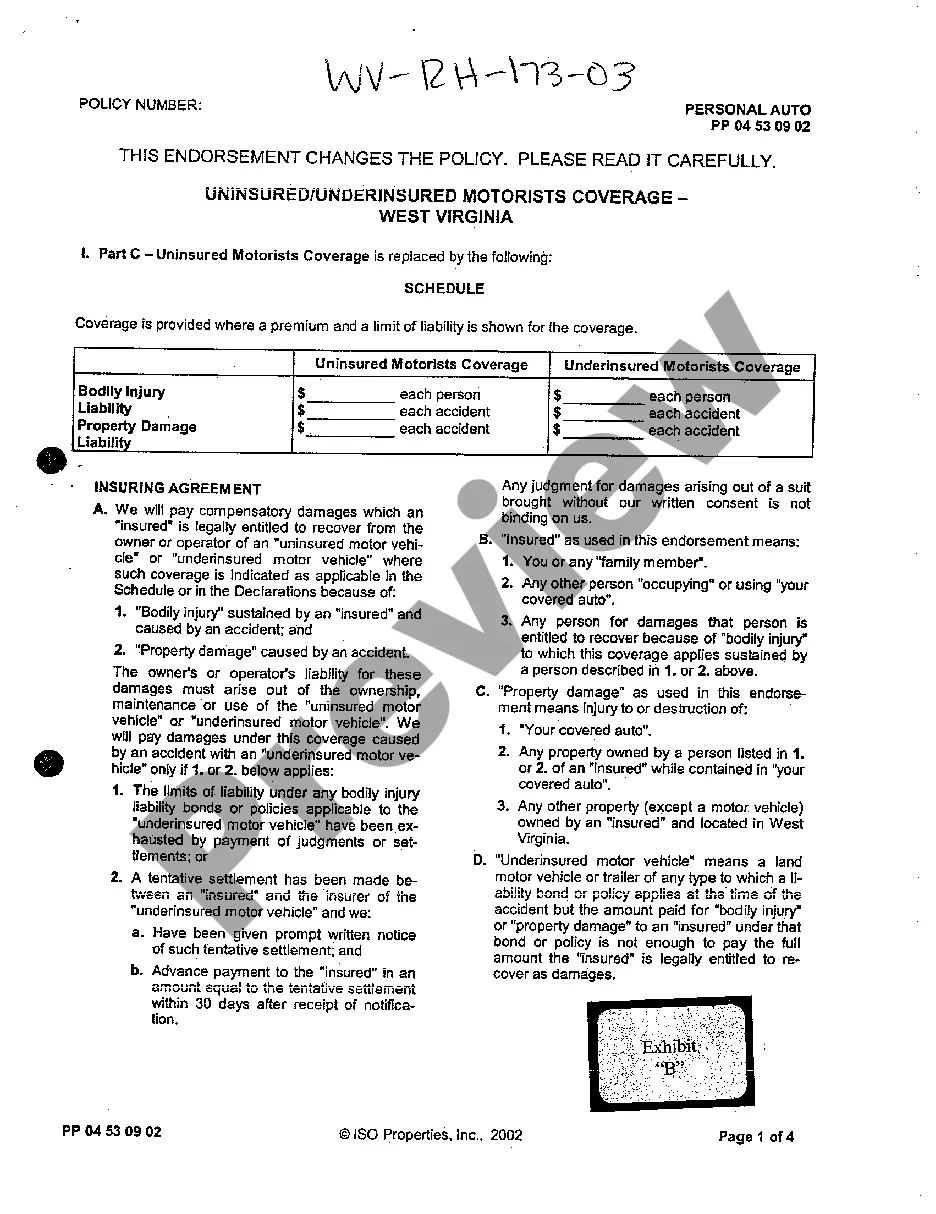

West Virginia Uninsured or Underinsured Motorists Coverage

Description

How to fill out West Virginia Uninsured Or Underinsured Motorists Coverage?

