West Virginia Removal From Office - Resolution Form - Corporate Resolutions

Description

How to fill out Removal From Office - Resolution Form - Corporate Resolutions?

If you desire to be thorough, obtain, or print recognized document templates, utilize US Legal Forms, the premier collection of legal forms that are available online.

Use the website's straightforward and user-friendly search to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Each legal document format you acquire is yours indefinitely. You will have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Be proactive and download, and print the West Virginia Removal From Office - Resolution Form - Corporate Resolutions with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the West Virginia Removal From Office - Resolution Form - Corporate Resolutions with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Obtain button to find the West Virginia Removal From Office - Resolution Form - Corporate Resolutions.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have chosen the form for your specific city/state.

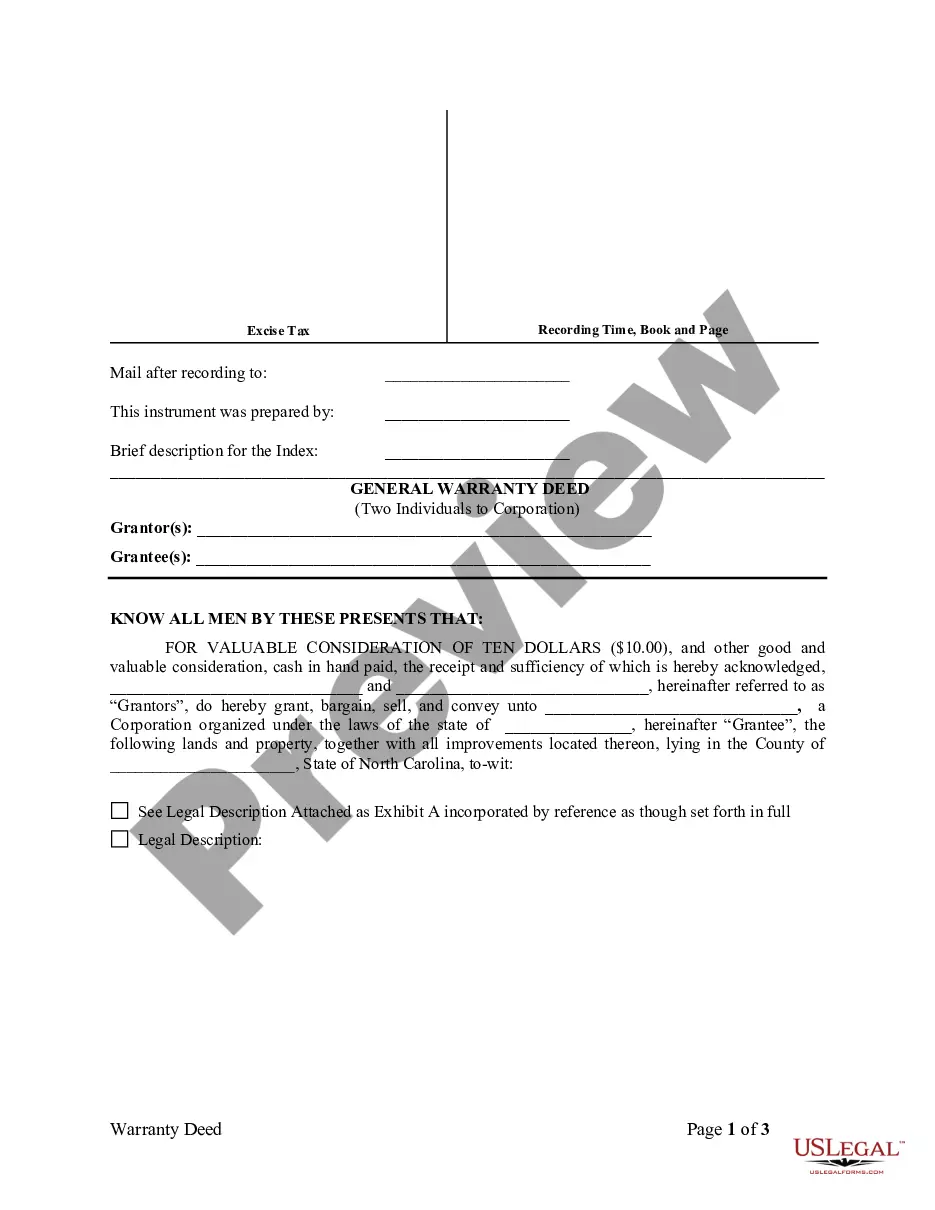

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find different versions of the legal form format.

