A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to withdraw property from the trust. This form is a sample of a trustor amending the trust agreement in order to withdraw property from the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

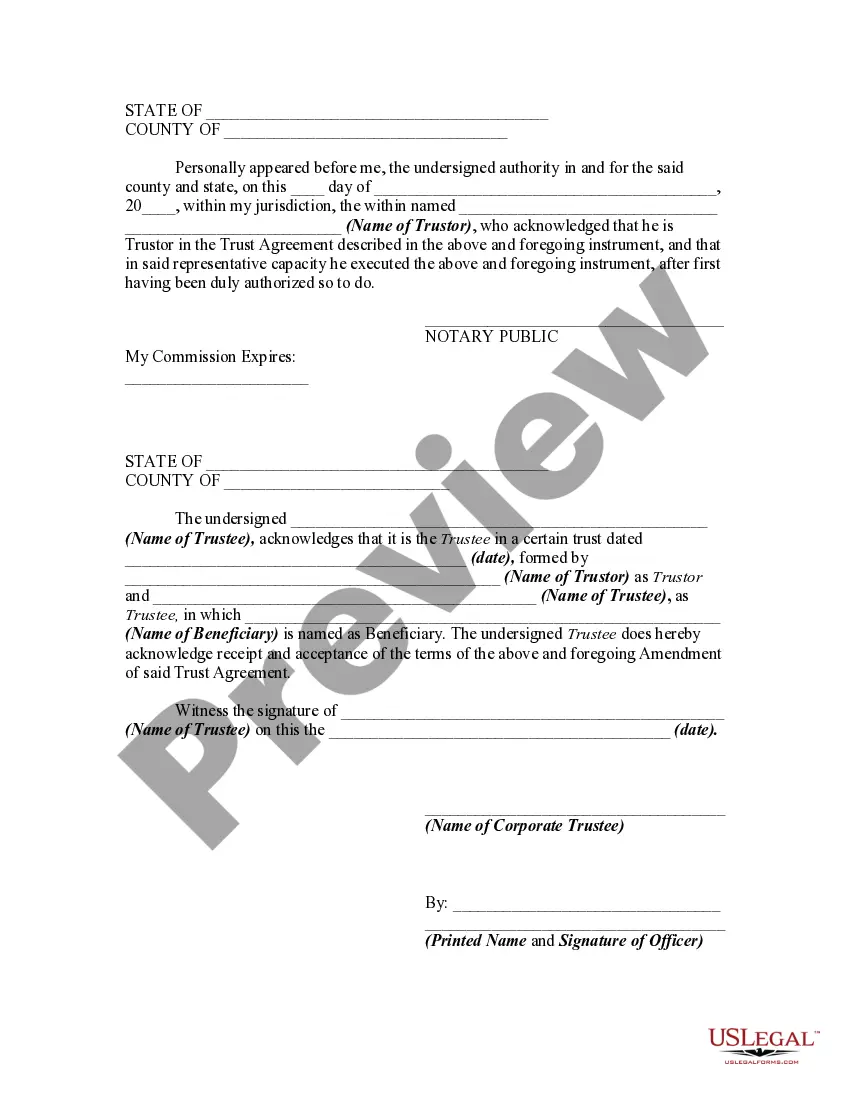

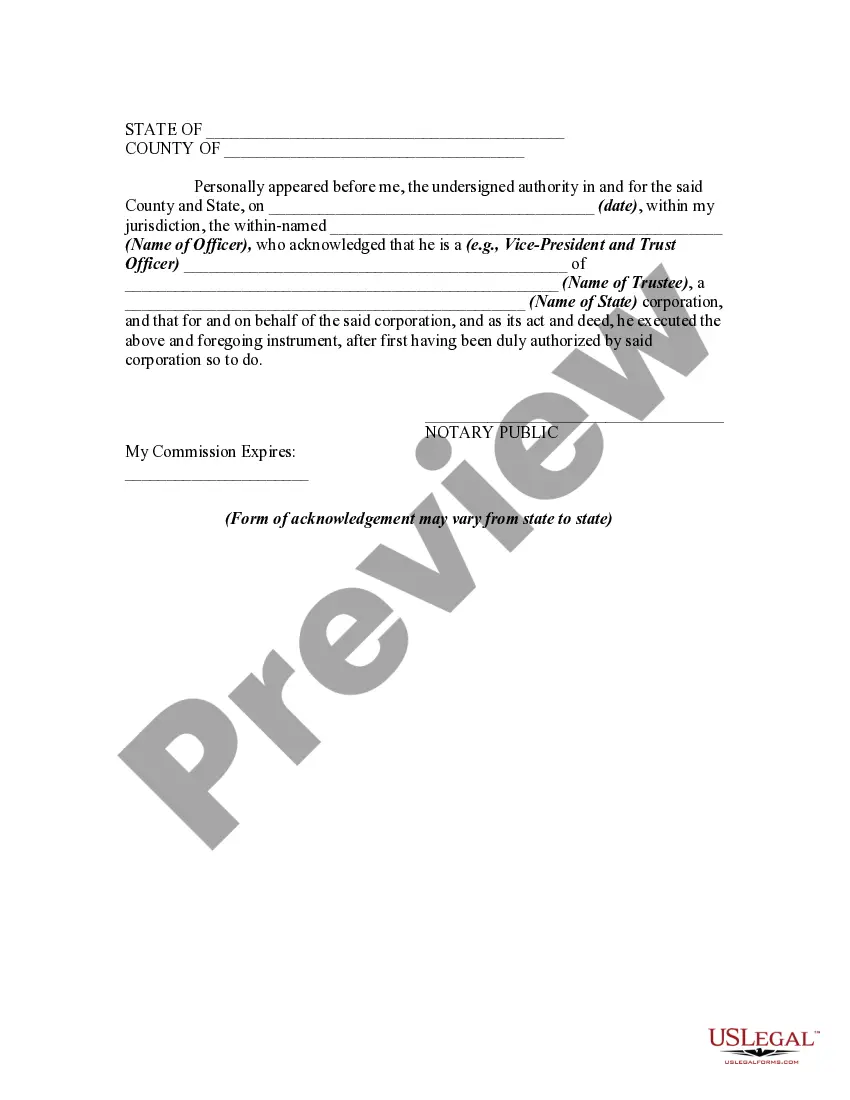

The West Virginia Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee is a legal document that allows a beneficiary or granter to make changes to an existing trust in order to withdraw specific properties or assets from the trust. This amendment is crucial in ensuring that the trust agreement reflects the current wishes and circumstances of the parties involved. The process of making this amendment involves obtaining the consent of the trustee, who is responsible for managing and administering the trust in accordance with its terms. By obtaining the trustee's consent, the beneficiary or granter can legally remove the designated property from the trust and regain control over it. This amendment must be executed in accordance with the laws and regulations in West Virginia to ensure its validity. In West Virginia, there are several types of amendments that can be made to a trust agreement in order to withdraw property from an inter vivos trust and obtain the trustee's consent. These may include: 1. Limited Withdrawal Amendment: This type of amendment allows the beneficiary or granter to withdraw specific properties or assets from the trust without affecting the overall structure or provisions of the trust agreement. 2. Full Withdrawal Amendment: This amendment enables the beneficiary or granter to completely withdraw all properties or assets from the inter vivos trust, effectively terminating the trust agreement. 3. Partial Withdrawal Amendment: This type of amendment allows the beneficiary or granter to withdraw a portion of the properties or assets held within the trust, while leaving the remaining assets intact. 4. Specific Asset Withdrawal Amendment: In certain cases, the beneficiary or granter may want to withdraw a specific asset or property from the trust. This amendment caters to such needs and ensures that only the designated asset is removed from the trust. To execute any of these amendments, it is essential to consult with an experienced attorney who specializes in trust and estate planning to ensure compliance with West Virginia laws and to protect the interests of all parties involved. Proper