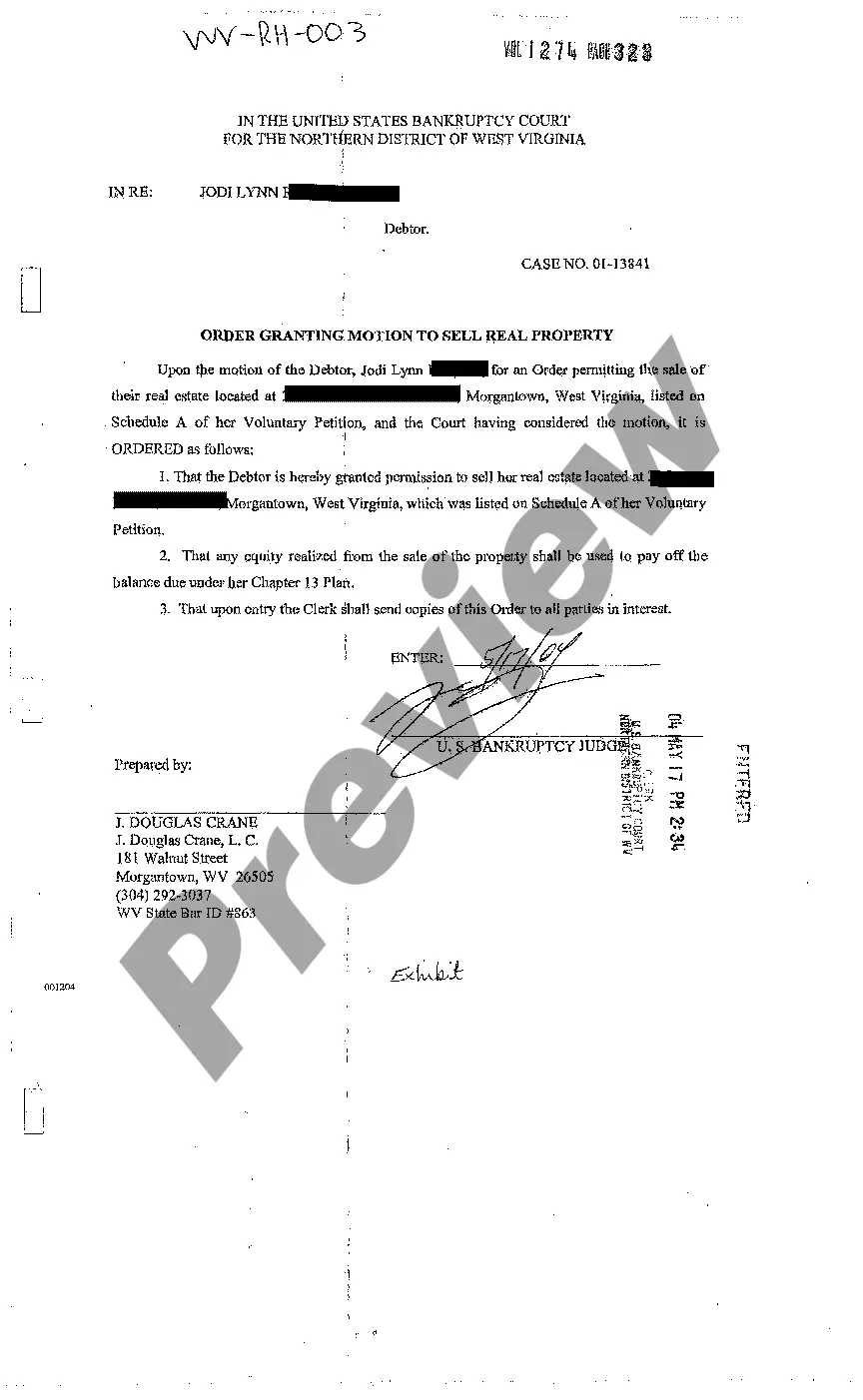

West Virginia Order Granting Motion to Sell Real Property to Pay off Balance Due under Chapter 13 Bankruptcy

