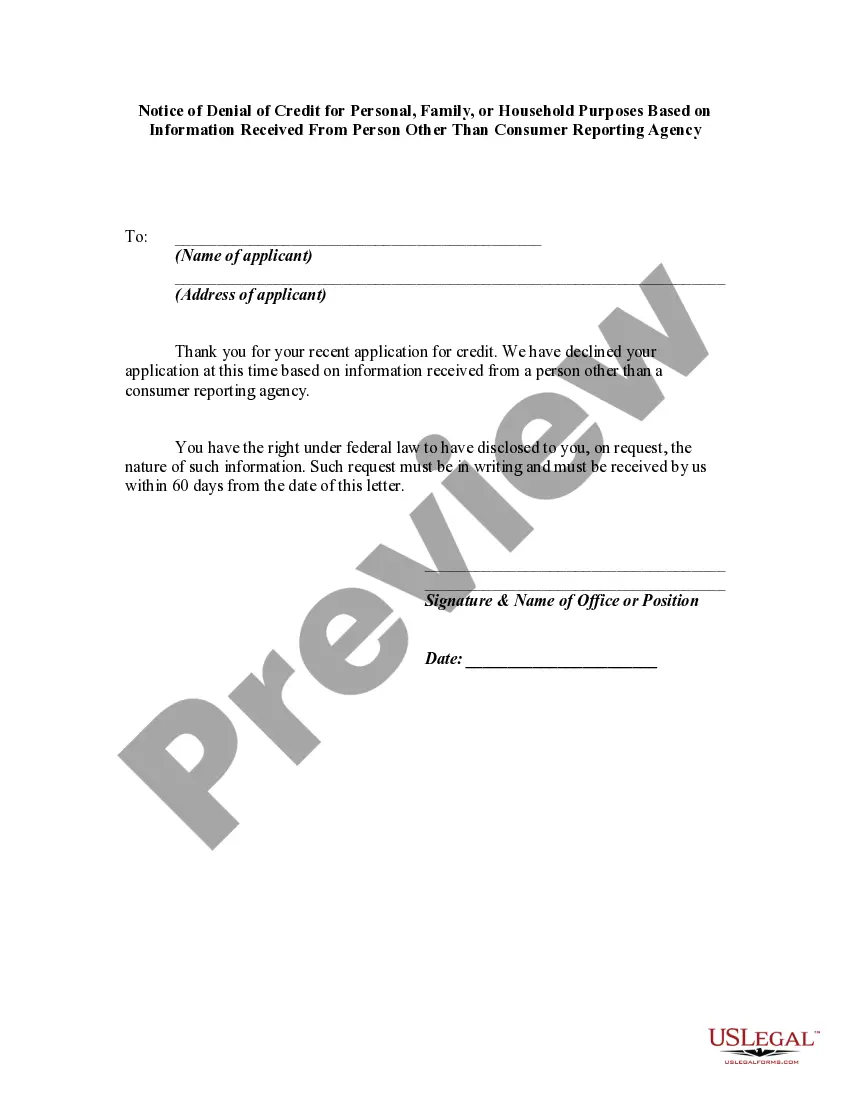

Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information.

West Virginia Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency

Description

How to fill out Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency?

US Legal Forms - one of many largest libraries of authorized varieties in the USA - gives a variety of authorized record templates you can obtain or print. Making use of the site, you can find thousands of varieties for organization and person reasons, categorized by groups, claims, or keywords.You will discover the most up-to-date models of varieties like the West Virginia Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency in seconds.

If you already have a registration, log in and obtain West Virginia Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency from your US Legal Forms catalogue. The Obtain button will show up on each develop you see. You gain access to all earlier downloaded varieties from the My Forms tab of the profile.

If you would like use US Legal Forms the very first time, here are basic recommendations to help you get started out:

- Ensure you have picked the proper develop to your metropolis/region. Select the Review button to examine the form`s content. Read the develop outline to ensure that you have chosen the appropriate develop.

- When the develop does not match your demands, take advantage of the Search area near the top of the display to get the one which does.

- When you are content with the shape, confirm your option by visiting the Acquire now button. Then, opt for the costs program you like and provide your accreditations to register on an profile.

- Method the financial transaction. Utilize your charge card or PayPal profile to perform the financial transaction.

- Pick the format and obtain the shape on your system.

- Make alterations. Fill out, change and print and indication the downloaded West Virginia Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency.

Each and every web template you included with your bank account lacks an expiry day and is the one you have forever. So, if you want to obtain or print an additional copy, just check out the My Forms portion and click on the develop you will need.

Get access to the West Virginia Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency with US Legal Forms, by far the most extensive catalogue of authorized record templates. Use thousands of professional and state-certain templates that fulfill your small business or person requirements and demands.

Form popularity

FAQ

THE ACT, WHICH SAFEGUARDS CONSUMERS BY REQUIRING FULL DISCLOSURE OF THE TERMS AND CONDITIONS OF FINANCE CHARGES IN CREDIT TRANSACTIONS OR IN OFFERS TO EXTEND CREDIT, IS PRESENTED AS AMENDED THROUGH MARCH 1976.

Creditors have five (5) years to file their debt collection suit for the sum of money owed on an open account. If the debt is for the non-payment of an outstanding balance on a credit card, then the creditor has ten (10) years to file a collection lawsuit against the debtor.

West Virginia law, specifically WV Code §46A-2-127, states that debt collectors should not deceive, mislead, or perform fraudulent activities when collecting and attempting to collect a debt. Examples of these bad business practices include: Refusal to give their true name and hide behind the company's name.

The Truth in Lending Act ensures that creditors provide complete and honest information. The Fair Credit Reporting Act regulates credit reports. The Equal Credit Opportunity Act prevents creditors from discriminating against individuals.

West Virginia law, specifically WV Code §46A-2-127, states that debt collectors should not deceive, mislead, or perform fraudulent activities when collecting and attempting to collect a debt. Examples of these bad business practices include: Refusal to give their true name and hide behind the company's name.

Under the FCRA, Consumer Reporting Agencies are defined as persons who regularly engage in the practice of assembling or evaluating consumer credit information for the purpose of furnishing consumer reports to third parties. 15 U.S.C. § 1681a(f).

The West Virginia Consumers Credit and Protection Act requires every person engaging in this State in making consumer credit sales or consumer loans and every person having an office or a place of business in this State who takes assignments of and undertakes direct collection of payments from or enforcement or rights ...

Virginia law does not adhere to the Uniform Deceptive Trade Practices Act, but the Virginia Consumer Protection Act of 1977 bans false advertising, automobile odometer tampering, and other deceptive methods. Individuals, commonwealth attorneys, and the state attorney general may file suit for violations.