West Virginia LLC Reinstatement is the process of reactivating a West Virginia Limited Liability Company (LLC) after it has been administratively dissolved or revoked by the West Virginia Secretary of State. There are three types of West Virginia LLC Reinstatement: Administrative Reinstatement, Voluntary Reinstatement, and Involuntary Reinstatement. Administrative Reinstatement is the process by which a West Virginia LLC is reinstated after failing to file an Annual Report or pay the associated fees. This process requires an LLC to file the necessary paperwork and pay the appropriate fees to the West Virginia Secretary of State. Voluntary Reinstatement is the process by which a West Virginia LLC is reinstated after the LLC's assets and liabilities have been assigned to another entity. This process requires the LLC to submit a Voluntary Reinstatement form and pay the appropriate fees to the West Virginia Secretary of State. Involuntary Reinstatement is the process by which a West Virginia LLC is reinstated due to a court order. This process requires the LLC to submit an Involuntary Reinstatement form and pay the appropriate fees to the West Virginia Secretary of State.

West Virginia LLC Reinstatement

Description

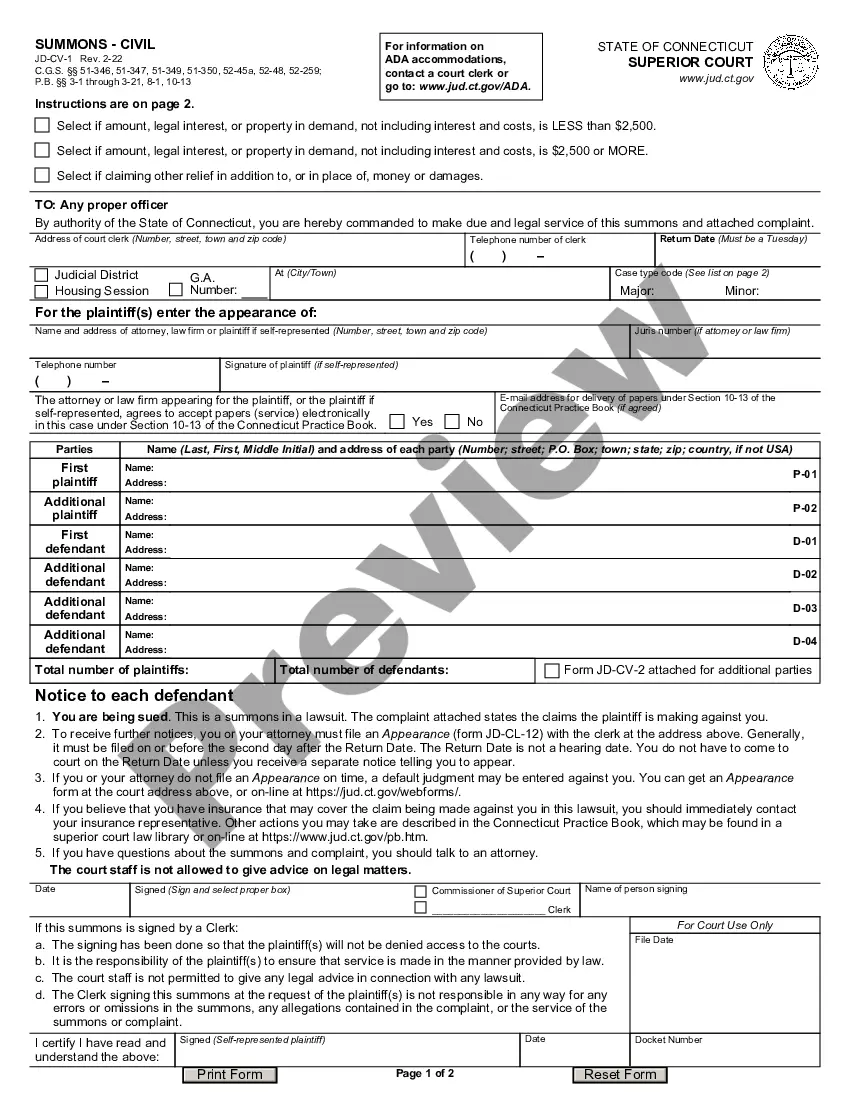

How to fill out West Virginia LLC Reinstatement?

How much time and resources do you usually spend on composing formal documentation? There’s a better option to get such forms than hiring legal experts or wasting hours searching the web for an appropriate template. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, including the West Virginia LLC Reinstatement.

To obtain and prepare a suitable West Virginia LLC Reinstatement template, follow these easy steps:

- Look through the form content to make sure it meets your state laws. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your needs, locate a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the West Virginia LLC Reinstatement. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely safe for that.

- Download your West Virginia LLC Reinstatement on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us today!

Form popularity

FAQ

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

Visit to file the statement of dissolution for a partnership in real time.

To dissolve your Virginia Limited Liability Company you complete and file form LLC-1050, Articles of Cancellation of a Virginia Limited Liability Company. You state on the form that you have completed winding up affairs and the instructions refer to paying all debts, liabilities and obligations of the company.

Removing a member from an LLC To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail. The member in question of removal may need to get compensated for his share of membership interests.

How much does it cost for an LLC in West Virginia? It costs $100 to file for an LLC in West Virginia and another $30 to obtain a business license in the state.

How do you dissolve a West Virginia LLC? First you have to formally dissolve your West Virginia LLC and wind up its business affairs. Then you file original Articles of Termination of a West Virginia Limited Liability Company with the West Virginia Secretary of State, Business Division (SOS).

You can submit the West Virginia Application for Reinstatement to the West Virginia Secretary of State Business & Licensing Division. You can file by e-mail, fax, mail, in-person. You can pay by credit card, check, money order, or cashier's check (made payable to ?West Virginia Secretary of State?).