A West Virginia Demand Bond is a type of financial instrument or security that is issued by the state of West Virginia to finance various infrastructure and development projects. It is a debt instrument where the state pledges to repay the principal amount along with interest to the bondholder upon request or demand. This type of bond is commonly used by government entities to raise capital for projects that require immediate funding. West Virginia Demand Bonds typically have a fixed interest rate and a maturity period, which can vary depending on the specific bond issuance. The interest payments on these bonds are typically made semi-annually or annually. This makes them attractive to investors seeking a stable source of income. There are different types of West Virginia Demand Bonds, each serving a specific purpose or addressing different needs: 1. General Obligation Demand Bonds: These bonds are backed by the full faith and credit of the state of West Virginia, meaning that the state guarantees the repayment of the bondholders. They are typically used to finance projects with broad public benefit, such as infrastructure improvements, education facilities, or healthcare initiatives. 2. Revenue Demand Bonds: Unlike general obligation bonds, revenue demand bonds are backed by specific revenue sources, such as tolls, user fees, or dedicated taxes. The repayment of these bonds relies on the revenue generated by the project they finance, such as a bridge or a highway. 3. Special Tax Demand Bonds: These bonds are secured by a specific tax imposed to fund the project. For example, a special tax might be levied on hotel stays to fund the construction of a new convention center. The revenue generated from the special tax is used to repay the bondholders. 4. Municipal Demand Bonds: Municipalities in West Virginia may also issue demand bonds to finance local projects. These bonds are similar to general obligation bonds but are issued by local government entities, such as cities or counties, rather than the state itself. Investing in West Virginia Demand Bonds can offer investors a relatively stable and predictable income stream while supporting essential infrastructure development in the state. It is important for potential investors to carefully review the specific terms and risks associated with each bond issuance before making any investment decisions. Keywords: West Virginia, Demand Bond, infrastructure projects, development, debt instrument, interest rate, maturity period, General Obligation Demand Bonds, Revenue Demand Bonds, Special Tax Demand Bonds, Municipal Demand Bonds.

West Virginia Demand Bond

Description

How to fill out West Virginia Demand Bond?

