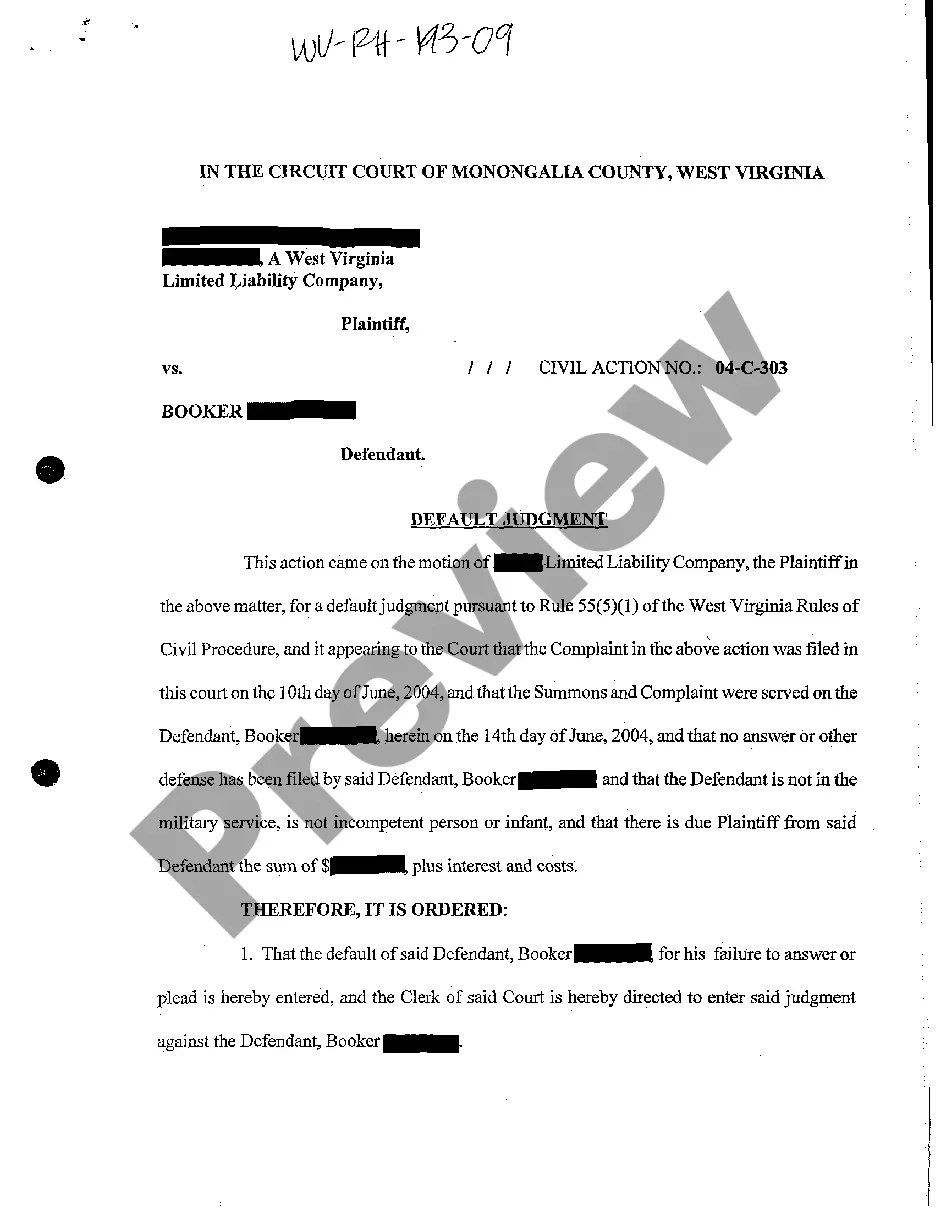

West Virginia Default Judgment

Description

How to fill out West Virginia Default Judgment?

