The West Virginia Assumption Agreement of Loan Payments pertains to an agreement made between two parties regarding the transfer of an existing loan from the original borrower, also known as the assumption, to a new borrower, also known as the assumptive. This legal document outlines the terms and conditions under which the loan is to be assumed, including the repayment schedule, interest rates, and other relevant factors. In West Virginia, there are essentially two types of Assumption Agreements of Loan Payments: 1. Residential Mortgage Assumption Agreement: This type of agreement typically occurs when a property with an existing mortgage is sold, and the new buyer wishes to assume the existing mortgage rather than obtaining a new loan. The Residential Mortgage Assumption Agreement ensures the smooth transfer of the loan, where the assumptive becomes responsible for the remaining loan payments, similar to the original borrower. 2. Commercial Loan Assumption Agreement: This type of agreement applies to commercial properties where one business entity assumes the existing loan of another business entity. This agreement allows the assumptive to take over the remaining payments and takes responsibility for fulfilling the original loan terms, conditions, and any other obligations associated with the loan. The West Virginia Assumption Agreement of Loan Payments is a crucial legal document that protects the rights and interests of both the assumption and the assumptive. It covers details such as the loan amount, interest rate, loan maturity, penalties for default, and any other pertinent terms specific to West Virginia laws and regulations. To execute a West Virginia Assumption Agreement of Loan Payments, it is advisable to consult with an attorney or a legal professional experienced in real estate or commercial law. This ensures that the agreement complies with all legal requirements, meets the needs of both parties, and protects their interests throughout the loan assumption process.

West Virginia Assumption Agreement of Loan Payments

Description

How to fill out West Virginia Assumption Agreement Of Loan Payments?

US Legal Forms - among the largest libraries of legitimate forms in the United States - provides a wide range of legitimate file themes you may acquire or produce. Using the website, you will get 1000s of forms for company and personal functions, categorized by classes, states, or keywords.You can get the most up-to-date variations of forms like the West Virginia Assumption Agreement of Loan Payments within minutes.

If you currently have a subscription, log in and acquire West Virginia Assumption Agreement of Loan Payments from your US Legal Forms catalogue. The Acquire switch can look on every single type you see. You have accessibility to all previously delivered electronically forms from the My Forms tab of your bank account.

If you would like use US Legal Forms initially, here are easy guidelines to get you began:

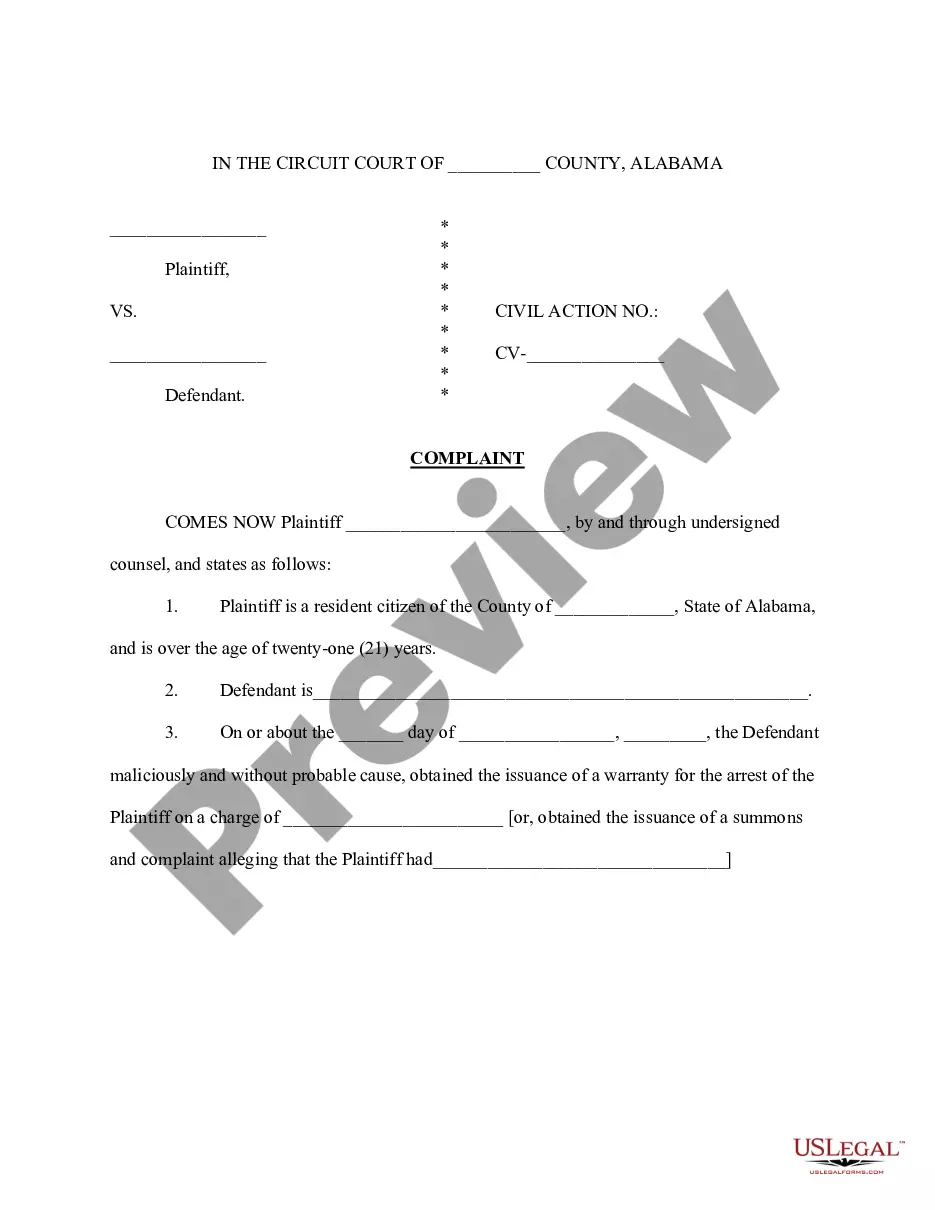

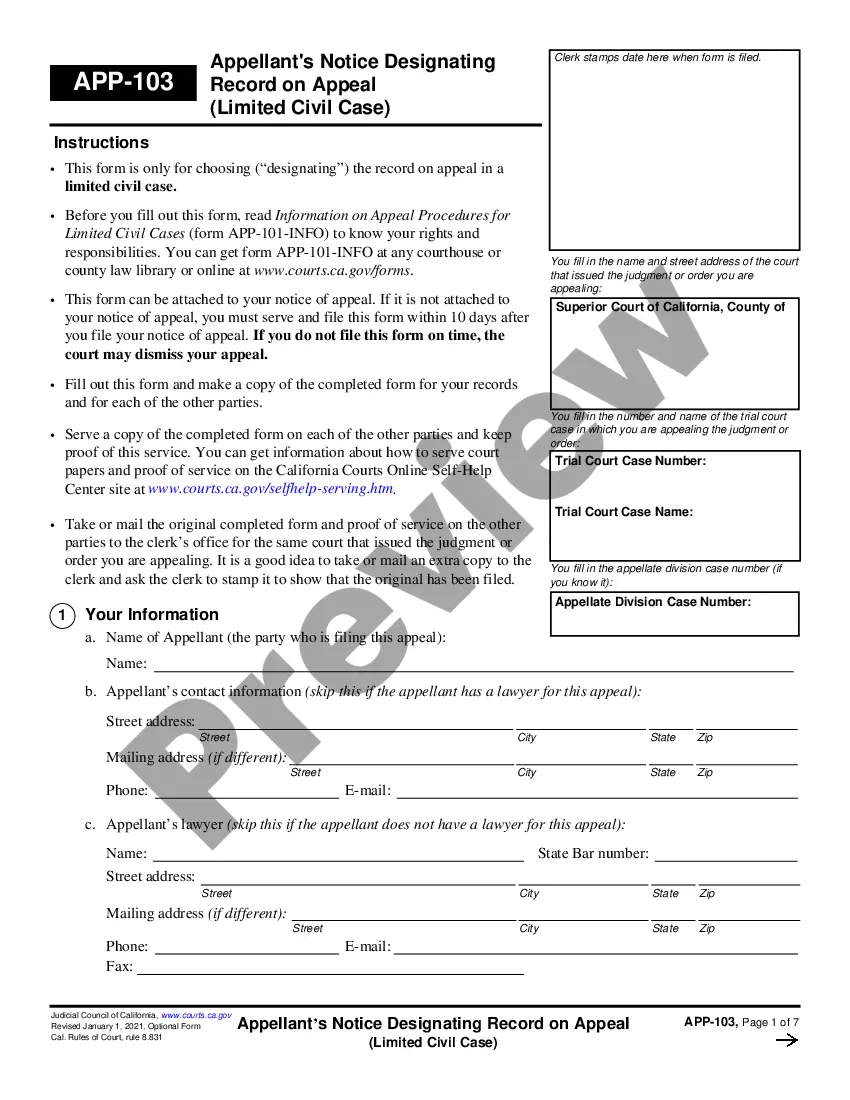

- Ensure you have selected the right type for your city/area. Click the Review switch to analyze the form`s articles. Browse the type description to ensure that you have selected the right type.

- In the event the type does not match your specifications, take advantage of the Search field towards the top of the display to obtain the one which does.

- If you are content with the form, confirm your choice by simply clicking the Buy now switch. Then, opt for the pricing program you like and provide your credentials to sign up for an bank account.

- Approach the transaction. Utilize your credit card or PayPal bank account to perform the transaction.

- Select the structure and acquire the form on your gadget.

- Make alterations. Load, edit and produce and sign the delivered electronically West Virginia Assumption Agreement of Loan Payments.

Every web template you added to your account does not have an expiry time and is also the one you have eternally. So, in order to acquire or produce one more backup, just check out the My Forms portion and click on in the type you will need.

Get access to the West Virginia Assumption Agreement of Loan Payments with US Legal Forms, one of the most extensive catalogue of legitimate file themes. Use 1000s of expert and state-particular themes that satisfy your business or personal demands and specifications.

Form popularity

FAQ

