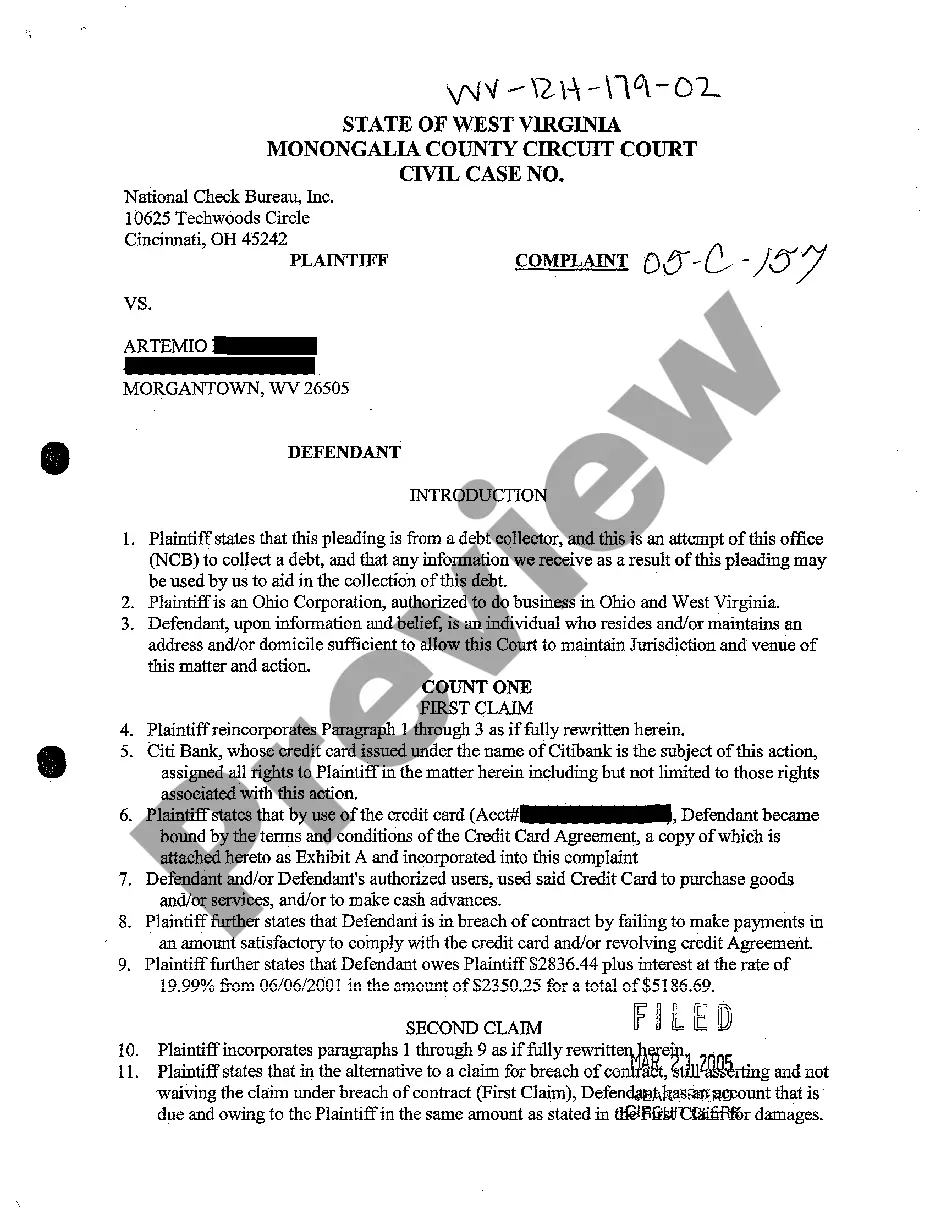

West Virginia Complaint for Collection of Debt by Credit Company for Breach of Credit Card Revolving Agreement

Description

How to fill out West Virginia Complaint For Collection Of Debt By Credit Company For Breach Of Credit Card Revolving Agreement?

Among lots of paid and free templates which you find on the internet, you can't be certain about their reliability. For example, who created them or if they’re qualified enough to take care of what you require them to. Keep calm and utilize US Legal Forms! Locate West Virginia Complaint for Collection of Debt by Credit Company for Breach of Credit Card Revolving Agreement templates created by professional attorneys and get away from the expensive and time-consuming procedure of looking for an lawyer and after that paying them to write a papers for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are seeking. You'll also be able to access all of your earlier acquired files in the My Forms menu.