Among countless free and paid examples that you’re able to find on the web, you can't be sure about their reliability. For example, who made them or if they are qualified enough to deal with what you need these people to. Always keep calm and utilize US Legal Forms! Locate West Virginia Uninsured or Underinsured Motorists Coverage samples developed by skilled lawyers and get away from the expensive and time-consuming procedure of looking for an attorney and then having to pay them to write a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you are searching for. You'll also be able to access all your previously acquired examples in the My Forms menu.

If you are making use of our website for the first time, follow the instructions listed below to get your West Virginia Uninsured or Underinsured Motorists Coverage with ease:

- Make certain that the file you find is valid in your state.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or look for another example using the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you’ve signed up and paid for your subscription, you may use your West Virginia Uninsured or Underinsured Motorists Coverage as many times as you need or for as long as it continues to be active where you live. Revise it in your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

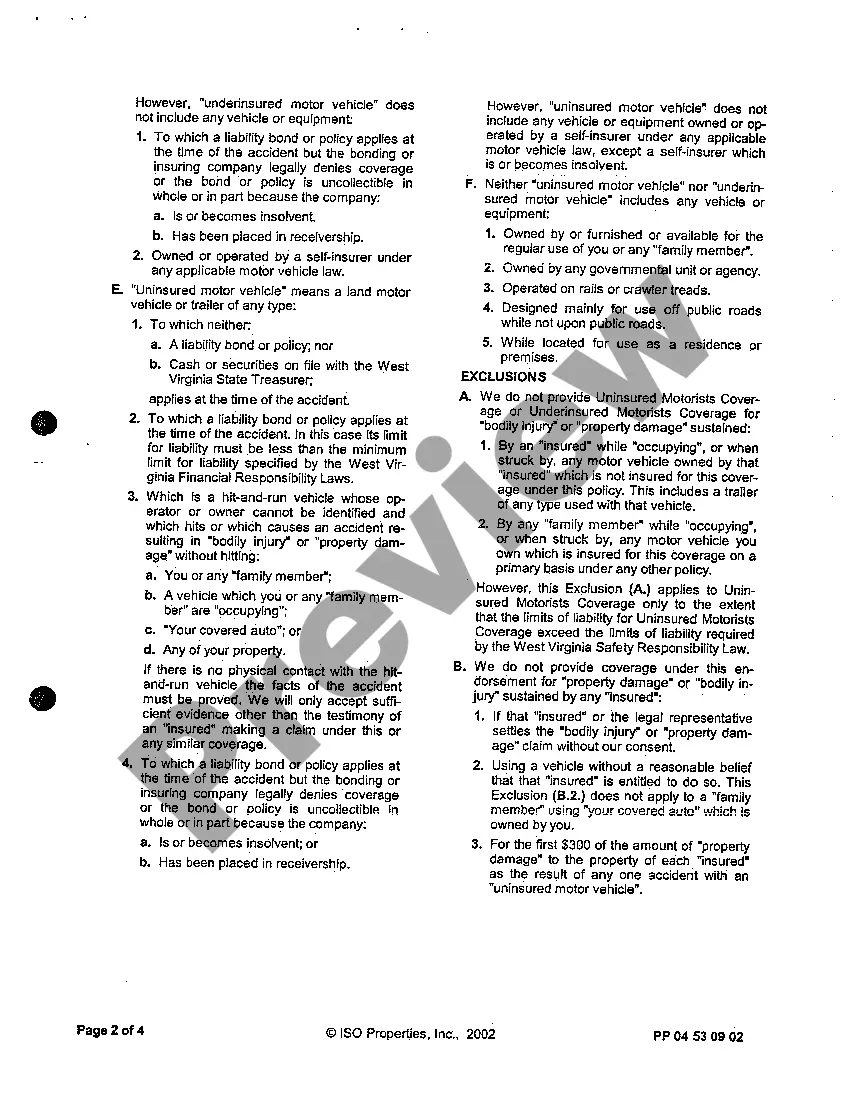

Twenty two jurisdictions require uninsured motorist coverage (UM): Connecticut, District of Columbia, Illinois, Kansas, Maine, Maryland, Massachusetts, Minnesota, Missouri, Nebraska, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Oregon, South Carolina, South Dakota, Vermont, Virginia, West Virginia

