This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

West Virginia Change or Modification Agreement of Deed of Trust

Description

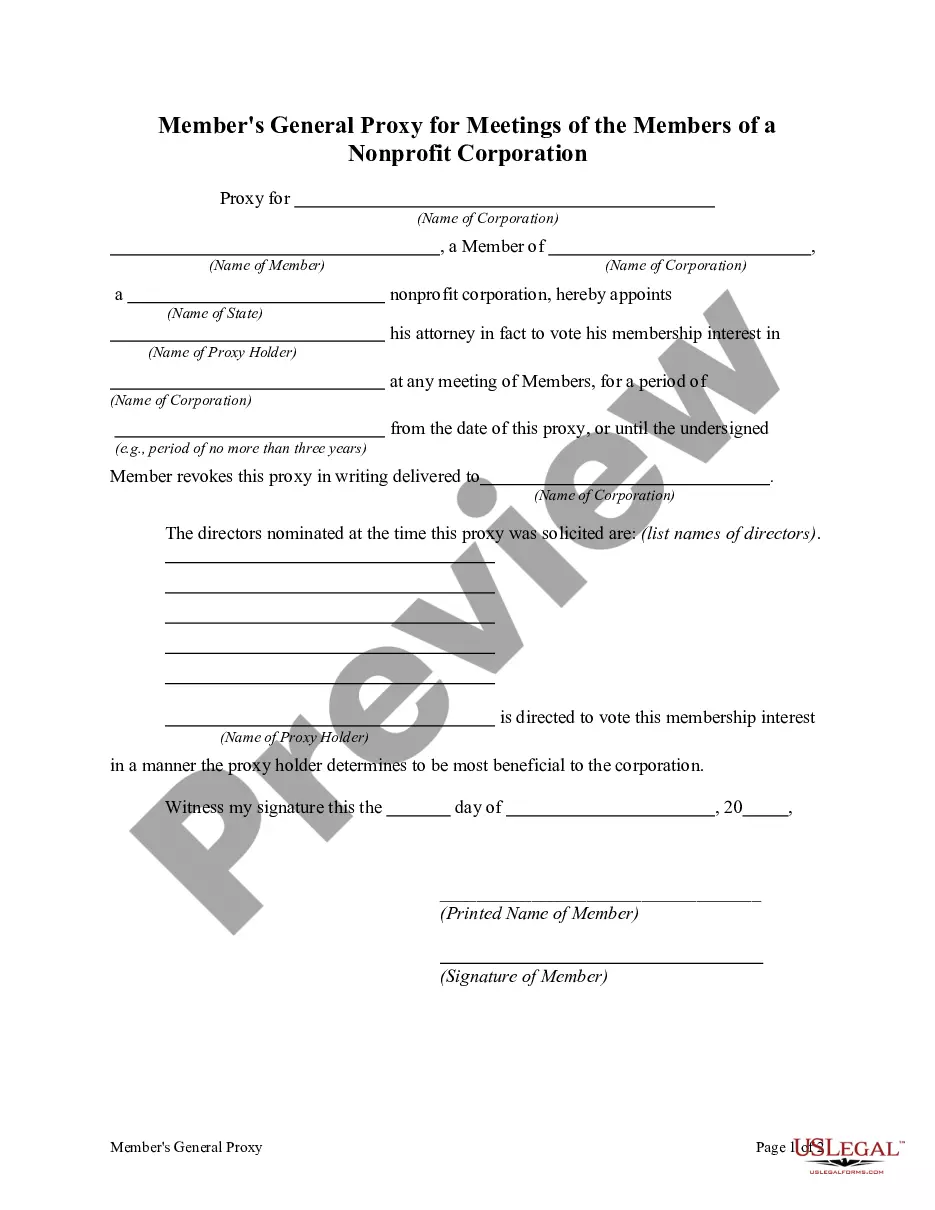

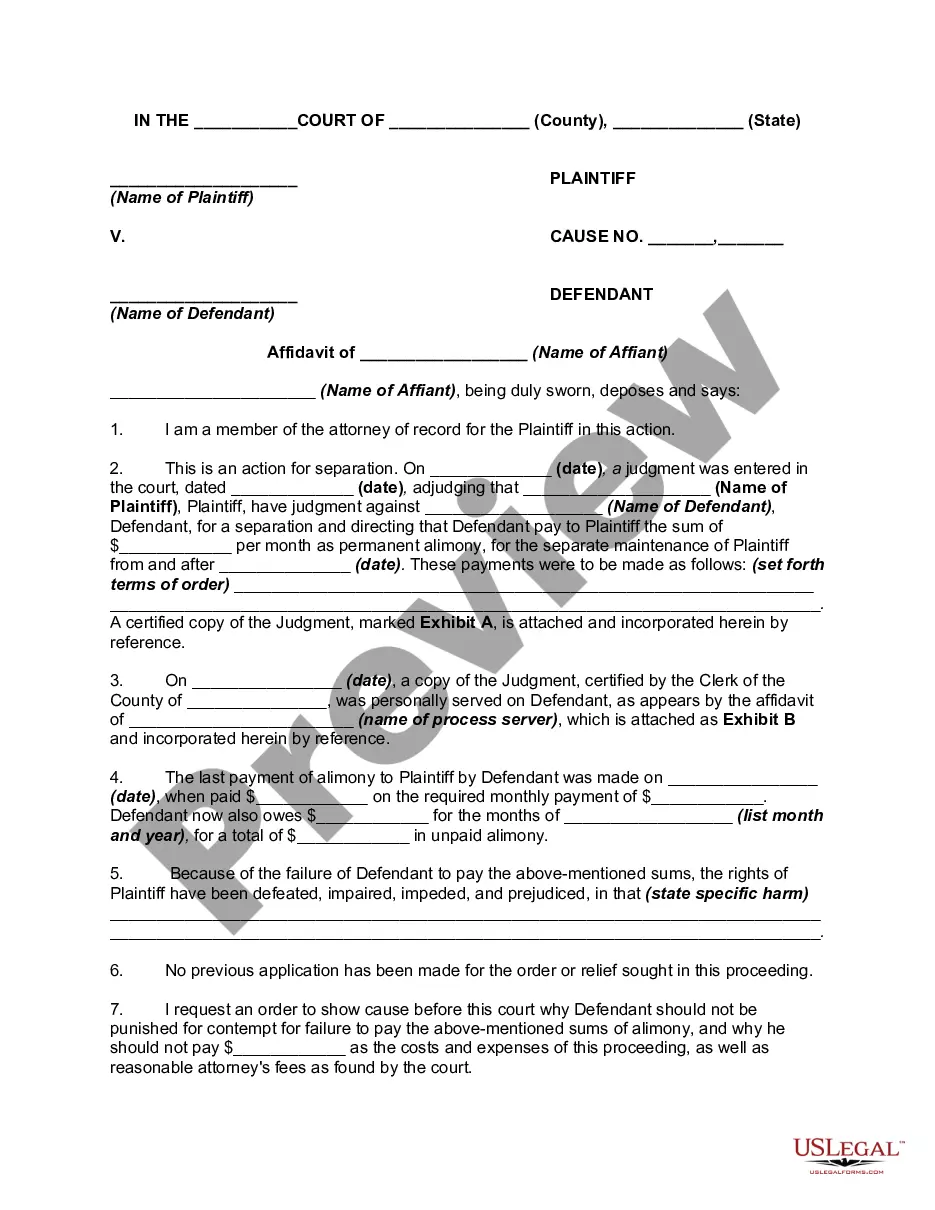

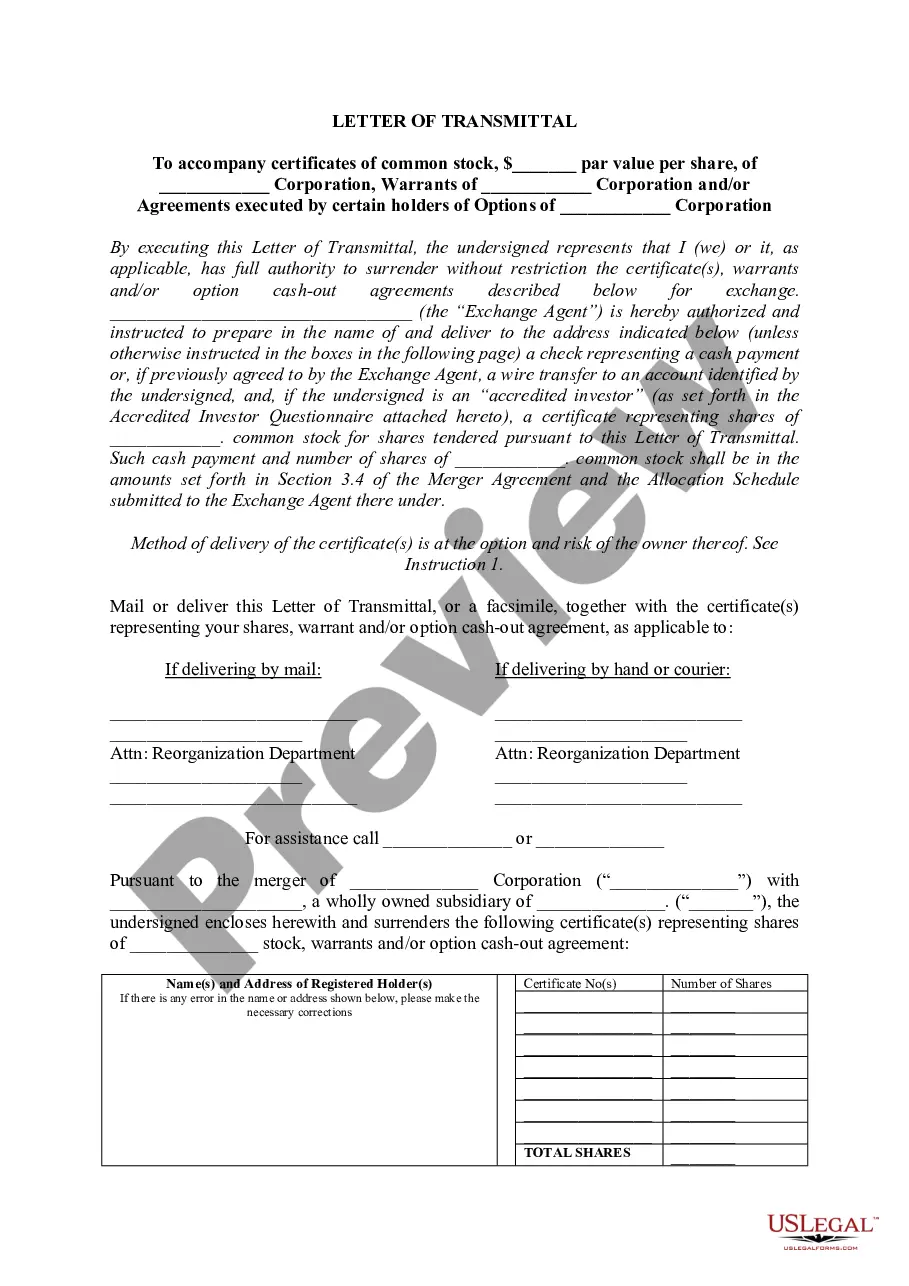

How to fill out Change Or Modification Agreement Of Deed Of Trust?

Are you currently in a circumstance where you require documents for either business or personal reasons almost daily.

There are numerous authentic document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of template forms, such as the West Virginia Change or Modification Agreement of Deed of Trust, designed to comply with federal and state regulations.

Once you have the right form, simply click Buy now.

Select the pricing plan you prefer, fill out the required information to set up your payment, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the West Virginia Change or Modification Agreement of Deed of Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/county.

- Use the Preview button to examine the form.

- Review the description to confirm that you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that meets your needs and requirements.

Form popularity

FAQ

To make an amendment in a trust deed, you should prepare a formal amendment document that specifies the changes. All parties involved need to sign this document to validate the amendment. It is important to follow the legal requirements to ensure the amendment stands up in court. For convenience, you can use a West Virginia Change or Modification Agreement of Deed of Trust available on the US Legal Forms platform.

