West Virginia Accounts Receivable Monthly Customer Statement

Description

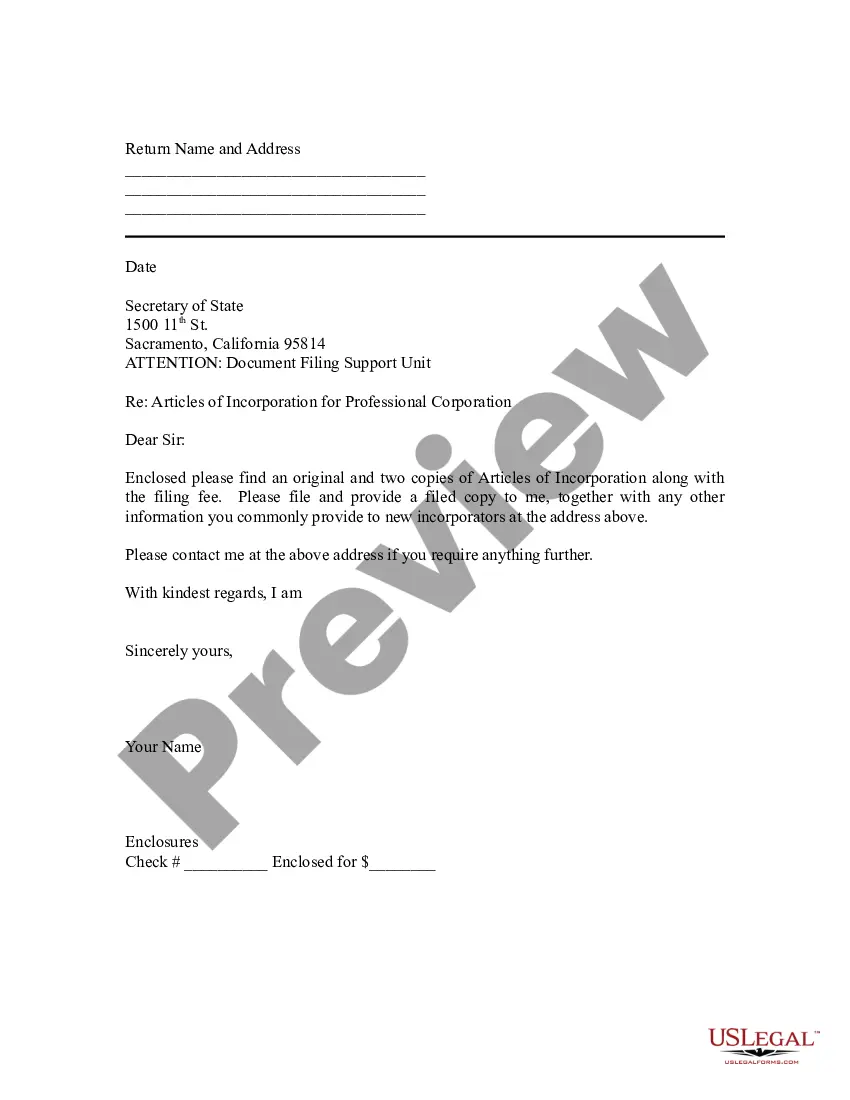

How to fill out Accounts Receivable Monthly Customer Statement?

You might spend numerous hours on the web searching for the official document template that meets the state and federal requirements you need.

US Legal Forms offers a wide array of legal forms that can be reviewed by professionals.

You can download or print the West Virginia Accounts Receivable Monthly Customer Statement from our service.

If available, utilize the Preview button to inspect the document template as well. If you want to find another version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you desire, click Purchase now to proceed. Select the pricing plan you want, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the West Virginia Accounts Receivable Monthly Customer Statement. Obtain and print a variety of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the West Virginia Accounts Receivable Monthly Customer Statement.

- Every legal document template you obtain is yours permanently.

- To download another version of a purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple steps below.

- First, ensure you have chosen the correct document template for your area/town of preference.

- Review the form description to ensure you have selected the right form.

Form popularity

FAQ

Yes, West Virginia taxes unrelated business income for organizations that operate under tax-exempt status. This income is generally subject to the state’s corporate income tax. To ensure you understand your tax responsibilities, including any implications on your West Virginia Accounts Receivable Monthly Customer Statement, you may want to consult the West Virginia Tax Department or utilize US Legal Forms for guidance. They can provide you with the necessary information and support to navigate these tax matters.

Yes, if you earn income in West Virginia, you typically need to file a tax return. The requirement can depend on your income level, filing status, and residency. It’s important to stay compliant with state tax regulations, which may also relate to your West Virginia Accounts Receivable Monthly Customer Statement. For assistance in determining your filing obligations, consider using US Legal Forms, which offers resources and forms to simplify the filing process.

To create a journal entry for accounts receivable, you can follow these steps: Document accurate financial records. ... Record the details of each transaction. ... Record the debit amount. ... Record the credit amount.

The Accounts Receivables Statements are documents that itemize all invoices, payments, and credits created during a specific time period, and whose intention is to remind the account holder of their account status.

Accounts receivable (AR) are the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivable are listed on the balance sheet as a current asset.

Receivables of all types are normally reported on the balance sheet at their net realizable value, which is the amount the company expects to receive in cash. Valuing Receivables: Receivables are recorded at net realizable value.

How To Keep Track Of Accounts Payable in 9 Steps Set up a system for recording invoices. Implement approval workflow. Monitor invoice data capturing. Regularly review accounts payable. Match invoices and purchase orders. Pay invoices on time. Track payments. Periodically run reports.