West Virginia Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

Are you presently in a location where you frequently require documents for both corporate and personal purposes.

Numerous legal document templates are available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the West Virginia Bill of Transfer to a Trust, designed to comply with state and federal regulations.

Select the pricing option that suits you, fill in the necessary information to create your account, and purchase the order via PayPal or a credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the West Virginia Bill of Transfer to a Trust at any time if needed. Simply click on the desired form to download or print the document template.

- If you are familiar with the US Legal Forms site and already have an account, just Log In.

- Subsequently, you can download the West Virginia Bill of Transfer to a Trust template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and verify it is for the correct city/state.

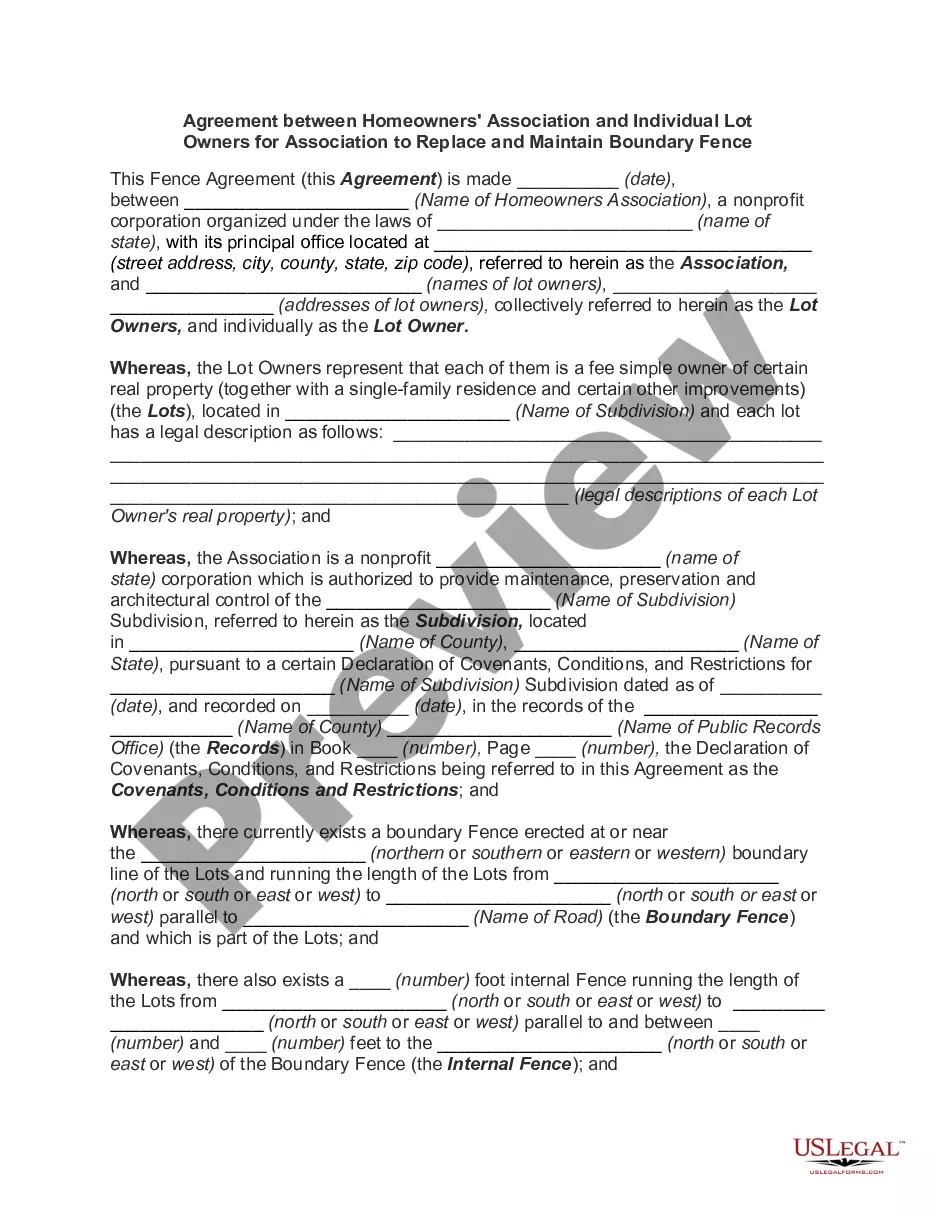

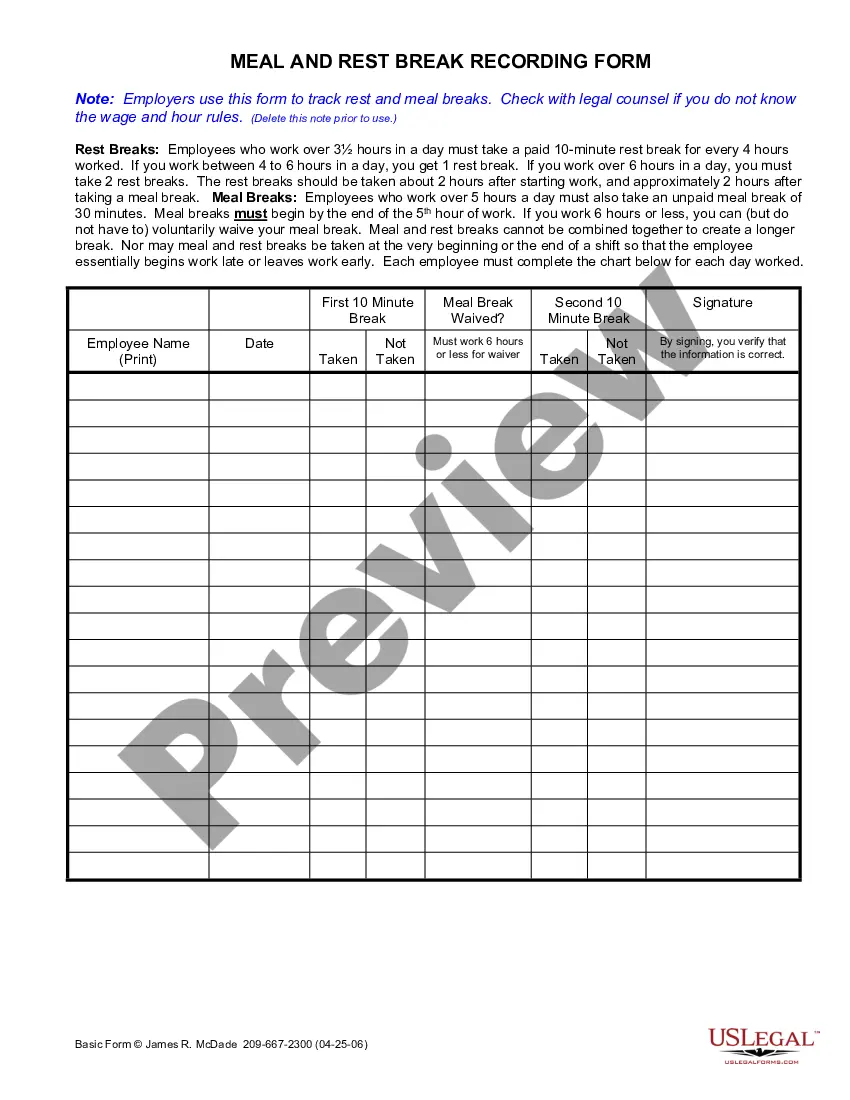

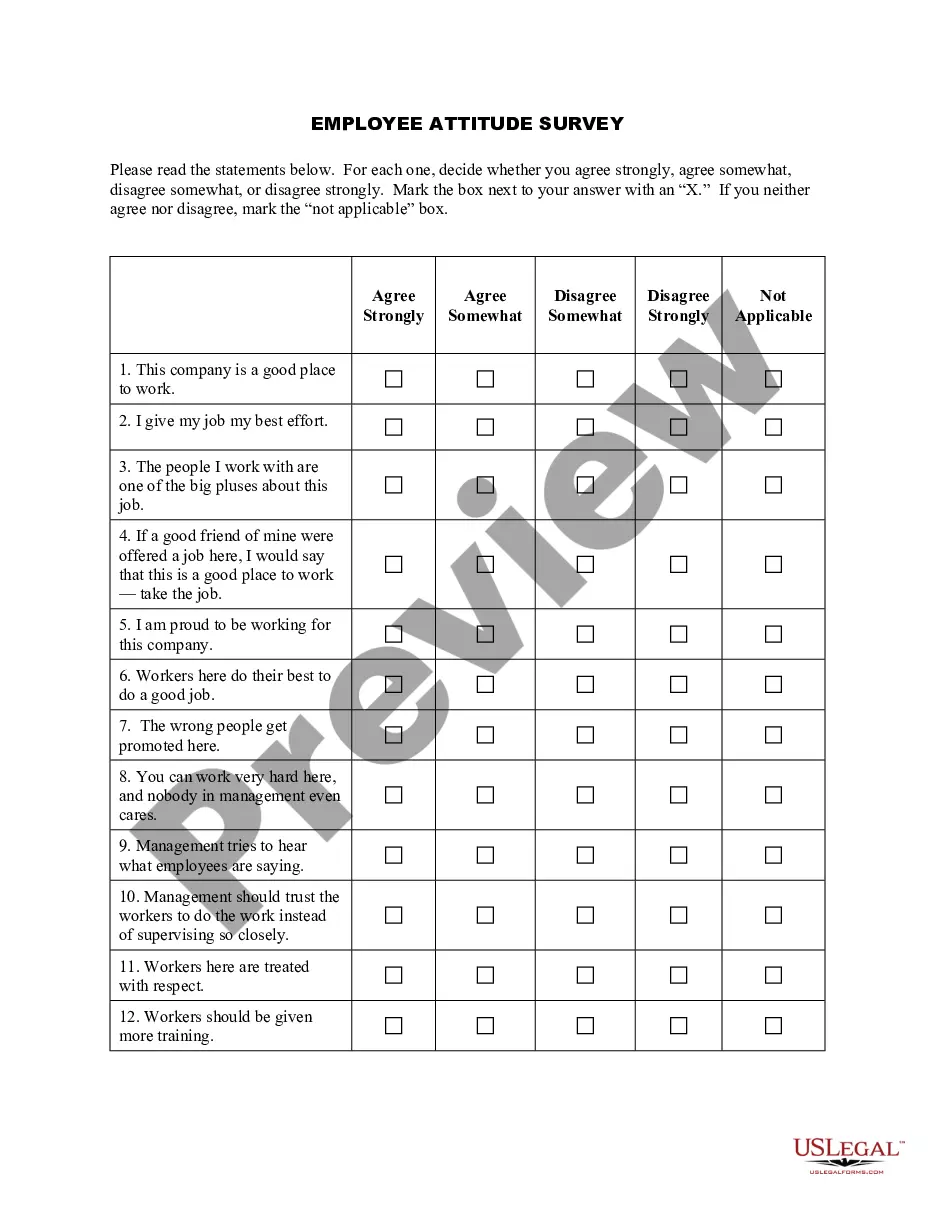

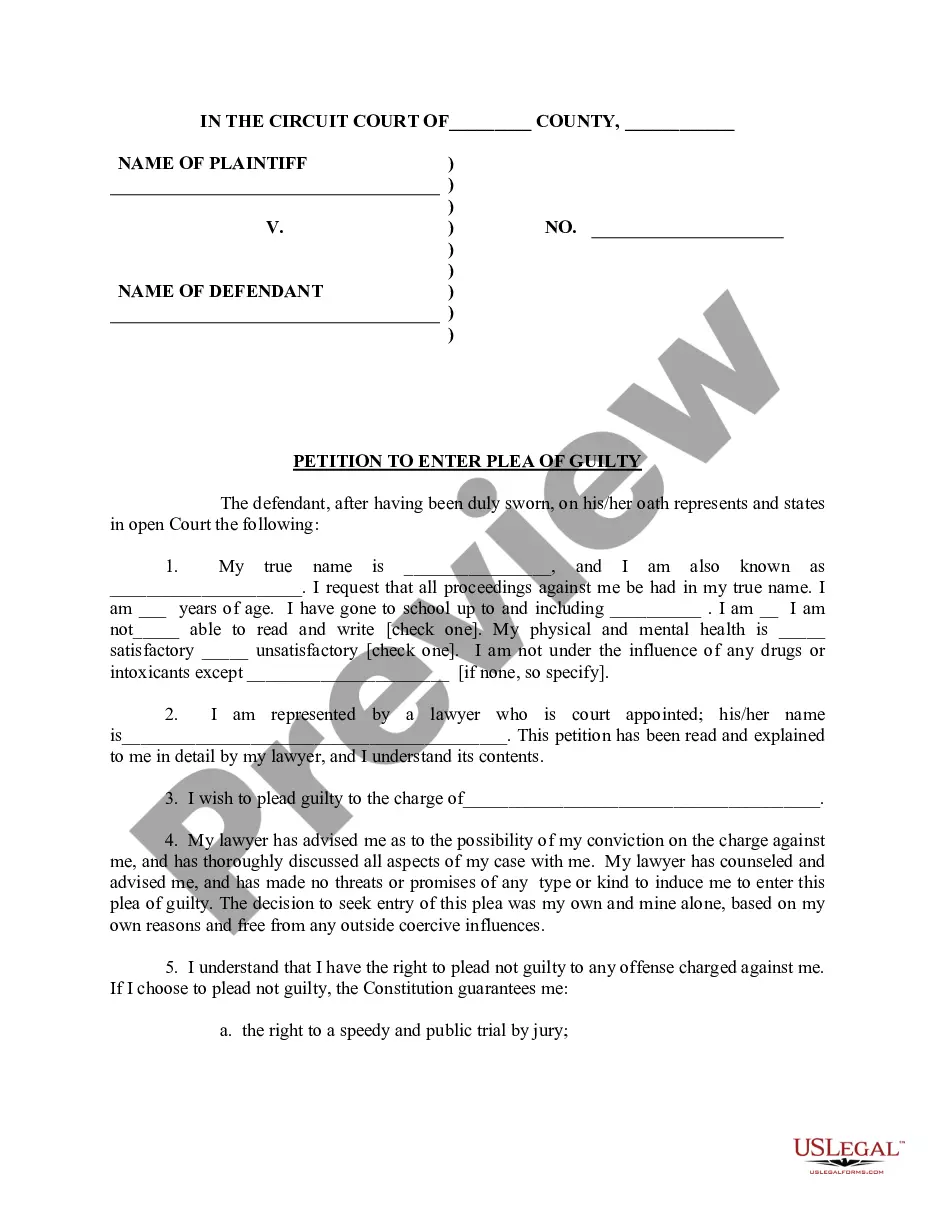

- Utilize the Preview option to review the document.

- Examine the summary to ensure you have selected the accurate form.

- If the form does not match what you are looking for, use the Lookup field to find the form that meets your needs and specifications.

