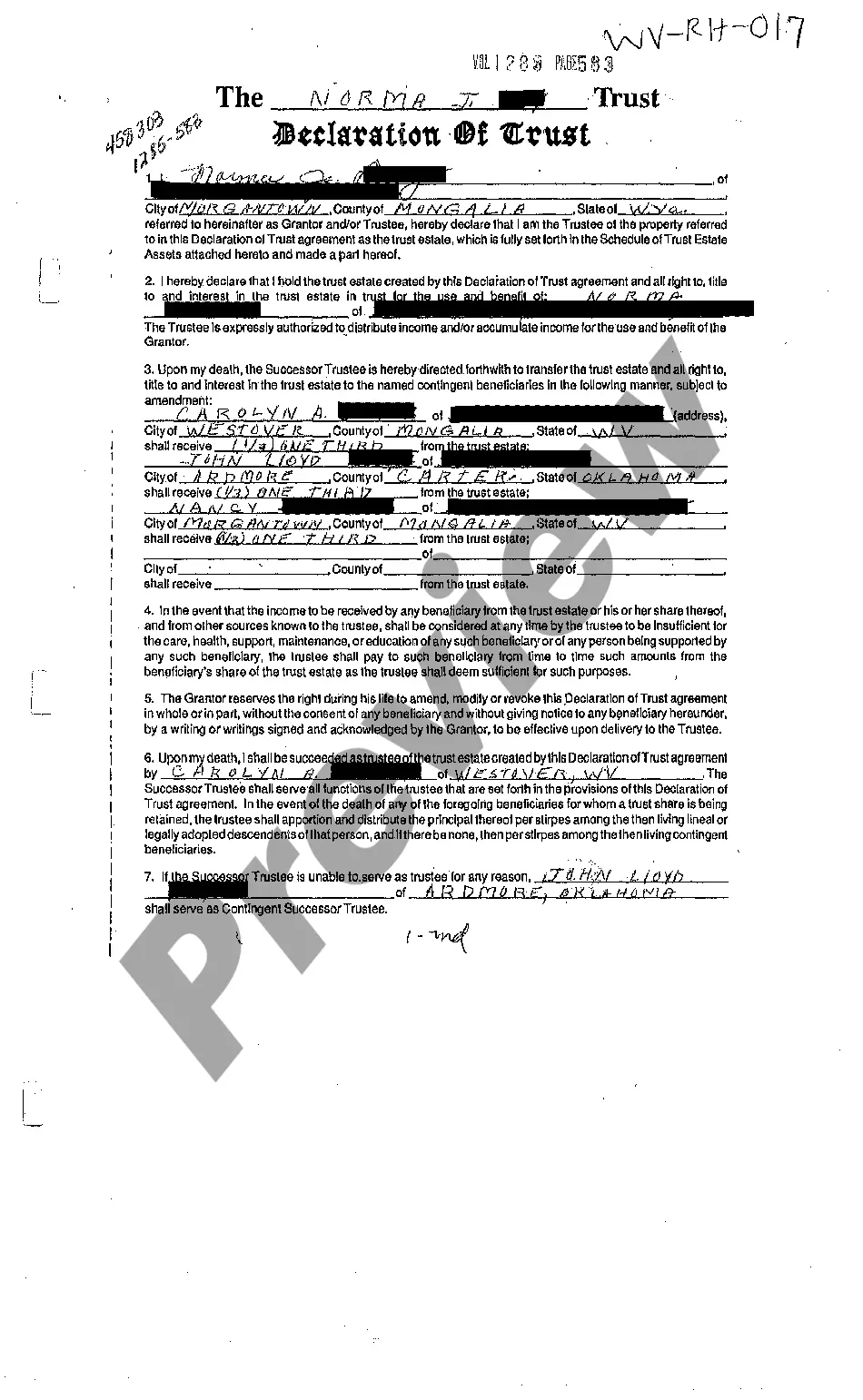

West Virginia Declaration of Trust

Description

How to fill out West Virginia Declaration Of Trust?

Among hundreds of paid and free samples which you get on the web, you can't be certain about their accuracy and reliability. For example, who created them or if they’re skilled enough to deal with what you need those to. Keep relaxed and use US Legal Forms! Find West Virginia Declaration of Trust templates developed by skilled attorneys and prevent the expensive and time-consuming procedure of looking for an attorney and after that paying them to draft a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you are searching for. You'll also be able to access all of your earlier saved documents in the My Forms menu.