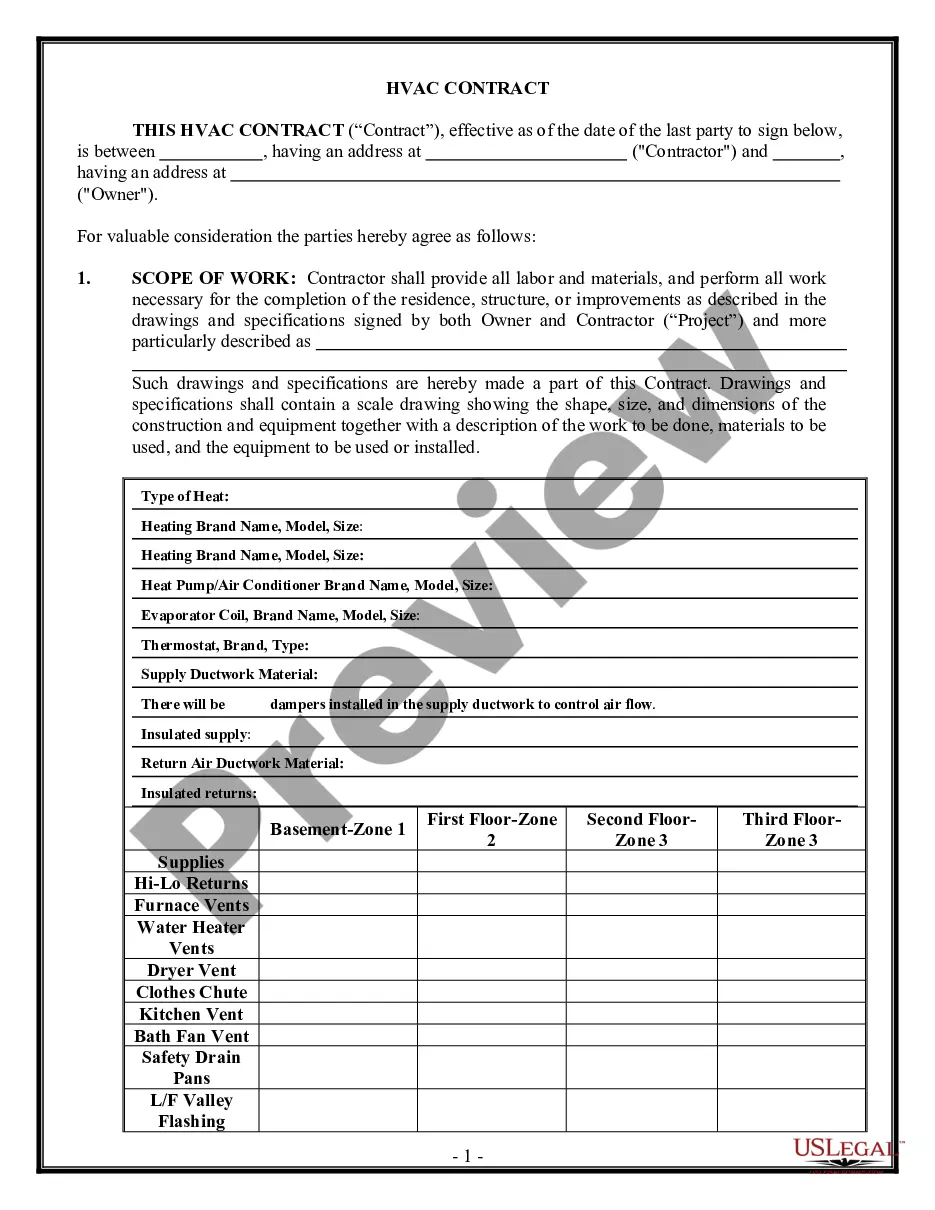

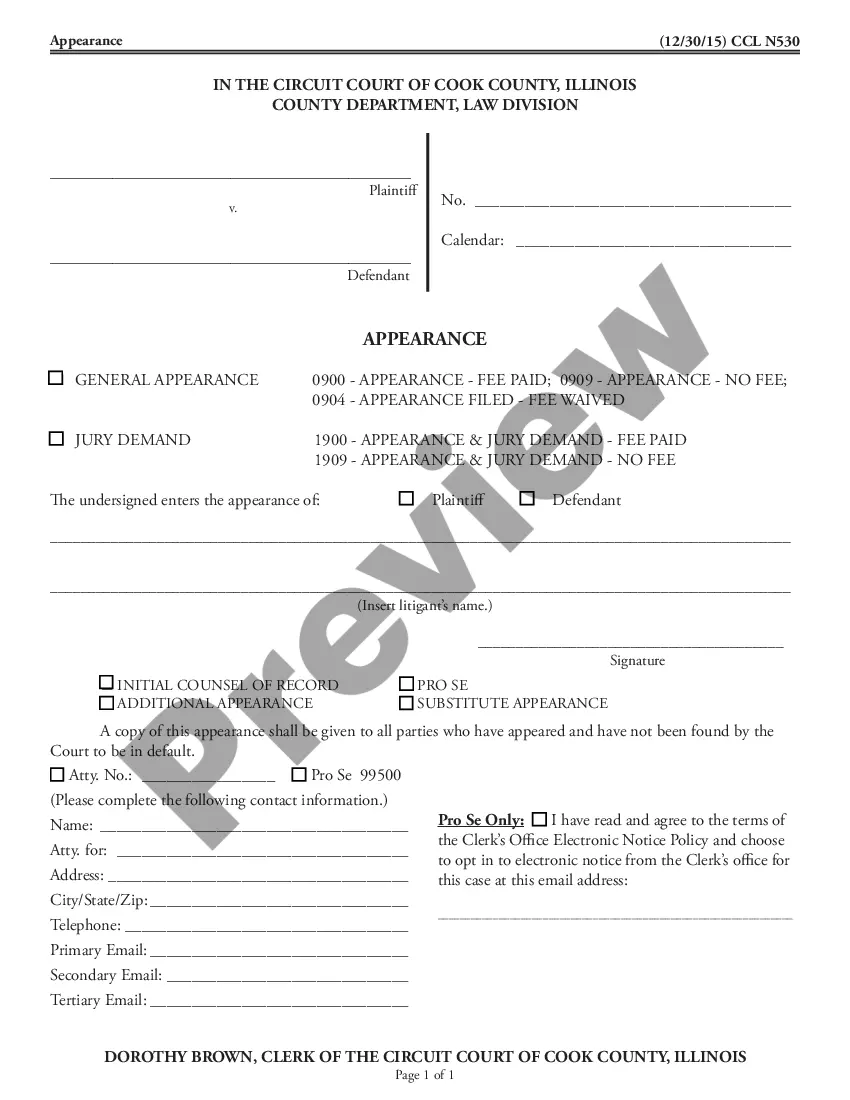

Description

How to fill out West Virginia Order Granting Motion To Sell Real Property To Pay Off Balance Due Under Chapter 13 Bankruptcy?

Among countless paid and free samples that you’re able to get on the net, you can't be sure about their accuracy. For example, who created them or if they’re competent enough to deal with what you require them to. Keep relaxed and use US Legal Forms! Discover West Virginia Order Granting Motion to Sell Real Property to Pay off Balance Due under Chapter 13 Bankruptcy templates developed by professional legal representatives and get away from the costly and time-consuming process of looking for an lawyer or attorney and then paying them to draft a document for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access your previously acquired templates in the My Forms menu.

If you’re making use of our service the first time, follow the instructions listed below to get your West Virginia Order Granting Motion to Sell Real Property to Pay off Balance Due under Chapter 13 Bankruptcy quickly:

- Make sure that the file you find applies where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another template utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you have signed up and paid for your subscription, you can use your West Virginia Order Granting Motion to Sell Real Property to Pay off Balance Due under Chapter 13 Bankruptcy as many times as you need or for as long as it remains active where you live. Edit it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

Although a chapter 13 debtor generally receives a discharge only after completing all payments required by the court-approved (i.e., "confirmed") repayment plan, there are some limited circumstances under which the debtor may request the court to grant a "hardship discharge" even though the debtor has failed to

