West Virginia Stock Retirement Agreement is a legal document that outlines the terms and conditions for the retirement of stocks in the state of West Virginia. This agreement is specifically designed for individuals or companies who wish to retire their stocks in a secure and regulated manner. In West Virginia, there are several types of Stock Retirement Agreements available, each catering to different circumstances and requirements. These include: 1. Individual Stock Retirement Agreement: This agreement is suitable for individuals who hold stocks and want to retire them. It covers the necessary provisions for the transfer, cancellation, or redemption of stocks upon retirement. 2. Corporate Stock Retirement Agreement: This agreement is specifically designed for corporations and businesses looking to retire their stocks. It includes comprehensive provisions related to the retirement process, such as shareholder notifications, the handling of retired stocks, and the distribution of retirement benefits. 3. Employee Stock Retirement Agreement: This type of agreement is often used by employers who offer employee stock ownership plans (Sops) as a retirement benefit. It outlines the process for employees to retire their stocks after meeting specific eligibility criteria, such as attaining a certain age or completing a minimum number of years with the company. 4. Voluntary Stock Retirement Agreement: This agreement is suitable for individuals or businesses that voluntarily choose to retire their stocks. It provides the necessary guidelines and procedures for retiring stocks without any external pressures or legal obligations. Regardless of the type of Stock Retirement Agreement, certain essential components are typically included. These may cover details such as the identification of the retiring party, the number and type of stocks being retired, the retirement method (cancellation, transfer, or redemption), any applicable fees or taxes, and the distribution of retirement benefits. It is essential to consult with a legal professional or an attorney experienced in stock retirement matters to understand the specific requirements and implications of a West Virginia Stock Retirement Agreement. This ensures compliance with state laws and guarantees a smooth and legitimate retirement process for stocks.

West Virginia Stock Retirement Agreement

Description

How to fill out West Virginia Stock Retirement Agreement?

You might spend countless hours online searching for the valid document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of valid forms that are reviewed by experts.

You can easily download or create the West Virginia Stock Retirement Agreement from our service.

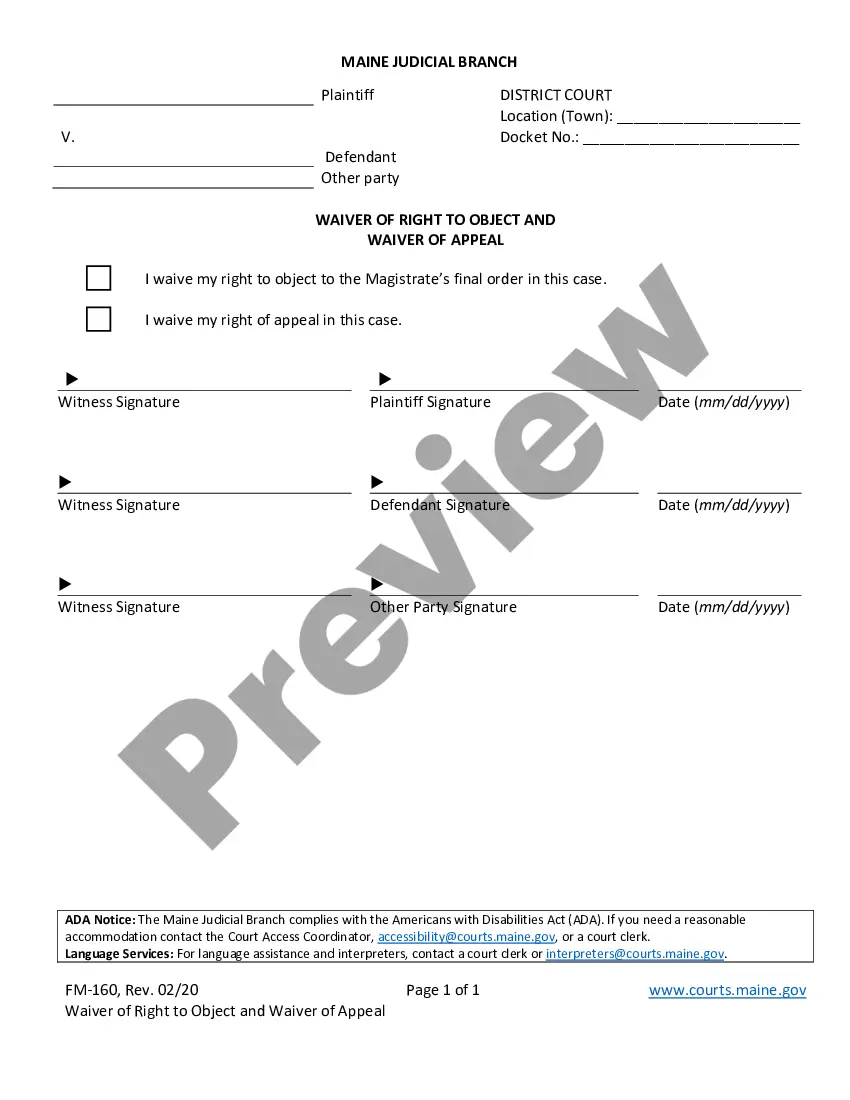

If available, use the Preview button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, modify, print, or sign the West Virginia Stock Retirement Agreement.