If you are making use of our website the first time, follow the tips below to get your West Virginia Complaint for Collection of Debt by Credit Company for Breach of Credit Card Revolving Agreement fast:

- Make certain that the document you discover is valid in your state.

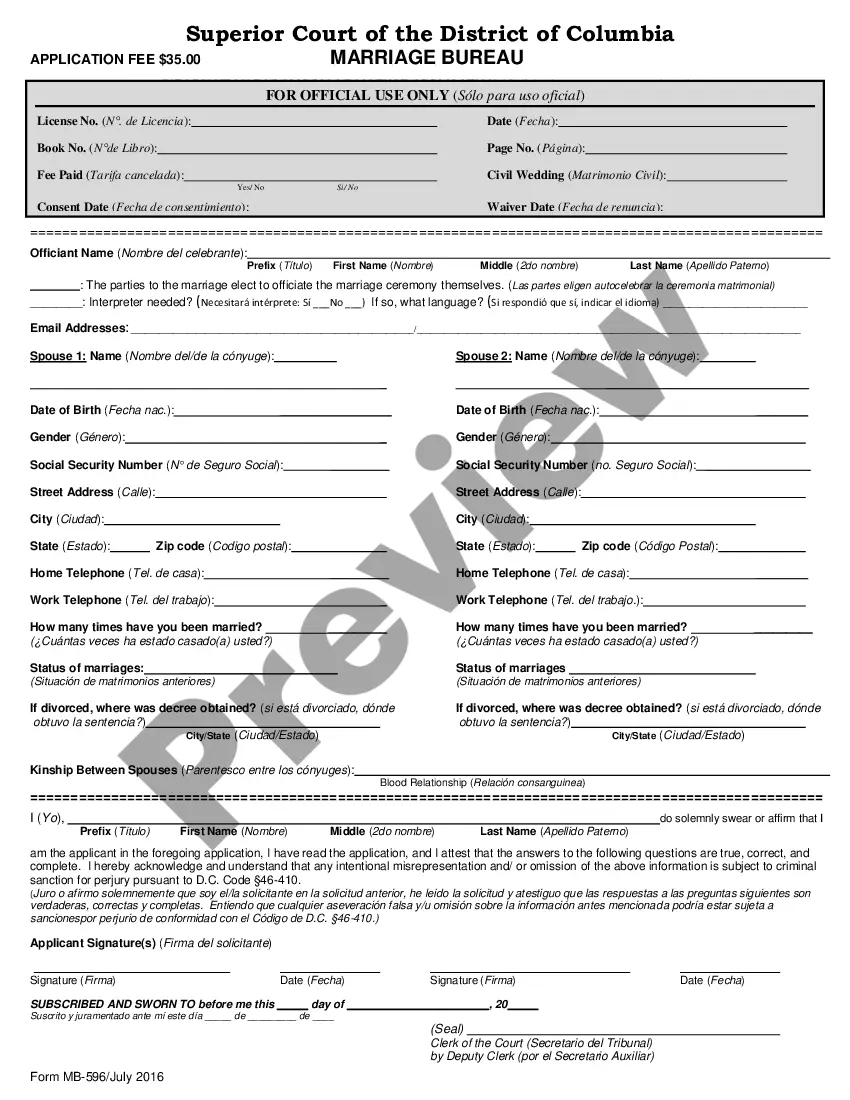

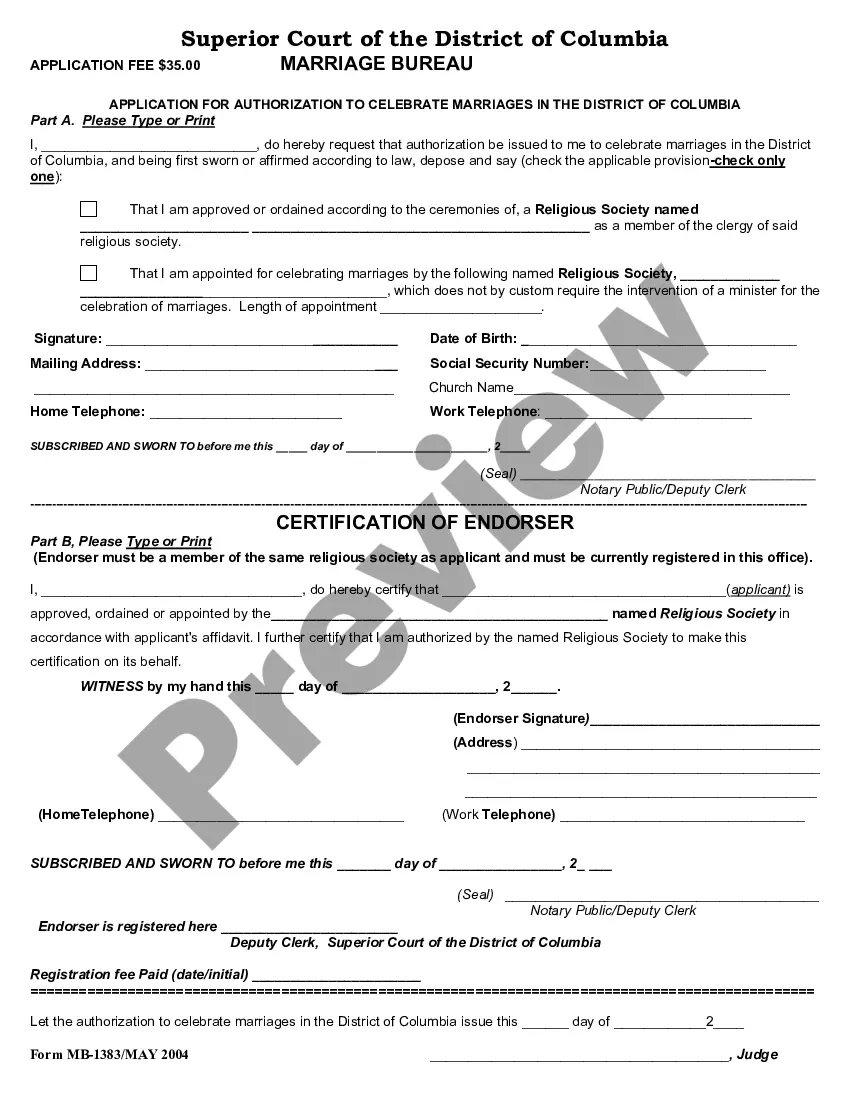

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing process or find another sample utilizing the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and purchased your subscription, you can use your West Virginia Complaint for Collection of Debt by Credit Company for Breach of Credit Card Revolving Agreement as many times as you need or for as long as it continues to be active in your state. Change it with your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

A judgment gives the creditor the right to use additional collection methods to collect the debt owed to them. For example, if the credit card company proves to the court that you owe $5,000, a court may enter a judgment saying that you owe $5,000 (plus costs and interest).

Don't ignore the summons. When you get a court summons for credit card debt, pay attention to itand make a plan of action. Verify the debt. Consider debt settlement. Contact an attorney. Look at your budget. Request a payment plan. Make a lump-sum payment.

Financial institutions typically don't sue customers who owe less than $1,000 or are making regular payments. As such, you shouldn't need to worry about a lawsuit unless you owe a substantial amount and are well behind on your payments.

A statute of limitations is a law that tells you how long someone has to sue you. In California, most credit card companies and their debt collectors have only four years to do so. Once that period elapses, the credit card company or collector loses its right to file a lawsuit against you.

Credit card companies sue for non-payment in about 15% of collection cases. Usually debt holders only have to worry about lawsuits if their accounts become 180-days past due and charge off, or default.

Unsecured Debts. Unsecured creditors such as credit card companies and most trade creditors must first sue you and win a money judgment against you before they grab your income and property.Instead, the creditor may simply write off your debt and treat it as a deductible business loss for income tax purposes.

Big creditors don't sue over small debts.In fact, many big creditors won't sue over amounts much larger than $1,000. When you consider that the time, effort, and manpower involved in suing someone often exceeds $5,000, then you understand why many of them won't sue.

If a debt goes unpaid and you've made no plans to repay it, your credit card company may sue you in civil court for the balance, hoping a judge will order you to pay.If you think ignoring a creditor's calls about an unpaid credit card debt will make the calls stop, you may eventually be right.

If the debt holder still doesn't pay whomever is collecting the debt, the creditor can file a lawsuit against the debt holder in civil court. However, the creditor is less likely to do so if the balance owed is under $1,000, or if the debt is settled.