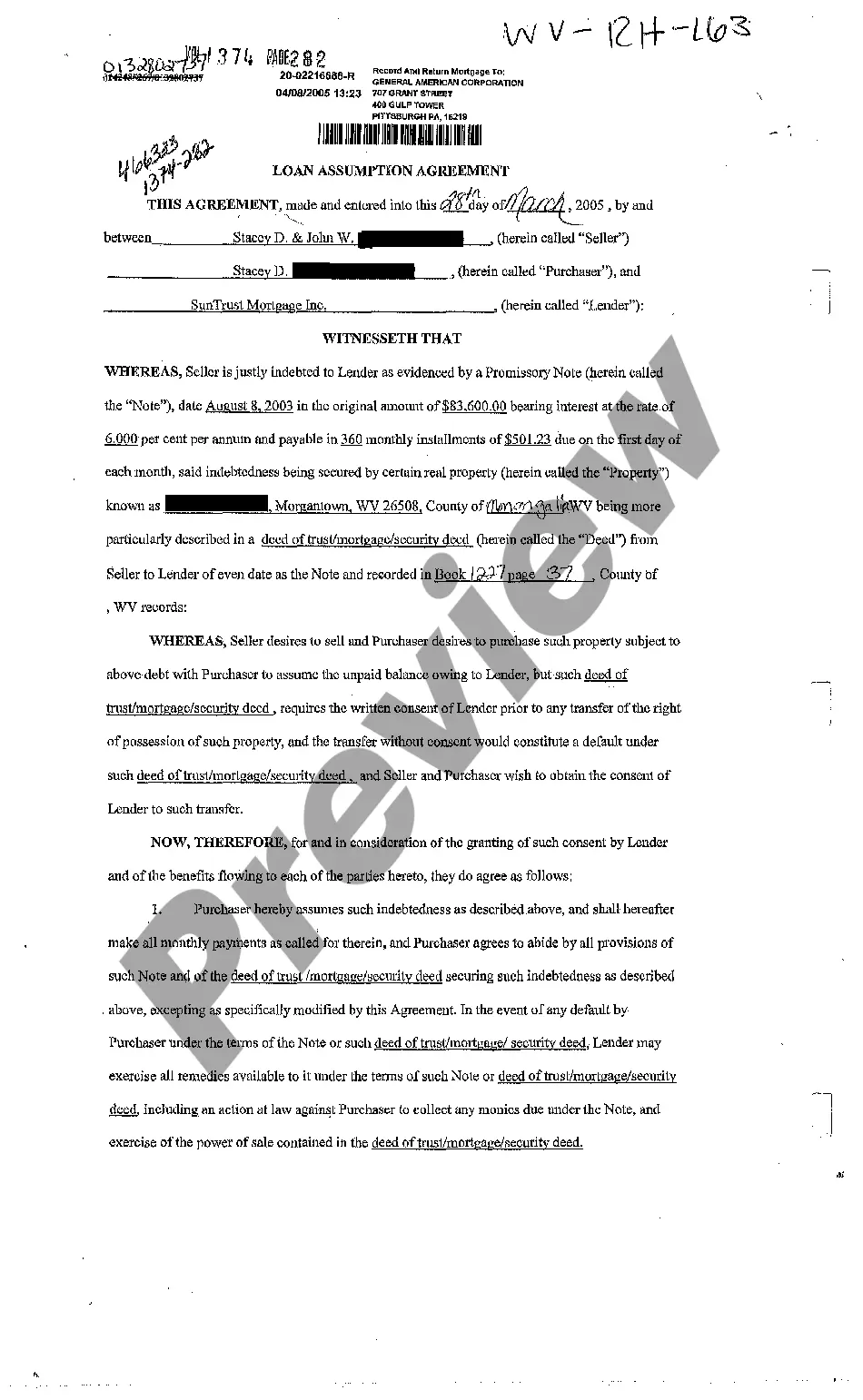

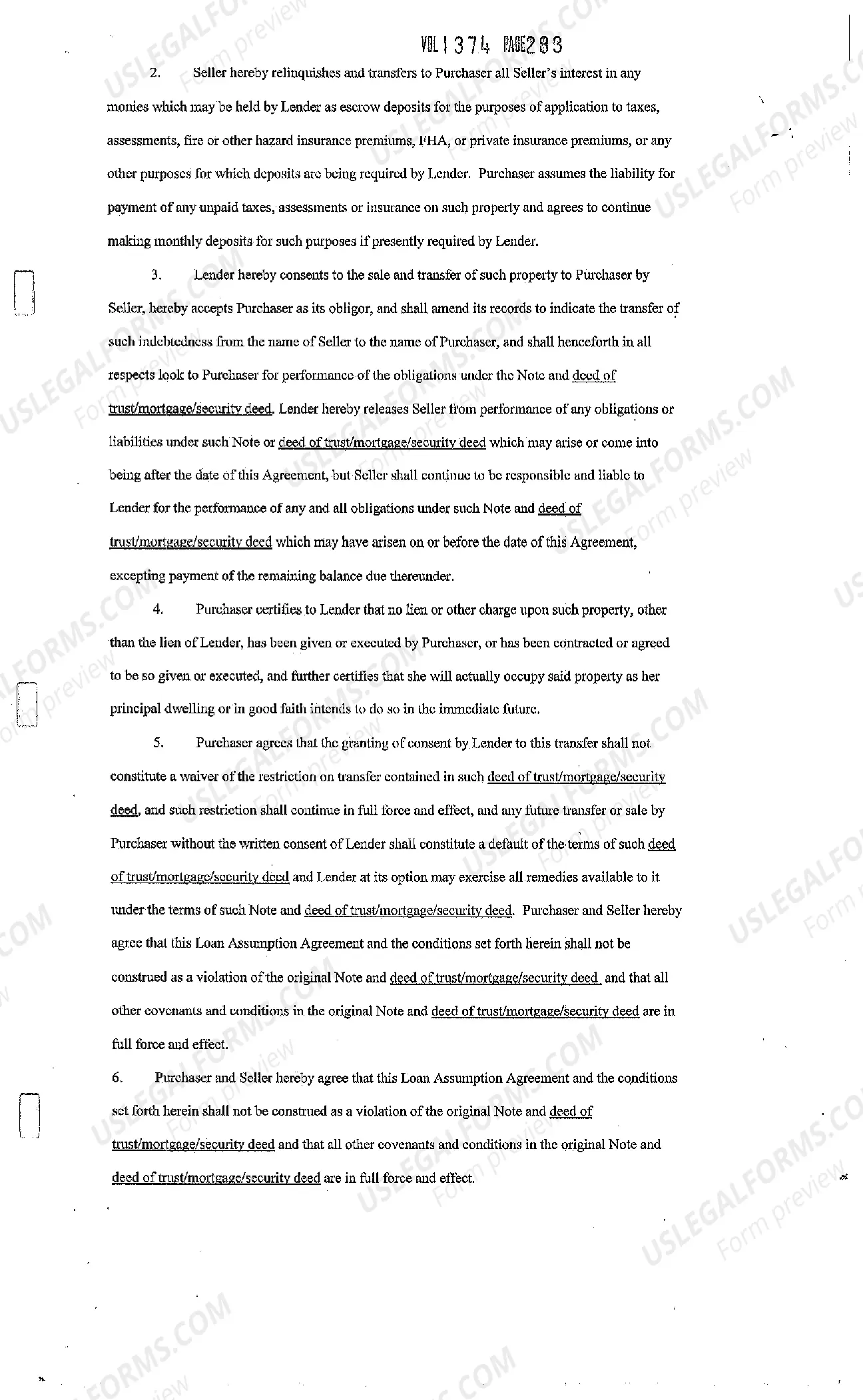

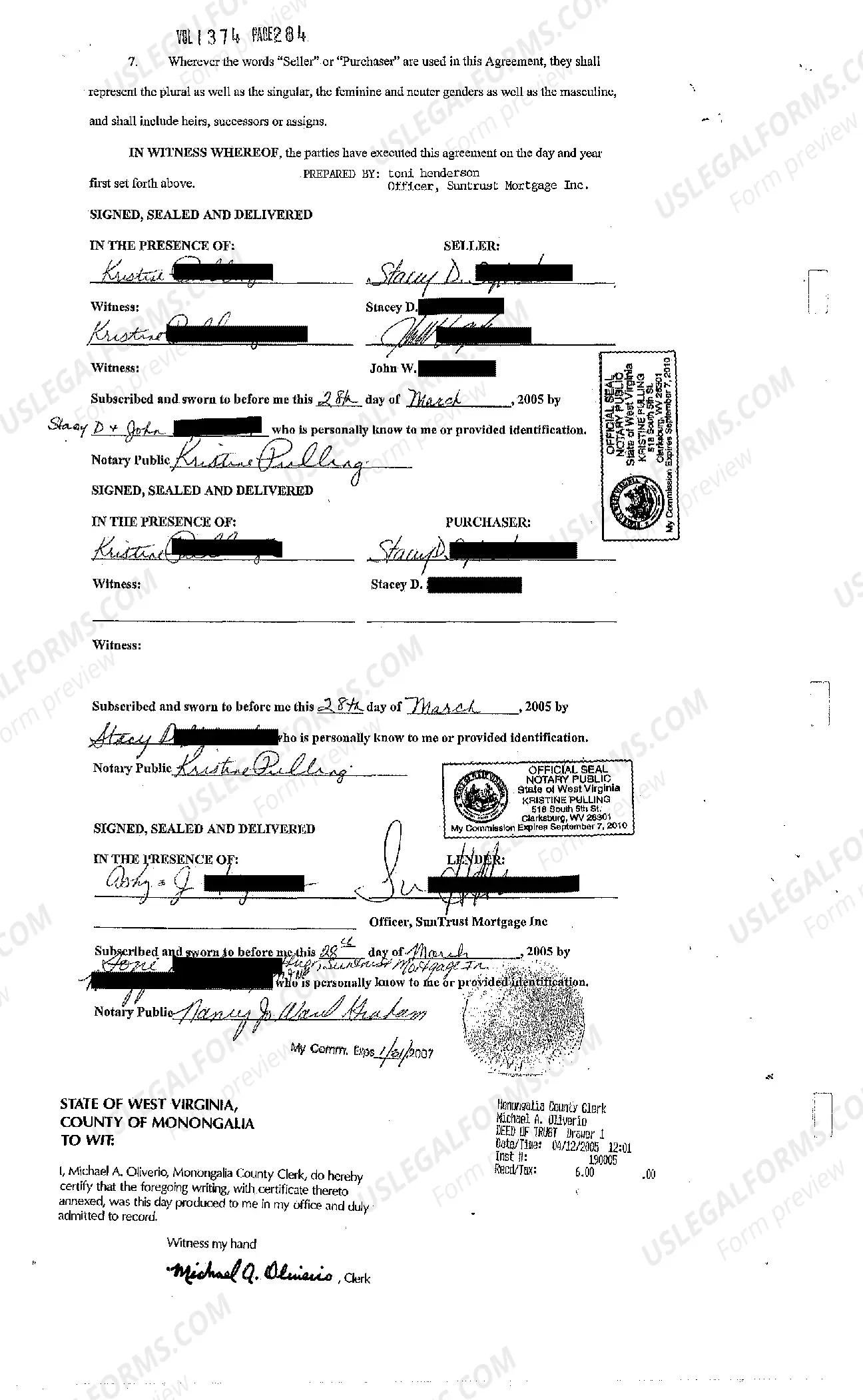

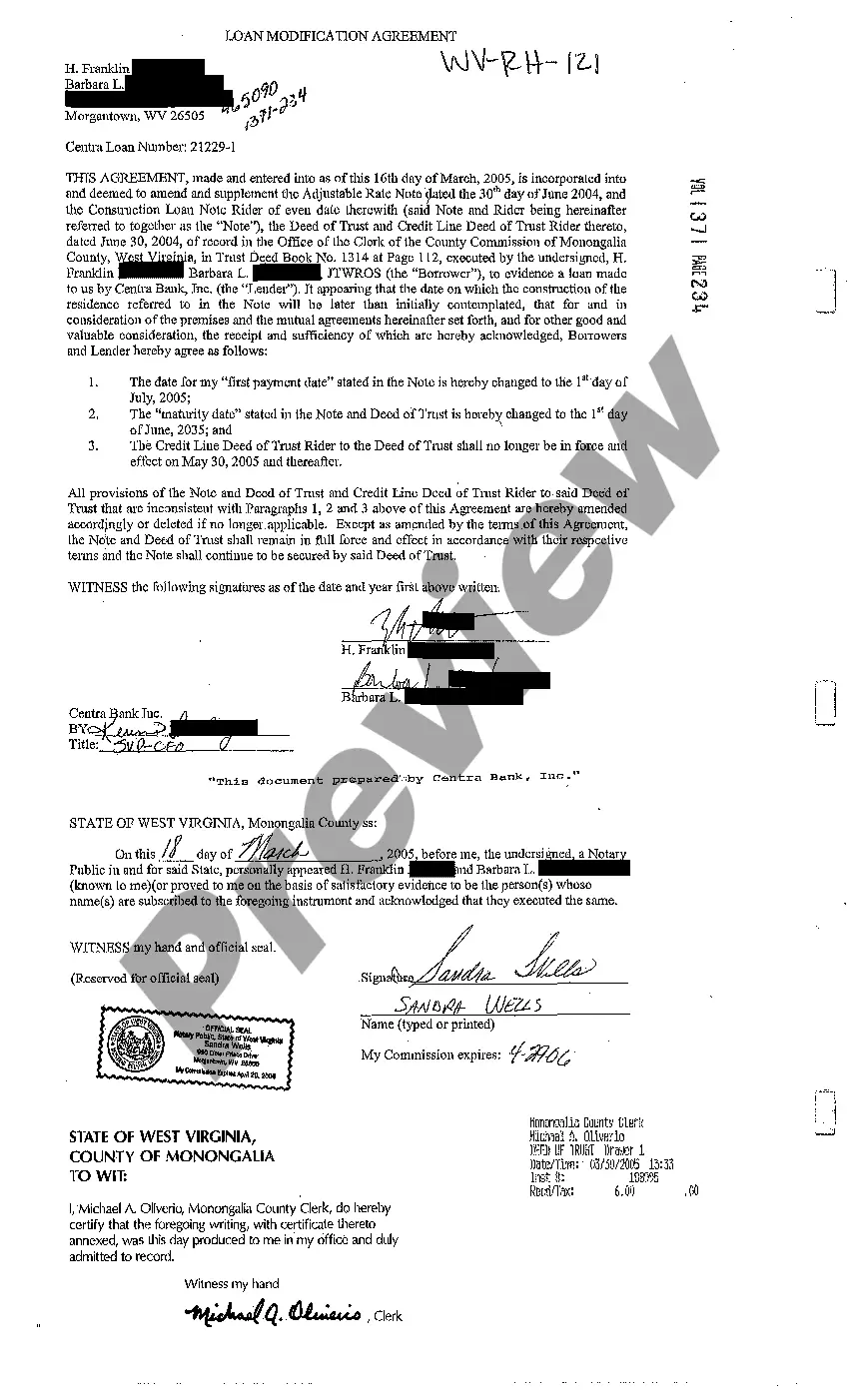

West Virginia Loan Assumption Agreement

Description

How to fill out West Virginia Loan Assumption Agreement?

Among numerous paid and free samples that you find on the web, you can't be sure about their accuracy and reliability. For example, who created them or if they’re competent enough to take care of what you need them to. Keep relaxed and use US Legal Forms! Discover West Virginia Loan Assumption Agreement samples created by skilled legal representatives and get away from the costly and time-consuming procedure of looking for an lawyer and after that having to pay them to draft a papers for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you’re seeking. You'll also be able to access all your previously saved samples in the My Forms menu.

If you’re making use of our platform for the first time, follow the guidelines listed below to get your West Virginia Loan Assumption Agreement quickly:

- Make sure that the document you see is valid in your state.

