A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

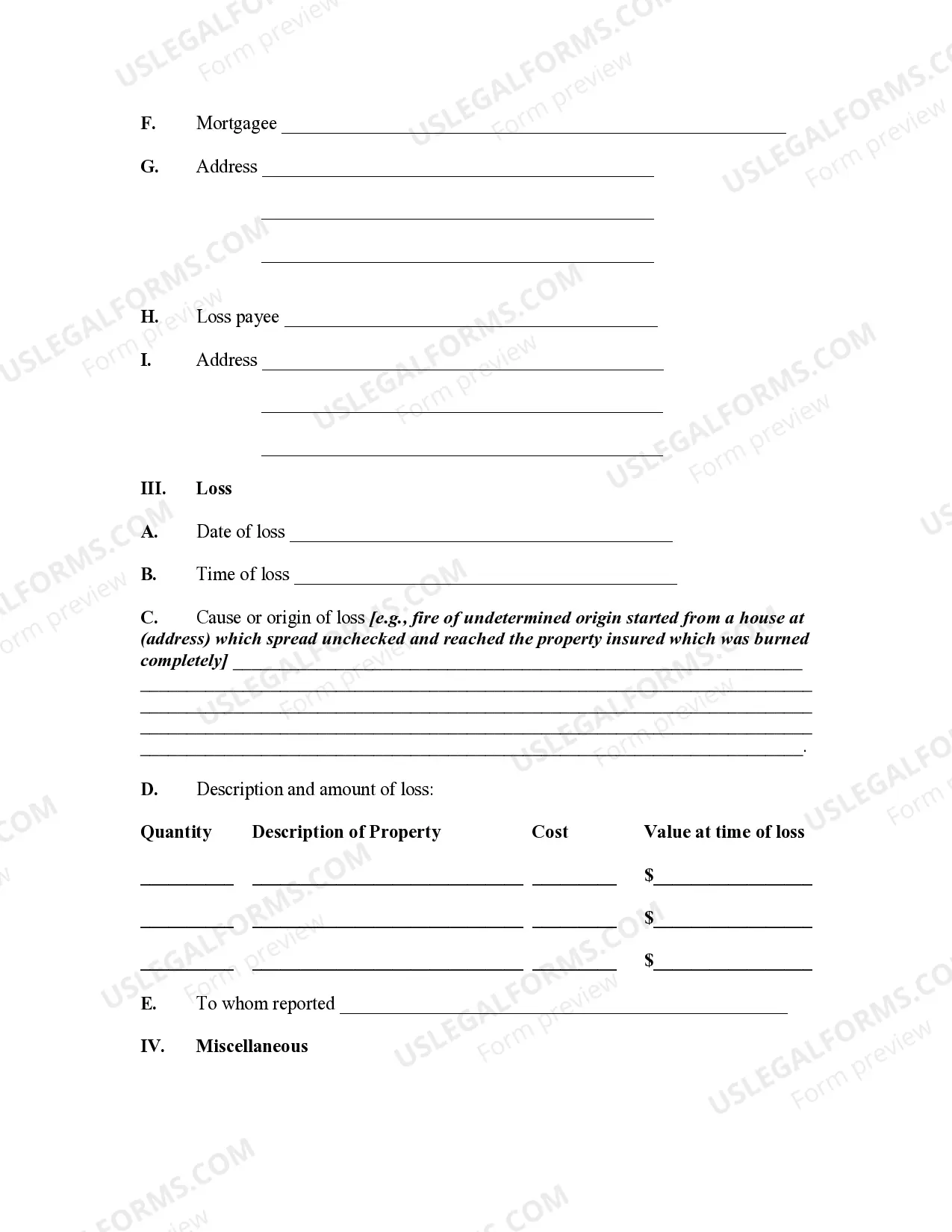

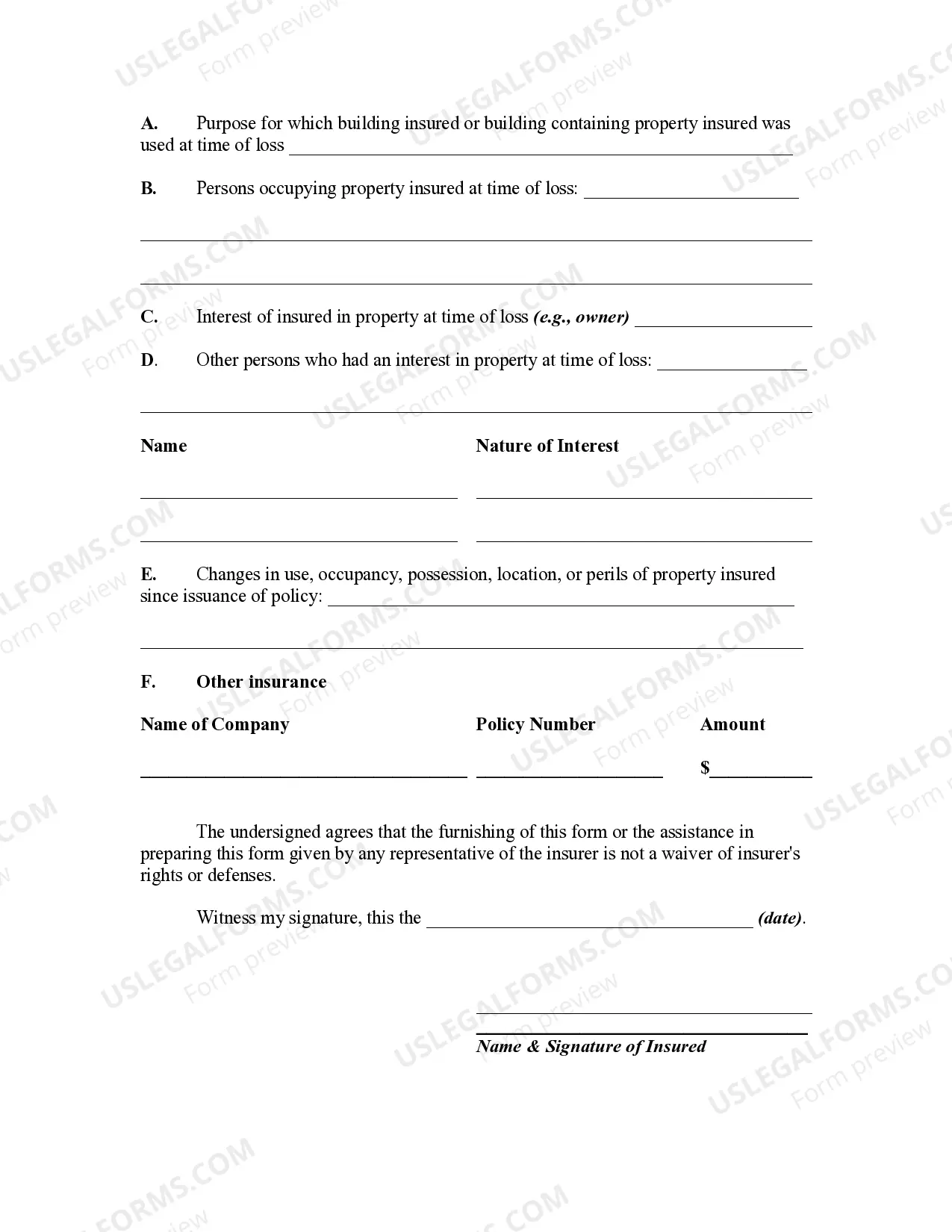

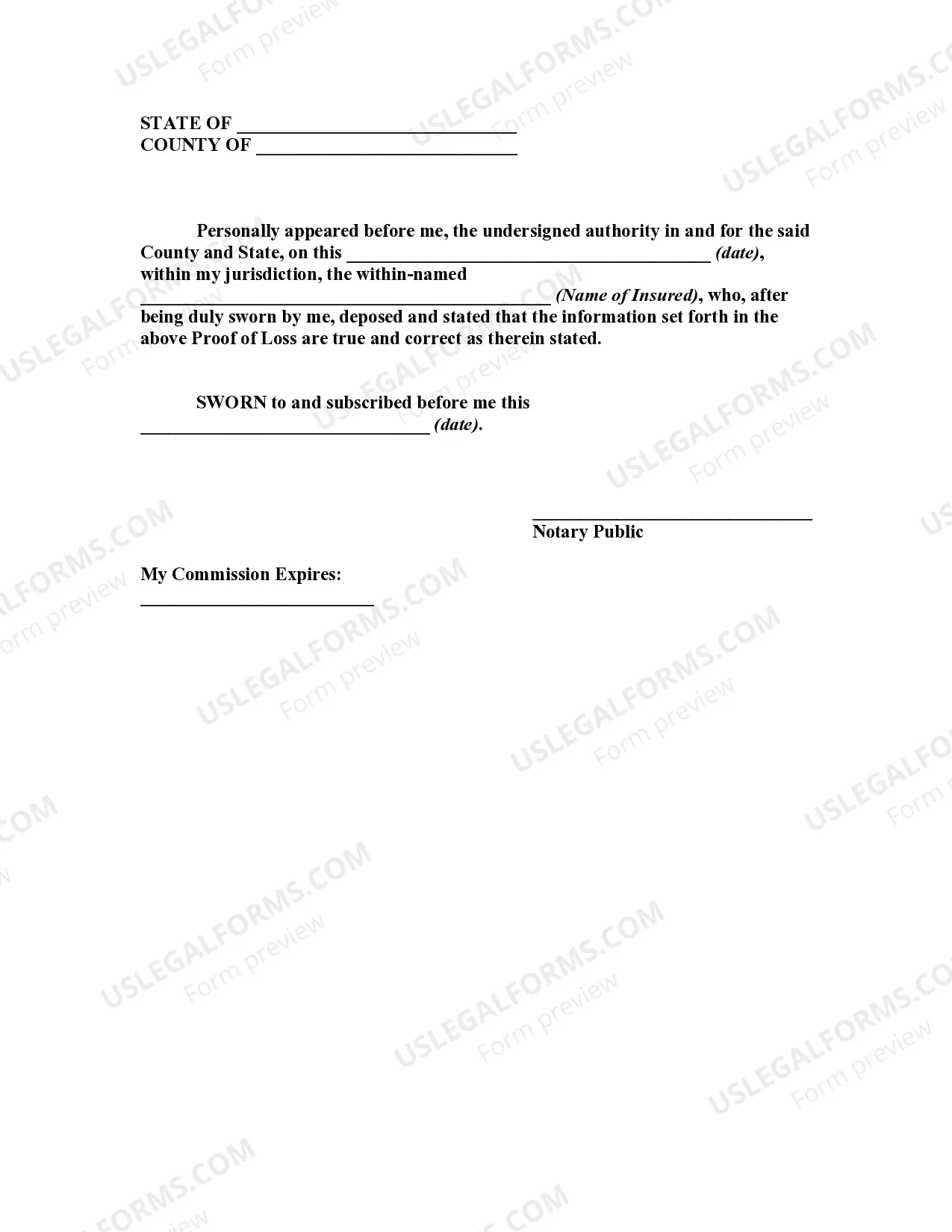

West Virginia Proof of Loss for Fire Insurance Claim: A Comprehensive Overview In the unfortunate event of a fire, West Virginia homeowners and businesses have the right to file a fire insurance claim to recover damages. When initiating an insurance claim, it is crucial to understand the process, including providing a West Virginia Proof of Loss document. This detailed description aims to offer insights into the purpose, requirements, and types of Proof of Loss for fire insurance claims in West Virginia. 1. Purpose of West Virginia Proof of Loss: The Proof of Loss serves as a formal statement required by the insurance company detailing the extent and value of the damages resulting from a fire incident. It provides a comprehensive overview of the losses suffered, including both tangible (property damage, personal belongings) and intangible losses (emotional distress, temporary displacement). This document enables both the insured party and the insurer to assess the validity and extent of the claim accurately. 2. Requirements for West Virginia Proof of Loss: To ensure a successful fire insurance claim, the Proof of Loss must meet several crucial requirements set forth by the insurance company. These requirements may include but are not limited to: a. Detailed information: The Proof of Loss should include a thorough description of the damaged property, including its location, date of purchase, and original cost. It should also provide an itemized list