West Virginia Agreement to Sell Personal Property

Description

How to fill out Agreement To Sell Personal Property?

Are you in a location where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but locating trustworthy ones can be challenging.

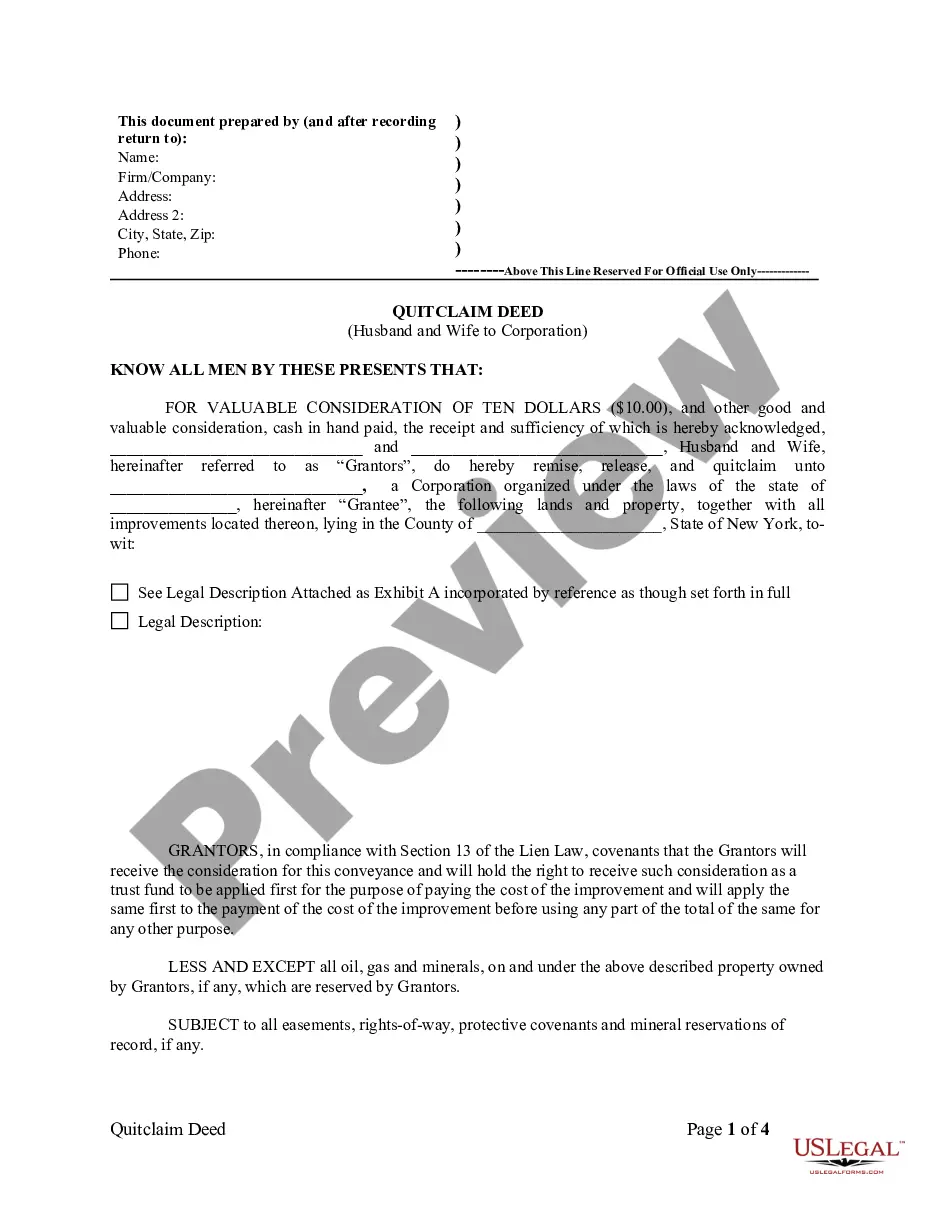

US Legal Forms offers thousands of form templates, such as the West Virginia Agreement to Transfer Personal Property, designed to meet state and federal regulations.

Once you locate the correct form, click Purchase now.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete the payment using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the West Virginia Agreement to Transfer Personal Property template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

- Utilize the Preview feature to examine the form.

- Check the description to confirm you have selected the appropriate form.

- If the form isn’t what you require, use the Search box to find the form that matches your needs.

Form popularity

FAQ

Yes, you typically need a business license to sell products online in West Virginia. This requirement applies whether you are selling through a personal website, a marketplace, or social media. Before you enter any agreements related to the West Virginia Agreement to Sell Personal Property, ensure that all necessary licenses are obtained to comply with state laws.

To obtain a West Virginia resale certificate, businesses must fill out the application available through the West Virginia State Tax Department's website. The process is straightforward, requiring basic business information and details regarding your sales activities. If you're involved in the West Virginia Agreement to Sell Personal Property, securing this certificate can streamline your purchasing process.

Certain entities and organizations are exempt from West Virginia sales tax, such as non-profit organizations, government agencies, and some educational institutions. If you are involved in a transaction governed by the West Virginia Agreement to Sell Personal Property, it's important to confirm your eligibility for exemption. For individuals or businesses, specific conditions apply, so reviewing current tax regulations is advisable.

In West Virginia, personal property encompasses items that are movable and not permanently attached to land. This includes vehicles, machinery, and household items. When you prepare a West Virginia Agreement to Sell Personal Property, it's essential to define what constitutes personal property to avoid any potential disputes during the sale.

Personal property typically falls into two categories: tangible and intangible. Tangible personal property includes things like vehicles and furniture, while intangible personal property encompasses things like stocks and bonds. Understanding these categories is crucial when drafting a West Virginia Agreement to Sell Personal Property, as it clarifies what is being sold and any obligations involved.

Certain individuals and organizations may qualify for exemptions from personal property tax in West Virginia. For instance, nonprofits and veterans with disabilities often enjoy these benefits. When creating a West Virginia Agreement to Sell Personal Property, knowing who is exempt can help in determining tax implications and ensuring compliance.

In West Virginia, the personal property tax rates can vary by county, but typically, the average rate is around 0.5% to 1% of the assessed value of the personal property. When dealing with a West Virginia Agreement to Sell Personal Property, it's important to consider these taxes as they can influence the overall transaction. Make sure to check the specific rates for your county to better understand your tax obligations.

Yes, you can sell your house without a realtor in West Virginia. To do so, you should prepare a West Virginia Agreement to Sell Personal Property to outline the sale terms. This approach gives you more control over the selling process, but be prepared to handle marketing and negotiations on your own. Many resources are available to assist you in completing a successful sale without professional representation.

In West Virginia, all heirs typically need to agree to sell inherited property. If there’s a disagreement among heirs, the process may become complicated and require legal intervention. A West Virginia Agreement to Sell Personal Property can outline the terms agreed upon by all heirs. It’s advisable to seek legal advice to navigate these situations effectively.

Currently, West Virginia has not announced plans to eliminate personal property taxes. It’s crucial to stay informed about any changes in legislation regarding taxes in West Virginia. Utilizing the West Virginia Agreement to Sell Personal Property can help you understand how taxes may affect the sale process. Keeping accurate records and being aware of potential tax implications can aid in a smoother transaction.