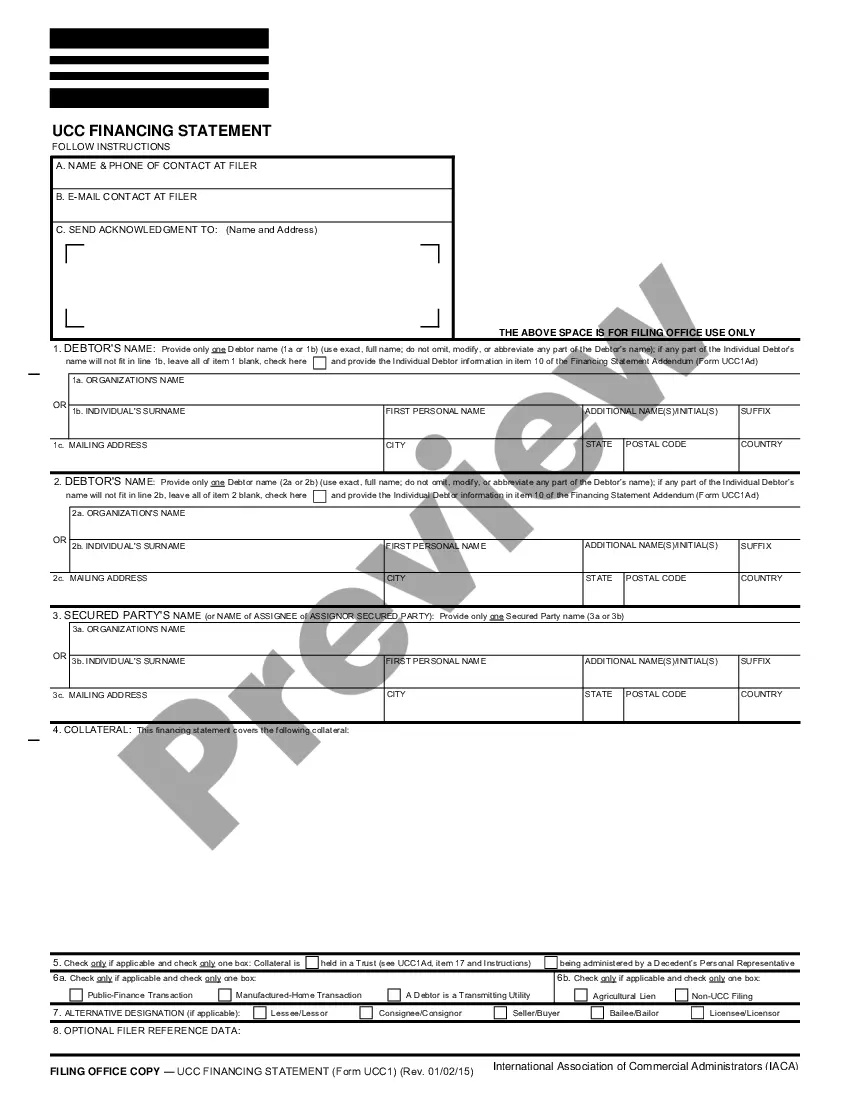

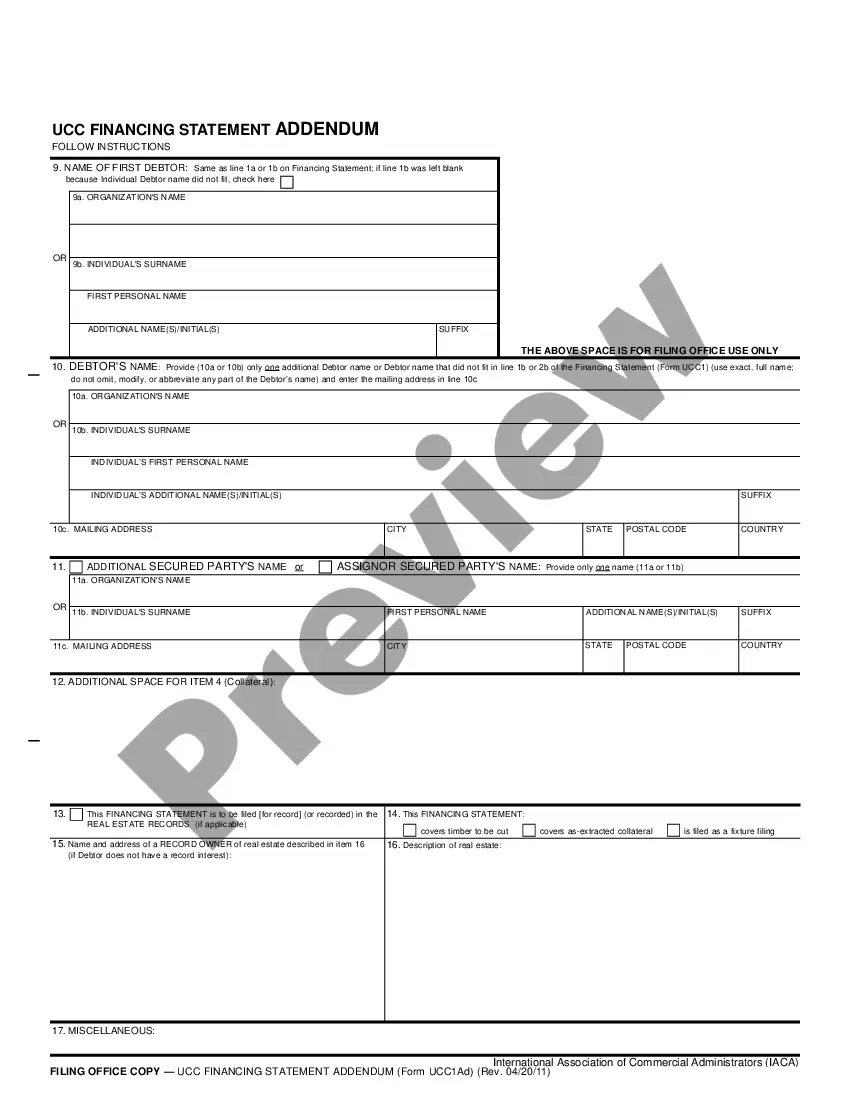

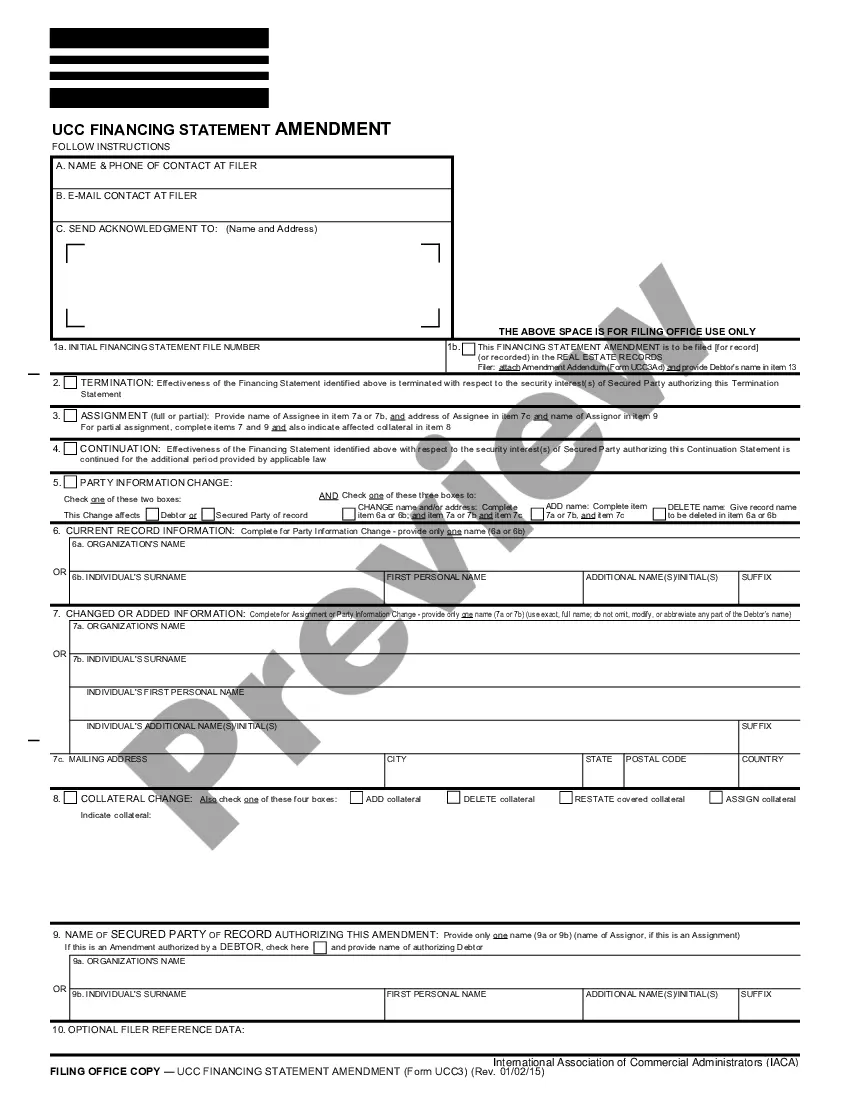

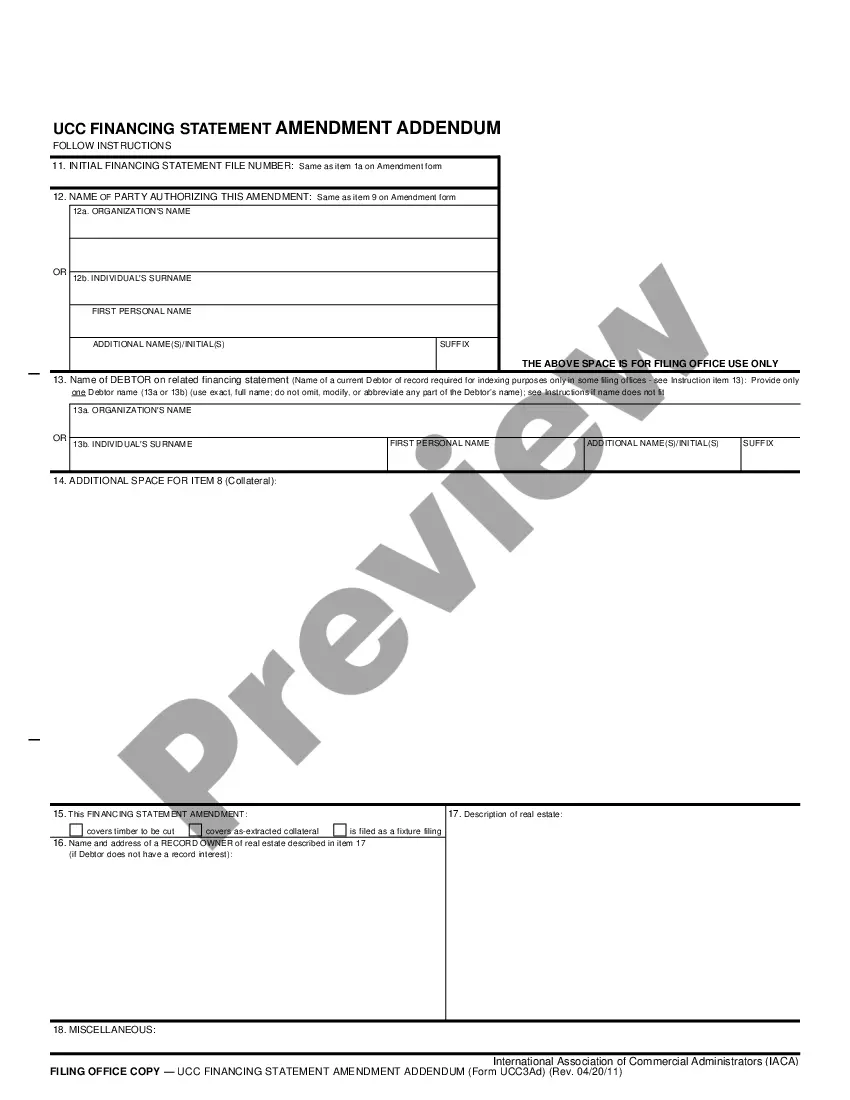

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another example utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

Once you have signed up and bought your subscription, you can utilize your West Virginia Loan Assumption Agreement as often as you need or for as long as it continues to be valid where you live. Edit it with your favored offline or online editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

This mortgage is being assumed because of {reasons for assumption}. I reside at the property and intend to assume the mortgage. {Other name} will release all liability and rights to the property located at {address}. I would like all information regarding this assumption to be sent to {address}.