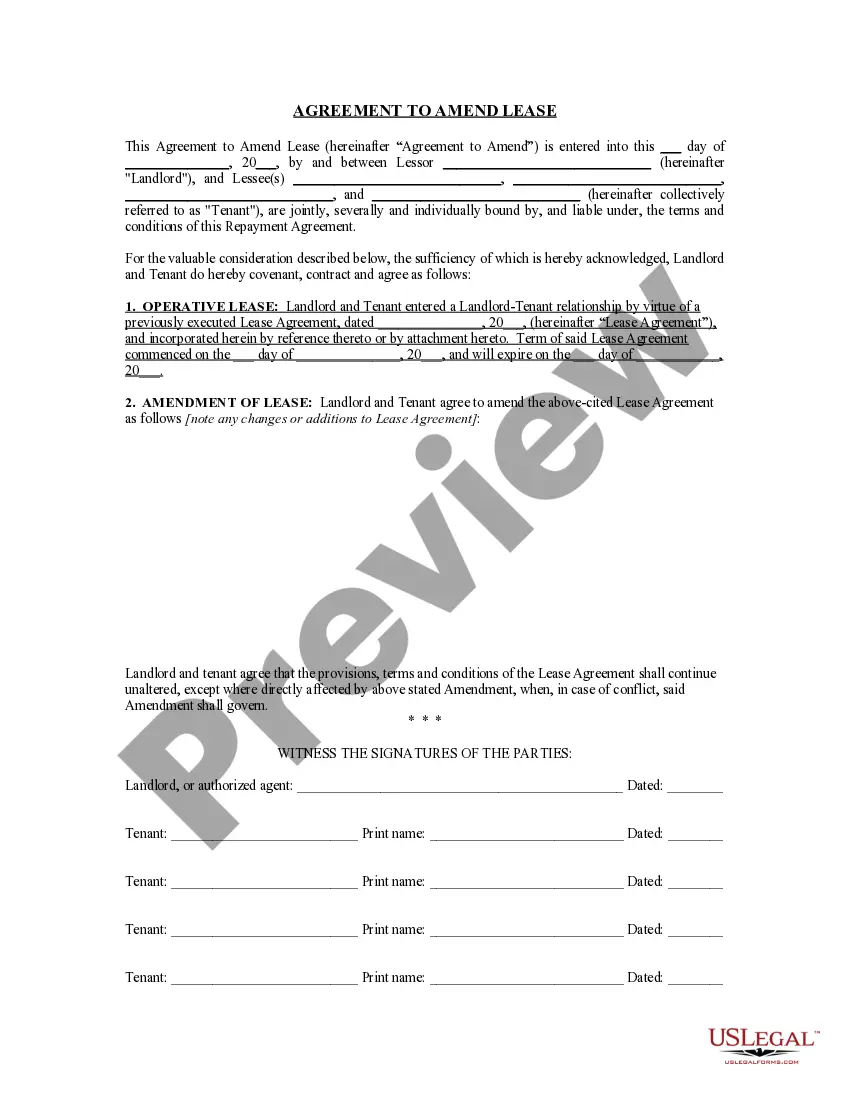

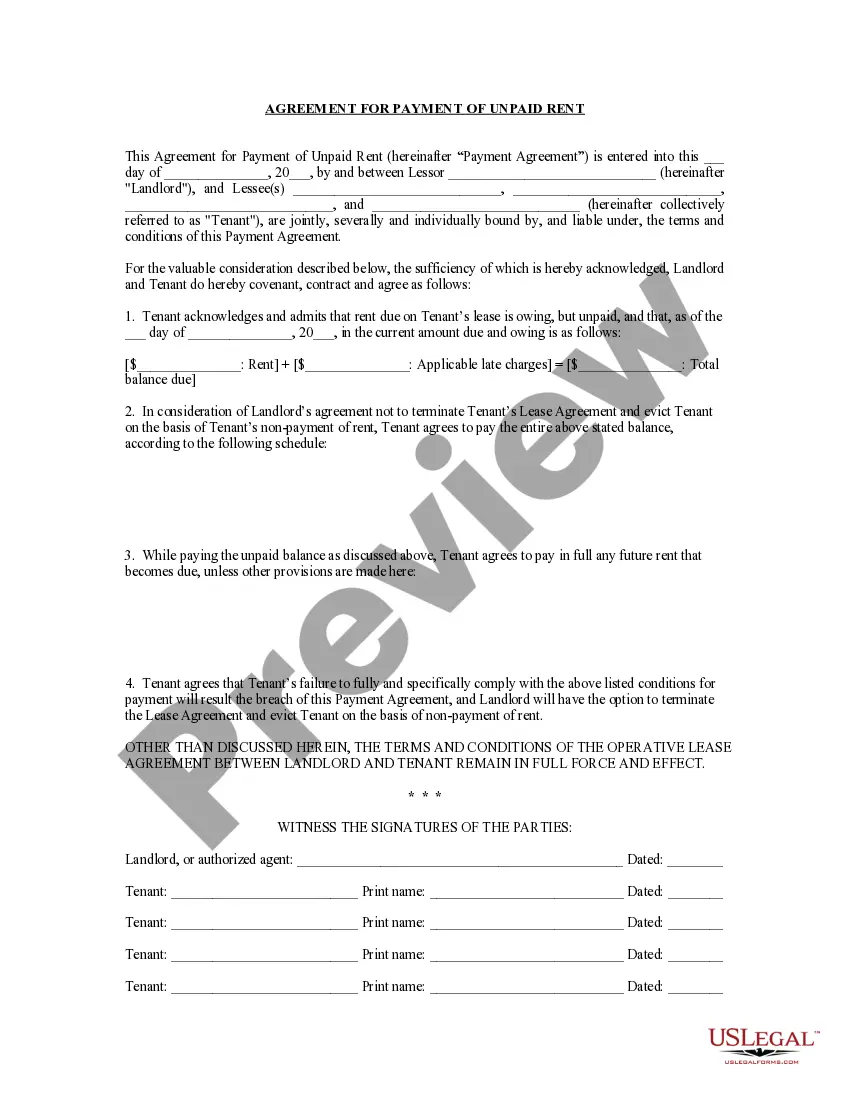

Among numerous paid and free examples that you’re able to get on the net, you can't be certain about their accuracy. For example, who created them or if they are skilled enough to deal with what you require those to. Always keep relaxed and make use of US Legal Forms! Locate West Virginia Default Judgment samples made by professional legal representatives and prevent the costly and time-consuming process of looking for an lawyer or attorney and after that paying them to write a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you are looking for. You'll also be able to access all of your earlier downloaded examples in the My Forms menu.

If you are utilizing our platform the very first time, follow the guidelines listed below to get your West Virginia Default Judgment with ease:

- Make sure that the document you see applies where you live.

