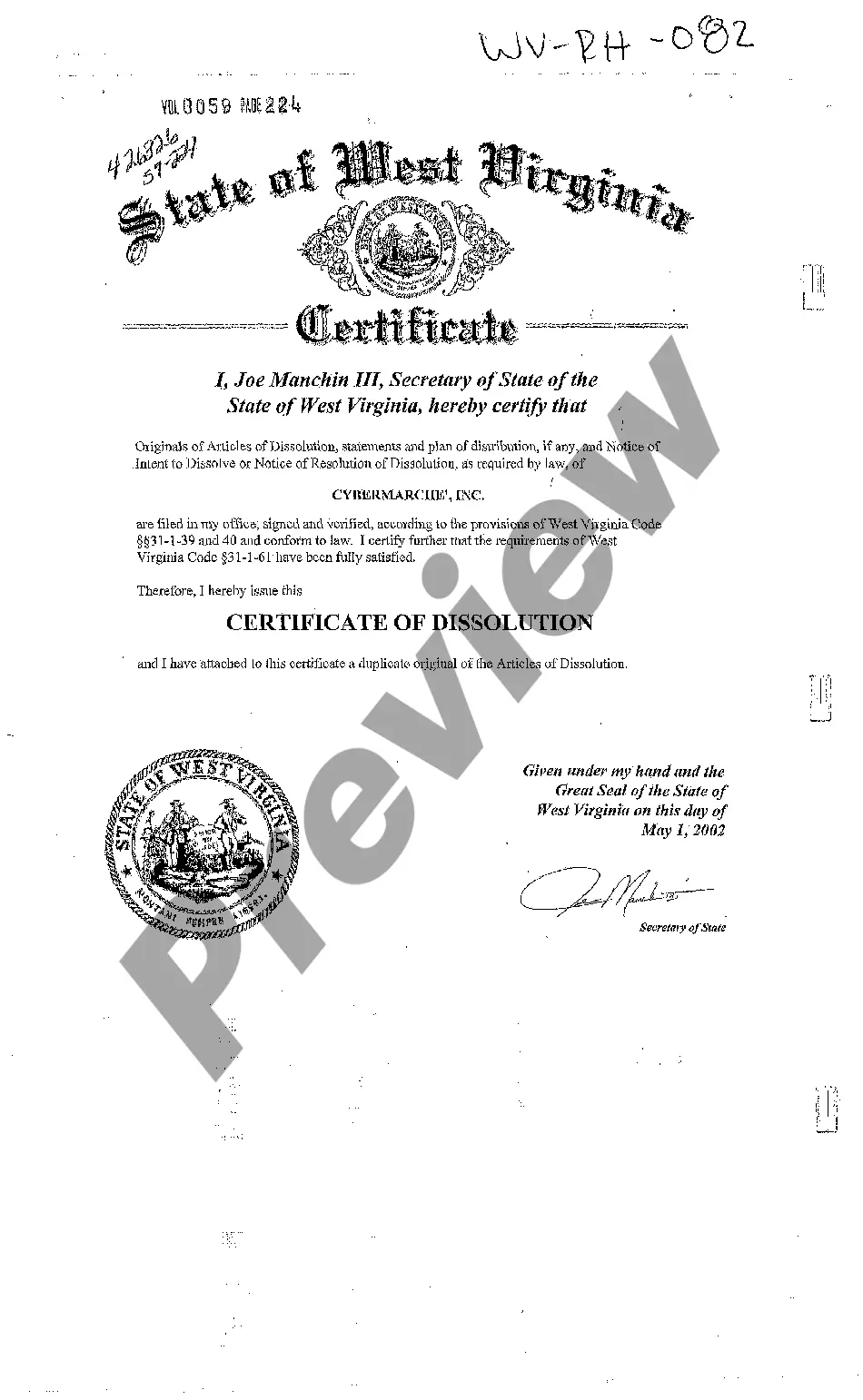

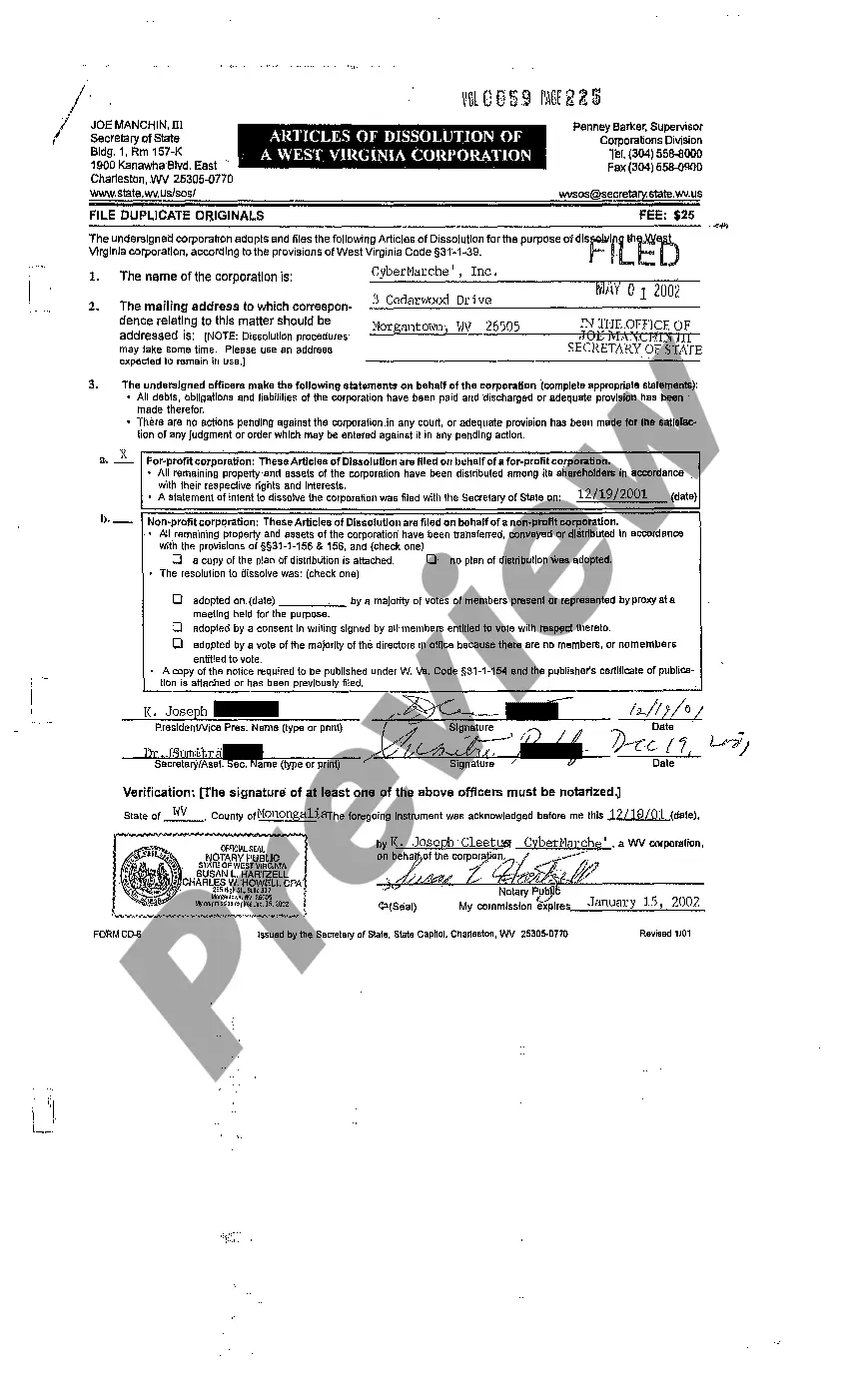

West Virginia Certificate of Dissolution of Corporation

Description

How to fill out West Virginia Certificate Of Dissolution Of Corporation?

Among hundreds of free and paid templates that you find on the net, you can't be certain about their reliability. For example, who created them or if they are skilled enough to take care of what you require these people to. Keep relaxed and use US Legal Forms! Get West Virginia Certificate of Dissolution of Corporation templates developed by professional legal representatives and prevent the expensive and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to draft a papers for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you’re seeking. You'll also be able to access all of your previously saved documents in the My Forms menu.

If you’re using our platform the first time, follow the tips below to get your West Virginia Certificate of Dissolution of Corporation quick:

- Make sure that the document you find is valid in your state.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another template utilizing the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

When you have signed up and purchased your subscription, you can utilize your West Virginia Certificate of Dissolution of Corporation as often as you need or for as long as it continues to be valid in your state. Edit it with your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Hold a Directors meeting and record a resolution to Dissolve the Virginia Corporation. Hold a Shareholder meeting to approve Dissolution of the Virginia Corporation. File a Articles of Dissolution with the VA State Corporation Commission.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

File Articles of Dissolution with the state. Visit an online legal document creation service such as Legal Docs.com or Legal Zoom.com and write the LLC's Articles of Dissolution. These documents are necessary to legally separate each LLC member from the entity.

The fastest, easiest way to dissolve or terminate a domestic, West Virginia-formed business is to file online at One Stop Business Portal. To get started, create a user account log in through the portal. If you have an existing user account log in, simply log into your dashboard to dissolve or terminate the business.

An inactive business is a business that still exists but has no activity, which means no business transactions during a specific year.Even if the business has no income, it may still be considered active for tax purposes. There are many reasons a business may become inactive.