In most circumstances, a mortgage can't be transferred from one borrower to another. That's because most lenders and loan types don't allow another borrower to take over payment of an existing mortgage.

You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

A simple assumption mortgage is a private transaction between a home seller and homebuyer. The buyer takes the title to the home and assumes responsibility for the seller's mortgage payments. This arrangement may not involve loan underwriting.

You may be charged a loan assumption fee on top of your closing costs. For example, FHA lenders can charge buyers up to $900 for assuming a loan.

You can legally take over a mortgage by assuming the original loan, provided you meet the bank's requirements.Most conventional loans are not assumable. Government loans, such as loans backed by the Federal Housing Administration or Department of Veterans Affairs, are often 100 percent assumable.

The existing loan must be current. The buyer must qualify based on VA credit and income standards. The buyer must assume all mortgage obligations, including repayment to the VA if the loan goes into default.

If a loan is "assumable," you're in luck: That means you can transfer the mortgage to somebody else. In most cases, the new borrower needs to qualify for the loan. To complete a transfer of an assumable loan, request the change with your lender.

Most of the closing costs associated with a VA purchase aren't part of an assumption, either. But the person assuming the loan does pay a funding fee of 0.5 percent of the loan balance. That fee goes directly to the VA and helps keep the loan program running for future generations of military buyers.