A contract is usually discharged by performance of the terms of the agreement. However, the parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. The following form is a sample of a letter accompanying a check tendered in settlement of a claim that is in dispute.

West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account

Description

How to fill out Settlement Offer Letter From A Business Regarding A Disputed Account?

You could devote hours online looking for the valid document template that complies with the state and federal requirements you require.

US Legal Forms offers thousands of valid templates that are reviewed by professionals.

It is easy to access or print the West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account through my service.

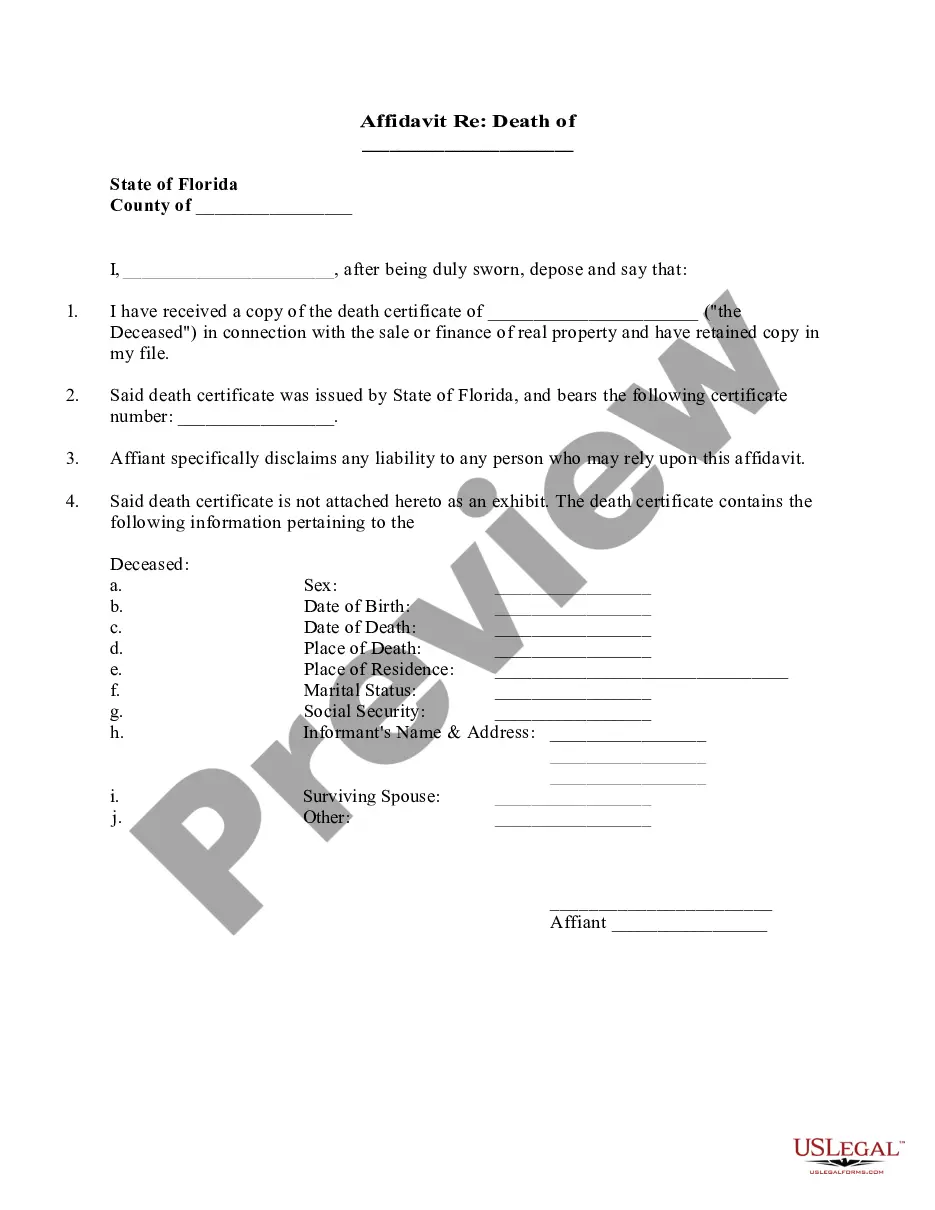

If available, use the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download option.

- Next, you can complete, modify, print, or sign the West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account.

- Every valid document template you obtain is yours permanently.

- To acquire another copy of the purchased form, visit the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/city of choice.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

When writing a letter of settlement, begin by recognizing the details of your dispute and the original terms of the agreement. Clearly outline the new terms, including the settlement amount and payment schedule. Make sure to communicate your desire to resolve the issue and restore the relationship. A professional West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account can help formalize this process.

Writing a letter of payment settlement requires clarity and professionalism. State your account information, the amount being settled, and any terms agreed upon. It is important to express your commitment to fulfill the settlement terms, reinforcing your intention to move forward amicably. A well-drafted West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account can be instrumental in solidifying your settlement agreement.

When requesting a payment arrangement, clearly state your account information and the reason for your request. Outline the payment terms you can manage, including timelines and amounts. Politeness and transparency are crucial, as they help convey your willingness to comply. A West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account can guide you in presenting your proposal convincingly.

To write a letter requesting payment relief, start by explaining your current financial difficulties. Provide details about your account and state your request for relief, such as reduced payments or a temporary hold on the account. Be honest and respectful, emphasizing your commitment to resolving the debt. Utilizing a West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account can help structure your request more formally.

Writing a dispute letter to your business involves stating the issue clearly and providing supporting documentation. Begin by addressing the letter to the appropriate department and including relevant details about your account. Clearly articulate your concerns and the resolution you seek, maintaining a professional tone. A formal West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account is essential if your goal is to negotiate a settlement.

To write an effective debt settlement letter, start by clearly stating your intent to settle the account. Include your account details and a specific offer that reflects your financial situation. Be concise and polite, expressing your willingness to resolve the matter quickly. Utilizing a West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account can guide you in crafting a formal and respectful proposal.

Rule 403 in West Virginia allows the court to exclude relevant evidence if its probative value is substantially outweighed by the risk of unfair prejudice, confusion, or wasting time. This rule ensures fair trial procedures and can impact how evidence is presented in cases involving disputes. If you receive a West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account, understanding this rule may inform your approach to assessing the offer.

Rule 404(b) in West Virginia addresses the admissibility of prior acts in legal proceedings. Essentially, it prevents the use of past behavior to influence the judgment about a person's character unless it has substantial relevance to the current case. This rule can be particularly relevant when evaluating a West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account, as prior conduct might be considered in negotiations.

The 3-term rule in West Virginia refers to a guideline used in certain legal settings, particularly involving contracts and debts. It states that if a business offers a settlement within three terms, you may find more favorable outcomes in negotiations. Understanding this rule could be beneficial, especially when considering a West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account, as it provides a framework for assessing offers.

To file a complaint against a business in West Virginia, you can start by visiting the West Virginia Attorney General's website. They provide a straightforward process for submitting complaints related to consumer issues. After filling out the complaint form, you may want to keep a copy of all correspondence, especially if you receive a West Virginia Settlement Offer Letter from a Business Regarding a Disputed Account, as this can help in resolving your issue.