West Virginia Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

How to fill out West Virginia Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

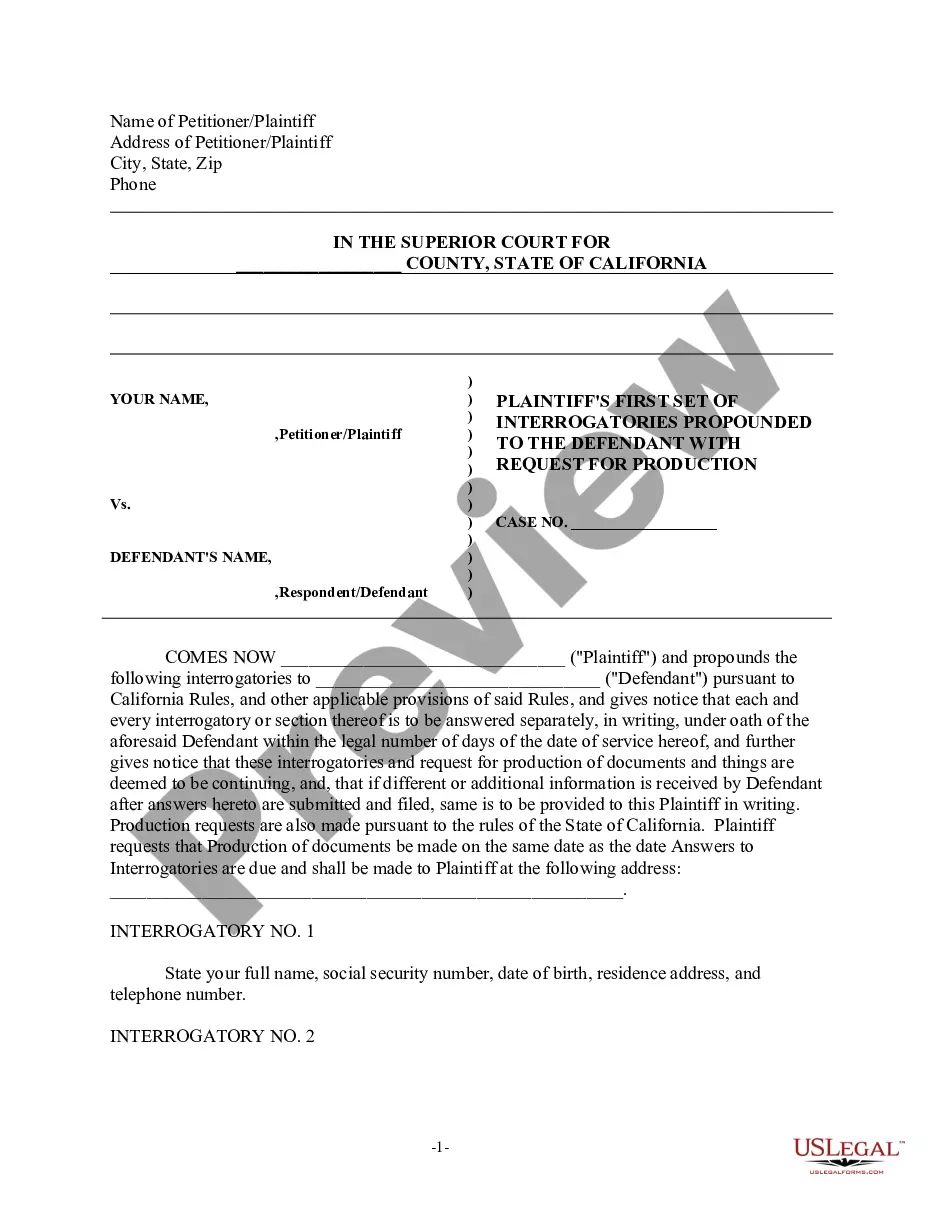

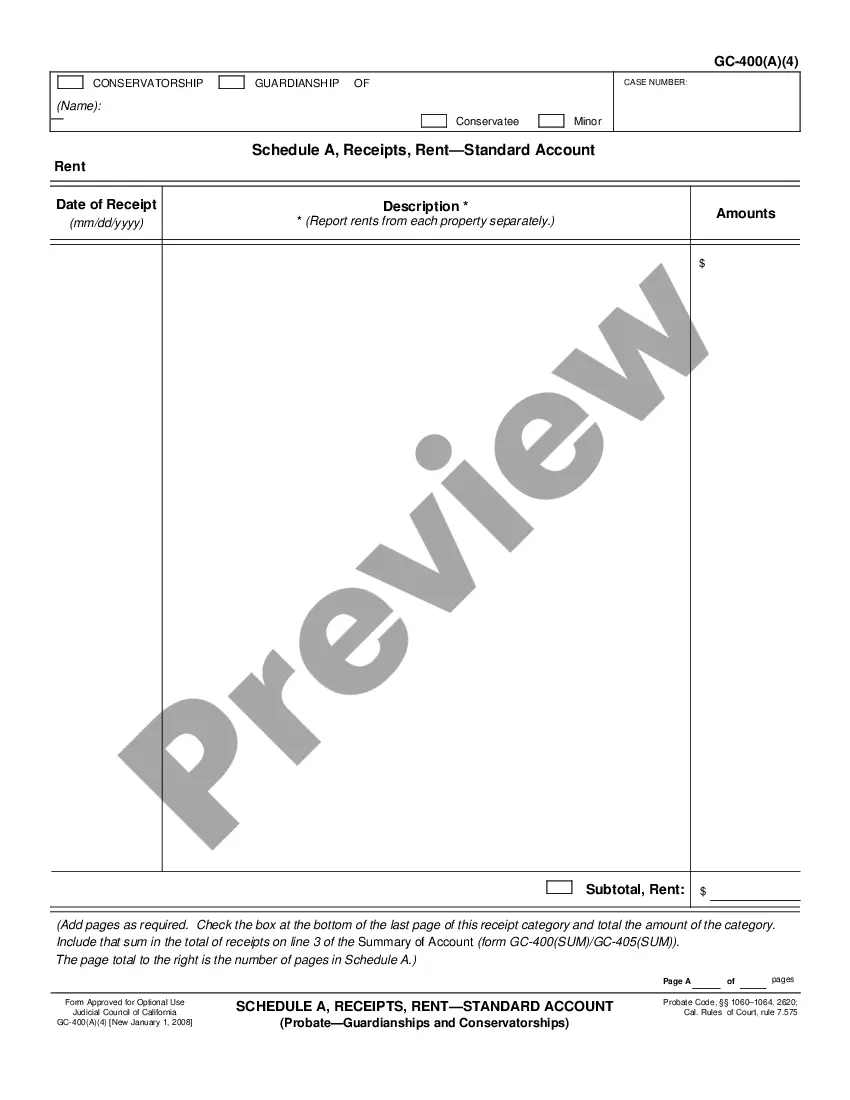

Finding the right legal papers web template could be a have difficulties. Naturally, there are a lot of layouts available on the Internet, but how will you find the legal kind you need? Make use of the US Legal Forms internet site. The services delivers thousands of layouts, like the West Virginia Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits, that you can use for business and personal demands. Each of the types are examined by specialists and meet up with federal and state requirements.

If you are presently registered, log in to the account and then click the Acquire switch to get the West Virginia Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits. Use your account to check through the legal types you possess acquired previously. Visit the My Forms tab of the account and get yet another duplicate in the papers you need.

If you are a whole new end user of US Legal Forms, here are easy recommendations for you to adhere to:

- Initial, make certain you have selected the proper kind for your personal metropolis/county. You can look through the shape using the Review switch and read the shape description to ensure it will be the right one for you.

- In case the kind is not going to meet up with your preferences, take advantage of the Seach field to discover the right kind.

- When you are certain that the shape is acceptable, click on the Buy now switch to get the kind.

- Choose the rates plan you would like and enter the essential info. Design your account and pay for an order making use of your PayPal account or Visa or Mastercard.

- Opt for the data file formatting and acquire the legal papers web template to the system.

- Full, change and produce and indication the acquired West Virginia Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits.

US Legal Forms is definitely the most significant local library of legal types in which you can find different papers layouts. Make use of the service to acquire skillfully-made files that adhere to express requirements.

Form popularity

FAQ