To modify a trust deed, you typically need to draft a modification agreement that outlines the specific changes. This document should be signed by all relevant parties and notarized to ensure validity. Utilizing a West Virginia Change or Modification Agreement of Deed of Trust can simplify this process. US Legal Forms provides templates to help you create the necessary documentation efficiently.

Yes, a trustee can amend a trust deed under certain conditions. In West Virginia, the process usually requires the consent of all parties involved. It is essential to document the changes properly to ensure they are legally binding. For assistance, consider using a West Virginia Change or Modification Agreement of Deed of Trust through US Legal Forms.

You can modify your deed without a lawyer, but it is often advisable to seek legal assistance to ensure compliance with state laws. In West Virginia, a Change or Modification Agreement of Deed of Trust can be completed using proper forms. Using resources like USLegalForms can simplify this process, providing you with the necessary documents and guidance. Remember, making changes to your deed correctly is crucial to avoid future legal complications.

To amend a trust deed, you typically need to create an amendment document that outlines the changes to the original agreement. This document must be signed by all parties involved and may require notarization, depending on state laws. If you are dealing with a West Virginia Change or Modification Agreement of Deed of Trust, following proper procedures for amendments is essential to maintain legal integrity. Consulting with a legal professional can guide you through this process smoothly.

A modification of deed of trust refers to changes made to the original terms of a deed of trust without creating a new deed. This process might include adjustments to payment terms, interest rates, or other financial obligations. Understanding the specifics of a West Virginia Change or Modification Agreement of Deed of Trust is crucial for property owners looking to adjust their commitments. Legal assistance can help ensure that modifications are valid and enforceable.

To transfer a property deed in West Virginia, you need to prepare a new deed that includes details about the property and the parties involved. Once the new deed is drafted, it must be signed, notarized, and then filed with the county clerk's office. This process can sometimes be essential when executing a West Virginia Change or Modification Agreement of Deed of Trust, as it updates the ownership records accurately. Utilizing platforms like USLegalForms can streamline this process for you.

Yes, West Virginia allows the use of transfer on death deeds, which enable property owners to transfer their real estate upon their death without going through probate. This can simplify the process for beneficiaries and is an efficient way to manage property. If you are considering a West Virginia Change or Modification Agreement of Deed of Trust, understanding transfer on death deeds may enhance your estate planning strategy. It’s advisable to consult with a legal expert to ensure proper execution.

In West Virginia, it is not mandatory for an attorney to prepare a deed. However, having legal assistance can be beneficial, especially when dealing with complex transactions like a West Virginia Change or Modification Agreement of Deed of Trust. Attorneys can ensure that all legal requirements are met and help avoid potential issues in the future. While you can create a deed yourself, professional guidance can provide peace of mind.