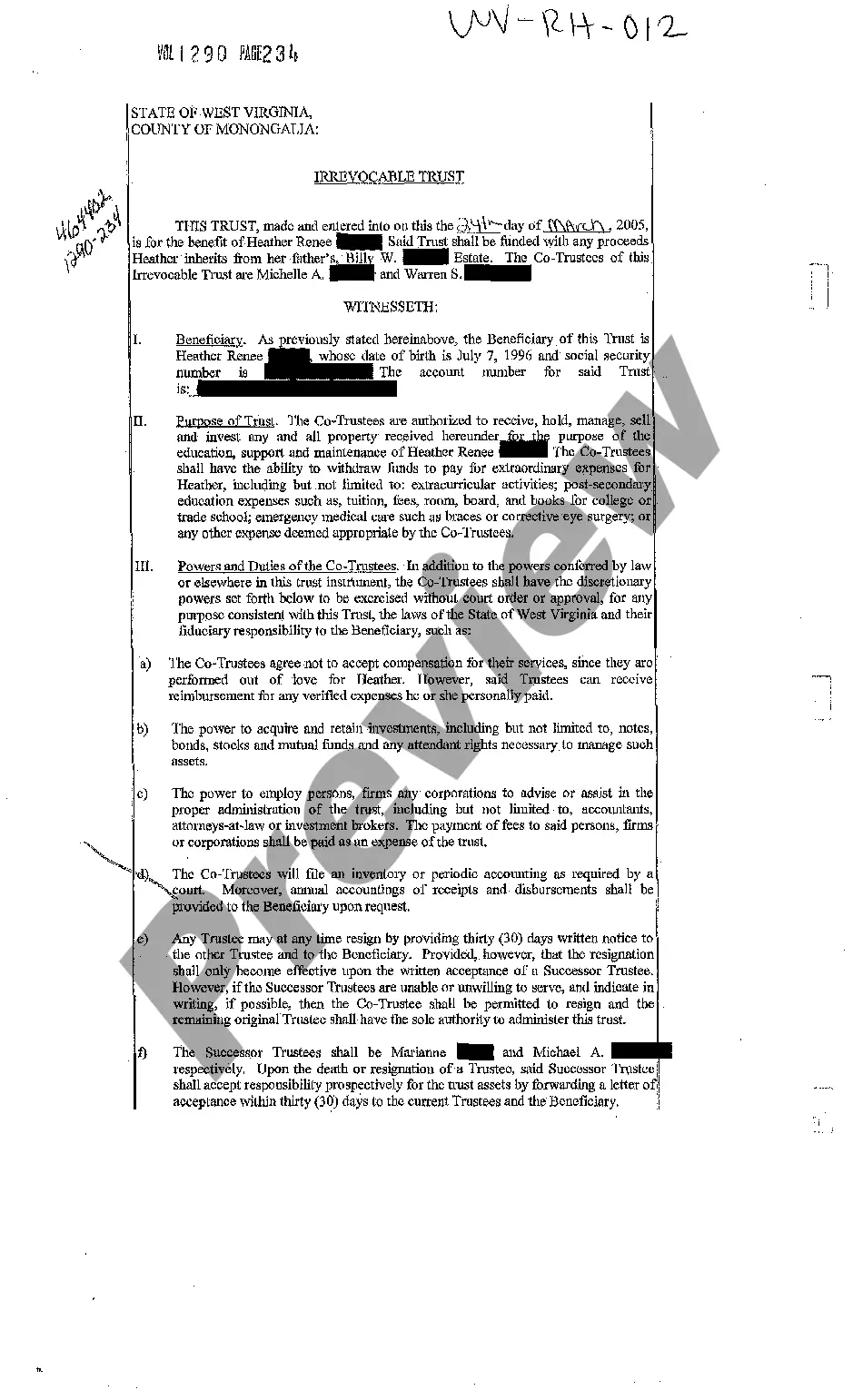

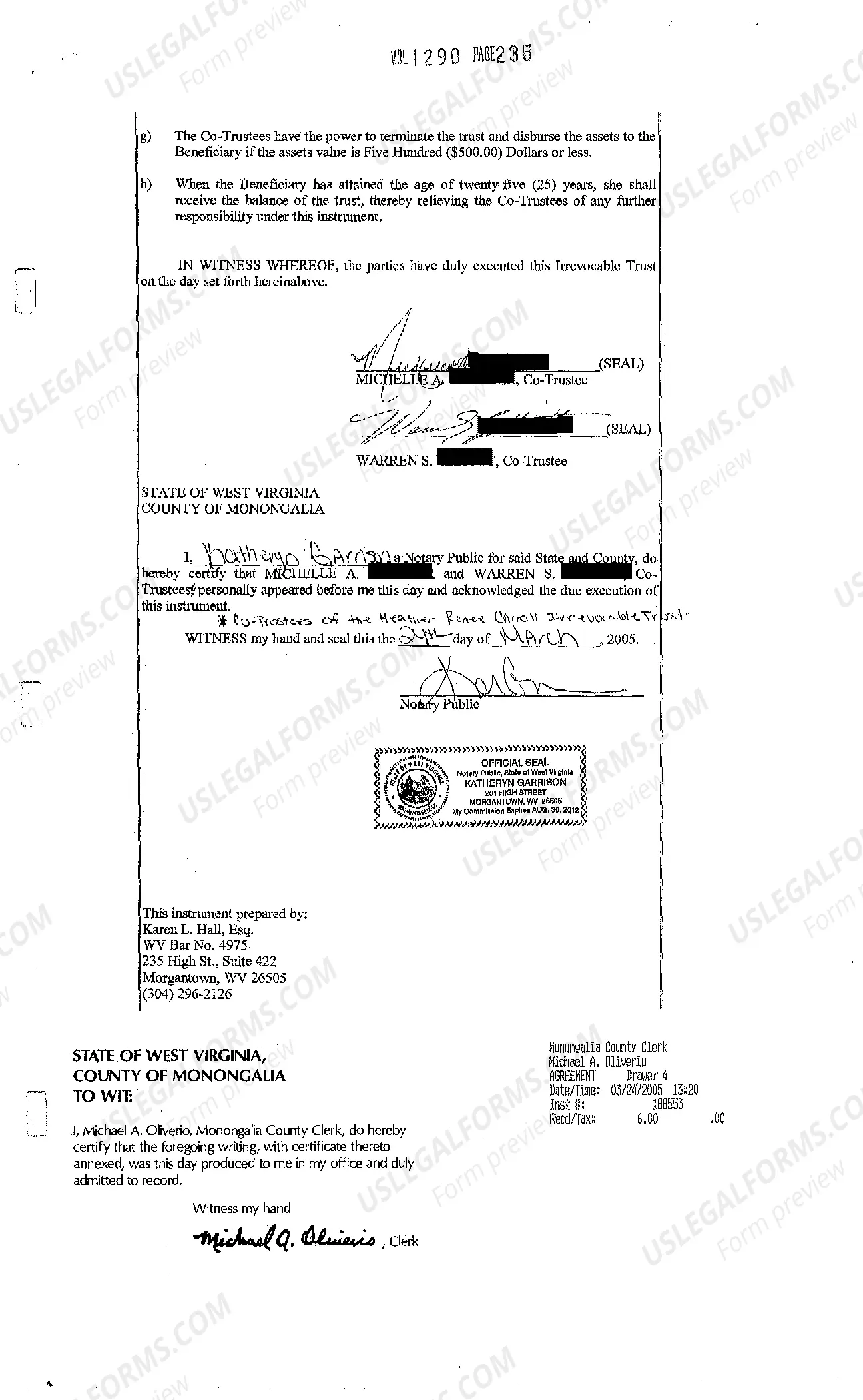

West Virginia Irrevocable Trust

Description

How to fill out West Virginia Irrevocable Trust?

Among numerous free and paid samples that you find online, you can't be certain about their reliability. For example, who made them or if they’re qualified enough to deal with what you need them to. Always keep relaxed and make use of US Legal Forms! Locate West Virginia Irrevocable Trust samples created by skilled legal representatives and prevent the expensive and time-consuming procedure of looking for an lawyer and after that having to pay them to write a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you’re looking for. You'll also be able to access all of your earlier saved samples in the My Forms menu.