- Step 4. Once you have found the form you need, click on the Buy now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the West Virginia Removal From Office - Resolution Form - Corporate Resolutions.

Form popularity

FAQ

Dissolution can occur through voluntary action, involuntary action, or administrative action. In a voluntary dissolution, the business owners agree to dissolve the company, often facilitated by a West Virginia Removal From Office - Resolution Form - Corporate Resolutions. Involuntary dissolution may arise when a court orders it due to legal issues or failure to comply with regulations. Lastly, administrative dissolution occurs when the state revokes the business's legal status due to noncompliance, which can also be addressed with the right resolution forms.

No, the business license number is not the same as the Employer Identification Number (EIN). The business license number identifies your business operation within the state, while the EIN is issued by the IRS for tax purposes. It's essential to have both numbers to ensure compliance with state and federal regulations. For streamlined processes, consider using a platform like uslegalforms to manage your West Virginia Removal From Office - Resolution Form - Corporate Resolutions and other necessary documents.

You can obtain a West Virginia business license by applying through your county government. Start by visiting your local clerk's office to understand the specific requirements. You will need to provide necessary documentation, such as your West Virginia Removal From Office - Resolution Form - Corporate Resolutions, if applicable. Once your application is approved, you will receive your business license to operate legally.

The IRS does not have a specific form exclusively for removing a member from an LLC. However, you must report any changes in ownership on your tax returns and to the state. When you remove a member, using the West Virginia Removal From Office - Resolution Form - Corporate Resolutions helps to document the change properly. By keeping records accurate and up to date, you ensure compliance with both state and IRS requirements.

Kicking a member out of an LLC involves a few crucial steps, but it typically begins with a review of the operating agreement. This document may specify grounds for removal, such as misconduct or failure to fulfill duties. Once you identify the reasons and follow any required voting process, utilize the West Virginia Removal From Office - Resolution Form - Corporate Resolutions to formalize the removal. This approach ensures that you maintain legal protection and clarity within your LLC.

To voluntarily remove a member from your LLC, start by reviewing your company's operating agreement. The agreement often outlines the procedure for removal, including necessary votes or documentation. After confirming the process, you may need to complete the West Virginia Removal From Office - Resolution Form - Corporate Resolutions. This form will document the resolution to remove the member officially, ensuring compliance with state laws and protecting your LLC's interests.

To close your West Virginia sales tax account, you must notify the state's tax department directly. Prepare the necessary documentation and make sure to settle any outstanding taxes before proceeding. Utilizing the West Virginia Removal From Office - Resolution Form - Corporate Resolutions can streamline this procedure, ensuring you follow the required steps properly. The uslegalforms platform offers these forms to help ease the process.

Yes, sales tax exemption certificates in West Virginia have an expiration date, typically five years from the date of issuance. It is important to monitor the expiration date to ensure compliance and to renew as necessary. If you need additional help with documentation, consider using the West Virginia Removal From Office - Resolution Form - Corporate Resolutions available on the uslegalforms platform. This can help you manage your paperwork effectively.

To cancel your sales tax permit in West Virginia, you need to contact the state's tax department. They will provide you with the necessary steps to complete the cancellation. Filling out the West Virginia Removal From Office - Resolution Form - Corporate Resolutions can also simplify the process by ensuring you have documented your intent to end business activities. Always keep a copy of any correspondence for your records.

To close a sales tax account in West Virginia, you must notify the West Virginia State Tax Department. This includes filing a final return to account for any outstanding sales tax due. Additionally, if you're in the process of dissolving your corporation, completing the West Virginia Removal From Office - Resolution Form - Corporate Resolutions is a necessary step for comprehensive compliance.