West Virginia Revocable Living Trust for Married Couple

Description

How to fill out Revocable Living Trust For Married Couple?

Are you presently in the location where you require files for potentially business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding versions you can rely on isn't easy.

US Legal Forms provides thousands of form templates, including the West Virginia Revocable Living Trust for Married Couples, which can be tailored to meet federal and state requirements.

When you find the appropriate form, click Get now.

Select the pricing plan you want, fill out the required information to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the West Virginia Revocable Living Trust for Married Couples template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for your correct city/county.

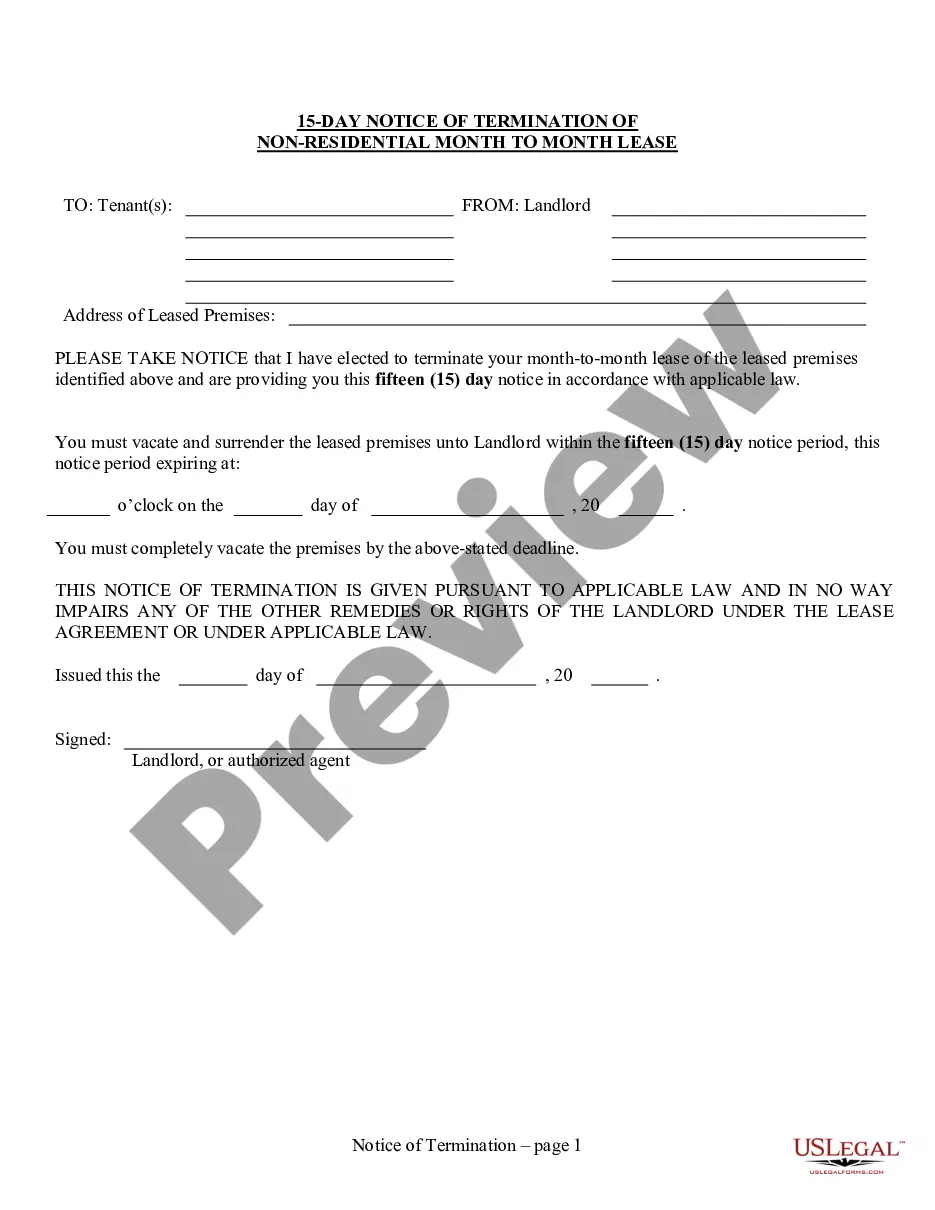

- Use the Review button to verify the form.

- Check the information to ensure you have selected the correct form.

- If the form isn't what you are looking for, use the Search section to find the form that suits your needs.

Form popularity

FAQ

Yes, a revocable trust can be changed after one spouse dies. The surviving spouse typically retains the ability to modify the trust's provisions, reflecting new personal or financial situations. This adaptability is a primary feature of the West Virginia Revocable Living Trust for Married Couple. To ensure a smooth transition, it may be beneficial to work with an expert in estate planning to navigate the modifications effectively.

In general, a joint trust created under the West Virginia Revocable Living Trust for Married Couple remains revocable after one spouse passes away. The surviving spouse usually has the authority to amend or dissolve the trust, thus maintaining flexibility. However, it is wise to review the trust terms and consult with an attorney to understand any specific stipulations. This approach ensures that your estate plan adapts to your circumstances.

The three main types of trusts include revocable trusts, irrevocable trusts, and testamentary trusts. A West Virginia Revocable Living Trust for Married Couples is a popular choice for its flexibility, allowing couples to alter or dissolve the trust during their lifetime. Irrevocable trusts, on the other hand, typically cannot be changed once established, while testamentary trusts are created through a will and take effect after a person's death. Each type serves different needs and offers unique benefits.

Establishing a trust, such as a West Virginia Revocable Living Trust for Married Couples, can have some disadvantages. One significant drawback is the complexity involved in setting it up compared to a standard will. Furthermore, maintaining a trust requires ongoing management and record-keeping to ensure it remains compliant with state laws. Additionally, all assets in the trust may incur costs, from initial setup fees to potential tax obligations.

There are some disadvantages to consider with a joint revocable trust. One potential issue is that both spouses must agree to any changes, which can complicate decision-making. Additionally, with a West Virginia Revocable Living Trust for Married Couple, if one partner passes away, it may still be subject to probate unless properly handled, so understanding the intricacies of your trust is important.

The choice between a revocable and irrevocable trust depends on your specific needs. A West Virginia Revocable Living Trust for Married Couple offers flexibility, allowing you to amend or dissolve the trust at any time. On the other hand, an irrevocable trust might provide asset protection and potential tax benefits but does not offer the same level of control.

While no trust completely avoids all taxes, irrevocable trusts can help minimize certain tax obligations. A West Virginia Revocable Living Trust for Married Couple can be structured to manage tax implications effectively, but typically, revocable trusts do not provide tax benefits during your lifetime. Consulting with a tax advisor and incorporating the correct provisions is crucial.

Revocable trusts are generally appropriate for married couples, particularly a West Virginia Revocable Living Trust for Married Couple. This trust offers control over assets and the ability to change terms as needed. Additionally, it can provide peace of mind by avoiding probate and ensuring that the couple's wishes are fulfilled.

The best trust for a married couple often depends on individual circumstances, but many choose a revocable living trust. A West Virginia Revocable Living Trust for Married Couple allows couples to retain control over their assets while ensuring a smooth transition to beneficiaries. This type of trust provides flexibility and can be amended as life changes occur.

Yes, a married couple can establish a joint revocable trust. This type of trust allows both partners to manage assets together during their lifetime. With a West Virginia Revocable Living Trust for Married Couple, you benefit from simplified estate planning. Plus, this joint trust can help avoid probate, making the transfer of assets more efficient for your heirs.