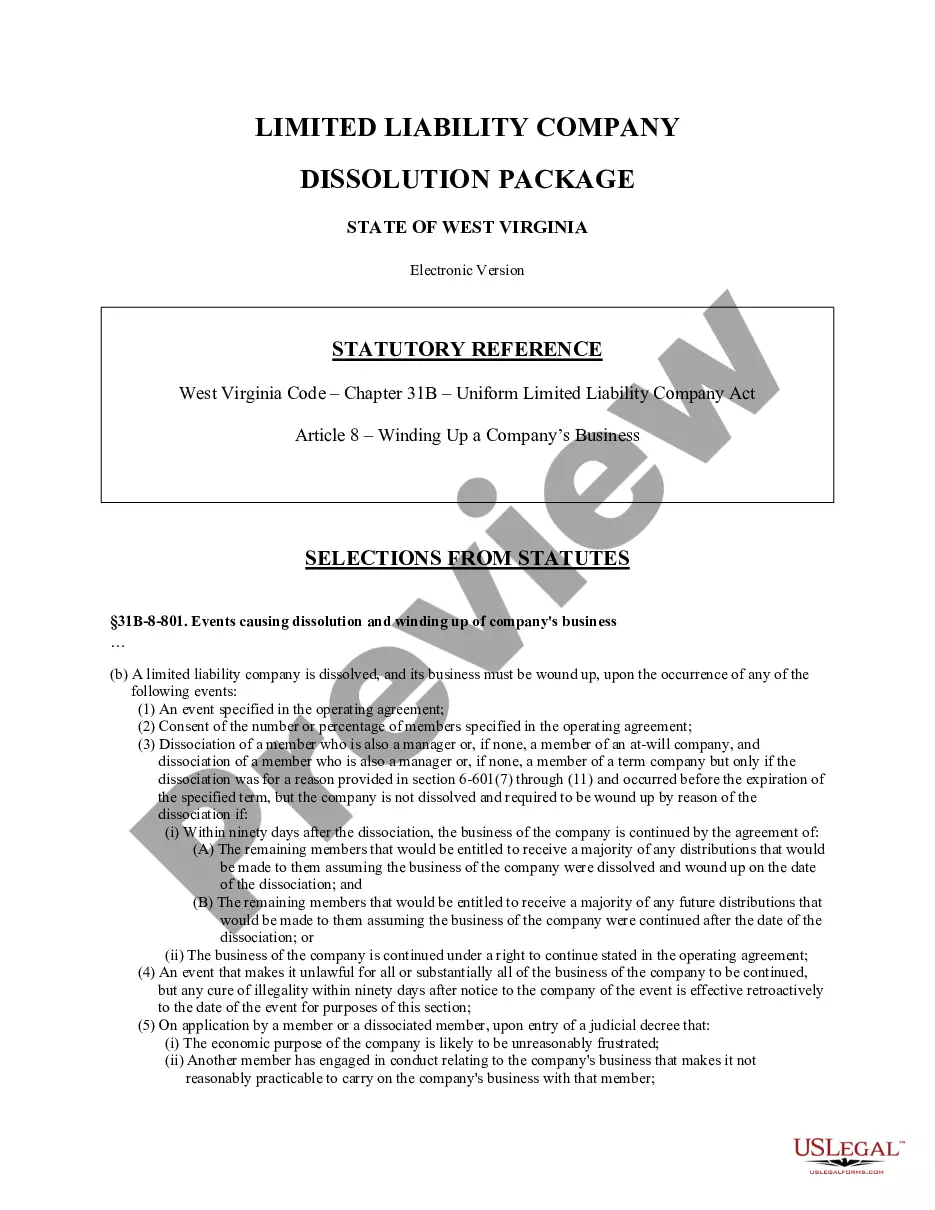

The West Virginia Dissolution Package to Dissolve Corporation is a comprehensive set of documents designed to facilitate the formal dissolution of a corporation in West Virginia. This package includes all required forms, step-by-step instructions, and relevant information needed to ensure compliance with state laws governing corporate dissolution. It is specifically tailored for those intending to officially close a corporation rather than simply ceasing operations.

