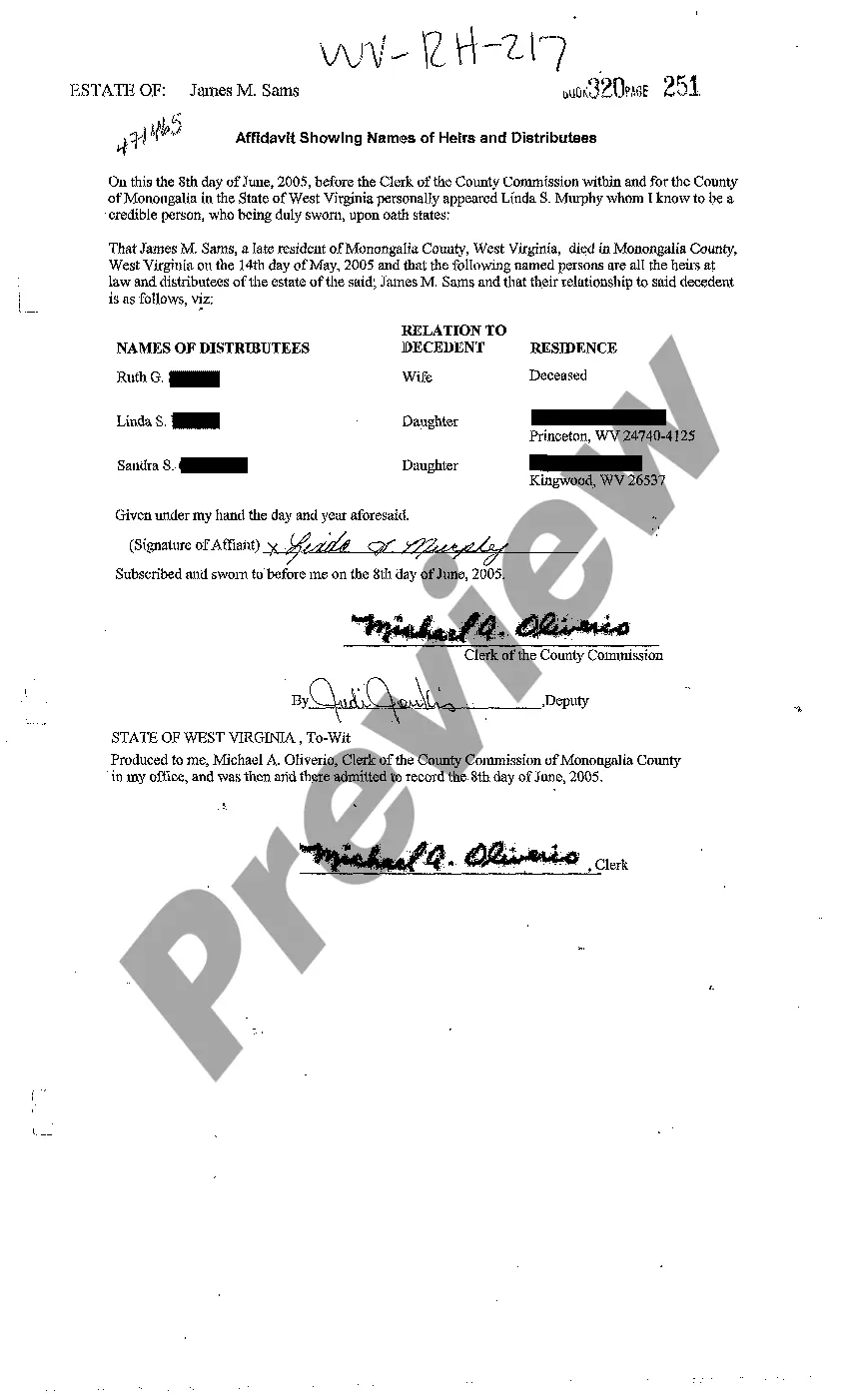

West Virginia Affidavit Showing Names of Heirs and Distributees

Description

How to fill out West Virginia Affidavit Showing Names Of Heirs And Distributees?

Among numerous free and paid examples that you find on the net, you can't be sure about their accuracy and reliability. For example, who created them or if they’re competent enough to deal with what you require those to. Keep calm and use US Legal Forms! Get West Virginia Affidavit Showing Names of Heirs and Distributees templates created by skilled attorneys and prevent the high-priced and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to draft a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you’re trying to find. You'll also be able to access all of your earlier saved examples in the My Forms menu.

If you’re making use of our platform the very first time, follow the tips below to get your West Virginia Affidavit Showing Names of Heirs and Distributees quick:

- Make sure that the document you see applies where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or find another sample utilizing the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

Once you have signed up and bought your subscription, you can utilize your West Virginia Affidavit Showing Names of Heirs and Distributees as often as you need or for as long as it continues to be valid where you live. Revise it in your favorite editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

An affidavit is used for the purpose of proving in court that a claim is true, and is typically used in conjunction with witness statements and other corroborating evidence. Through an affidavit, an individual swears that the information contained within is true to the best of their knowledge.

An Affidavit of Heirship is a sworn statement that heirs can use in some states to establish property ownership when the original owner dies intestate. Affidavits of Heirship are generally used when the decedent only left real property, personal property, or had a small estate.

An heir-at-law is anyone who's entitled to inherit from someone who dies without leaving a last will and testament or other estate plans.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

An affidavit of heirship is needed to transfer a deceased person's interest in real or personal property to his or her heirs when the decedent dies without leaving a last will and testament or without disposing of all of his or her property in a will.

Following approval by the court, heirs can use this affidavit to acquire property from the estate. Estates with no will or a will that has not been probated by the Texas courts within four years of the deceased's death can be inherited via the use of an affidavit of heirship.