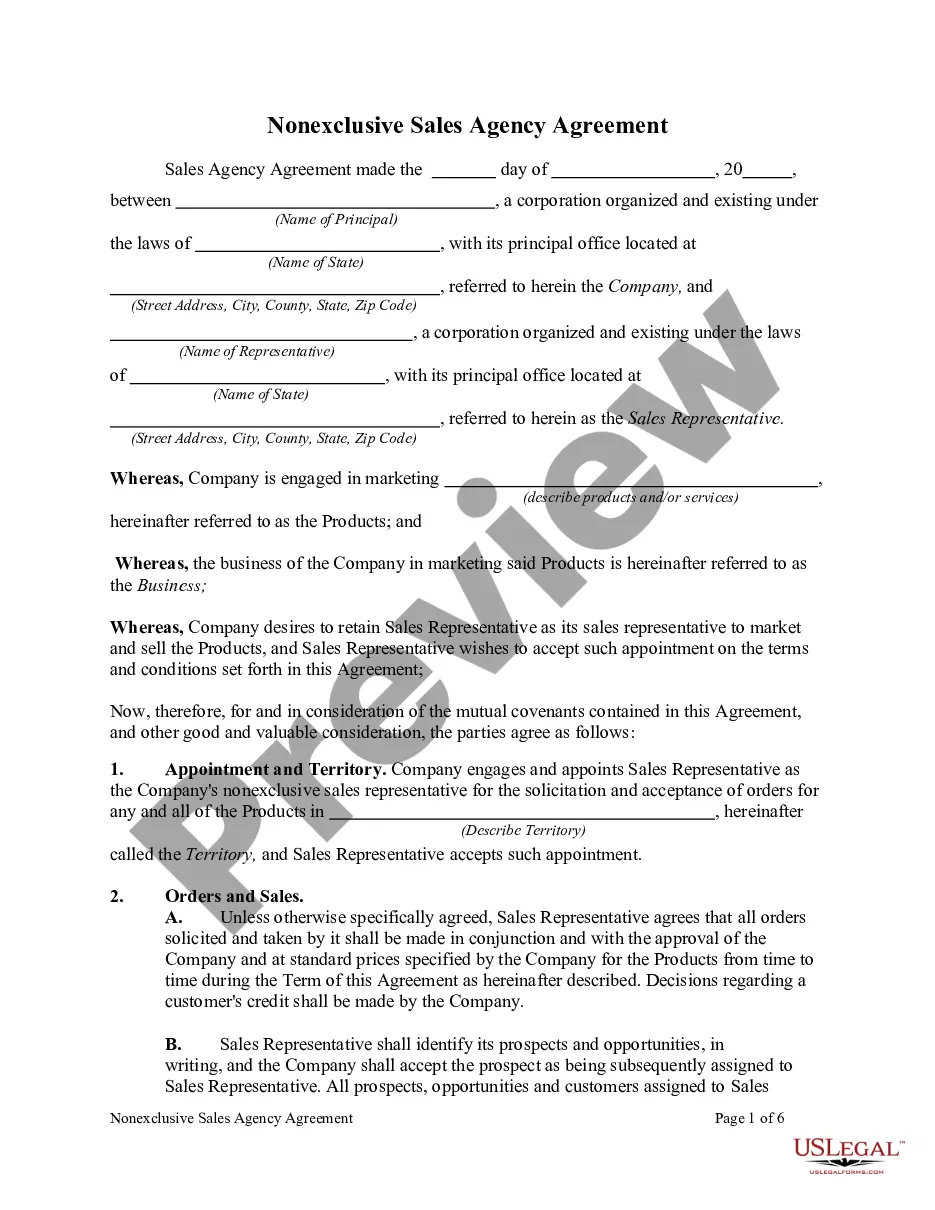

If you have to comprehensive, download, or print out authorized file themes, use US Legal Forms, the most important selection of authorized kinds, which can be found on-line. Use the site`s simple and easy handy search to obtain the files you want. Different themes for organization and individual functions are sorted by classes and states, or keywords. Use US Legal Forms to obtain the West Virginia Demand Bond in just a handful of mouse clicks.

If you are presently a US Legal Forms buyer, log in for your account and then click the Acquire switch to have the West Virginia Demand Bond. Also you can gain access to kinds you formerly acquired within the My Forms tab of the account.

If you are using US Legal Forms initially, follow the instructions under:

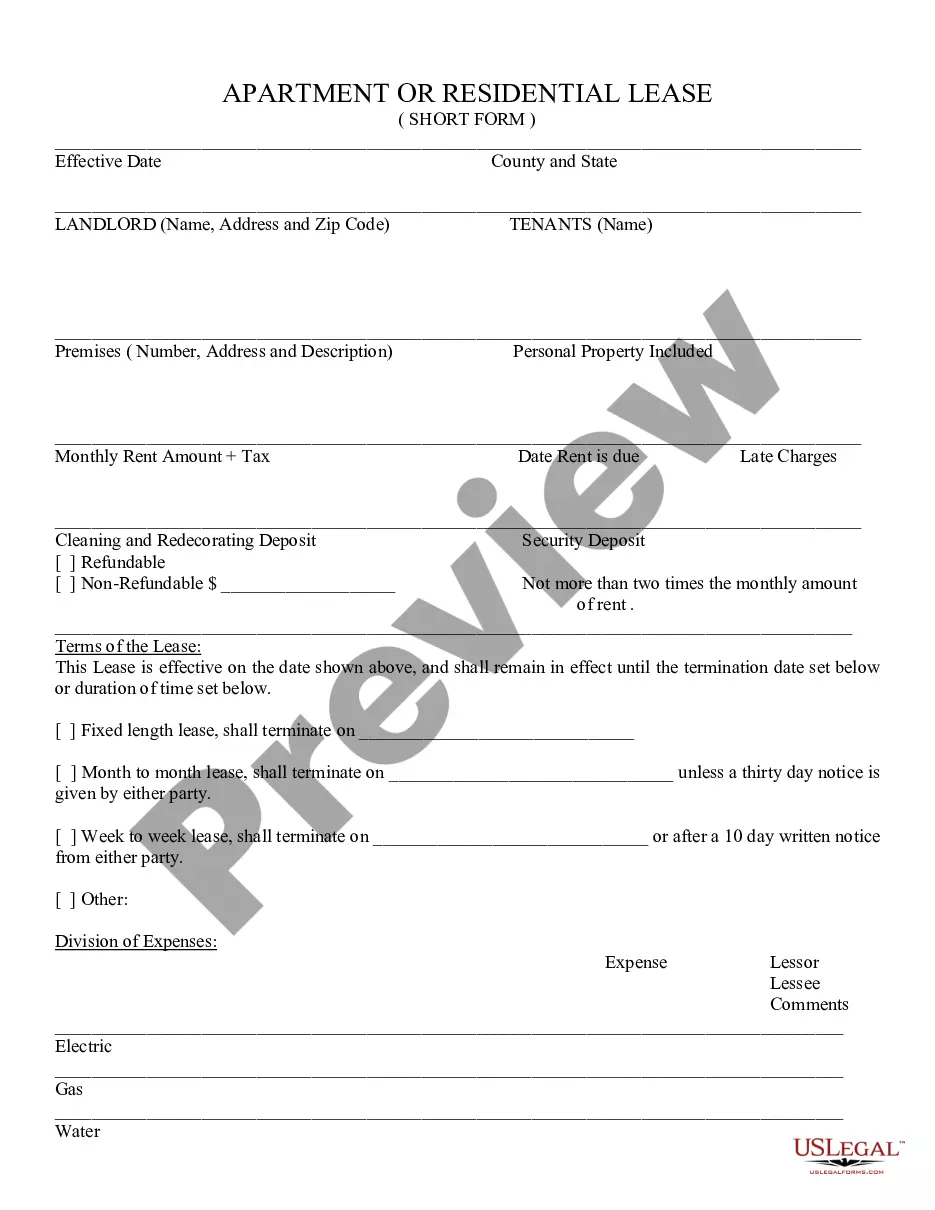

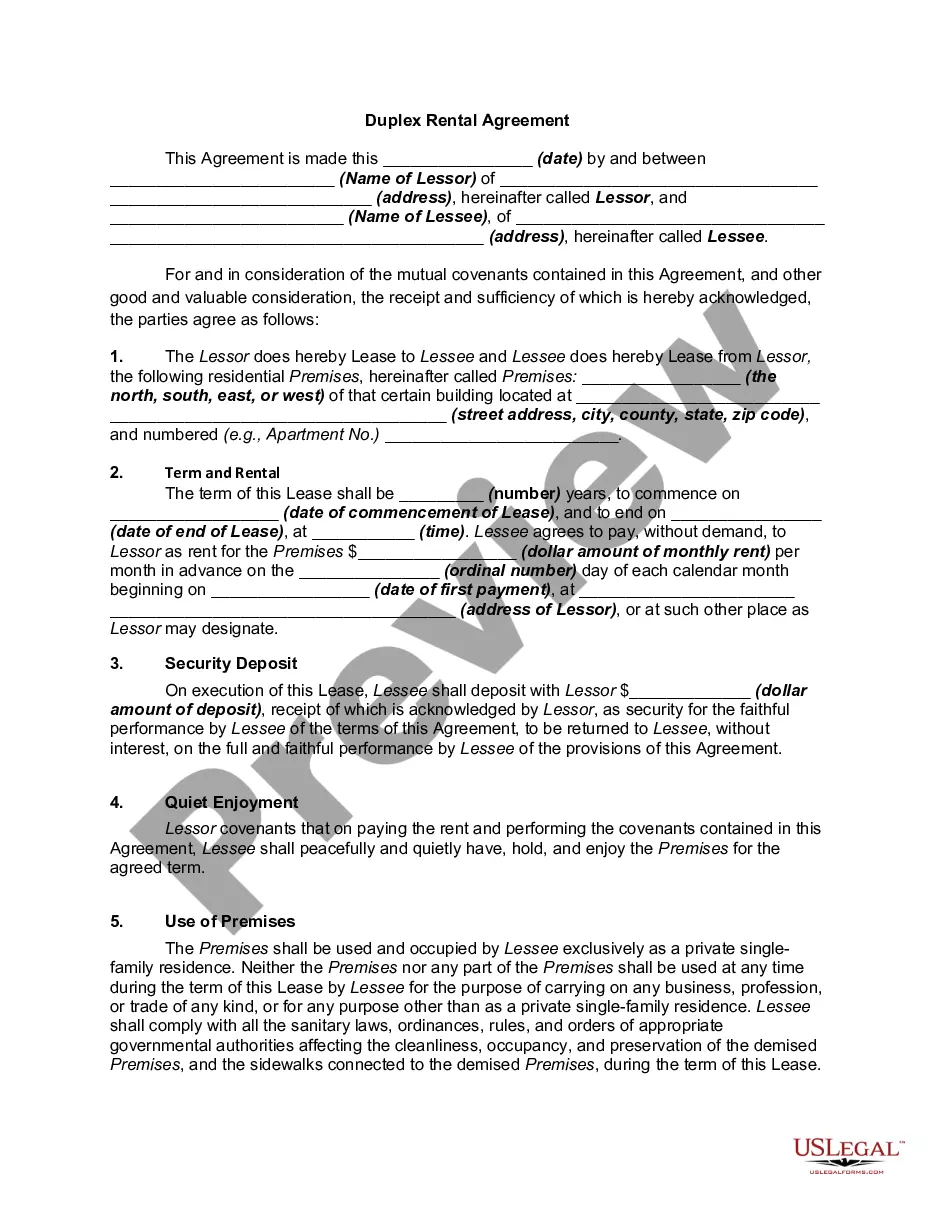

- Step 1. Make sure you have selected the form to the appropriate town/nation.

- Step 2. Utilize the Review option to check out the form`s articles. Do not forget about to see the outline.

- Step 3. If you are unhappy together with the kind, take advantage of the Lookup discipline at the top of the monitor to locate other versions of your authorized kind design.

- Step 4. When you have found the form you want, click on the Buy now switch. Opt for the pricing prepare you favor and put your references to register on an account.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal account to finish the financial transaction.

- Step 6. Select the format of your authorized kind and download it on your system.

- Step 7. Complete, modify and print out or sign the West Virginia Demand Bond.

Each authorized file design you buy is your own eternally. You might have acces to every kind you acquired with your acccount. Click on the My Forms area and decide on a kind to print out or download once again.

Contend and download, and print out the West Virginia Demand Bond with US Legal Forms. There are millions of specialist and status-particular kinds you can use for your organization or individual requirements.