of personal belongings affected by the fire. b. Documentation: The document should be accompanied by supporting evidence, such as photographs, videos, purchase receipts, appraisals, and any relevant documentation illustrating the value of the property and belongings. c. Sworn statement: The Proof of Loss typically requires a sworn statement where the insured party affirms the truthfulness and accuracy of the submitted information. Any false statements may lead to severe legal consequences. d. Timely submission: West Virginia regulations mandate that Proof of Loss must be submitted within a specified timeframe, usually within 60 days from the date of the fire. Failing to adhere to this deadline may result in denial of the claim. 3. Types of West Virginia Proof of Loss for Fire Insurance Claim: Although there is no specific categorization of different types of Proof of Loss, variations may arise depending on the insurer's requirements and the complexity of the fire insurance claim. Some insurers may provide specific templates or forms to streamline the process, while others may require a more customized approach. It is essential to consult with the insurance company directly to obtain the specific Proof of Loss form required for your claim. In conclusion, when filing a fire insurance claim in West Virginia, submitting a comprehensive Proof of Loss is paramount. By meticulously documenting the damages and providing the necessary information and evidence, insured parties can enhance their chances of a successful claims process. Prompt, accurate, and proactive filing of the West Virginia Proof of Loss will enable the insurer to assess the claim efficiently, aiding in the speedy recovery and settlement of fire-related losses.West Virginia Proof of Loss for Fire Insurance Claim: A Comprehensive Overview In the unfortunate event of a fire, West Virginia homeowners and businesses have the right to file a fire insurance claim to recover damages. When initiating an insurance claim, it is crucial to understand the process, including providing a West Virginia Proof of Loss document. This detailed description aims to offer insights into the purpose, requirements, and types of Proof of Loss for fire insurance claims in West Virginia. 1. Purpose of West Virginia Proof of Loss: The Proof of Loss serves as a formal statement required by the insurance company detailing the extent and value of the damages resulting from a fire incident. It provides a comprehensive overview of the losses suffered, including both tangible (property damage, personal belongings) and intangible losses (emotional distress, temporary displacement). This document enables both the insured party and the insurer to assess the validity and extent of the claim accurately. 2. Requirements for West Virginia Proof of Loss: To ensure a successful fire insurance claim, the Proof of Loss must meet several crucial requirements set forth by the insurance company. These requirements may include but are not limited to: a. Detailed information: The Proof of Loss should include a thorough description of the damaged property, including its location, date of purchase, and original cost. It should also provide an itemized list of personal belongings affected by the fire. b. Documentation: The document should be accompanied by supporting evidence, such as photographs, videos, purchase receipts, appraisals, and any relevant documentation illustrating the value of the property and belongings. c. Sworn statement: The Proof of Loss typically requires a sworn statement where the insured party affirms the truthfulness and accuracy of the submitted information. Any false statements may lead to severe legal consequences. d. Timely submission: West Virginia regulations mandate that Proof of Loss must be submitted within a specified timeframe, usually within 60 days from the date of the fire. Failing to adhere to this deadline may result in denial of the claim. 3. Types of West Virginia Proof of Loss for Fire Insurance Claim: Although there is no specific categorization of different types of Proof of Loss, variations may arise depending on the insurer's requirements and the complexity of the fire insurance claim. Some insurers may provide specific templates or forms to streamline the process, while others may require a more customized approach. It is essential to consult with the insurance company directly to obtain the specific Proof of Loss form required for your claim. In conclusion, when filing a fire insurance claim in West Virginia, submitting a comprehensive Proof of Loss is paramount. By meticulously documenting the damages and providing the necessary information and evidence, insured parties can enhance their chances of a successful claims process. Prompt, accurate, and proactive filing of the West Virginia Proof of Loss will enable the insurer to assess the claim efficiently, aiding in the speedy recovery and settlement of fire-related losses.