Collection agencies can garnish your bank account if they have obtained a court judgment against you. Wage and bank account garnishments are particularly worrisome because they can happen unexpectedly and cause you to default on other planned payments. Again, the rules vary depending on your situation and province.

At the latest, you must notify your bank within 60 days after your bank or credit union sends your statement showing the unauthorized transaction. If you wait longer, you could have to pay the full amount of any transactions that occurred after the 60-day period and before you notify your bank.

Send the agency a letter by mail asking them to confirm their debt in writing. Search for the company name on the internet, review their website, call their number, etc. Do your homework. If they refuse to answer all of your questions, there's a good chance you're in the middle of a scam.

Direct Deposit Will Be Returned to the Sender It can take about five to 10 days for funds to be returned to the sender.

Typically, you'll be asked to pay back the cash.

Bank errors are rare, but do happen. If there's an error in your favor, the money is not yours to keep. Spending money that's not yours could land you in jail.

It is not possible to get the money back without the consent of the wrong beneficiary. The process is a little tough, but he/she has to accept that there was a wrong transaction made to his/her account. Then, you need to contact your bank and communicate the matter in detail.

Notify your bank immediately. For more details, give a missed call on 14440. If someone has fraudulently withdrawn money from your bank account, inform your bank immediately. When you notify the bank, remember to take acknowledgement from your bank.

Absent a court order (e.g., garnishee), a bank's ability to automatically withdraw money from your accounts is limited to debts owing to that institution and debts owing to Canada Revenue Agency.

Can banks take your money without your permission? A bank can't take money from your account without your permission using right of offset unless the following conditions are all met: The current account and the debt are both in your name. The position is a bit more complicated with joint debts and joint accounts.