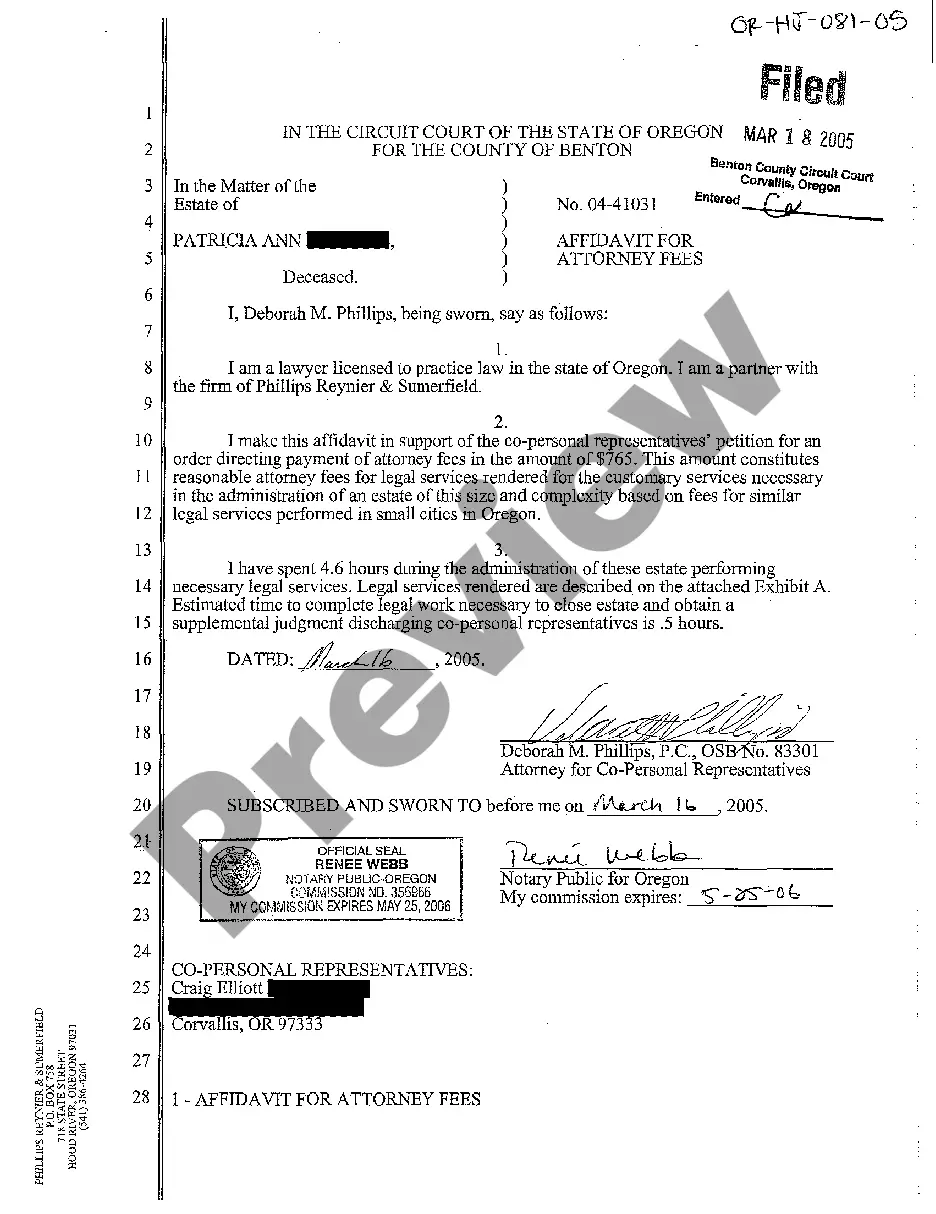

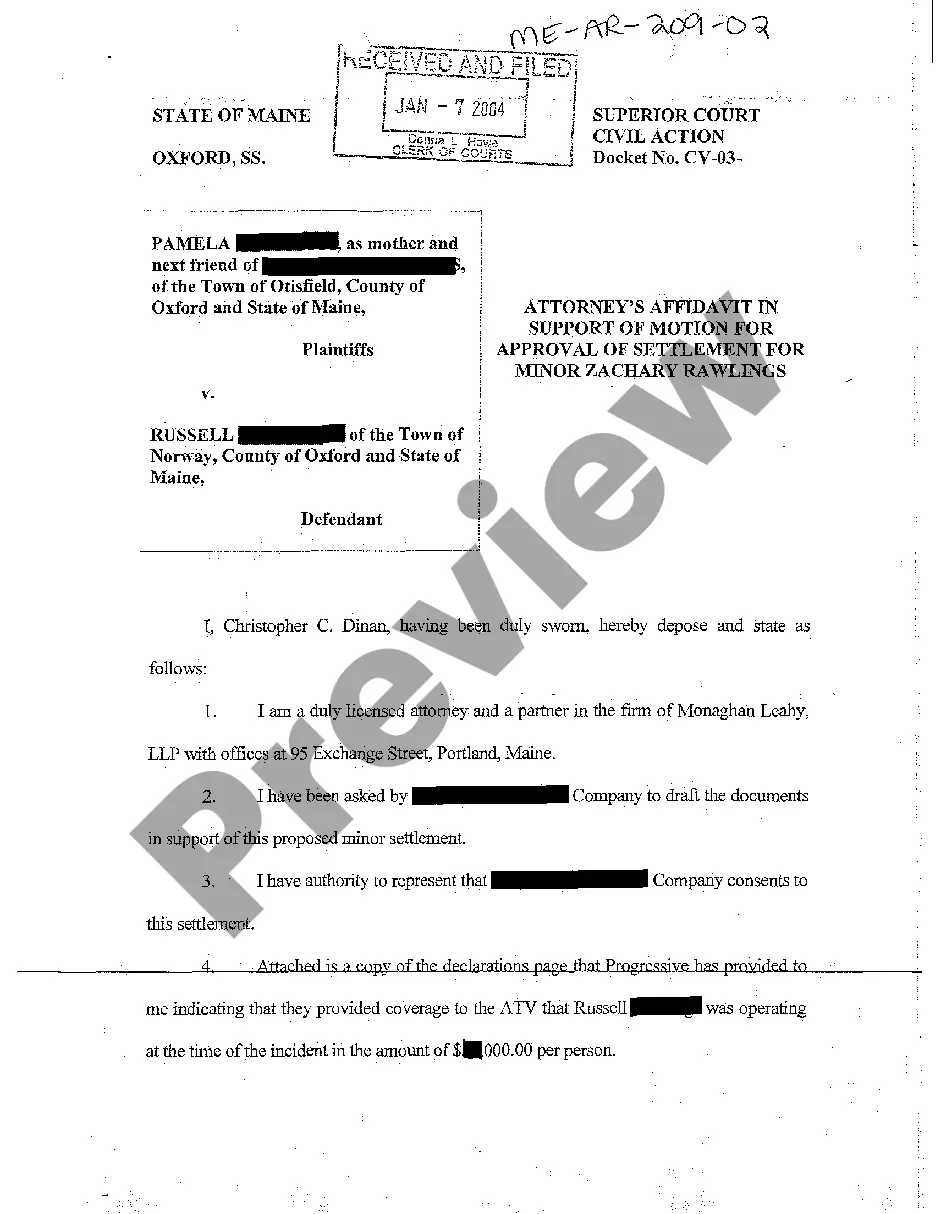

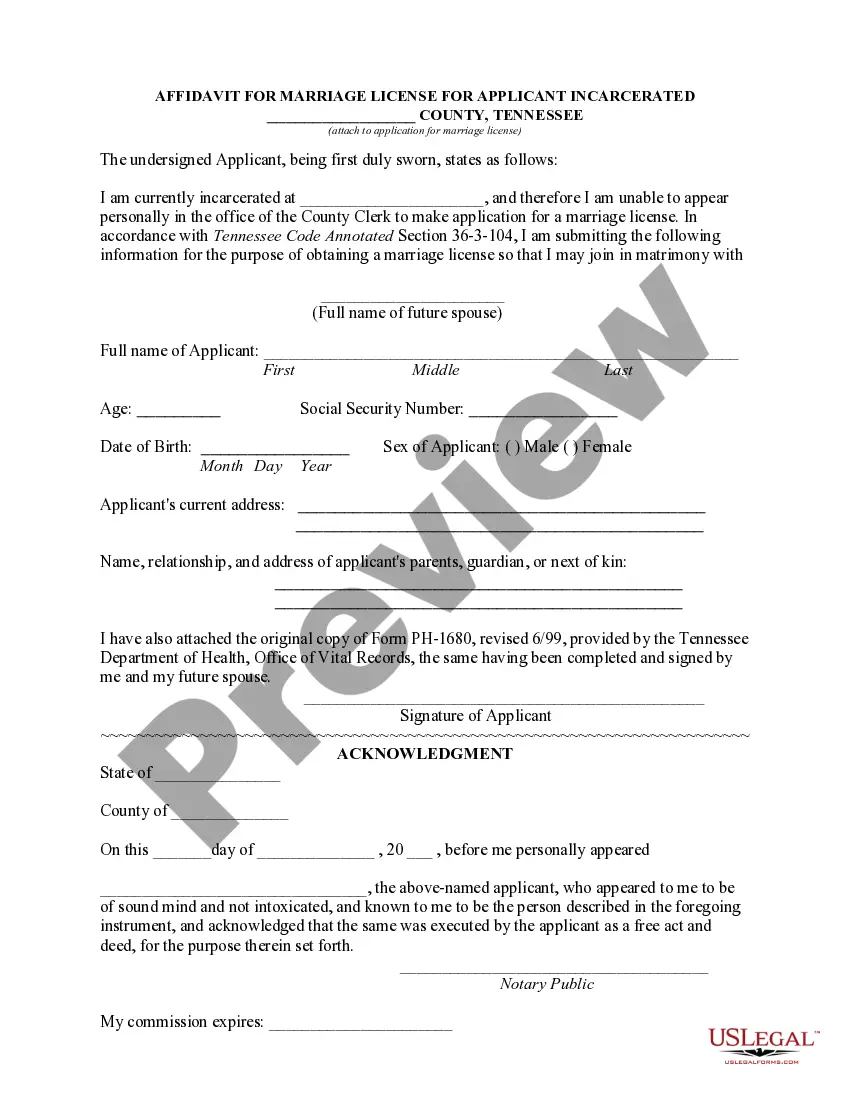

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or find another sample using the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

Once you have signed up and purchased your subscription, you can utilize your West Virginia Default Judgment as often as you need or for as long as it remains active in your state. Change it with your preferred editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

