For use in all states except AK,FL,ME,NY,PR,VT,VA,WV,WI

West Virginia Multistate Promissory Note - Unsecured - Signature Loan

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

Selecting the appropriate legitimate document format can be a challenge. Certainly, there are numerous templates accessible online, but how will you find the correct type you require? Utilize the US Legal Forms website. The service provides thousands of templates, including the West Virginia Multistate Promissory Note - Unsecured - Signature Loan, suitable for both business and personal needs. All forms are reviewed by professionals to ensure compliance with state and federal regulations.

If you are already registered, Log In to your account and click on the Obtain button to retrieve the West Virginia Multistate Promissory Note - Unsecured - Signature Loan. Use your account to browse through the legal forms you have purchased previously. Navigate to the My documents section of your account to download another copy of the necessary document.

If you are a new user of US Legal Forms, here are straightforward instructions to follow: First, ensure you have selected the correct form for your location. You can examine the document using the Review button and read the form description to confirm it suits your needs. If the form does not meet your criteria, use the Search box to find the appropriate form. Once you are certain the form is suitable, click the Purchase now button to acquire it.

- Select the pricing plan you prefer and provide the necessary information.

- Create your account and make your payment using your PayPal account or credit card.

- Choose the document format and download the legal document format to your device.

- Complete, modify, print, and sign the retrieved West Virginia Multistate Promissory Note - Unsecured - Signature Loan.

- US Legal Forms boasts the largest library of legal forms from which you can access numerous document templates.

- Leverage the service to download well-crafted paperwork that complies with state regulations.

Form popularity

FAQ

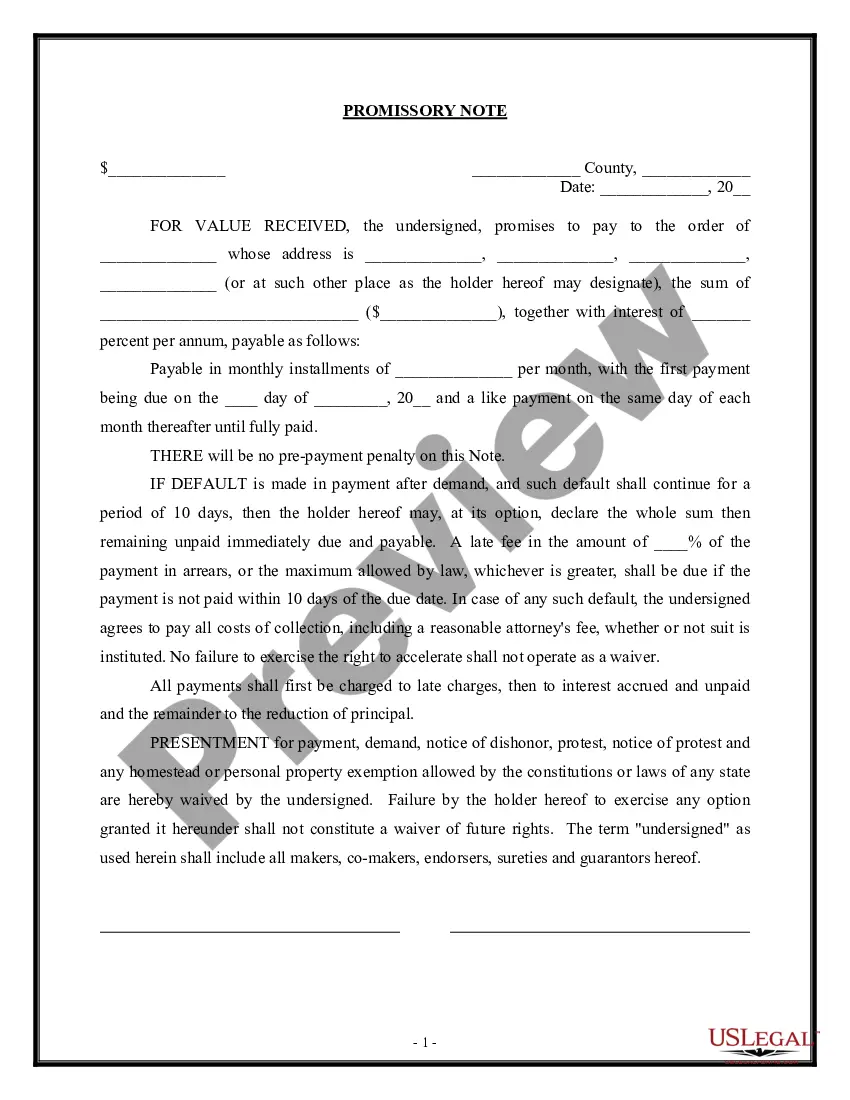

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

Lenders who decide to use an unsecured promissory note should consider the credibility of the borrower before signing the agreement. There is no collateral backing for an unsecured promissory note. In these circumstances, the person who holds the note can pursue compensation with the debt collection process.

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

An unsecured note is a loan that is not secured by the issuer's assets. Unsecured notes are similar to debentures but offer a higher rate of return. Unsecured notes provide less security than a debenture. Such notes are also often uninsured and subordinated.

In common speech, other terms, such as "loan", "loan agreement", and "loan contract" may be used interchangeably with "promissory note".

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

An unsecured promissory note is a legally binding contract between two parties where one party agrees to pay the other a certain amount of money at a specific time in the future. The reason it is called 'unsecured' is because the borrower does not want to pledge any assets as collateral for the loan.

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

A Promissory Note may be secured or unsecured. In case of a secured note, the borrower will be required to provide a collateral such as property, goods, services, etc., in the event that they fail to repay the borrowed amount.

An unsecured note is a loan that is not secured by the issuer's assets. Unsecured notes are similar to debentures but offer a higher rate of return. Unsecured notes provide less security than a debenture. Such notes are also often uninsured and subordinated. The note is structured for a fixed period.