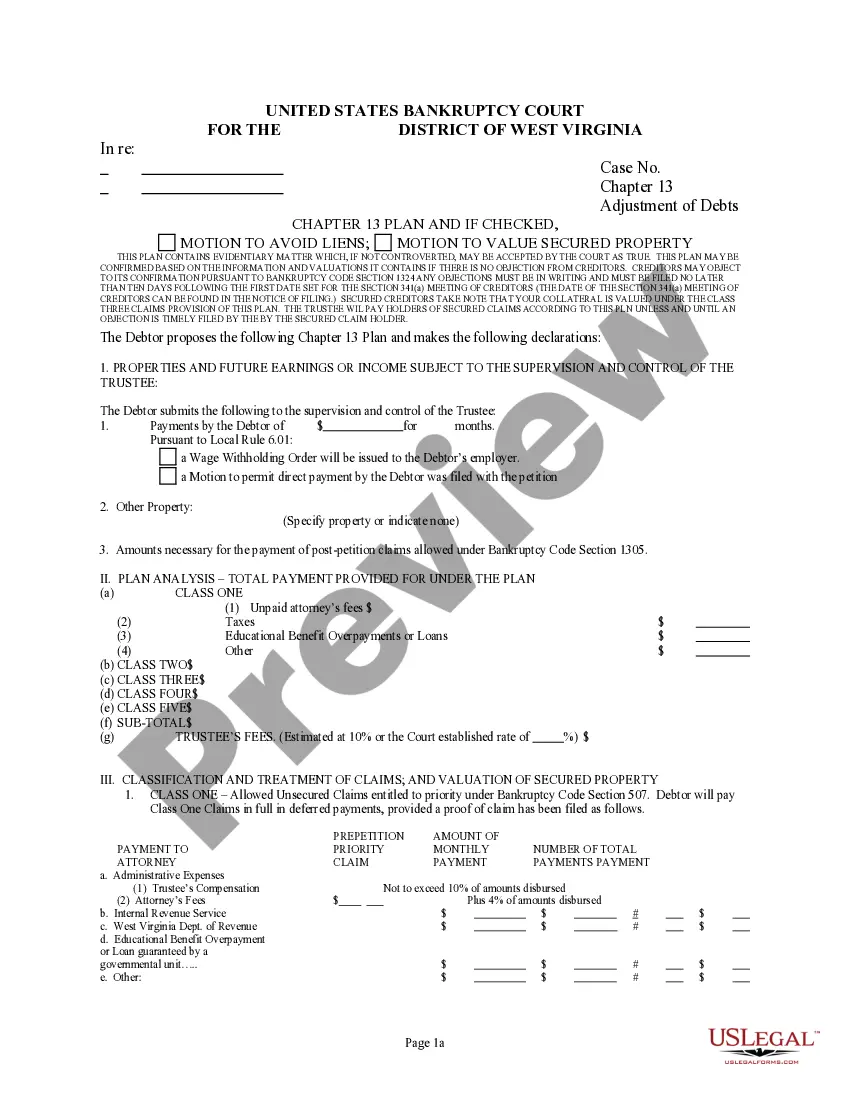

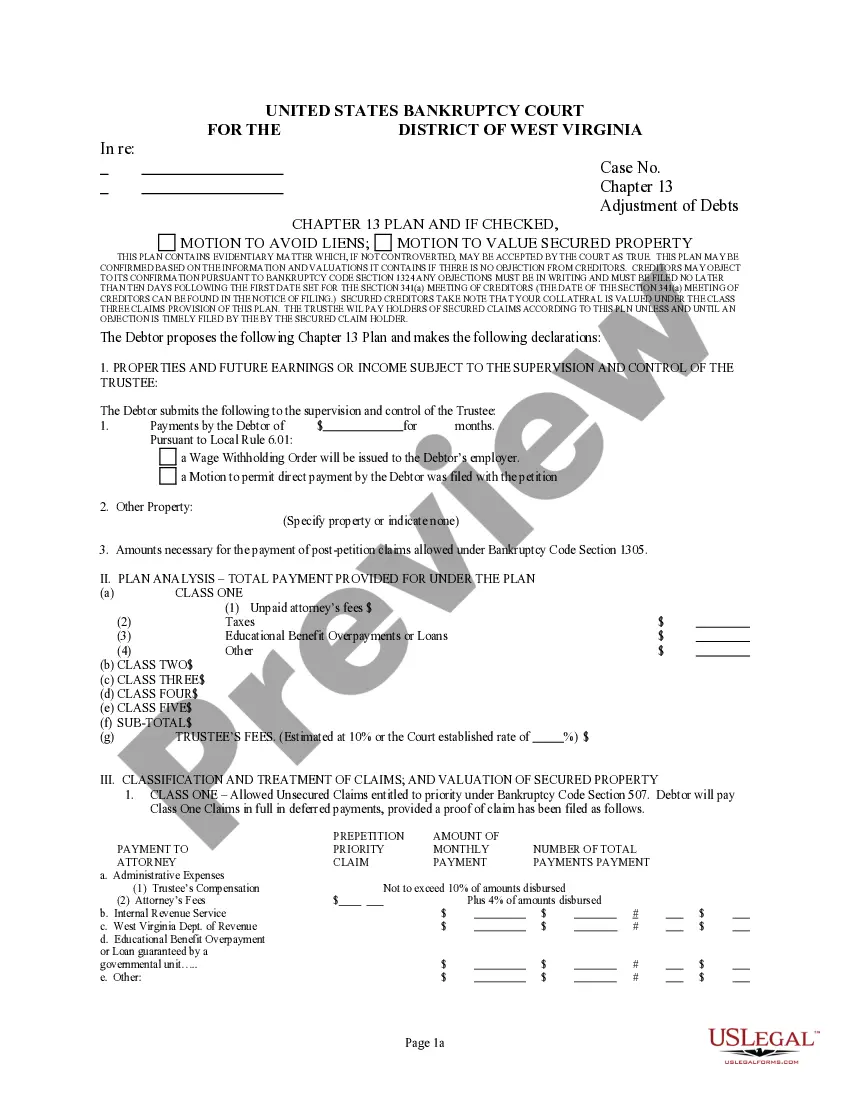

West Virginia Chapter 13 Model Plan is a type of debt repayment plan in which a debtor pays all or a portion of their debts over a period of three to five years. It is an alternative to filing for bankruptcy and allows debtors to keep their property, such as their home and car, while managing their debt. The West Virginia Chapter 13 Model Plan is organized by the United States Bankruptcy Court for the Southern District of West Virginia. The West Virginia Chapter 13 Model Plan offers two types of plans. The first type is the Traditional Plan, which allows debtors to pay all or a portion of their debts over a period of three to five years, depending on their income. During this time, the debtor must make regular payments to the trustee, who is responsible for distributing the payments to the creditors. The second type is the Wage Earner Plan, which is available to debtors who have a steady income and are able to make regular payments. This plan allows debtors to pay all or a portion of their debts over a period of three to five years. Under the West Virginia Chapter 13 Model Plan, debtors must complete a mandatory credit counseling course and provide the court with a budget of their income and expenses. The amount of the payments and the length of the repayment plan are determined by the debtor’s income and expenses. Debtors must also attend a meeting of creditors, during which the court will review the plan and the creditors can ask questions about it. Once the plan is approved, debtors must make their payments on time and keep up with their other obligations. At the end of the plan, any remaining debt is discharged, and the debtor is no longer liable for it.

West Virginia Chapter 13 Model Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

