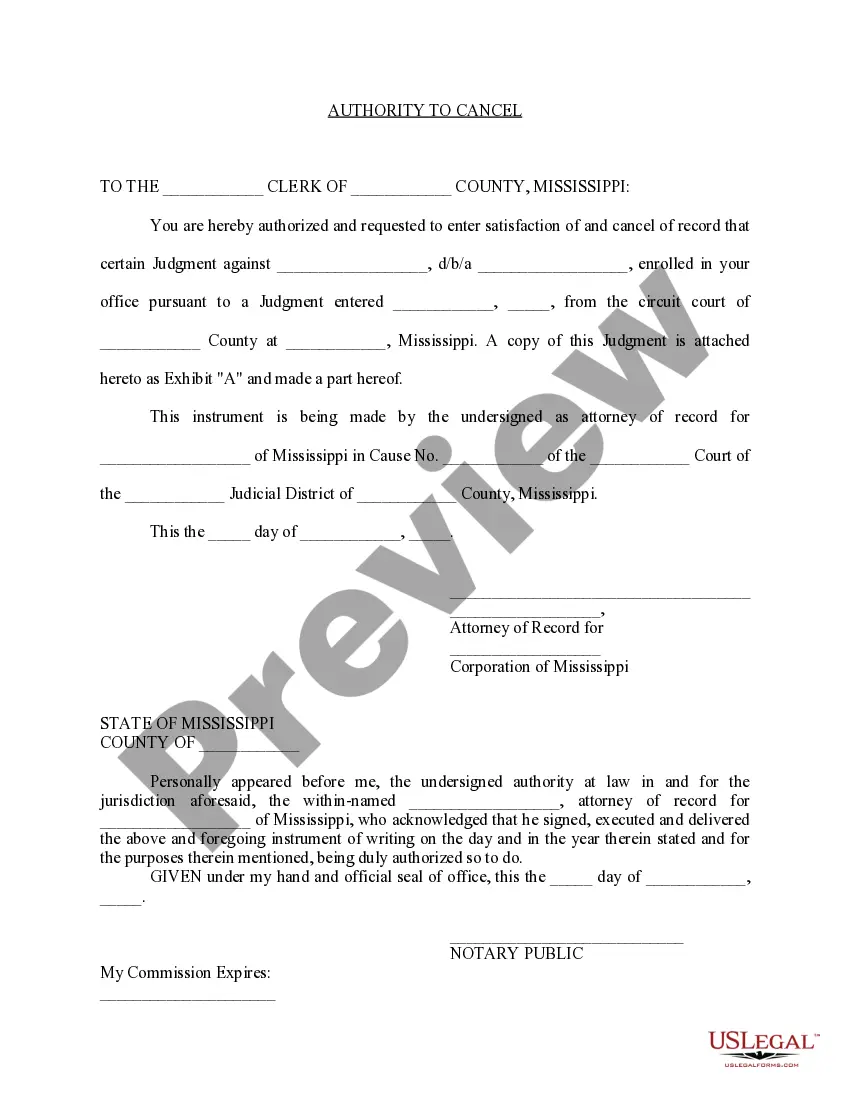

The West Virginia Statement of Agent of Process for Debt Collector is a document that must be filed by a debt collector in the state of West Virginia in order to act as an agent of process for the collection of debt. This document must be filed with the West Virginia Secretary of State in order to be effective. It must include the name of the debt collector, the registered address, and the name of the person authorized to receive service of process. It also must include the signature of the authorized representative of the debt collector. There are two types of West Virginia Statement of Agent of Process for Debt Collector. These are the “Original Agent for Process” and the “Additional Agent for Process.” The Original Agent for Process is the first agent of process the debt collector files with the West Virginia Secretary of State. The Additional Agent for Process is a subsequent agent of process that is filed following the Original Agent for Process.

West Virginia Statement of Agent of Process for Debt Collector

Description

How to fill out West Virginia Statement Of Agent Of Process For Debt Collector?

How much time and resources do you normally spend on drafting formal paperwork? There’s a greater option to get such forms than hiring legal experts or spending hours searching the web for an appropriate blank. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, including the West Virginia Statement of Agent of Process for Debt Collector.

To obtain and prepare an appropriate West Virginia Statement of Agent of Process for Debt Collector blank, follow these easy steps:

- Look through the form content to make sure it meets your state laws. To do so, check the form description or utilize the Preview option.

- In case your legal template doesn’t meet your requirements, find a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the West Virginia Statement of Agent of Process for Debt Collector. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally safe for that.

- Download your West Virginia Statement of Agent of Process for Debt Collector on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you safely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most trusted web solutions. Join us today!

Form popularity

FAQ

The statute of limitations is four years under the West Virginia Consumer Credit and Protection Act (W. Va. Code § 46A-5-101).

What Is the Statute of Limitations in WV? For most types of civil cases, the statute of limitations in West Virginia is two years. Most misdemeanor criminal charges must be filed within a year, while felonies have no statute of limitations.

In California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable. But there are tricks that can restart the debt clock.

Creditors have five (5) years to file their debt collection suit for the sum of money owed on an open account. If the debt is for the non-payment of an outstanding balance on a credit card, then the creditor has ten (10) years to file a collection lawsuit against the debtor.

Creditors have five (5) years to file their debt collection suit for the sum of money owed on an open account. If the debt is for the non-payment of an outstanding balance on a credit card, then the creditor has ten (10) years to file a collection lawsuit against the debtor.

The statute of limitations is four years under the West Virginia Consumer Credit and Protection Act (W. Va. Code § 46A-5-101).