Key parts of this document

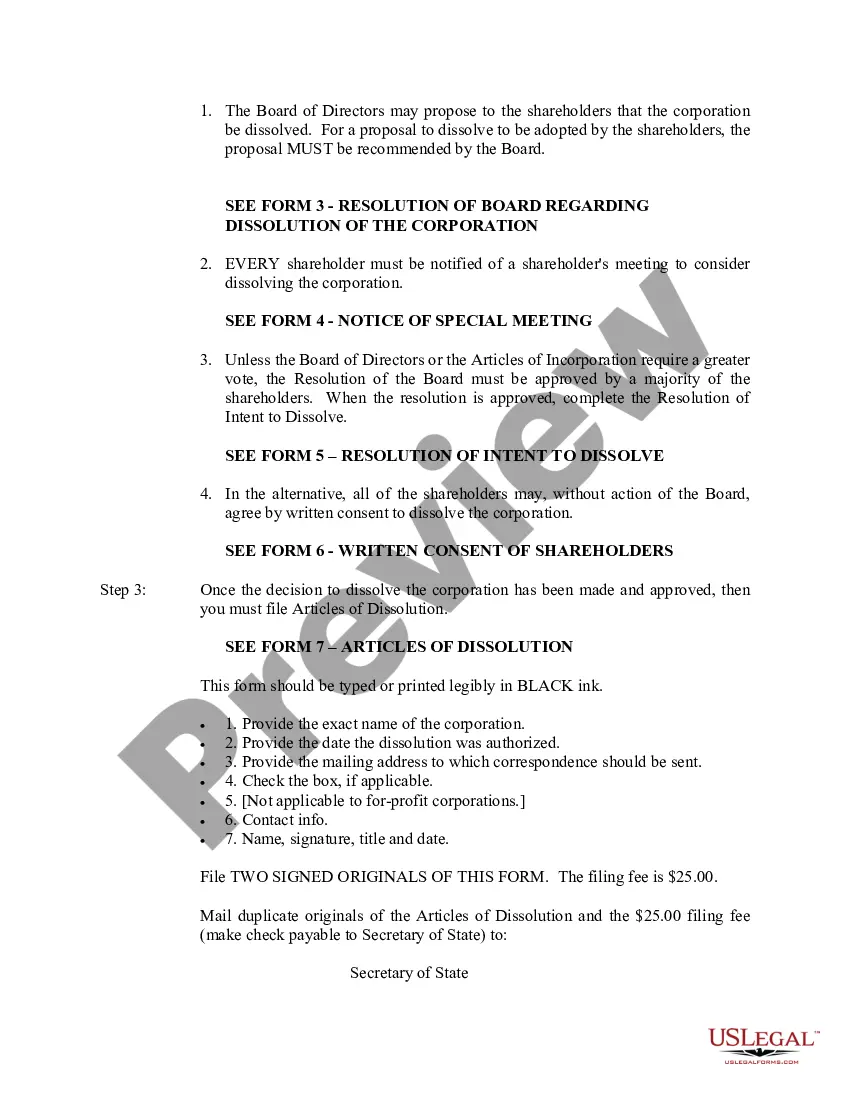

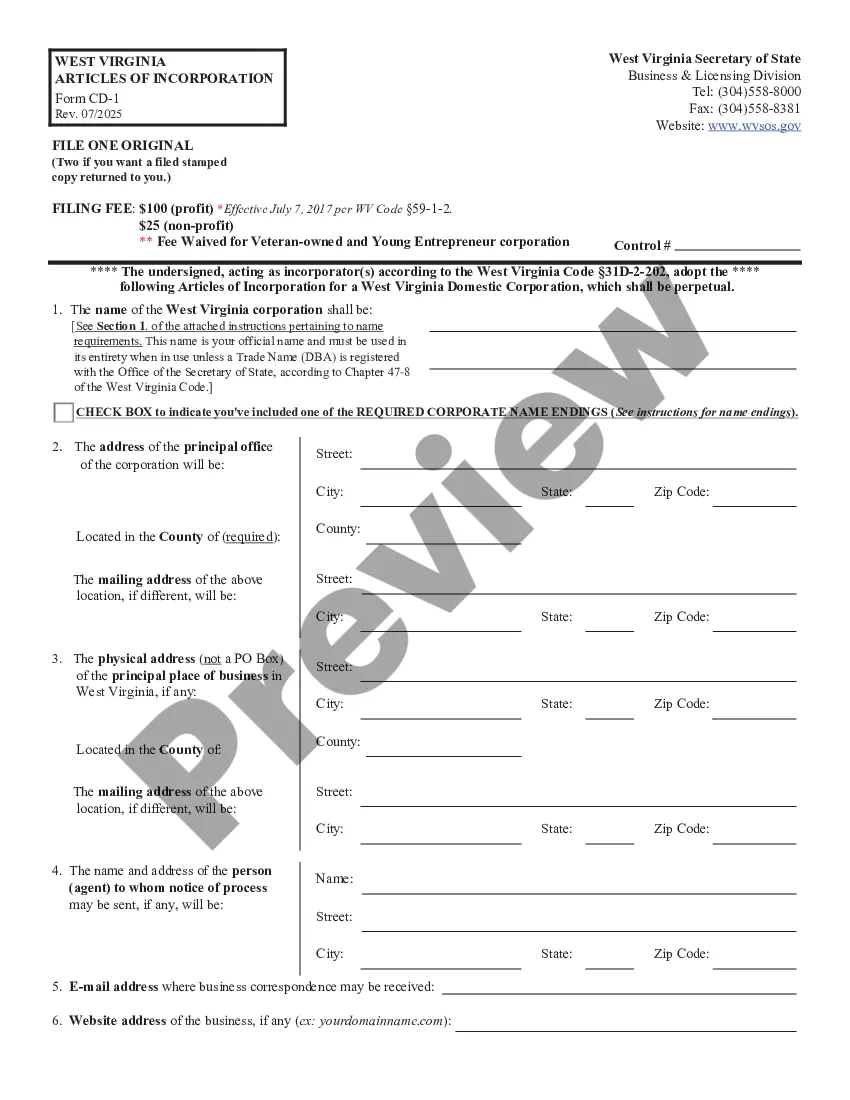

- Articles of Dissolution: Form to officially dissolve the corporation.

- Transmittal Letter: A cover letter used to accompany the Articles of Dissolution.

- Resolution of Intent to Dissolve: Document detailing the decision by the board of directors or shareholders.

- Notice of Special Meeting: Notification to shareholders regarding the meeting to discuss dissolution.

- Written Consent of Shareholders: Agreement from shareholders to proceed with the dissolution.

