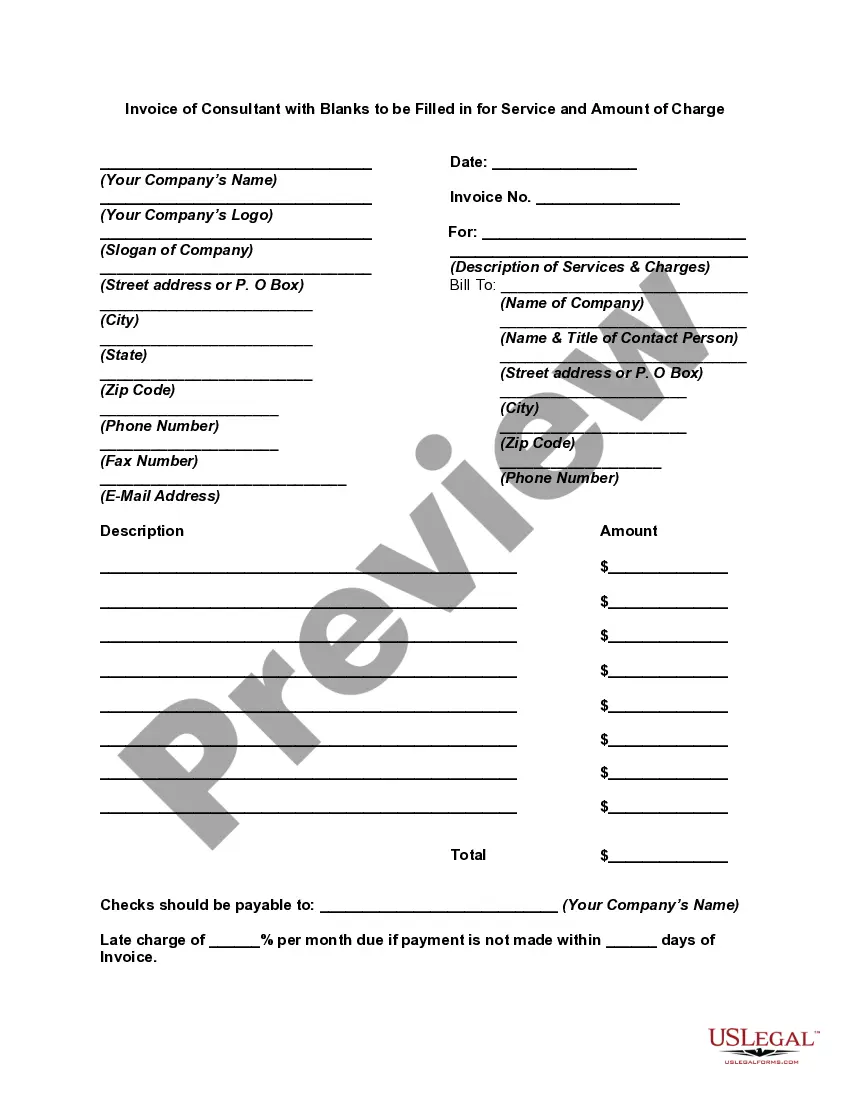

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

West Virginia Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is a crucial document used in the professional services' industry. It serves as a legal agreement and record between a consultant and their client, detailing the services provided and the corresponding charges. This invoice is used in West Virginia, adhering to the specific regulations and requirements of the state. The main purpose of the West Virginia Invoice of Consultant is to provide transparency and clarity regarding the scope of work, expenses, and fees associated with the provided services. It enables both parties to have a clear understanding of the expectations, responsibilities, and financial implications of the consultation engagement. The invoice is typically divided into several sections to capture the necessary information accurately. These sections usually include: 1. Consultant Information: This section is dedicated to capturing the full name, contact details, and any identifying information of the consultant or consulting firm. 2. Client Information: Here, the name, address, and contact information of the client or company availing the consulting services are filled in. 3. Invoice Number and Date: Each invoice is assigned a unique identification number, and the date of issue is recorded for reference and record-keeping purposes. 4. Description of Services: This section allows the consultant to provide a detailed overview of the services rendered. It is important to be clear, concise, and specific while describing the tasks performed, methodologies employed, and any notable outcomes achieved. 5. Service Date(s): The specific dates or duration during which the services were provided or executed are documented in this section. 6. Amount of Charge(s): The charges for each service or task are outlined in this section. The rates can be fixed or based on an hourly, daily, or project-based fee structure, depending on the agreement between the consultant and the client. 7. Subtotal and Tax: The subtotal is calculated by summing up the charges for all the services provided. If applicable, any sales tax, goods and services tax (GST), or other relevant taxes are added to determine the total amount due. 8. Terms and Conditions: This area specifies any additional terms and conditions related to payment methods, due dates, late payment penalties, dispute resolution, and confidentiality agreements, among others. 9. Signature and Contact Information: The consultant signs the invoice to confirm the accuracy and validity of the information provided. Their contact information is also included for easy communication and clarification. There are no different types of West Virginia Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge. However, variations may exist based on industry-specific requirements and individual preferences. Keywords: West Virginia, invoice of consultant, service, amount of charge, legal agreement, record, professional services industry, regulations, transparency, scope of work, expenses, fees, expectations, responsibilities, financial implications, client information, invoice number, description of services, service date(s), amount of charge(s), subtotal, tax, terms and conditions, signature, contact information.