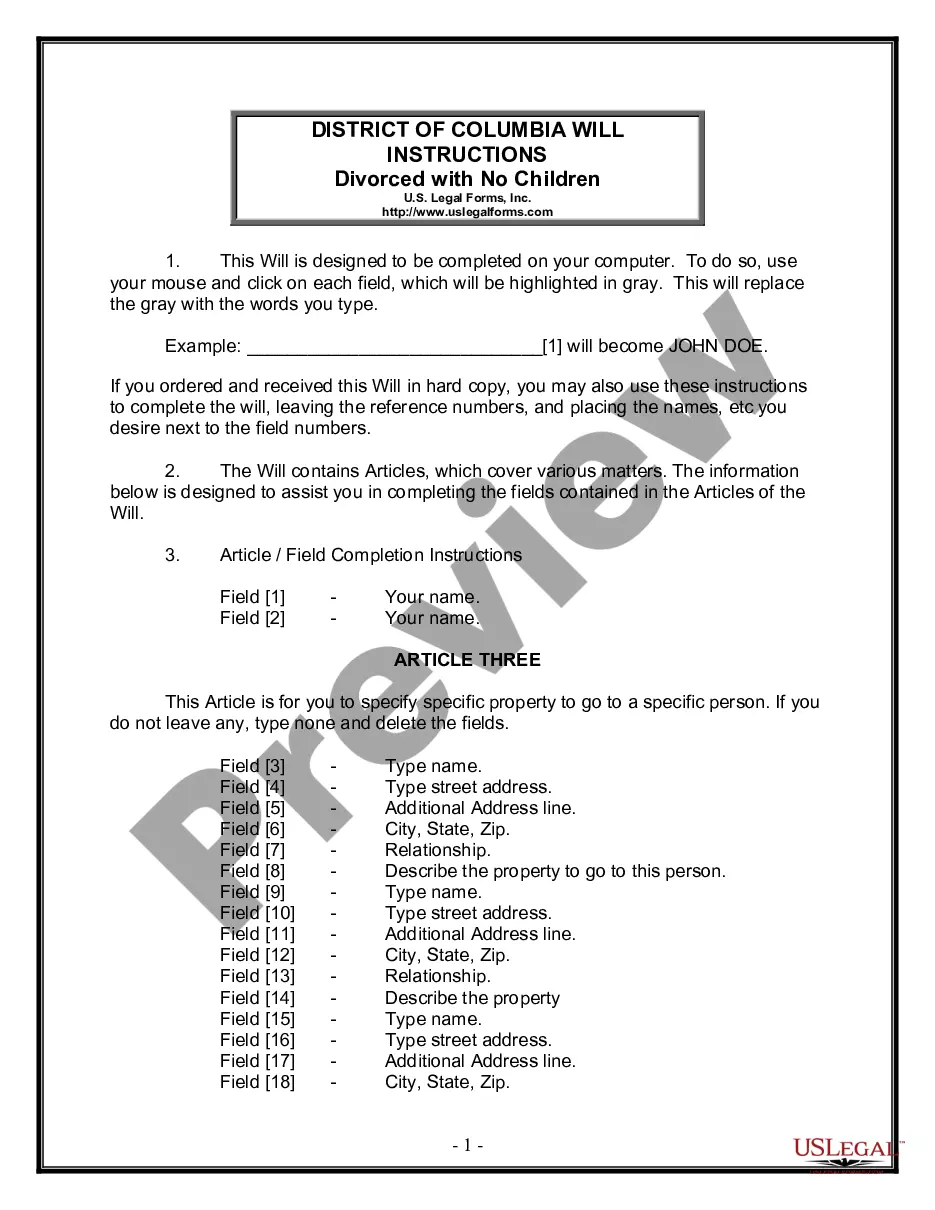

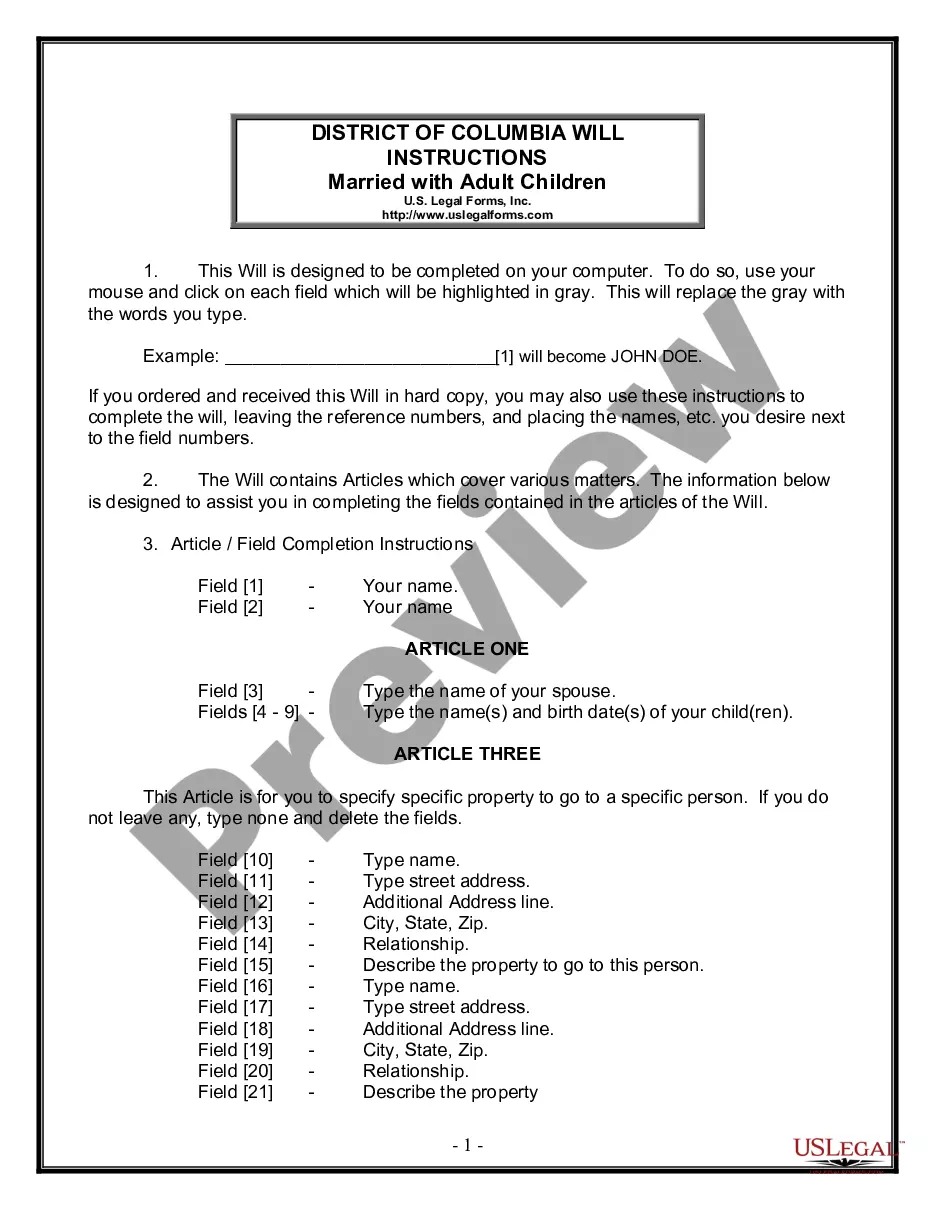

If you’re making use of our website the first time, follow the tips listed below to get your West Virginia Irrevocable Trust quickly:

- Ensure that the file you see is valid in the state where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing process or find another example utilizing the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

Once you have signed up and purchased your subscription, you can use your West Virginia Irrevocable Trust as many times as you need or for as long as it continues to be active in your state. Change it in your favored online or offline editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

Irrevocable trust: The purpose of the trust is outlined by an attorney in the trust document. Once established, an irrevocable trust usually cannot be changed. As soon as assets are transferred in, the trust becomes the asset owner. Grantor: This individual transfers ownership of property to the trust.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

The trustee of an irrevocable trust must complete and file Form 1041 to report trust income, as long as the trust earned more than $600 during the tax year. Irrevocable trusts are taxed on income in much the same way as individuals.

The step-up in basis is equal to the fair market value of the property on the date of death. In our example, if the parents had put their home in this irrevocable income only trust, and the fair market value upon their demise was $300,000, the children would receive the home with a basis equal to this $300,000 value.

What assets can I transfer to an irrevocable trust? Frankly, just about any asset can be transferred to an irrevocable trust, assuming the grantor is willing to give it away. This includes cash, stock portfolios, real estate, life insurance policies, and business interests.

A irrevocable trust gives you the benefit of protecting your assets from creditors and lawsuits. It also lowers your estate's tax liability and provides a plan for handling your estate's assets.

Irrevocable trusts are commonly used for estate planning.Grantors can add additional money to the trust each year, up to the gift-tax exclusion amount, to pass money to heirs without paying estate tax.

The main downside to an irrevocable trust is simple: It's not revocable or changeable. You no longer own the assets you've placed into the trust. In other words, if you place a million dollars in an irrevocable trust for your child and want to change your mind a few years later, you're out of luck.