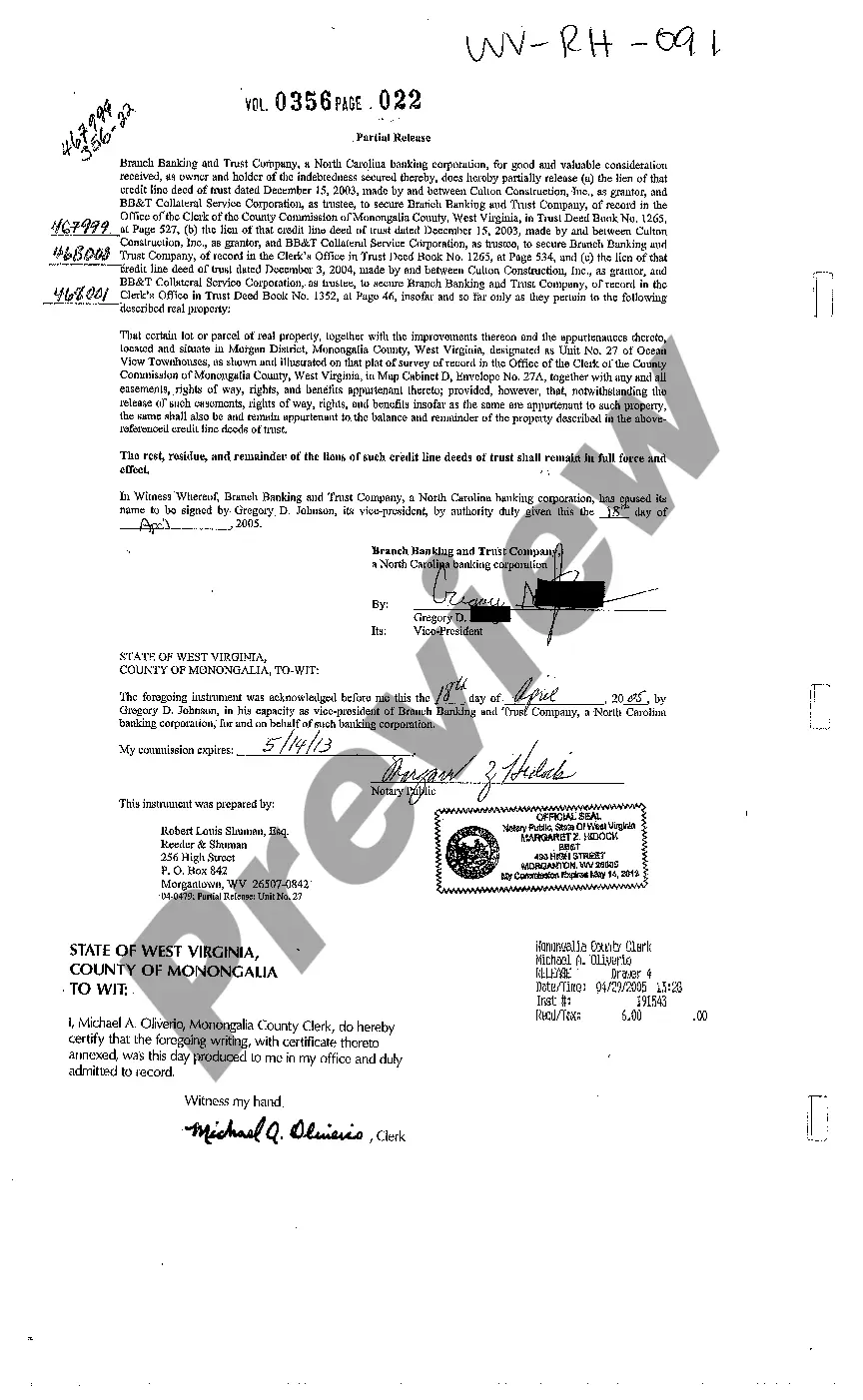

West Virginia Partial Release of Lien of Credit Line Deed of Trust

Description

How to fill out West Virginia Partial Release Of Lien Of Credit Line Deed Of Trust?

Among lots of paid and free templates that you find on the web, you can't be certain about their reliability. For example, who made them or if they are skilled enough to take care of the thing you need those to. Always keep calm and utilize US Legal Forms! Discover West Virginia Partial Release of Lien of Credit Line Deed of Trust templates created by skilled lawyers and avoid the high-priced and time-consuming process of looking for an lawyer or attorney and after that paying them to draft a document for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the form you are trying to find. You'll also be able to access all of your previously downloaded templates in the My Forms menu.

If you’re utilizing our platform for the first time, follow the instructions below to get your West Virginia Partial Release of Lien of Credit Line Deed of Trust fast:

- Make sure that the file you see is valid in your state.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another sample using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

When you have signed up and purchased your subscription, you may use your West Virginia Partial Release of Lien of Credit Line Deed of Trust as many times as you need or for as long as it continues to be valid in your state. Revise it with your favored offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

A deed of trust or mortgage is a contract that places a lien on your property. Both provide a way for your lender to take back your home through foreclosure. Deeds of trust and mortgages both serve the same basic purpose.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.

In lien theory states, the mortgage creates a lien only on the property and the title remains with the borrower.In a Deed of Trust, the borrower conveys title to a trustee who will hold title to the property for the benefit of the lender. The title remains in trust until the loan is paid.

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

A Deed of Trustis a document where a borrower transfers the legal title for its property to a trustee who holds the property in trust as security for the payment of the debt to the lender. If the borrower pays the debt as agreed, the deed of trust becomes void and the lender executes a Deed of Reconveyance.

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.

A Deed of Trust is a type of secured real-estate transaction that some states use instead of mortgages.A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes.