West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries

Description

How to fill out Trust Agreement - Revocable - Multiple Trustees And Beneficiaries?

You might dedicate hours online looking for the valid document template that meets the local and national criteria you need.

US Legal Forms offers a plethora of legal documents that are reviewed by professionals.

You can easily download or print the West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries from the service.

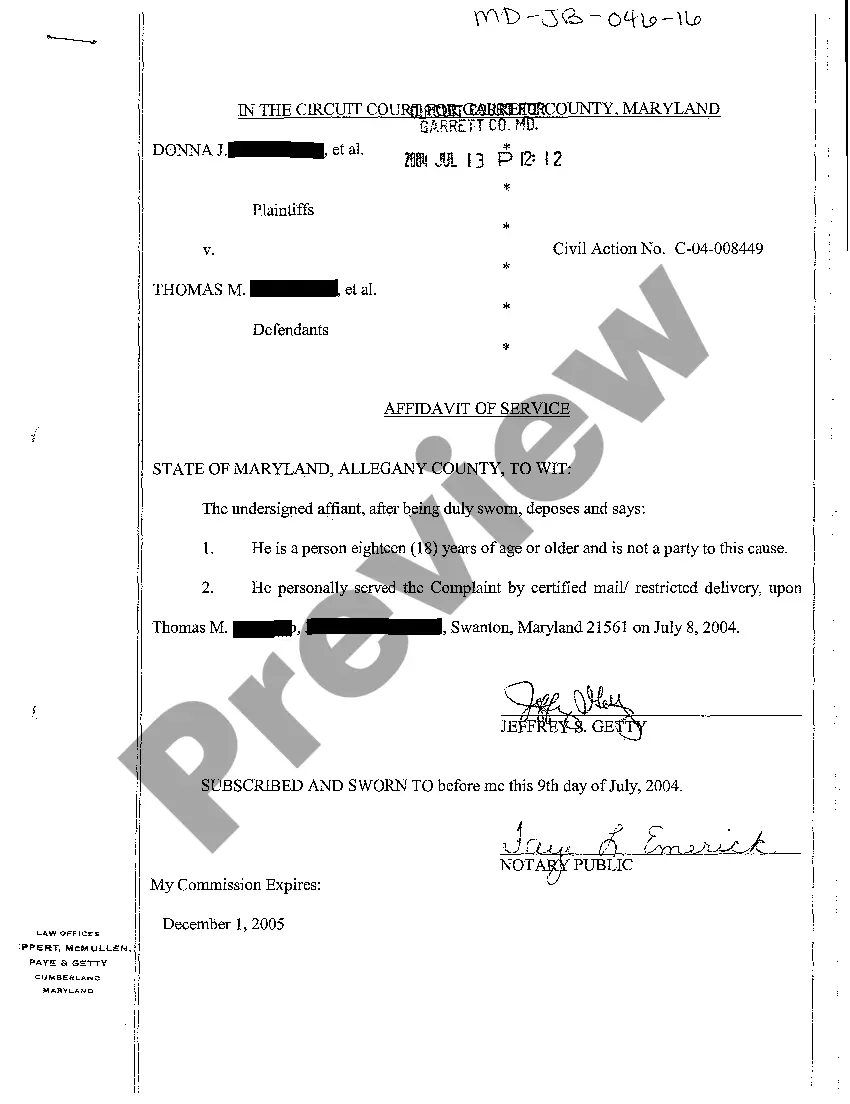

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries.

- Every legal document template you obtain is yours permanently.

- To acquire an additional copy of any purchased form, go to the My documents tab and click on the respective button.

- If this is your first time using the US Legal Forms website, follow the easy steps listed below.

- First, make sure that you have selected the correct document template for the state/city that you have chosen.

- Review the form description to ensure you have selected the appropriate form.

Form popularity

FAQ

Setting up a West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries involves a few key steps. First, you need to determine the type of trust that fits your needs, and then draft the trust documents, which detail the terms and conditions. You should also appoint trustees and beneficiaries accordingly. For streamlined assistance and access to templates, consider using the uslegalforms platform to ensure compliance with state laws.

The minimum amount to set up a trust can vary based on different factors, including the complexity of the West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries you wish to establish. Generally, there is no legal minimum amount required for a trust, but a sizable funding amount is often needed for the trust to be beneficial. It's advisable to consult with an estate planning attorney for personalized guidance on financial requirements.

One of the biggest mistakes parents make when setting up a trust fund is failing to properly fund the trust. It's crucial that your West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries is effectively funded with your assets to secure its purpose. Engaging a professional service such as uslegalforms can help you navigate this process and avoid common pitfalls.

Absolutely, two family members can serve as trustees of a trust. In a West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, sharing the role of trustees can help distribute responsibilities and allow for diverse oversight of the trust assets. This arrangement can foster collaboration and ensure that all beneficiaries' needs are considered.

Yes, adding a beneficiary to a revocable trust is a straightforward process. You simply need to create a formal amendment to your West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. Engaging a legal expert can help you navigate this process smoothly and ensure that all documentation is properly handled.

Adding a beneficiary to a revocable trust typically involves drafting an amendment to the existing trust document. In your West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, you will specify the new beneficiary's details. It's best to seek guidance from a legal professional to ensure proper execution and compliance with state regulations.

You can add beneficiaries to your trust even after it has been established. To do this, you will need to create an amendment to your West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. This amendment should clearly outline the names of the new beneficiaries and can be done with the help of a legal expert to avoid any complications.

Yes, you can name yourself as a beneficiary in your revocable living trust. This flexibility is one of the benefits of a West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. By doing so, you can retain access to the assets during your lifetime, while also planning for the distribution of your assets after your passing.

To add beneficiaries to an existing trust, you need to review the terms of your initial West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. Usually, you can amend the trust document by drafting an amendment that specifies the new beneficiaries. It is advisable to consult with a legal professional familiar with estate planning in your state to ensure that all changes comply with the law.

The best person to manage a trust is typically someone reliable, financially savvy, and capable of making sound decisions. This could be a family member, close friend, or even a professional fiduciary. Ultimately, you want someone who understands the purpose of your West Virginia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries and can act in the best interest of the beneficiaries.