Assumption of Obligations. New Borrower covenants, promises, and agrees that New Borrower, jointly and severally if more than one, will unconditionally assume and be bound by all terms, provisions, and covenants of the Assumed Loan Documents as if New Borrower had been the original maker of the Assumed Loan Documents.

Updated March 7, 2022. In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement.

An assumable mortgage is a home loan that can be transferred from the original borrower to the next homeowner. The interest rate and payment period stay the same. For example, if a 30-year mortgage is three years old, the person assuming the loan has 27 years to pay it off.

When a buyer buys property and assumes a mortgage, the buyer becomes primarily liable for the debt and the seller becomes secondarily liable for the debt. "Assume" means the buyer takes on liability, and the seller is no longer primarily liable. "Subject to" means the seller is not released from responsibility.

An assumption agreement, sometimes called an assignment and assumption agreement, is a legal document that allows one party to transfer rights and/or obligations to another party. It allows one party to "assume" the rights and responsibilities of the other party.

Loan assumption, however, allows a buyer to take over the current owner's mortgage while the loan's terms ? including the repayment period and interest rate ? remain the same. Ultimately, it can help people get into a home at a lower interest rate even as the housing market around them becomes more expensive.

An assumable mortgage allows a buyer to assume the rate, repayment period, current principal balance and other terms of the seller's existing mortgage rather than obtain a brand-new loan.