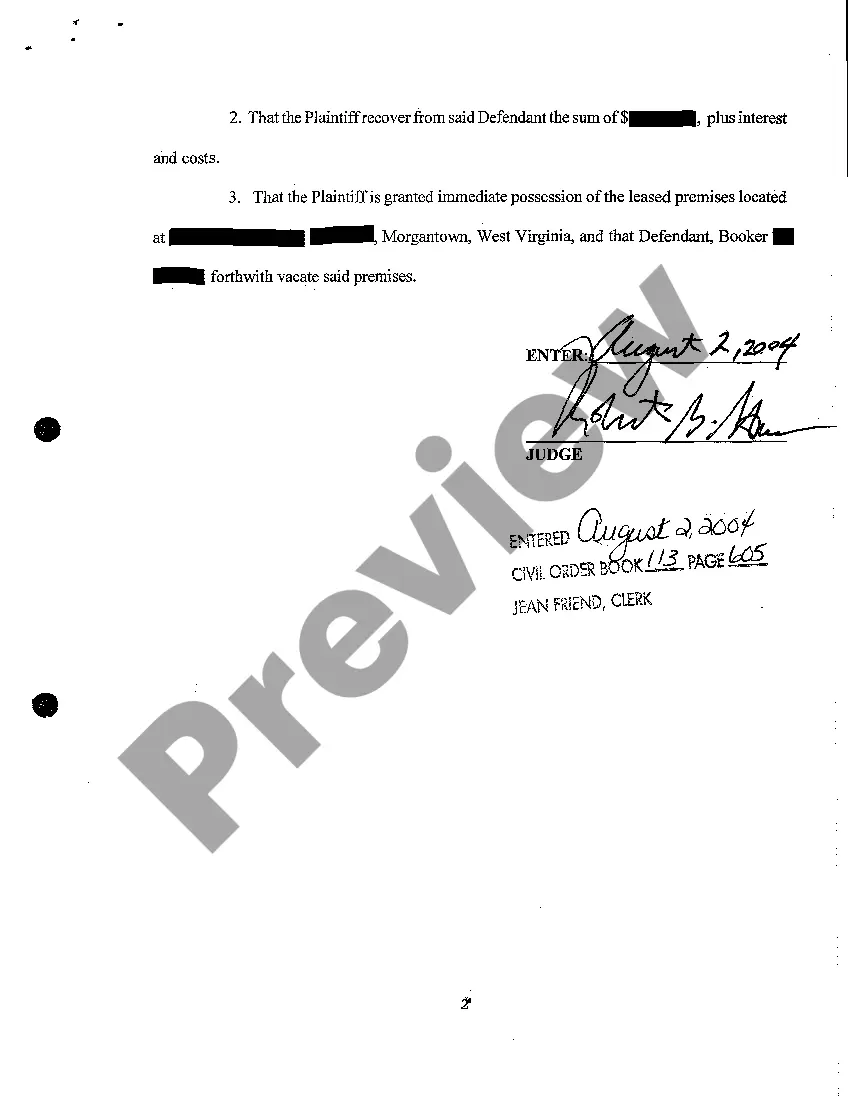

Generally, if a defendant fails to respond to a complaint you can get a default judgment after 45 days. However, the court system is very slow these days and it can take several months to get the court to issue the default judgment.

Default judgments happen when you don't respond to a lawsuit often from a debt collector and a judge resolves the case without hearing your side.Next up could be wage garnishment or a bank account levy, which allows a creditor to remove money from your bank accounts to repay the debt.

A default judgment means that the court has decided that you owe money. This a result of the person suing you in small claims court and you failed to appear at the hearing.

The danger of allowing a default judgment against you is once this occurs the debt buyer can garnish your wages and your bank accounts.If you don't submit a written answer to the lawsuit the court can enter a default judgment giving the debt buyer everything they are asking for.

After you notify the defendant of the judgment, you can begin to enforce the judgment. Your judgment might be for money, repossession, eviction, foreclosure, or any number of things. In any case, your rights at this point would be the same as if you had gone to trial and won.

First, you can ask the court to set aside the default judgment and give you an opportunity to contest it. Next, you can settle the debt with the debt buyer for an amount less than what the default judgment is for. And finally you can eliminate the default judgment completely by filing for bankruptcy.

Typically, a court's rules governing enforcement of default judgments include procedures for wage garnishments, attachment of bank accounts and seizure of assets. The plaintiff can usually pursue more than one of these enforcement mechanisms simultaneously.

What happens next? When you file your Motion and Affidavit to Set Aside Default, you will get a hearing date and time from the court clerk. At the hearing, the judge will grant or deny the motion. If the judge grants your motion, the default or default judgment will be set aside, and the case will move forward.