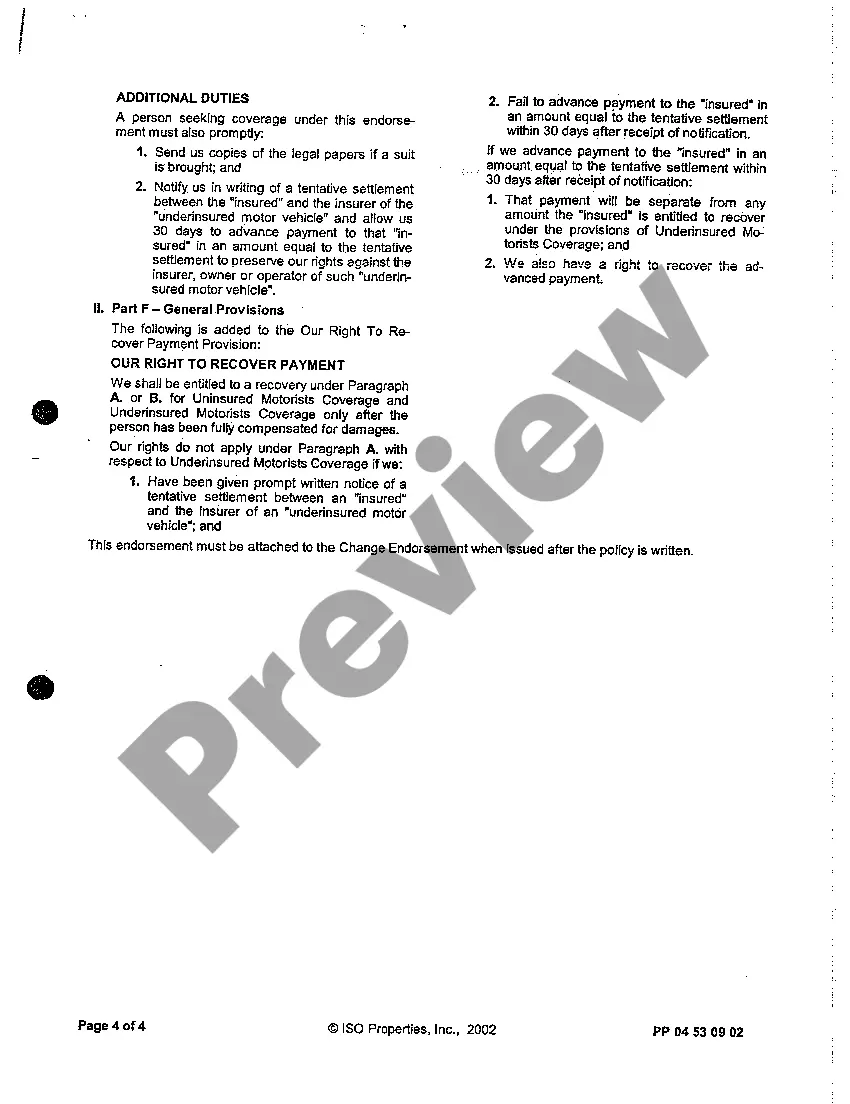

Uninsured and underinsured motorist coverages are policy add-ons that you can choose when you purchase insurance. If you've included uninsured or underinsured motorist coverage, your insurance will pay the claim after a collision with an uninsured driver.

Virginia underinsured motorist coverage, abbreviated "UIM," protects people against negligent drivers who do not have enough auto insurance. If you have more auto insurance than the person who hit you -- you have underinsured motorist coverage. Underinsured motorist coverage is required by Virginia law.

