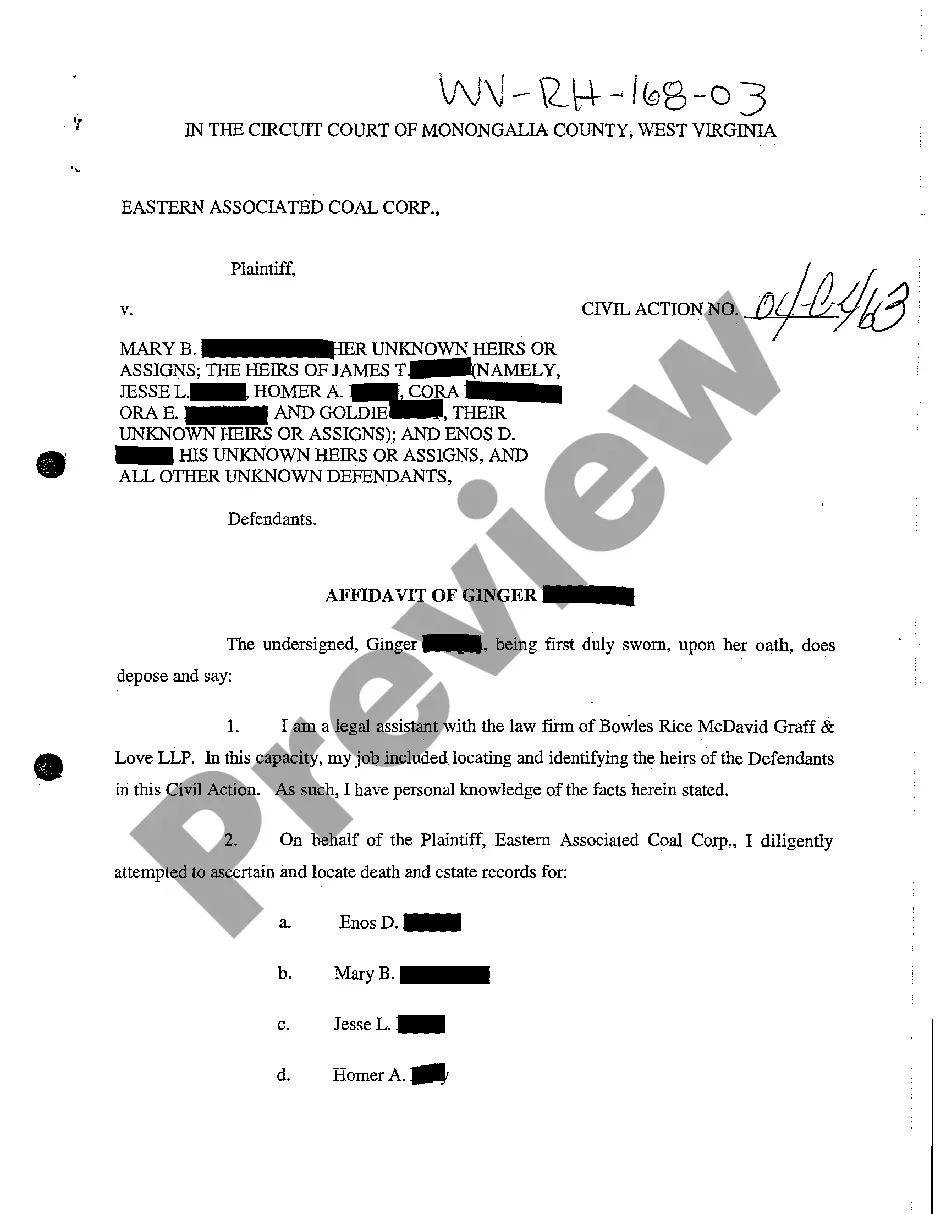

West Virginia Affidavit of Legal Assistant Charged with Locating the Heirs with Interest in Subject Property

Description

How to fill out West Virginia Affidavit Of Legal Assistant Charged With Locating The Heirs With Interest In Subject Property?

Among numerous free and paid examples which you find online, you can't be sure about their accuracy and reliability. For example, who created them or if they’re skilled enough to take care of what you need those to. Keep relaxed and utilize US Legal Forms! Discover West Virginia Affidavit of Legal Assistant Charged with Locating the Heirs with Interest in Subject Property samples developed by skilled attorneys and avoid the high-priced and time-consuming procedure of looking for an attorney and after that paying them to draft a papers for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access all your previously downloaded documents in the My Forms menu.

If you are making use of our service the very first time, follow the tips below to get your West Virginia Affidavit of Legal Assistant Charged with Locating the Heirs with Interest in Subject Property quick:

- Make certain that the document you see is valid in your state.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another sample using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you have signed up and paid for your subscription, you may use your West Virginia Affidavit of Legal Assistant Charged with Locating the Heirs with Interest in Subject Property as many times as you need or for as long as it remains valid in your state. Revise it with your preferred online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

For a beneficiary to effectively monitor the administration of estate property it goes without saying the beneficiary needs information regarding the performance of the executor's duties and powers. To this end the law has imposed on executors and trustees a duty to account beneficiaries.

As an executor, you have a fiduciary duty to the beneficiaries of the estate. That means you must manage the estate as if it were your own, taking care with the assets. So you cannot do anything that intentionally harms the interests of the beneficiaries.

If there is anyone to whom the deceased person owed money, they have only 60 days to file a claim against the estate to get paid.

Beneficiaries who receive a share of the balance of the estate (known as the residue) are entitled to a full accounting of the estate including details of all funds received and expended by the estate. A beneficiary can bring court proceedings against an executor who fails to provide adequate information.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

While an executor is obligated to notify beneficiaries and then move things along at a reasonable pace, he or she isn't required to distribute inheritances at the time of notification. In fact, beneficiaries might not receive anything until several months after they've been notified of their place in the will.

The executor can sell property without getting all of the beneficiaries to approve.The administrator will come in with a buyer and a contract and if someone else in court wants to pay more for the property than that contract price then the judge will allow that.

The creditors then have 3 months to make a claim. An inventory (called an Appraisement) of the estate's assets must be filed with the court listing the estate's assets within 90 days of the appointment of the executor.