West Virginia Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land

Description

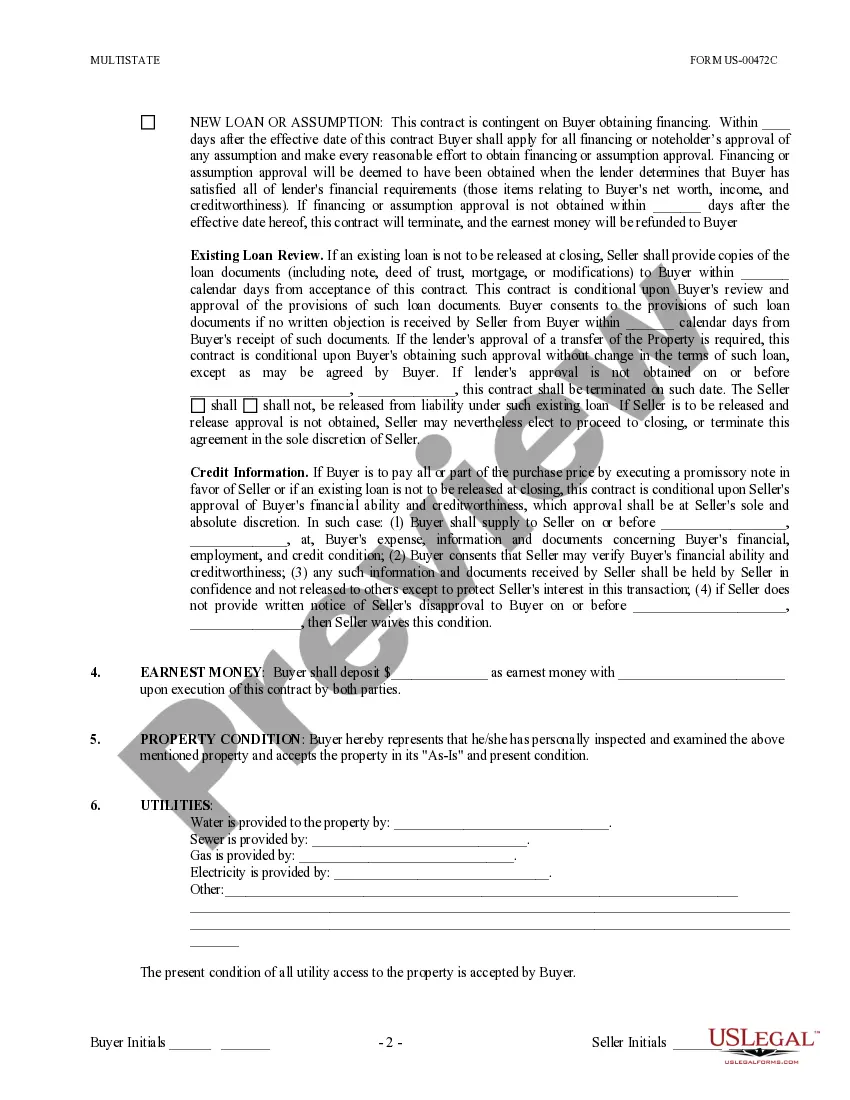

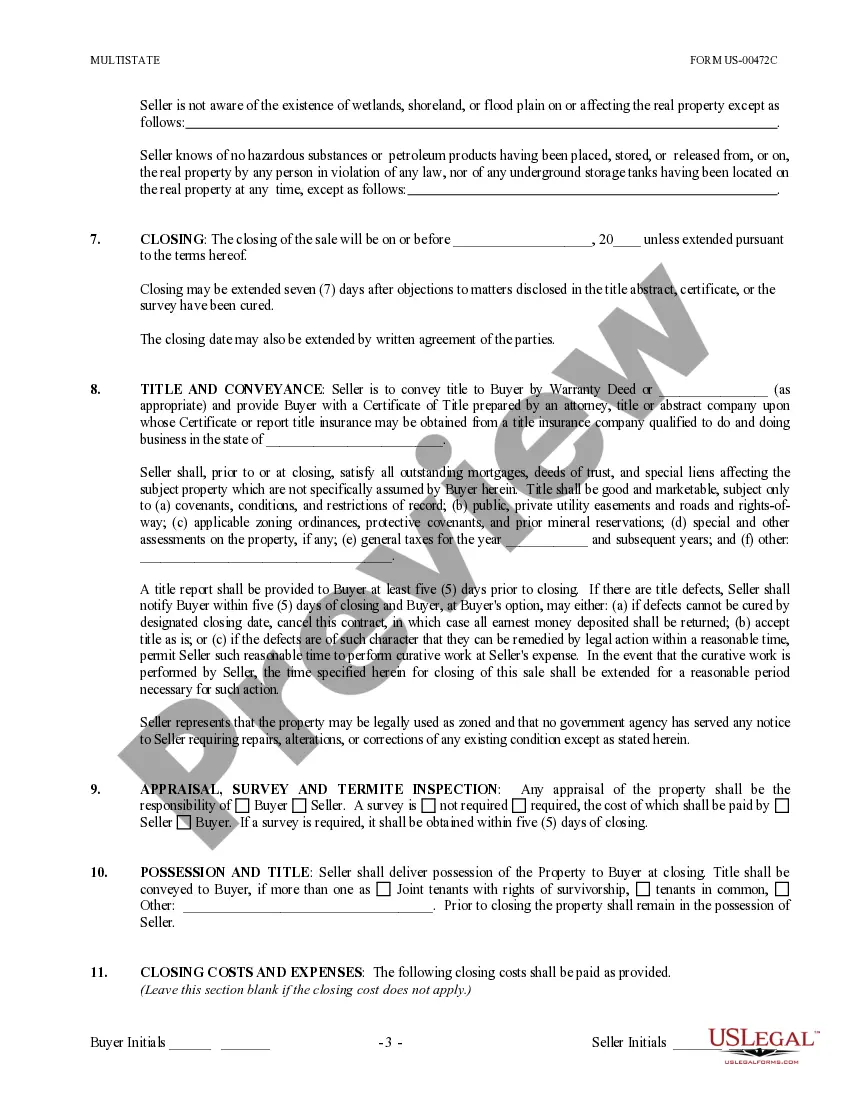

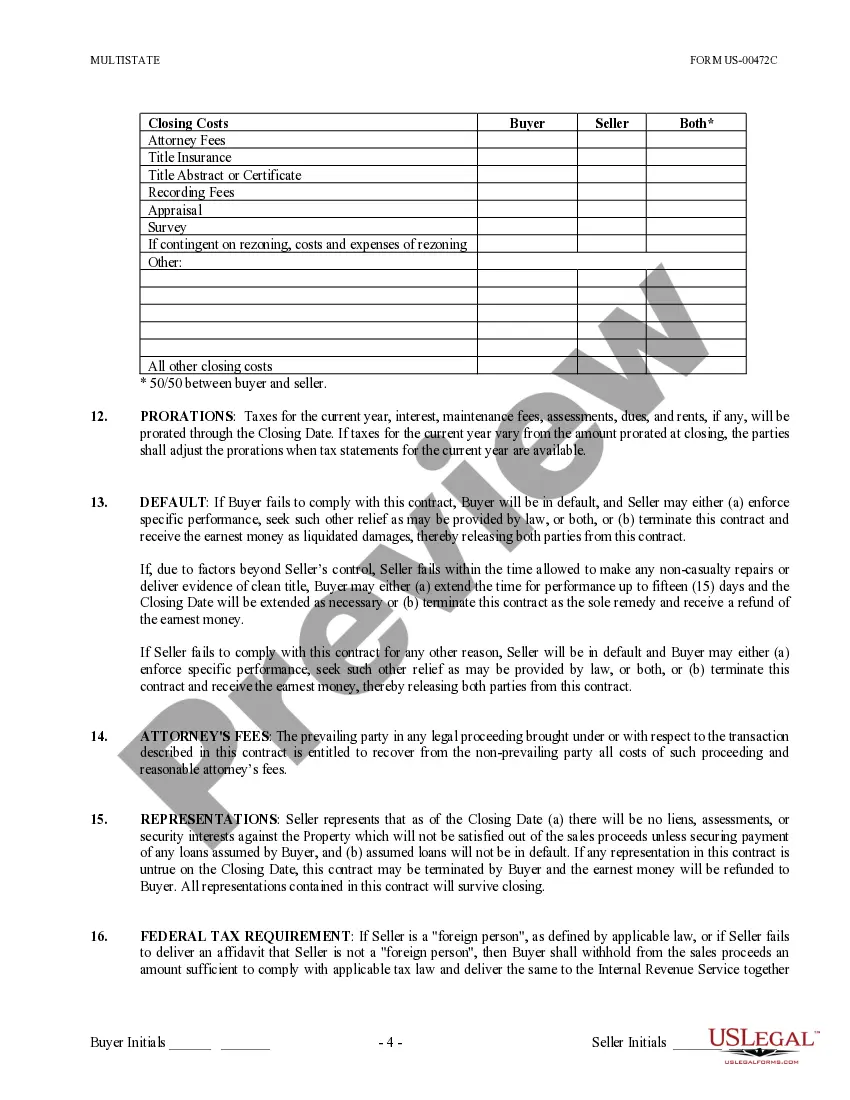

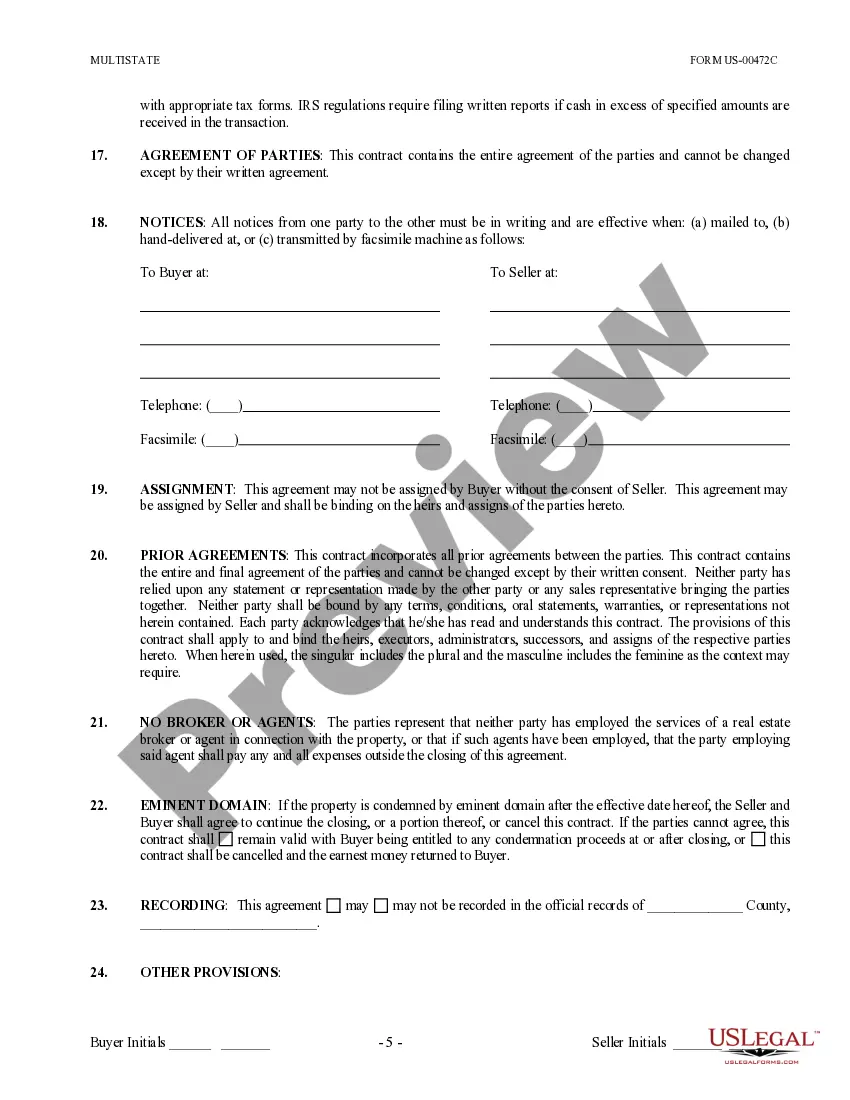

How to fill out Contract For The Sale And Purchase Of Real Estate - No Broker - Commercial Lot Or Land?

Are you presently in a situation where you regularly require documents for organizational or personal reasons every single day.

There is a multitude of legal document templates available online, but finding ones you can trust is quite challenging.

US Legal Forms offers a vast selection of form templates, including the West Virginia Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land, designed to meet both federal and state regulations.

When you find the correct form, click Get now.

Select the payment plan you wish to use, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the West Virginia Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land template.

- If you don’t have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it corresponds to the correct city/state.