A Motion for Relief from the automatic stay is basically a request from a creditor to the Bankruptcy Court for permission to take back collateral. Motions for Relief are set down for hearings before the Bankruptcy Court.If a creditor has good cause for filing the motion, it will be granted.

When you complete your Chapter 13 repayment plan, you'll receive a discharge order that will wipe out the remaining balance of qualifying debt. In fact, a Chapter 13 bankruptcy discharge is even broader than a Chapter 7 discharge because it wipes out certain debts that aren't nondischargeable in Chapter 7 bankruptcy.

The automatic stay in bankruptcy is a temporary federal injunction that immediately stops most collection efforts by creditors, collection agencies and government entities against debtors and their property.It merely suspends efforts to collect or proceed against those debts while a bankruptcy case is open.

When you file a Chapter 13 bankruptcy an automatic stay goes into effect immediately upon the filing of your case.When these payments are not made, a secured creditor can file a Motion for Relief seeking relief from the Automatic Stay so they can take action against the collateral (i.e. your house or car).

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

Government Fines, Penalties, and Forfeitures You'll be able to discharge obligations you owe to a city, county, state, or other governmental agency in Chapter 13 bankruptcy, including those arising from fraud. However, you'll have to pay any restitution or a criminal fine incurred in criminal sentencing.

What is the bankruptcy discharge process and how long does it take? The discharge process takes 6-8 weeks from time of the last disbursement. Payroll stop deducts sometimes takes up to four weeks to process. The Trustee does a final audit to make sure all claims were paid correctly.

A discharge is a win! The bankruptcy discharge order wipes out your personal legal liability to pay a debt. A dismissal is usually a loss. It means the bankruptcy case was closed before a discharge was entered.