A judgment lien is created when a court grants a creditor an interest in the debtor's property, based upon a court judgment. A plaintiff who obtains a monetary judgment is termed a "judgment creditor." The defendant becomes a "judgment debtor."

Judgment liens may be created through a wide variety of circumstances.

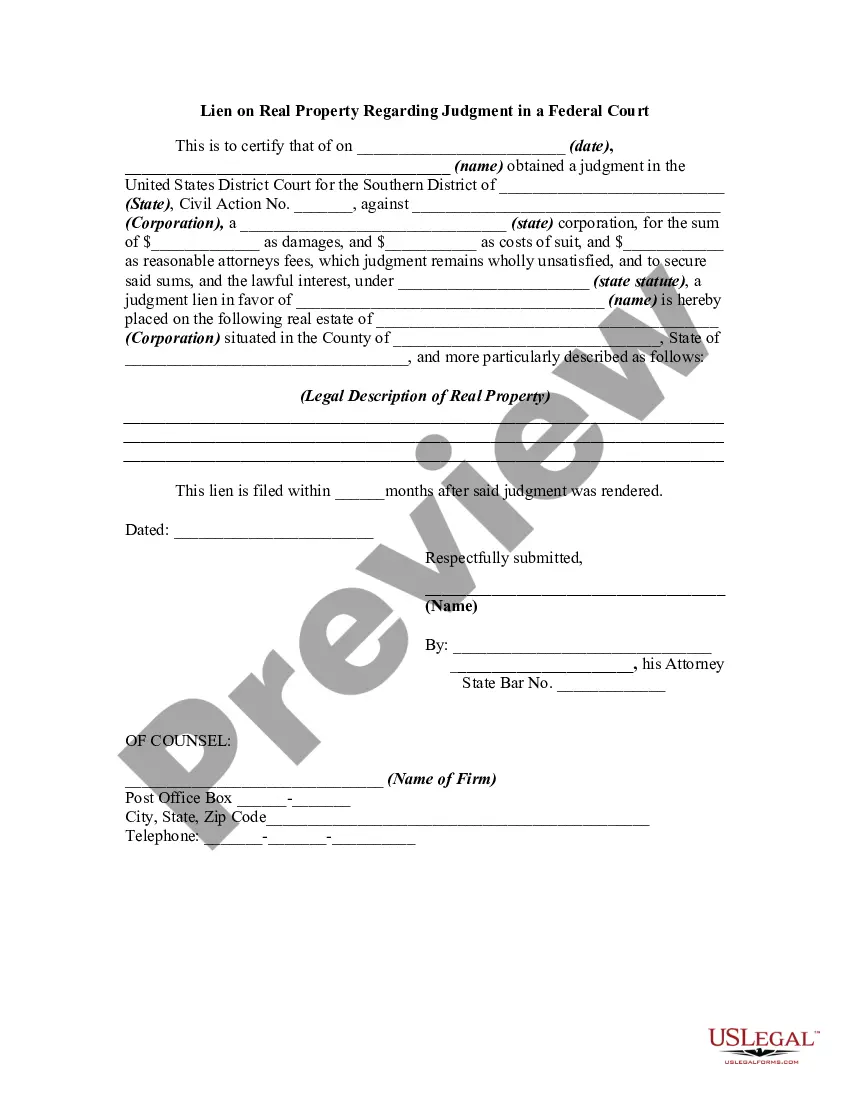

West Virginia Lien on Real Property Regarding Judgment in a Federal Court

Description

How to fill out Lien On Real Property Regarding Judgment In A Federal Court?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal form templates that you can download or print.

By using the site, you will obtain thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the West Virginia Lien on Real Property Regarding Judgment in a Federal Court in just moments.

If you already have a membership, Log In and download the West Virginia Lien on Real Property Regarding Judgment in a Federal Court from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously saved forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded West Virginia Lien on Real Property Regarding Judgment in a Federal Court. Every template you add to your account has no expiration date and is yours forever. Therefore, if you want to download or print another copy, simply visit the My documents section and click on the form you need. Access the West Virginia Lien on Real Property Regarding Judgment in a Federal Court with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- To use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/region.

- Click the Preview button to review the form's details.

- Read the form description to confirm that you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the payment plan you prefer and provide your information to register for the account.

Form popularity

FAQ

Involuntary Lien: A lien imposed against property without consent of the owner. Taxes, special assessments, federal income tax liens, and State tax liens are examples of involuntary liens.

A judgment lien is a type of non-consensual lien (a lien that attaches to a property without the owner's agreement). It's created when someone wins a lawsuit against the property owner and then records the judgment against an asset such as a house, land, bank account, or other personal assets.

Mechanics liens in West Virginia need to be filed and recorded in the county clerk's office in the county where the property is located. Each clerk's office will have its own filing fees and other specific requirements.

WEST VIRGINIA The lien will continue for 10 years from the date of entry. W.Va. Code § 38-3-7. The judgment may be renewed for an additional 10 years.

A judicial lien is created when a court grants a creditor an interest in the debtor's property, after a court judgment.

A judgment lien is a type of non-consensual lien (a lien that attaches to a property without the owner's agreement). It's created when someone wins a lawsuit against the property owner and then records the judgment against an asset such as a house, land, bank account, or other personal assets.

Limitations Period The statute of limitations is ten years for enforcing a judgment in West Virginia (W. Va.

Judgment liens are involuntary, general liens. If a lawsuit results in a money judgment against the loser, the winner (judgment creditor) may obtain a lien against the loser's (the judgment debtor's) property.