- Use the Review button to scrutinize the form.

- Go through the details to confirm that you have selected the appropriate form.

- If the form does not match what you need, utilize the Lookup field to find the form that satisfies your requirements.

Form popularity

FAQ

While this FAQ focuses on West Virginia, it is important to note that real estate contract laws can vary by state, including Alabama. Understanding these differences is crucial if you are considering transactions in another state. For precise guidance on Alabama laws regarding real estate contracts, consult a legal expert in that jurisdiction.

How to Make an Offer on a House Purchase AgreementLean on Your Real Estate Agent.Current Market Analysis.Determine How Much to Offer.Determine Down Payment and Earnest Money Terms.Write an Offer Letter.Write Purchase Agreement: Assessment and Contingencies.Wait for Seller to Accept, Counter or Decline.

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

Things to include in a letter of intent to purchaseThe full names of the buyer and the seller.The complete address of the property.The agreed-upon purchase price.The agreed-upon earnest deposit.The date of signing the SPA.The terms and conditions that surround the earnest deposit.More items...?

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

If you're a buyer or seller looking for a sale and purchase agreement, you'll need to contact your lawyer or conveyancer, a licensed real estate professional or the Auckland District Law Society (ADLS). You can also purchase digital sale and purchase agreement forms online.

As discussed above, a purchase agreement should contain buyer and seller information, a legal description of the property, closing dates, earnest money deposit amounts, contingencies and other important information for the sale.

(Rupees ), will be received by the FIRST PARTY from the SECOND PARTY, at the time of registration of the Sale Deed, the FIRST PARTY doth hereby agree to grant, convey, sell, transfer and assign all his rights, titles and interests in the said portion of the said property, fully

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

How to write a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...