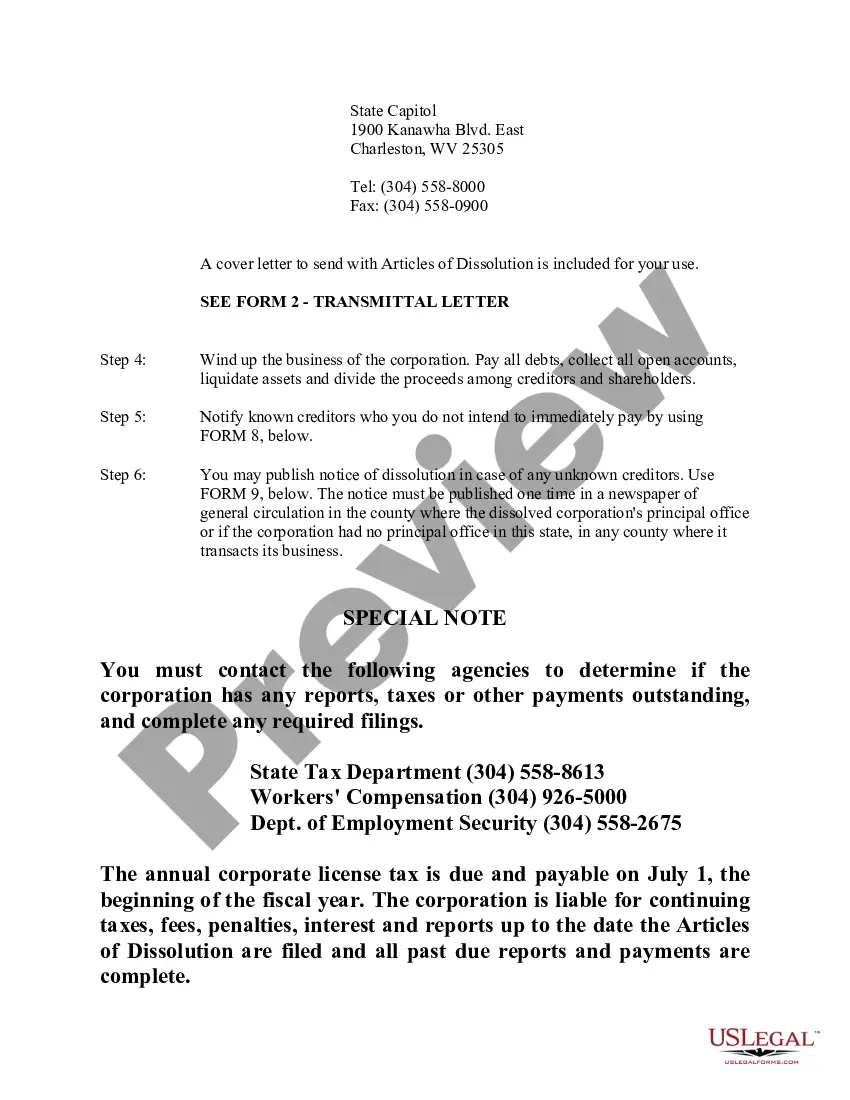

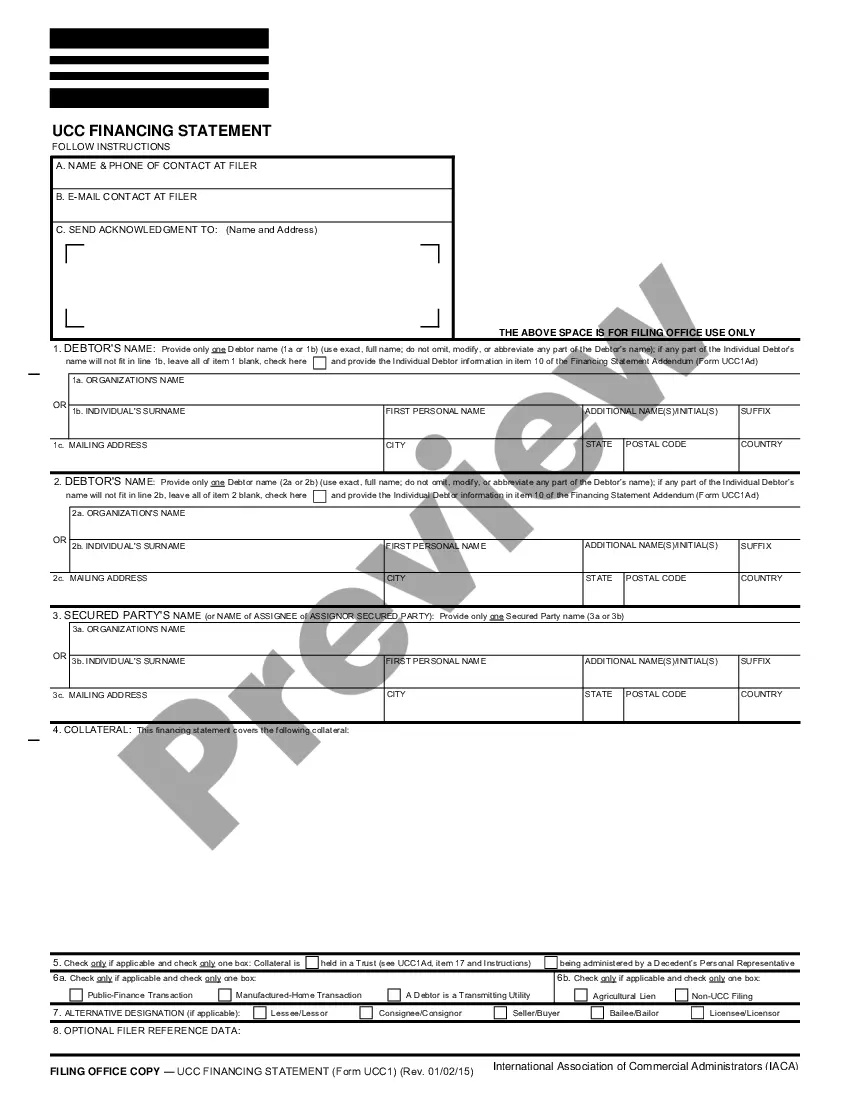

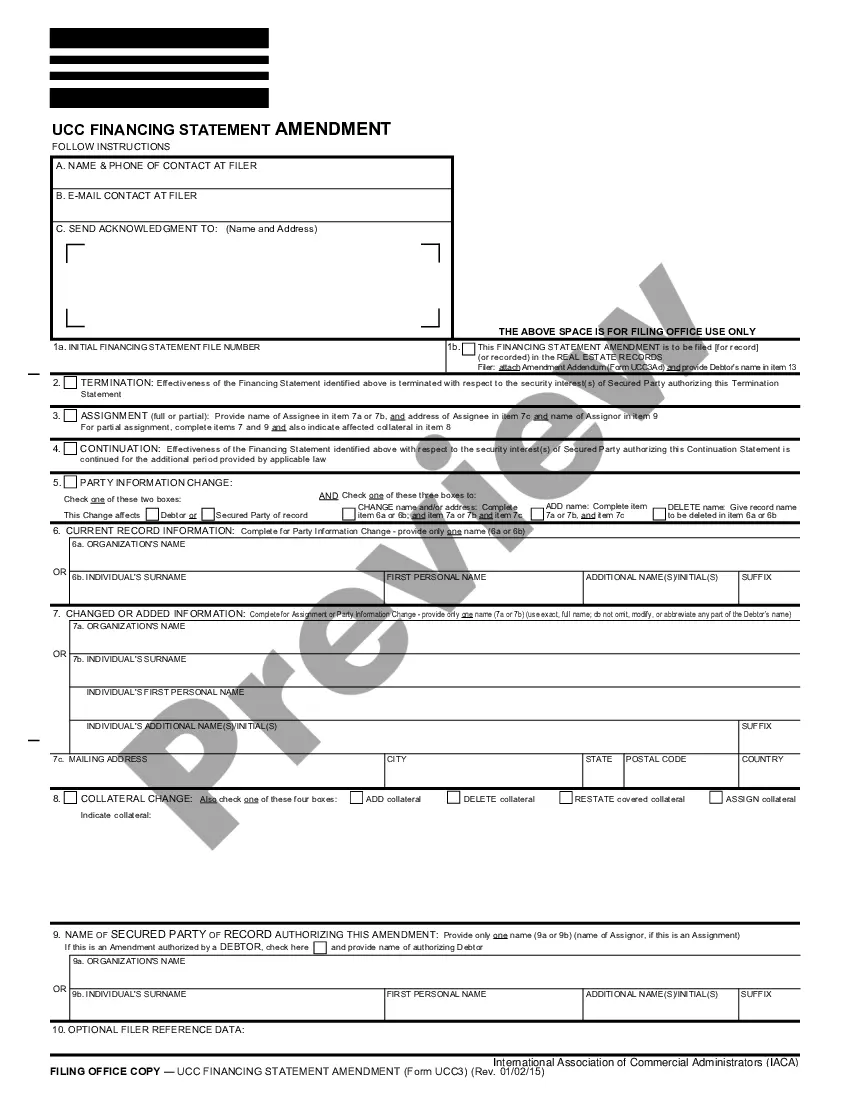

- Claim Notices: Notices to notify creditors and request claims following dissolution.

When this form is needed

This form package should be used when a corporation in West Virginia has decided to cease its operations and formally dissolve itself. It is applicable in various scenarios, including when all shareholders agree to the dissolution, when a corporation has never commenced business, or when the board of directors recommends dissolution to the shareholders. It ensures legal compliance while managing the responsibilities involved in winding down corporate affairs.

Intended users of this form

This form package is intended for:

- Corporation owners and directors in West Virginia.

- Shareholders involved in the decision to dissolve a corporation.

- Legal representatives seeking to assist with the formal dissolution process.

- Individuals responsible for managing corporate compliance and legal filings.

How to complete this form

- Gather required information about your corporation, including its legal name and incorporation date.