If you’re using our service the very first time, follow the tips listed below to get your West Virginia Declaration of Trust easily:

- Ensure that the file you find applies in your state.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another template using the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

Once you’ve signed up and paid for your subscription, you may use your West Virginia Declaration of Trust as often as you need or for as long as it continues to be active where you live. Change it with your favorite online or offline editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.

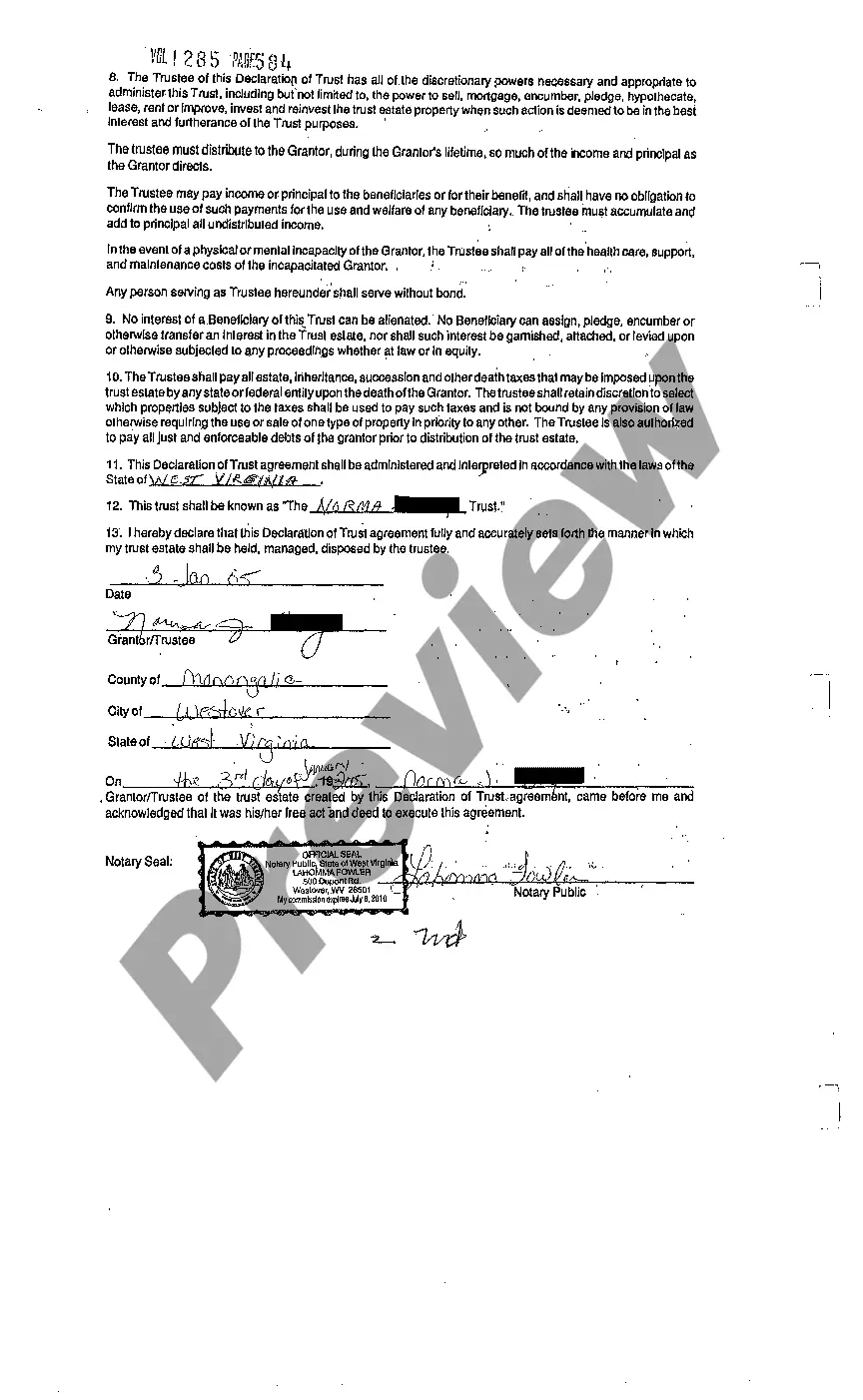

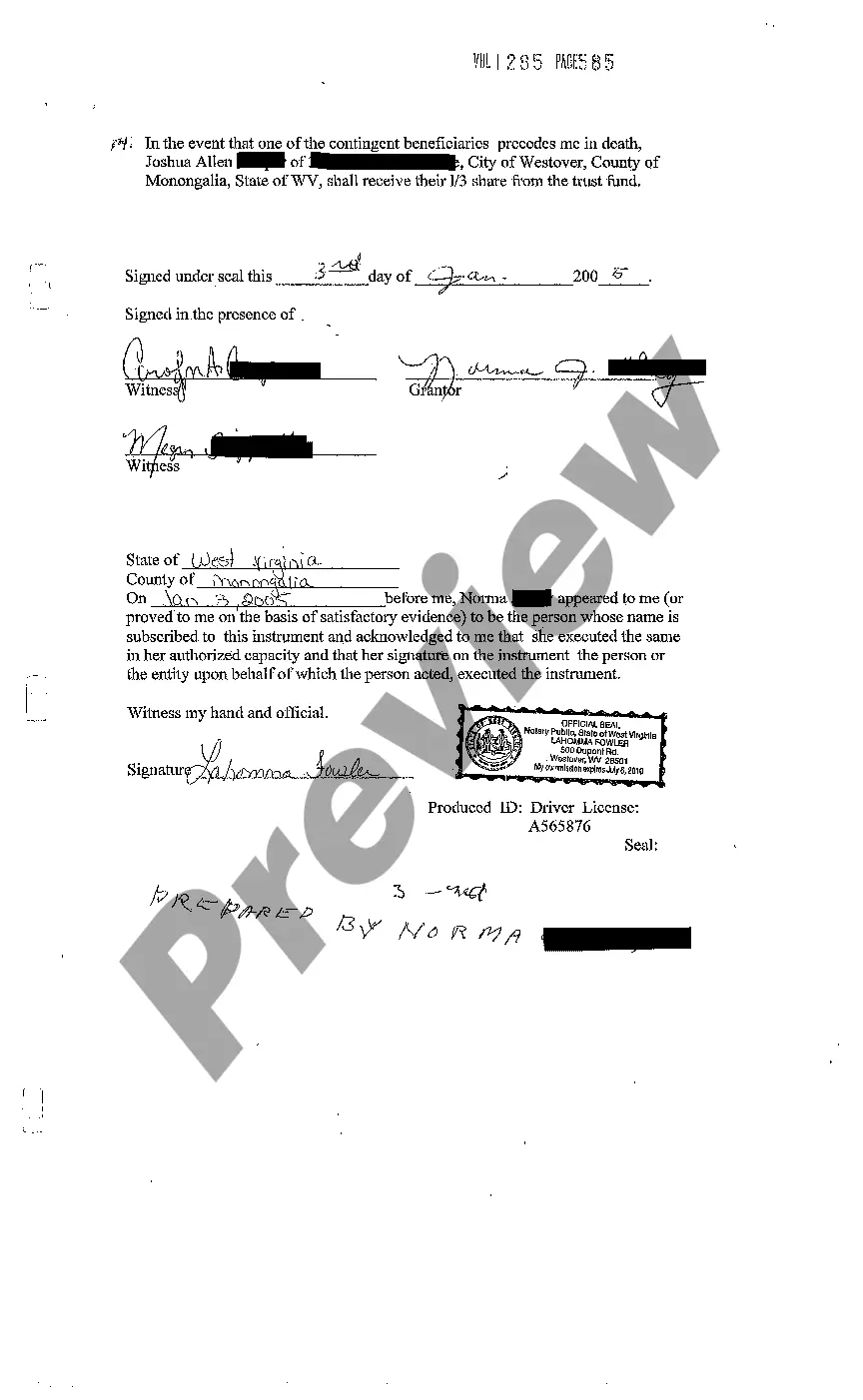

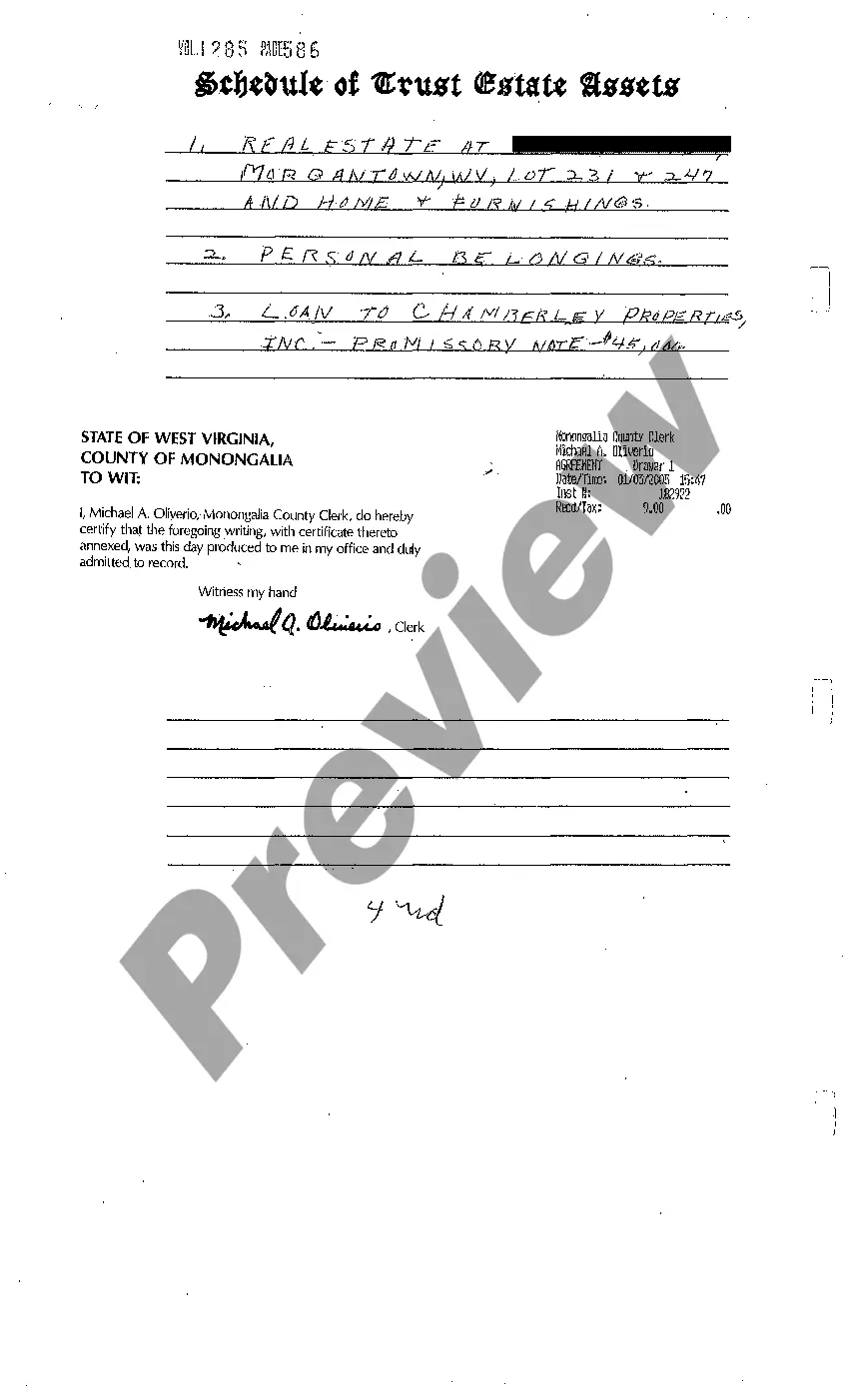

A Declaration of Trust, also known as a Deed of Trust, is a legally-binding document recording the financial arrangements between joint property owners, and/or anyone else with a financial interest in the property.

If you are the sole Trustee of the Trust, the document used to create it is called a declaration of trust. If the there is an additional Trustee, the document used to create the trust is called a trust agreement.

One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it. A will is a document that directs who will receive your property at your death and it appoints a legal representative to carry out your wishes.

Most states that use deeds of trust to secure home loans are title theory states.A few deed of trust states include West Virginia, Alaska, Virginia, Arizona, Texas, California, North Carolina, Colorado, New Mexico, Idaho, Montana, Illinois, Missouri and Mississippi.

A declaration of trust under U.S. law is a document or an oral statement appointing a trustee to oversee assets being held for the benefit of one or more other individuals. These assets are held in a trust.The declaration of trust is sometimes referred to as a nominee declaration.

A Declaration of Trust (also known as a Deed of Trust) is a legally binding document in which the legal owners of the property declare that they hold the property on trust for the beneficial owners and sets out the shares in which the beneficial interests are held.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.