documentation and adherence to legal procedures will help to facilitate a smooth and legally sound withdrawal of property from an inter vivos trust in West Virginia.The West Virginia Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee is a legal document that allows a beneficiary or granter to make changes to an existing trust in order to withdraw specific properties or assets from the trust. This amendment is crucial in ensuring that the trust agreement reflects the current wishes and circumstances of the parties involved. The process of making this amendment involves obtaining the consent of the trustee, who is responsible for managing and administering the trust in accordance with its terms. By obtaining the trustee's consent, the beneficiary or granter can legally remove the designated property from the trust and regain control over it. This amendment must be executed in accordance with the laws and regulations in West Virginia to ensure its validity. In West Virginia, there are several types of amendments that can be made to a trust agreement in order to withdraw property from an inter vivos trust and obtain the trustee's consent. These may include: 1. Limited Withdrawal Amendment: This type of amendment allows the beneficiary or granter to withdraw specific properties or assets from the trust without affecting the overall structure or provisions of the trust agreement. 2. Full Withdrawal Amendment: This amendment enables the beneficiary or granter to completely withdraw all properties or assets from the inter vivos trust, effectively terminating the trust agreement. 3. Partial Withdrawal Amendment: This type of amendment allows the beneficiary or granter to withdraw a portion of the properties or assets held within the trust, while leaving the remaining assets intact. 4. Specific Asset Withdrawal Amendment: In certain cases, the beneficiary or granter may want to withdraw a specific asset or property from the trust. This amendment caters to such needs and ensures that only the designated asset is removed from the trust. To execute any of these amendments, it is essential to consult with an experienced attorney who specializes in trust and estate planning to ensure compliance with West Virginia laws and to protect the interests of all parties involved. Proper documentation and adherence to legal procedures will help to facilitate a smooth and legally sound withdrawal of property from an inter vivos trust in West Virginia.