A West Virginia Corporate Resolution for Bank Account is a formal document that outlines the decision-making authority and guidelines for a corporation or company in West Virginia in regard to its bank accounts. This resolution is typically passed by the board of directors or shareholders of the corporation and is required by banks to open a business bank account. The West Virginia Corporate Resolution for Bank Account serves as a legal authorization and evidence of the corporation's decision to establish a bank account, delegate signing authority, and govern financial transactions related to the account. It outlines key details such as the corporation's legal name, address, and federal tax identification number. The resolution typically designates individuals or officers within the corporation who have the authority to open, operate, and manage the bank account. These authorized individuals are usually identified by their titles or positions within the organization, such as the president, treasurer, or designated officers. Their names should be clearly stated in the resolution. Furthermore, the resolution may specify the specific types of transactions that can be performed using the bank account, such as deposits, withdrawals, wire transfers, check issuance, and loan procurement. It may also determine the monetary limits for these transactions, requiring additional approval or the involvement of multiple authorized signatories for transactions exceeding specific amounts. Different types of West Virginia Corporate Resolutions for Bank Account may depend on the nature of the corporation or specific requirements enforced by the bank. Some possible variations include resolutions for non-profit organizations, professional corporations, limited liability companies, and partnerships. While the core purpose remains the same, the specific clauses and legalities may vary to align with the applicable laws and regulations governing each type of entity. In summary, the West Virginia Corporate Resolution for Bank Account is a crucial legal document for corporations in West Virginia that allows them to open and manage their bank accounts while defining the authorized individuals, their roles, and transaction limits. This resolution ensures accountability and compliance with internal policies and external regulations, providing a framework for financial operations related to the corporation's bank account.

West Virginia Corporate Resolution for Bank Account

Description

How to fill out West Virginia Corporate Resolution For Bank Account?

Have you ever found yourself in a circumstance where you require documents for potential business or personal purposes frequently.

There are numerous legal form templates accessible online, but finding versions you can rely on is not easy.

US Legal Forms offers thousands of document templates, including the West Virginia Corporate Resolution for Bank Account, which is drafted to comply with both state and federal requirements.

Select the payment plan you prefer, fill in the necessary information to create your account, and process your order using PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms site and possess an account, simply sign in.

- Then, you can download the West Virginia Corporate Resolution for Bank Account template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Identify the document you need and verify it is for your correct city/state.

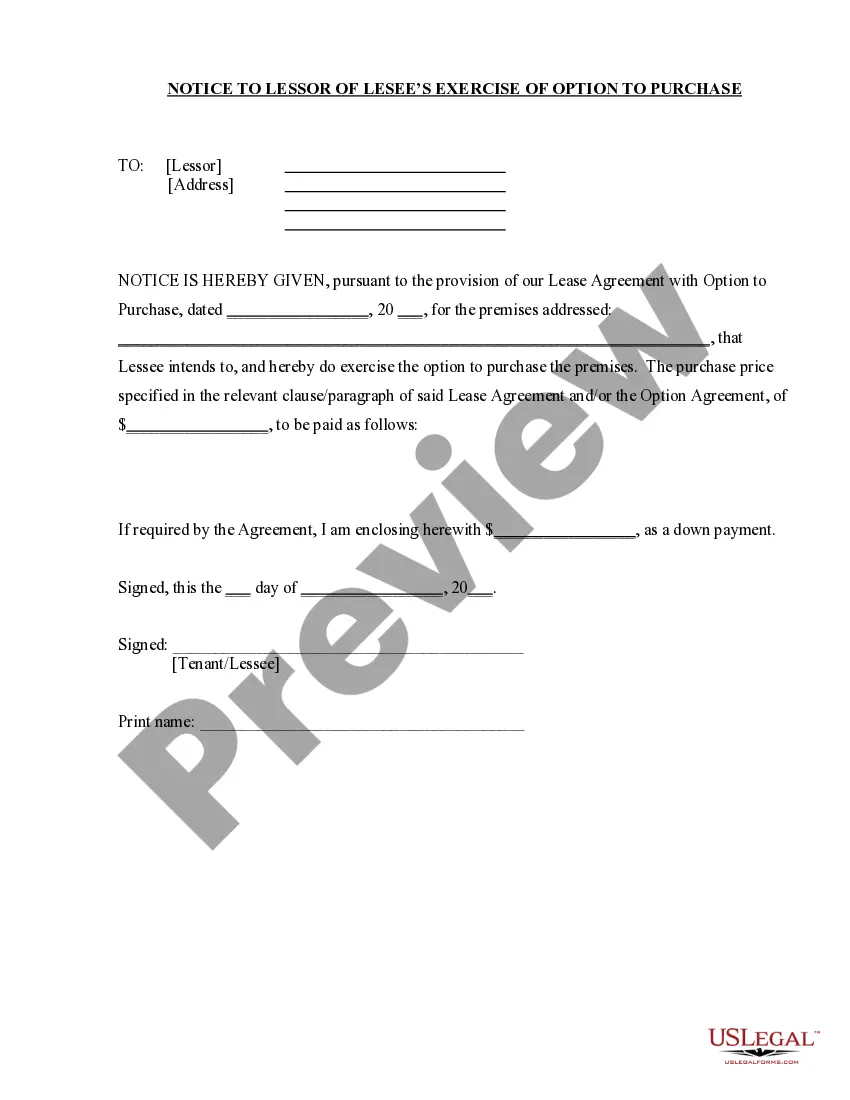

- Utilize the Preview button to review the form.

- Examine the details to ensure you have selected the right document.

- If the document is not what you are looking for, use the Search bar to find the document that meets your needs and criteria.

- Once you find the appropriate document, click Get now.

Form popularity

FAQ

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

RESOLVED THAT the Company's Banking Current Account No with (Name of the Bank), (address) be closed and the amount, if any, lying in the said account be returned to the Company by way of issuance of Bankers' Cheque or transfer to other Current Account in the name of the Company

What should a resolution to open a corporate bank account include?Corporation name and address.Bank name and address.Bank account number.Date of resolution.Certifying signatures and dates.Corporate seal.

What should a resolution to open a corporate bank account include?Corporation name and address.Bank name and address.Bank account number.Date of resolution.Certifying signatures and dates.Corporate seal.

Our banking resolution is the simplest way for a company to authorize opening a bank account. A banking resolution is required to properly record company decisions and to prove to financial institutions that the person applying for an account is authorized to act on behalf of the company.

A banking resolution is the simplest way to authorize someone to open a bank account and provide signature for the business. This document is created by the owners for a limited liability company (LLC) or the board of directors for a corporation.

The banking resolution document is drafted and adopted by a company's members or Board of Directors to define the relationship, responsibilities and privileges that the members or directors maintain with respect to the company's banking needs.

Our banking resolution is the simplest way for a company to authorize opening a bank account. A banking resolution is required to properly record company decisions and to prove to financial institutions that the person applying for an account is authorized to act on behalf of the company.

With a SMLLC, you'd only use a resolution to document the most important business matters or actions such as: buying or selling real estate. getting a loan, establishing a bank account, or otherwise working with a financial institution.