Form popularity

FAQ

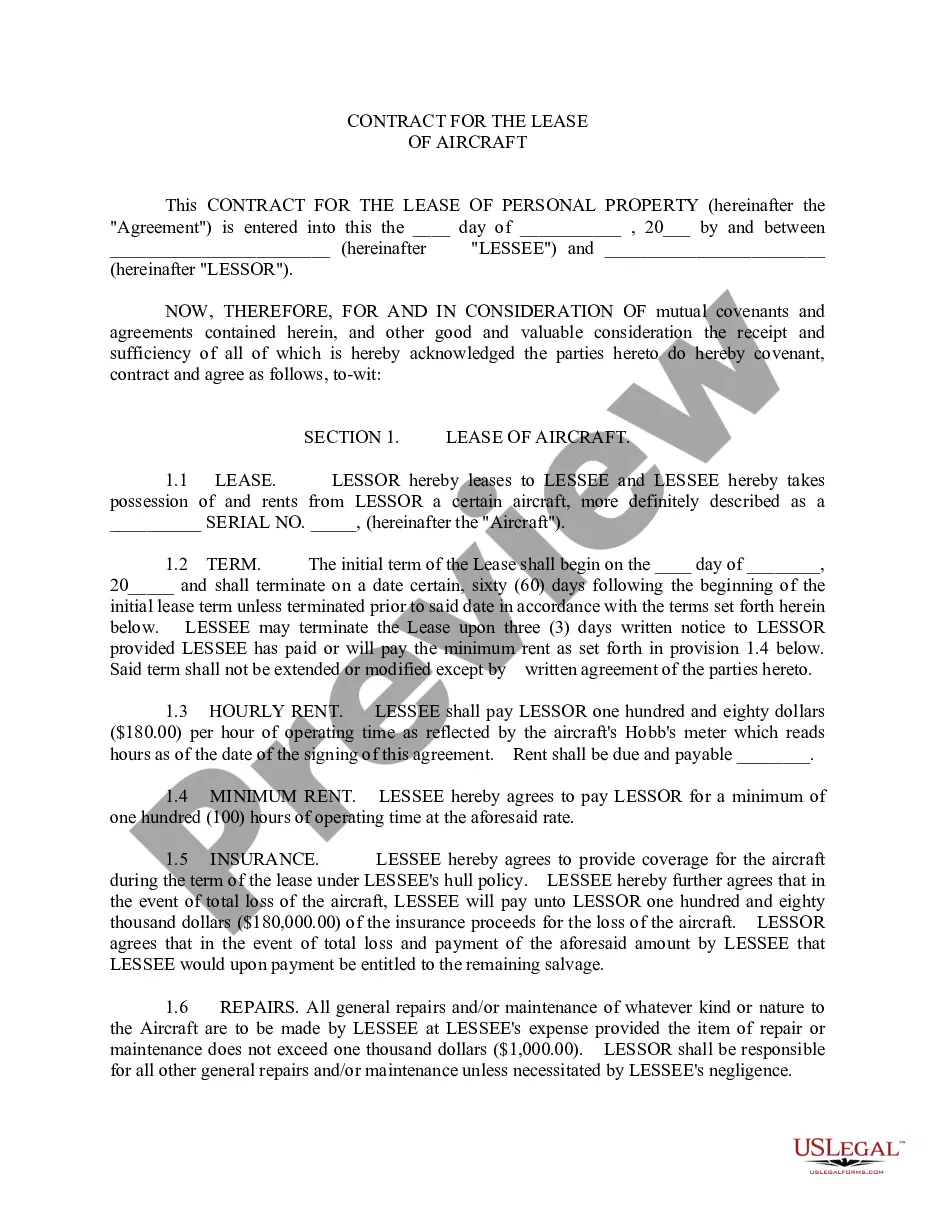

If the accused cannot afford to pay the full bail amount set by the court, they can hire a bail bondsman who charges a non-refundable fee, usually 10 percent of the bond. If the accused fails to appear in court, the bondsman is responsible for the full bond amount.

§62-1C-12. (a) When the condition of the bond has been satisfied or the forfeiture thereof has been set aside or remitted, the court or magistrate shall exonerate the surety and release any bail and, if the bail be in a form other than a recognizance, the deposit shall be returned to the person who made the same.

While many states require vehicle owners to purchase a surety bond as part of the titling process, some don't, such as West Virginia.

Depending on the type of contractor work performed, a bond may be required in the amount of $5,000 or more, but licensed contractors do not pay this full amount. The surety company providing the bond calculates the bond premium paid by the contractor as a percentage of the total bond to be secured.

West Virginia Bail Bonds Information West Virginia bail bonds are 10% of the total cost of the bail bond. After collecting fees, bail bond agents make sure that the defendant goes to all scheduled court appearances or the bond is forfeited and a warrant is issued.

The 10% premium is required by West Virginia law. However, West Virginia law also dictates that a minimum of 3% of the bond be paid as down payment for the bondsman to post the bond. The remaining amount due can be paid in installments to the bondsman.

§62-1C-12. (a) When the condition of the bond has been satisfied or the forfeiture thereof has been set aside or remitted, the court or magistrate shall exonerate the surety and release any bail and, if the bail be in a form other than a recognizance, the deposit shall be returned to the person who made the same.