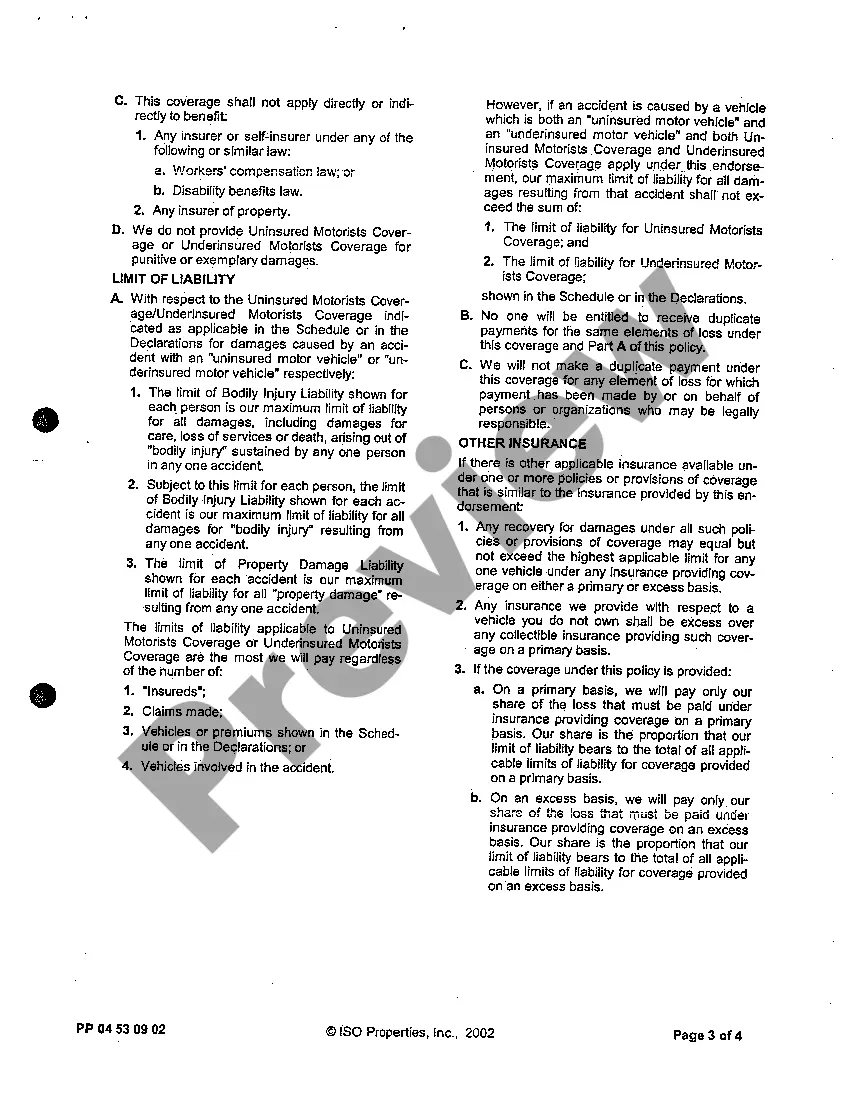

In West Virginia, drivers are required to carry $25,000 per person/$50,000 per accident in Uninsured Motorist Coverage (UM coverage). Underinsured Motorist Coverage (UIM Coverage) is not required, but rather, is an optional coverage that you may elect to carry, or reject.

Even though California does not require uninsured and underinsured motorist coverage, you should still consider buying it. In California, an average of 15% of drivers on the road don't have car insurance, which means there is a 1 in 7 chance that the other driver won't have coverage if you get into an accident.

Unstacked insurance means that your UM and UIM coverage limits for multiple vehicles are not combined. Premiums for unstacked insurance may be lower than premiums for stacked coverage. That's because stacking coverage increases the overall limit, or the amount that your insurer might have to pay toward a covered claim.

It is illegal to drive a car in Virginia without at least the minimum amount of liability coverage required by law: Bodily injury: $25,000 per person and $50,000 per accident. Property damage: $20,000 per accident. Uninsured motorist bodily injury: $25,000 per person and $50,000 per accident.

However, if you purchase insurance, uninsured motorist bodily injury coverage is required and includes underinsured motorist bodily injury coverage as well.If you purchase insurance, you must have uninsured motorist (which includes both property damage and bodily injury) and underinsured motorist coverage.