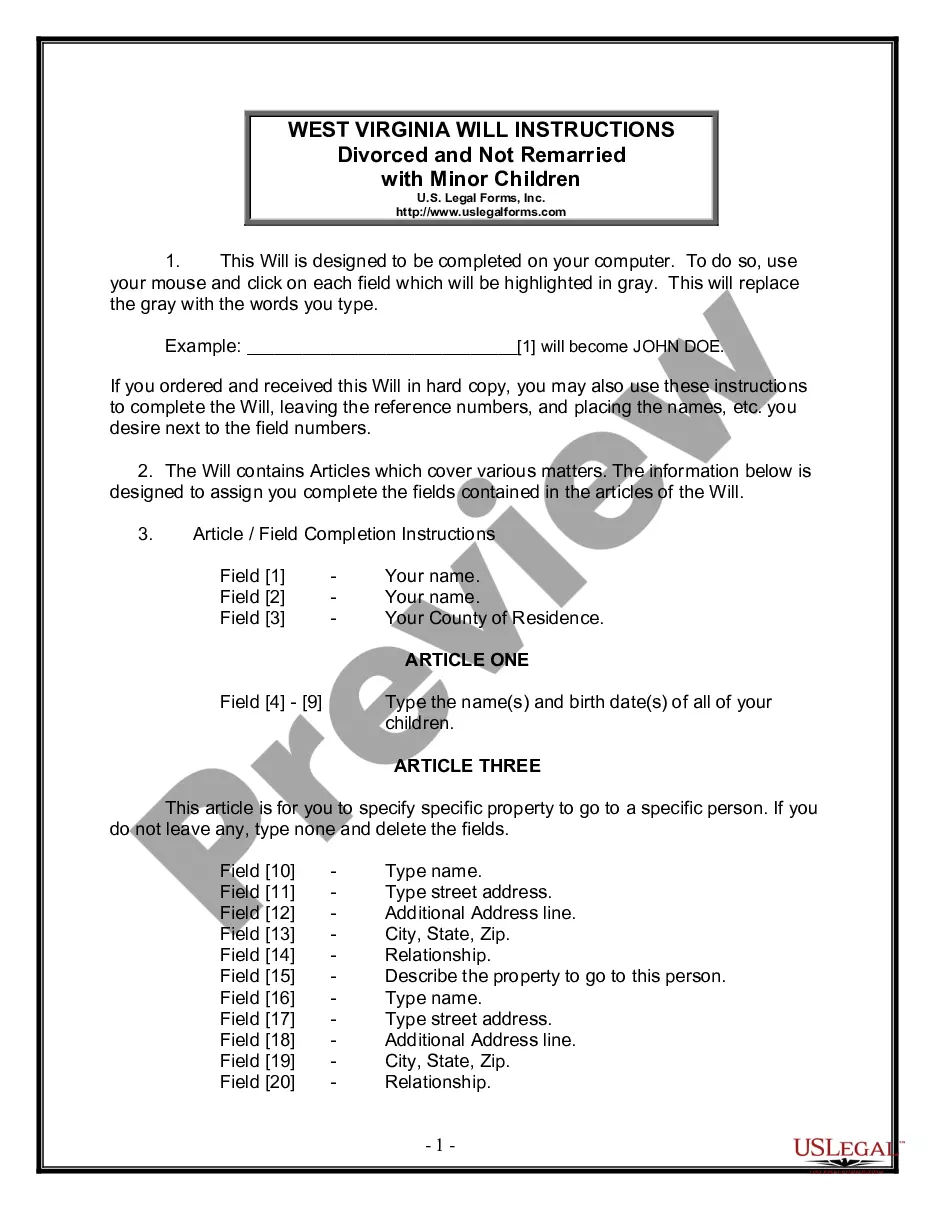

How to fill out West Virginia Chapter 13 Model Plan?

US Legal Forms is the most straightforward and affordable way to locate appropriate formal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and verified by attorneys. Here, you can find printable and fillable templates that comply with national and local regulations - just like your West Virginia Chapter 13 Model Plan.

Obtaining your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted West Virginia Chapter 13 Model Plan if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one corresponding to your requirements, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Create an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your West Virginia Chapter 13 Model Plan and download it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your reliable assistant in obtaining the corresponding formal paperwork. Give it a try!

Form popularity

FAQ

You may like to file Chapter 13 instead of a Chapter 7 bankruptcy, if you're behind on your mortgage payments and you're trying to save your home. Chapter 7 does not give you the opportunity to catch up mortgage payments or otherwise save your house. A Chapter 13 would be the appropriate chapter to file for that.

Although a Chapter 13 bankruptcy stays on your record for years, missed debt payments, defaults, repossessions, and lawsuits will also hurt your credit and may be more complicated to explain to a future lender than bankruptcy.

The main cons to Chapter 7 bankruptcy are that most unsecured debts won't be erased, you may lose nonexempt property, and your credit score will likely take a temporary hit. While a successful bankruptcy filing can give you a fresh start, it's important to do your research before deciding what's right for you.

In most cases, failure is due to one of several reasons: Life circumstances. Not having the guidance of an experienced bankruptcy attorney. Over-ambition.

An order confirming the chapter 13 plan is a Bankruptcy judge's approval of the Debtor's proposed chapter 13 repayment plan. For more information, see 11 U.S.C. §1325 .

Chapter 7 and Chapter 13 bankruptcy both affect your credit score the same ? having a Chapter 13 bankruptcy on your credit report will not be any better for your score than a Chapter 7. However, the individual reviewing your report will look at more than your score.