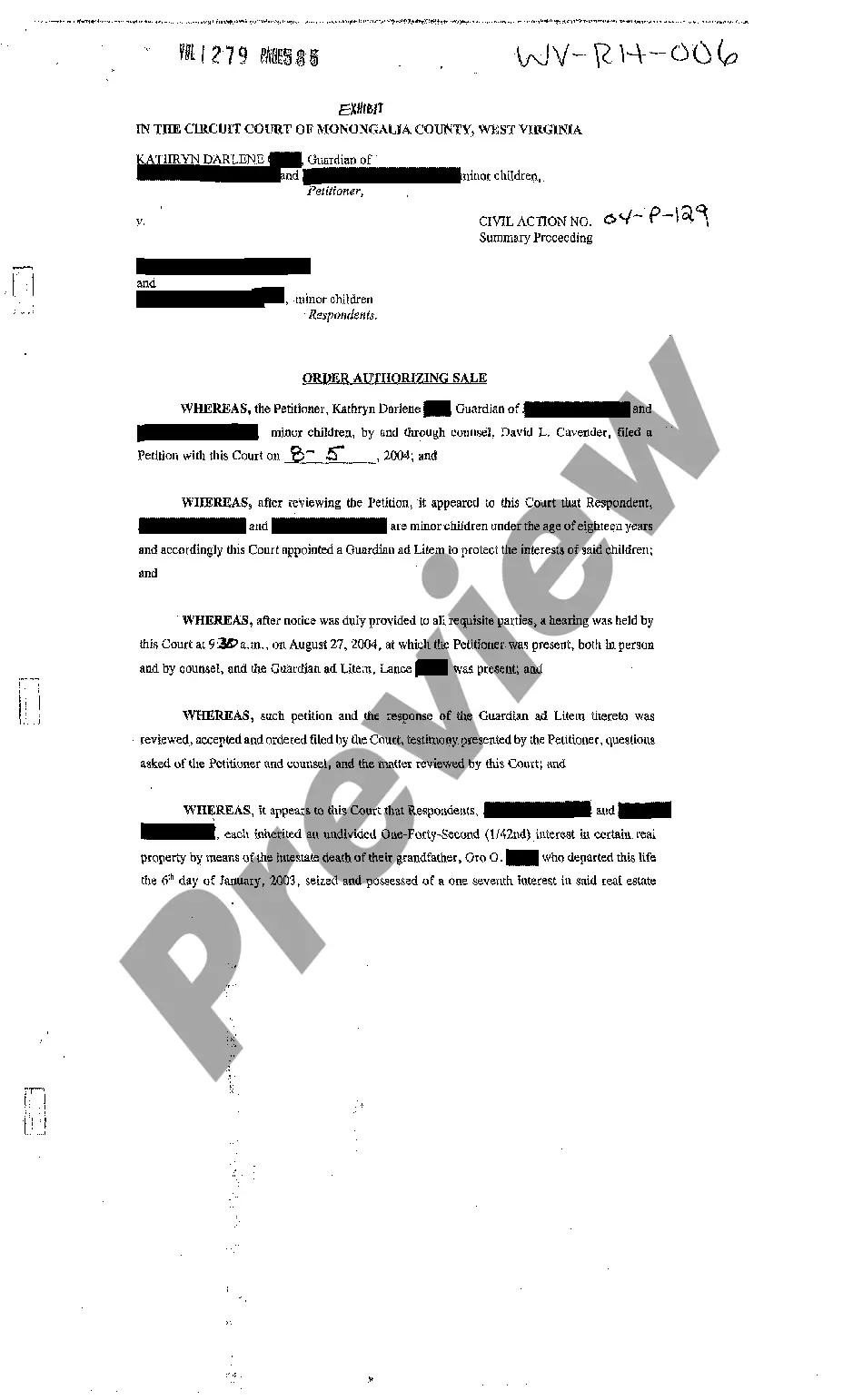

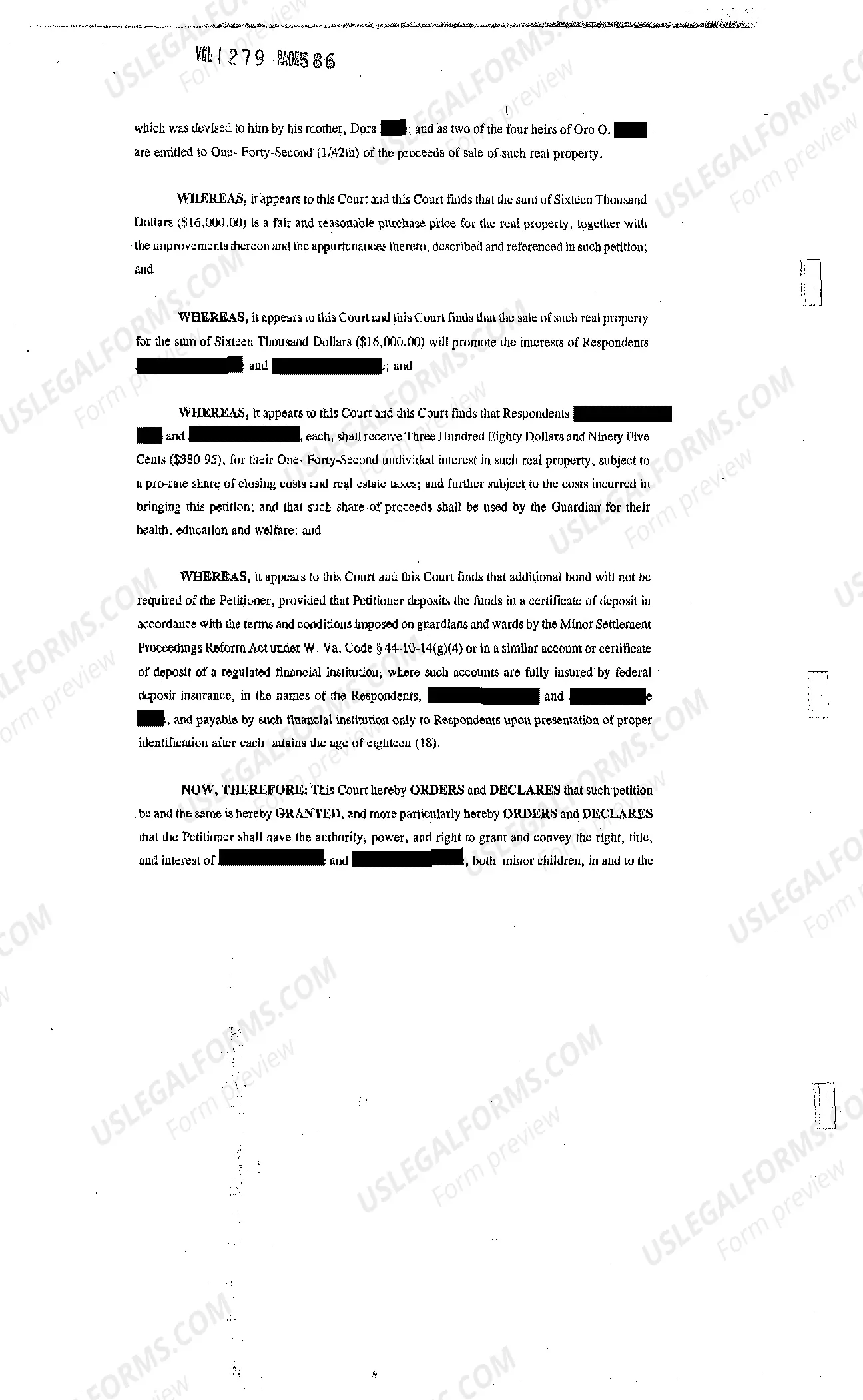

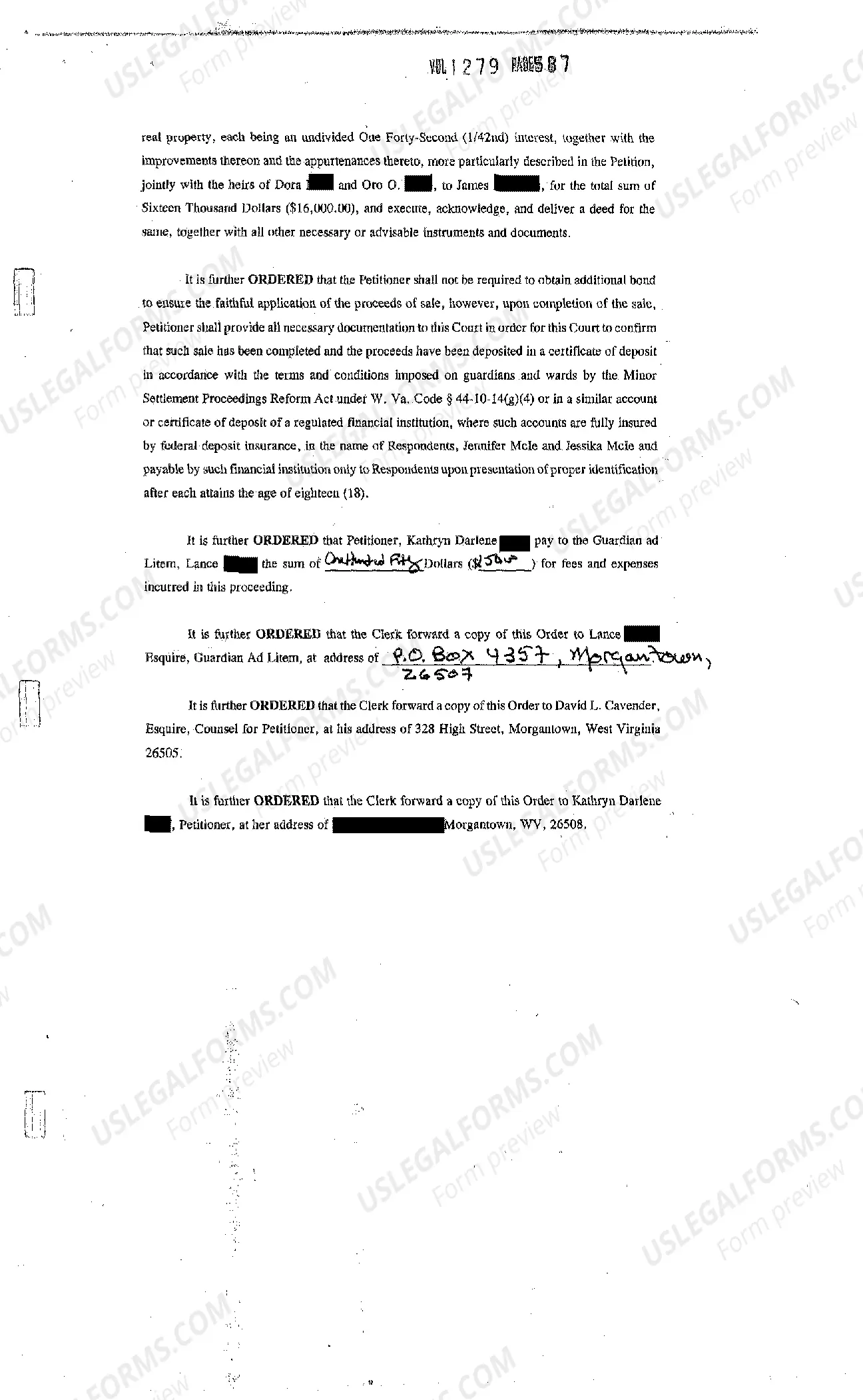

West Virginia Order Authorizing Sale of Decedent's Property

Description

How to fill out West Virginia Order Authorizing Sale Of Decedent's Property?

Among lots of paid and free templates which you find on the internet, you can't be sure about their accuracy. For example, who made them or if they are competent enough to deal with the thing you need these to. Keep calm and utilize US Legal Forms! Locate West Virginia Order Authorizing Sale of Decedent's Property samples made by skilled legal representatives and prevent the expensive and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to draft a papers for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you are trying to find. You'll also be able to access all your previously downloaded documents in the My Forms menu.

If you are using our website the very first time, follow the tips below to get your West Virginia Order Authorizing Sale of Decedent's Property quick:

- Make sure that the document you see is valid where you live.