- Once you have found the appropriate form, click on Acquire now.

Form popularity

FAQ

Generally, transferring assets to a trust is not a taxable event under federal law. However, specific aspects of the West Virginia Bill of Transfer to a Trust can influence potential tax implications. It is crucial to consult with a tax advisor or financial professional to understand your unique situation fully. Utilizing resources like US Legal Forms can help you navigate these complexities and ensure you make informed decisions regarding your trust.

Yes, placing bank accounts in a trust can provide substantial benefits. It allows for seamless management of your assets, especially during incapacity, ensuring that your directives are followed according to the West Virginia Bill of Transfer to a Trust. Additionally, this approach may help avoid probate, which can save time and reduce costs for your heirs. Overall, using a trust can offer peace of mind and legal protection for your financial interests.

A West Virginia broker is required to deposit trust funds into a trust account no later than five banking days after receiving them. Timely deposits are essential for safeguarding client funds and adhering to legal standards. This practice is crucial for anyone engaging in a West Virginia Bill of Transfer to a Trust, as it helps ensure the trust's integrity and compliance.

Upon receiving trust funds, a West Virginia salesperson must secure the funds and promptly turn them over to a designated broker or directly deposit them into a trust account. This requirement is critical for maintaining trust and accountability within real estate transactions. Knowledge of these responsibilities helps ensure compliance when dealing with a West Virginia Bill of Transfer to a Trust.

A bill of transfer in a trust refers to the legal document that officially transfers assets into a trust. This document must accurately detail the assets being transferred and the trust's terms and conditions to avoid future disputes. Understanding the components of a bill of transfer is essential for anyone engaging with a West Virginia Bill of Transfer to a Trust, as it formalizes the transition of ownership.

A trustee must include specific identifying information and clearly state the powers granted on a deed of trust in West Virginia. This includes the names of the involved parties, the description of the property, and the purpose of the trust. Proper documentation plays a crucial role in the effectiveness of a West Virginia Bill of Transfer to a Trust, ensuring clarity and legal efficacy.

The transfer rule in West Virginia governs how assets can be moved into a trust, ensuring that the process is legally sound. This rule requires explicit documentation to confirm the transfer, which protects both the trustor and the beneficiaries. For those utilizing the West Virginia Bill of Transfer to a Trust, adhering to this rule is essential for maintaining legal standing.

WV Code 30 40 1 outlines the legal definitions and provisions related to trust funds in West Virginia. It sets forth regulations that govern how trust funds should be managed, emphasizing accountability and transparency. Understanding this code is vital for anyone involved in a West Virginia Bill of Transfer to a Trust, as it ensures compliance with state laws.

To transfer assets to a trust after death, you typically need to go through probate. However, if you have a properly structured West Virginia Bill of Transfer to a Trust, this process can be streamlined. The trust document will guide the executor on how to distribute the assets. It's important to ensure that all documents are in order prior to your passing, reducing confusion for your loved ones.

Certain assets may not belong in a trust, including your primary residence if you rely on homestead exemptions. Additionally, you might want to keep retirement accounts outside a trust due to tax implications. When preparing your West Virginia Bill of Transfer to a Trust, it is crucial to assess which assets align with your estate plan. Consulting with a legal expert can guide you on best practices.