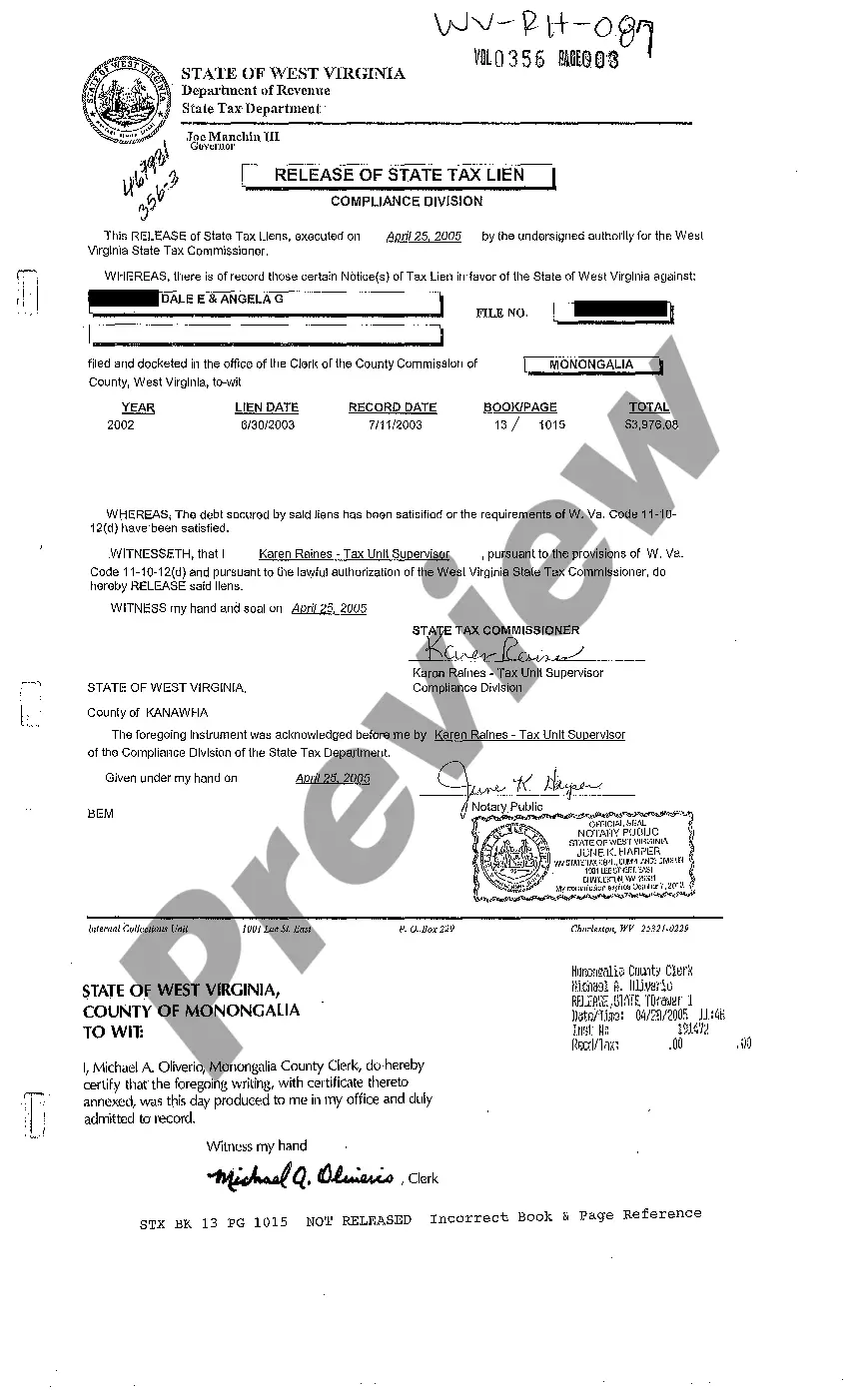

West Virginia Release of State Tax Lien

Description

How to fill out West Virginia Release Of State Tax Lien?

Among hundreds of paid and free examples that you find online, you can't be sure about their accuracy. For example, who made them or if they are competent enough to deal with what you require them to. Always keep relaxed and make use of US Legal Forms! Discover West Virginia Release of State Tax Lien templates developed by skilled lawyers and get away from the high-priced and time-consuming process of looking for an lawyer and then having to pay them to write a document for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you are trying to find. You'll also be able to access all your previously downloaded documents in the My Forms menu.

If you’re using our website for the first time, follow the guidelines below to get your West Virginia Release of State Tax Lien quick:

- Ensure that the file you find is valid in your state.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another sample utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you have signed up and paid for your subscription, you may use your West Virginia Release of State Tax Lien as many times as you need or for as long as it continues to be valid where you live. Edit it with your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

When you pay off your full tax balance or when the IRS runs out of time to collect the balance, the IRS will automatically release your tax lien. This removes the lien from your property. If the lien isn't automatically released, you can write to the IRS to request the release certificate.

Centralized Lien Operation To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

No Right to Redeem After a Tax Sale in Virginia Sometimes, state law permits homeowners who lose their property to a tax foreclosure to get the house back by catching up on the delinquent amounts or by reimbursing the purchaser the amount paid at the sale, plus various other amounts.

There are no tax lien sales in Virginia, however, you may purchase real estate at a public auction. You can sign up to receive notice of our upcoming tax sales (https://taxva.com/interested-bidder-form/).

You can also contact the IRS at 800-913-6050 to make the request. A Certificate of Release of Federal Tax Lien is sufficient proof to show creditors that you paid the federal tax debt. An unpaid tax lien will remain on your credit report for 15 years.

Virginia is a tax deed state. In a tax deed state the actual property is sold after tax foreclosure, opposed to a tax lien state where a lien is sold against the property giving the owner the right to collect the back due taxes and earn interest.

When homeowners fail to pay their property taxes, some tax jurisdictions choose to hold tax deed home sales to make back the money they are owed. Interested buyers can register to participate as a bidder on these homes in a tax deed auction.

A tax lien certificate is a certificate of claim against a property that has a lien placed upon it as a result of unpaid property taxes. 1feff Tax lien certificates are generally sold to investors through an auction process.

According to Ted Thomas, an authority on tax lien certificates and tax deeds, 21 states and the District of Columbia are tax lien states: Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, South Carolina,