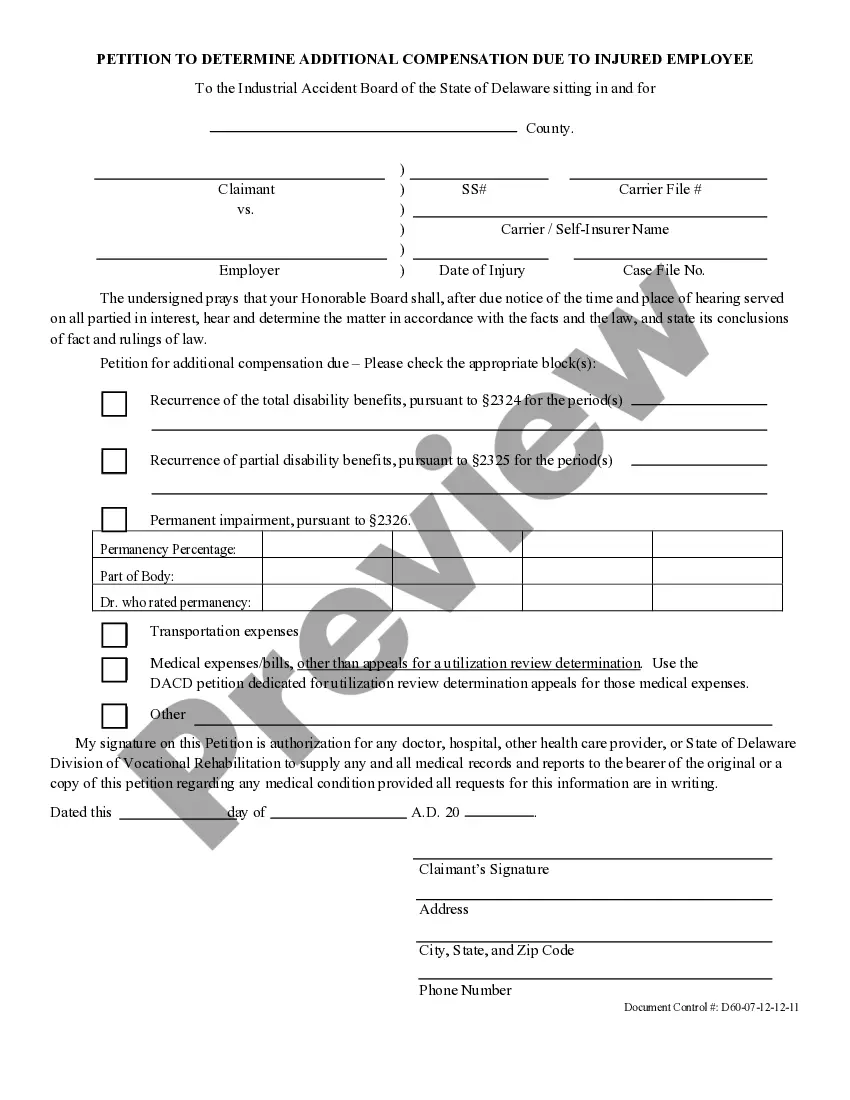

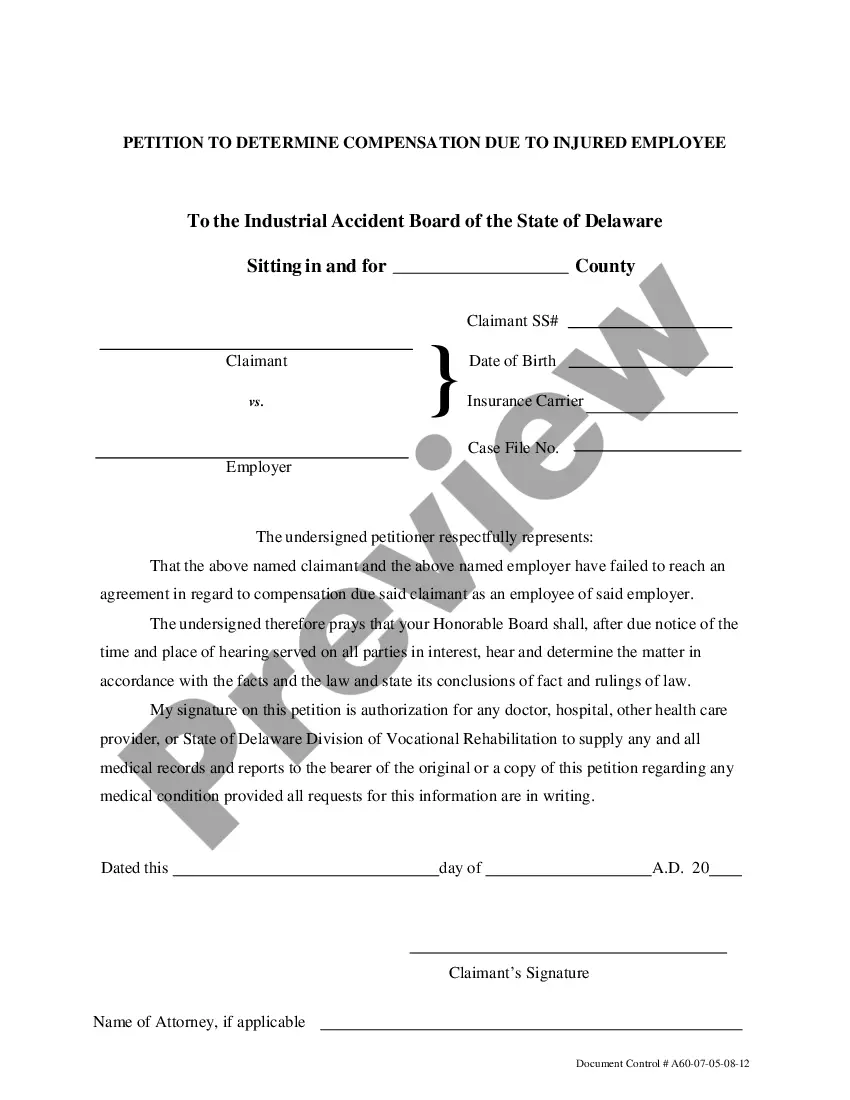

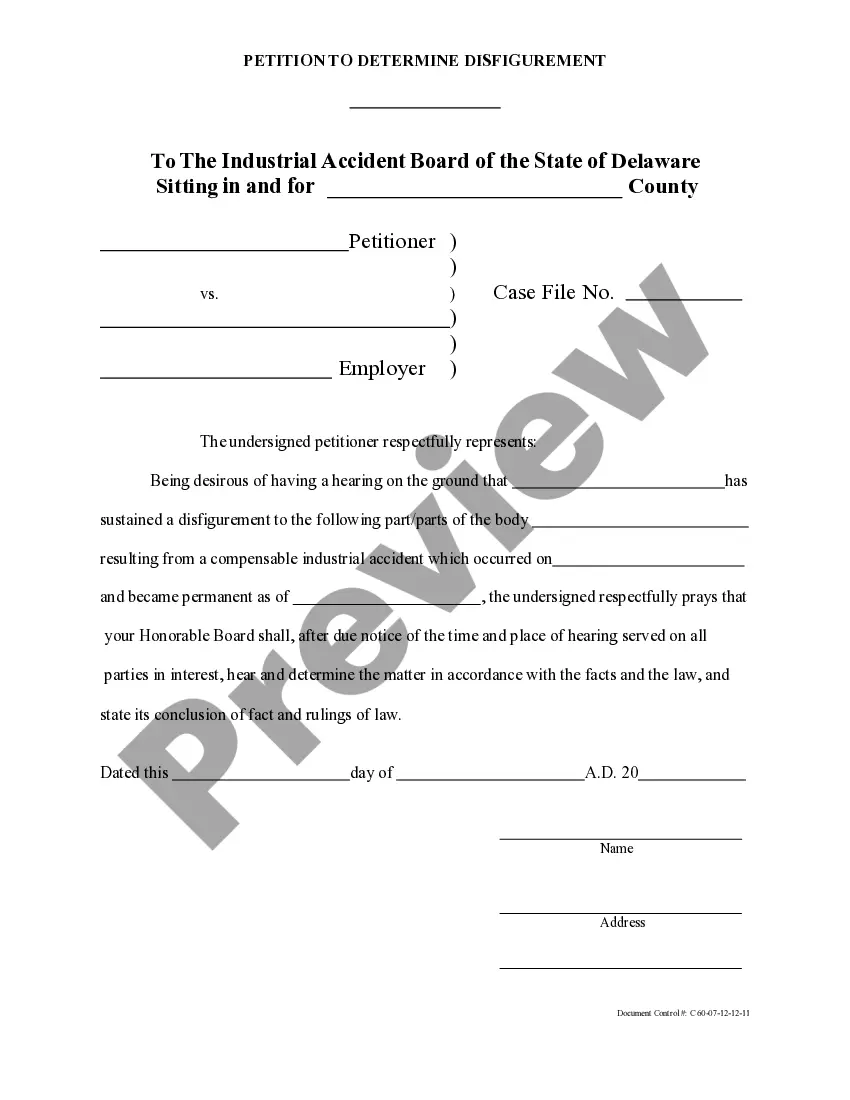

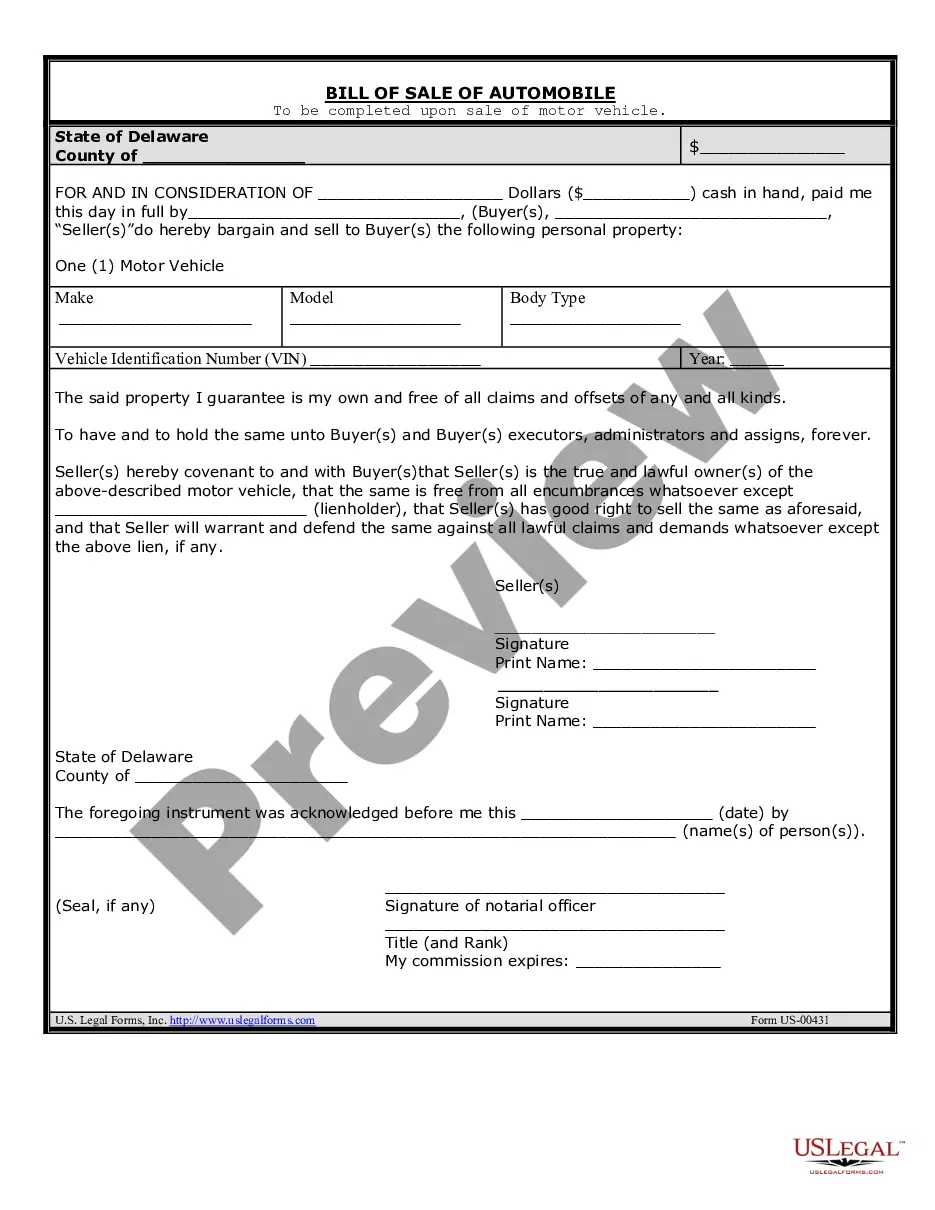

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or find another sample utilizing the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

When you’ve signed up and paid for your subscription, you can use your West Virginia Order Authorizing Sale of Decedent's Property as many times as you need or for as long as it remains valid where you live. Edit it in your favored offline or online editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

In regard to the question posed, the short answer is: No, all of the beneficiaries do not have to agree to the terms of the contract for a real estate contract to be legally binding.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot sell estate property to himself because the property belongs to someone else. Unless he pays full price for it.

If there is anyone to whom the deceased person owed money, they have only 60 days to file a claim against the estate to get paid.

Paying any debts and liabilities of the estate, owing prior to death; defending the Will of the deceased if litigation is started against the deceased's estate; attending to tax returns for the deceased and their estate; distributing the estate in accordance with the deceased's Will.

Generally the heirs don't decide if the house is sold unless somehow it is titled in all their names. If is a specific gift and the will requires it be transferred to all six, and one does not want to sell, that person can buy out the other 5. There of course is always a partition Acton.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

Length and Commitment of Process. A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

When a person dies without having a valid will in place, his or her property passes by what is called "intestate succession" to heirs according to state law. In other words, if you don't have a will, the state will make one for you. All fifty states have laws (or "statutes") of this kind on the books.

The executor can sell property without getting all of the beneficiaries to approve.The administrator will come in with a buyer and a contract and if someone else in court wants to pay more for the property than that contract price then the judge will allow that.