- Each valid document template you purchase is yours indefinitely.

- To get an additional copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choosing.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

Filing a West Virginia tax return depends on your specific financial situation. If you engage in transactions related to a West Virginia Stock Retirement Agreement, you may need to report any income generated from that agreement. Consider consulting a tax professional to better understand your obligations and navigate the complexities of state tax laws. UsLegalForms offers resources and guidance to help you manage your tax filing process effectively.

While there are many great towns in West Virginia, Lewisburg is often highlighted as one of the best for retirees. It features a charming downtown area, rich history, and a strong sense of community. Plus, Lewisburg offers various amenities that cater to seniors, including healthcare services and recreational activities. If you’re considering establishing a West Virginia Stock Retirement Agreement, this town provides an excellent backdrop for a fulfilling retirement.

West Virginia provides a welcoming environment for retirees looking for a slower pace of life. Communities in the state emphasize friendliness and support for seniors. You will find various healthcare facilities, social activities, and outdoor adventures tailored to your needs. A West Virginia Stock Retirement Agreement can assist you in ensuring your financial stability while enjoying the vibrant culture and natural scenery the state offers.

Yes, West Virginia does tax retirement pensions, although there are exemptions available under certain conditions. Understanding your tax obligations can be quite complex, but the West Virginia Stock Retirement Agreement outlines essential information regarding potential taxes on retirement income. Consulting this guide can help clarify how taxes may affect your retirement finances.

West Virginia teacher retirements are typically calculated based on the final average salary and years of service. The formula considers your highest earning years to ensure fair compensation during retirement. The West Virginia Stock Retirement Agreement is crucial in helping teachers estimate their retirement benefits accurately. Using this resource can assist you in understanding how your future retirement income is determined.

The rule of 80 for pensions in West Virginia allows individuals to retire when their age plus years of credited service equals at least 80. This rule aids public employees in determining their retirement eligibility based on tangible criteria. The West Virginia Stock Retirement Agreement provides essential insights into how this rule impacts pension benefits. It can serve as an excellent tool for calculating your retirement readiness.

Retirement eligibility for state employees in West Virginia varies based on the retirement plan you are enrolled in. Generally, employees can retire after reaching the required number of service years, or when they meet age and service combination rules. Utilizing the West Virginia Stock Retirement Agreement will help you understand these timelines clearly. Consequently, you can plan effectively for your retirement.

Yes, state employees in West Virginia are eligible for pensions through the Public Employees Retirement System. This pension plan is designed to support state workers after their years of service end. The West Virginia Stock Retirement Agreement includes details about pension calculations and benefits, making it easier for employees to comprehend their entitlements. This resource is invaluable for planning a secure retirement.

The rule of 80 in West Virginia allows an employee to retire when the sum of their age and years of service equals 80 or more. This rule encourages long-term service, offering more flexibility in retirement planning. Understanding the West Virginia Stock Retirement Agreement will provide you with clear criteria related to this rule. It is essential to evaluate your total years of service when considering your retirement options.

Teachers in West Virginia must serve for a minimum of 30 years to qualify for retirement benefits. However, if you have 25 years of teaching and are at least 55 years old, you can also retire. The West Virginia Stock Retirement Agreement provides crucial information to help educators navigate retirement planning effectively. Consider this guide for a smoother transition into retirement.

More info

We do not authorize anyone to use this document or its contents in any way but personal use. This document, including all materials contained herein, including computer code, in whole or in part, and the arrangement and selection of its materials, are © 2000 by Microsoft Corporation and/or its affiliates, or by other entities that create derivative works. The design and arrangement of materials contained herein is the copyrighted work of Microsoft Corporation. Copying, modifying, or using this template for use in other products is prohibited. In addition, you must retain all original copyright documentation and any author attribution that accompanies this document in order for your use of the template. Disclaimer: I, the person viewing this template site, am not employed by or associated with Microsoft Corporation. I do not accept any product liability insurance. I do not participate in pension or profit-sharing schemes.