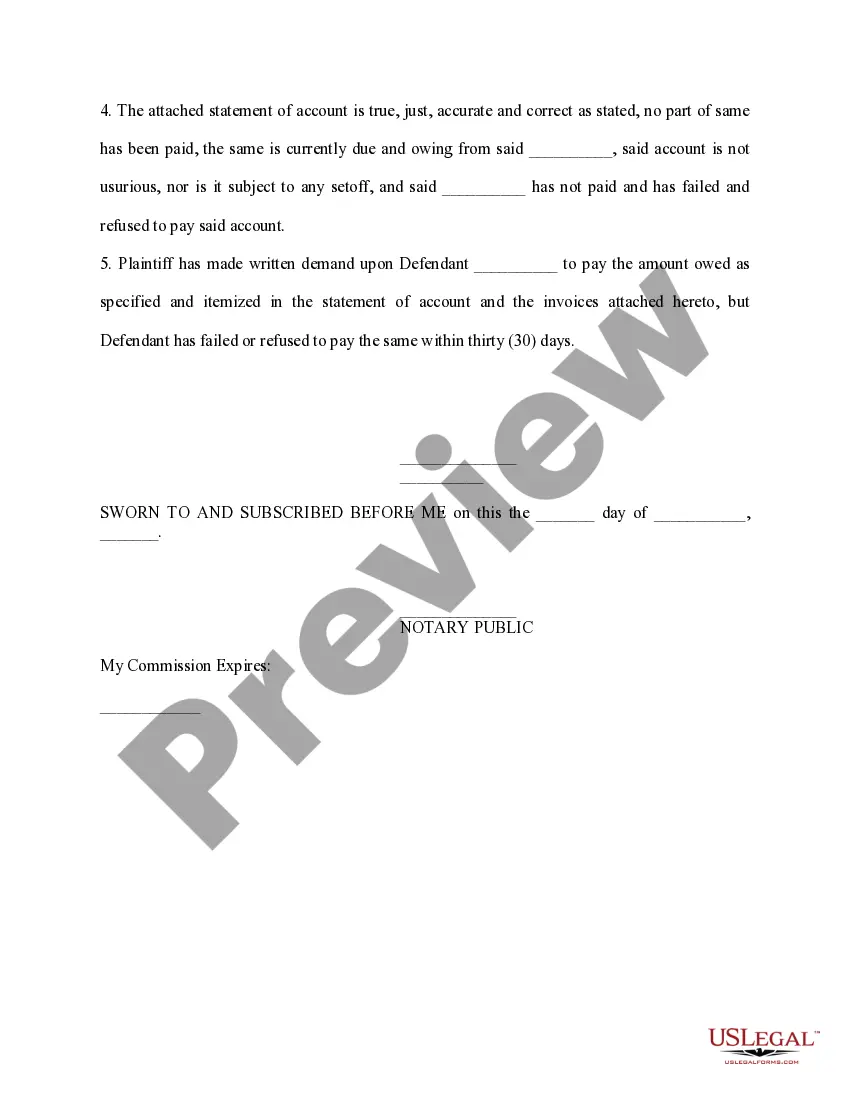

The West Virginia Affidavit of Amount Due on Open Account is a legal document used in the state of West Virginia to declare the total outstanding balance owed on an open account. An open account refers to a credit agreement between a creditor and a debtor where purchases or services are made on credit. This affidavit is a vital tool employed by creditors or collections agencies to establish the exact amount owed by a debtor. The West Virginia Affidavit of Amount Due on Open Account is crucial during debt collection proceedings as it provides an accurate record of the outstanding debt. It serves as evidence in court proceedings and can be used to support legal actions such as filing a lawsuit, obtaining a judgment, or pursuing other debt recovery measures. In West Virginia, there are different types of Affidavits of Amount Due on Open Account, including: 1. General Affidavit of Amount Due on Open Account: This is the standard form used to declare the total balance owed on an open account. It includes details such as the name and contact information of the creditor, debtor, and account number. It also provides a breakdown of the principal balance, interest charges, late fees, and any other applicable fees or charges. 2. Affidavit of Amount Due on Open Account for Medical Services: This specific affidavit is used in cases where medical services have been provided on credit. It includes additional details such as the nature of the medical services rendered, the date of the services, and itemized charges for specific treatments or procedures. 3. Affidavit of Amount Due on Open Account for Professional Services: This variation of the affidavit is tailored for businesses or individuals providing professional services, such as legal or consulting services, on credit. It includes specific information related to the type of professional services rendered and the hourly rates or fees applicable. The West Virginia Affidavit of Amount Due on Open Account is an essential document in debt collection proceedings and provides a comprehensive breakdown of the outstanding balance owed. It ensures transparency and accuracy in debt settlements, allowing creditors to pursue legal actions if necessary.

West Virginia Affidavit of Amount Due on Open Account

Description

How to fill out West Virginia Affidavit Of Amount Due On Open Account?

You are able to spend hours on-line searching for the legitimate record design that suits the federal and state demands you require. US Legal Forms provides 1000s of legitimate kinds which can be evaluated by experts. It is simple to obtain or produce the West Virginia Affidavit of Amount Due on Open Account from the services.

If you have a US Legal Forms bank account, you can log in and click on the Down load button. After that, you can total, edit, produce, or sign the West Virginia Affidavit of Amount Due on Open Account. Each legitimate record design you buy is your own forever. To obtain one more duplicate of any bought develop, visit the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms site initially, follow the easy guidelines beneath:

- Very first, be sure that you have selected the right record design for the region/town that you pick. Look at the develop explanation to ensure you have chosen the right develop. If offered, take advantage of the Preview button to appear from the record design too.

- In order to locate one more version of your develop, take advantage of the Search industry to obtain the design that meets your needs and demands.

- Upon having identified the design you want, simply click Purchase now to proceed.

- Pick the rates strategy you want, type in your references, and sign up for a merchant account on US Legal Forms.

- Complete the financial transaction. You can utilize your credit card or PayPal bank account to fund the legitimate develop.

- Pick the structure of your record and obtain it to your system.

- Make modifications to your record if possible. You are able to total, edit and sign and produce West Virginia Affidavit of Amount Due on Open Account.

Down load and produce 1000s of record layouts making use of the US Legal Forms website, which provides the greatest assortment of legitimate kinds. Use expert and status-distinct layouts to take on your business or person requires.