- Complete the Articles of Dissolution, ensuring all statements are accurate and signed by a majority of incorporators.

- If applicable, notify shareholders and get their consent to dissolve through the Resolution of Intent to Dissolve.

- File the Articles of Dissolution and any additional required forms with the West Virginia Secretary of State, along with the appropriate filing fee.

- Wind up affairs by settling debts, liquidating assets, and distributing remaining property to shareholders.

Notarization requirements for this form

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to properly notify all shareholders about the dissolution proposal.

- Not signing or notarizing required documents as specified by law.

- Neglecting to resolve outstanding debts and claims before filing for dissolution.

- Submitting incomplete forms or incorrect fees to the Secretary of State.

Benefits of completing this form online

- Convenient and accessible: Downloadable forms can be completed at your convenience.

- Guided instructions: Step-by-step guidance ensures all legal requirements are met.

- Time efficiency: Electronic filing options may be available to expedite the process.

- Compliance assurance: Utilizing attorney-drafted forms helps mitigate legal risks.

Looking for another form?

Form popularity

FAQ

Hold a Directors meeting and record a resolution to Dissolve the Virginia Corporation. Hold a Shareholder meeting to approve Dissolution of the Virginia Corporation. File a Articles of Dissolution with the VA State Corporation Commission.

In most states, to keep a corporation active, the owners must file annual reports and income tax returns. They may have to pay annual fees as well. Failure to do these things can render the corporation inactive. A corporation may also voluntarily become inactive by ceasing to do business.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

An inactive business is a business that still exists but has no activity, which means no business transactions during a specific year.Even if the business has no income, it may still be considered active for tax purposes. There are many reasons a business may become inactive.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.