No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

West Virginia Collection Agency's Return of Claim as Uncollectible

Description

How to fill out Collection Agency's Return Of Claim As Uncollectible?

If you need to fulfill, acquire, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site’s straightforward and user-friendly navigation to locate the documents you need.

Numerous templates for business and personal purposes are sorted by categories and regions, or keywords.

Step 4. After locating the form you need, click on the Get now button. Select your preferred payment plan and enter your information to register for an account.

Step 5. Complete the payment process. You may use your Visa or Mastercard or PayPal account to finalize the purchase. Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, edit and print or sign the West Virginia Collection Agency's Return of Claim as Uncollectible.

- Utilize US Legal Forms to retrieve the West Virginia Collection Agency's Return of Claim as Uncollectible with just a few simple clicks.

- If you are an existing US Legal Forms customer, Log In to your account and select the Download option to obtain the West Virginia Collection Agency's Return of Claim as Uncollectible.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the appropriate state/region.

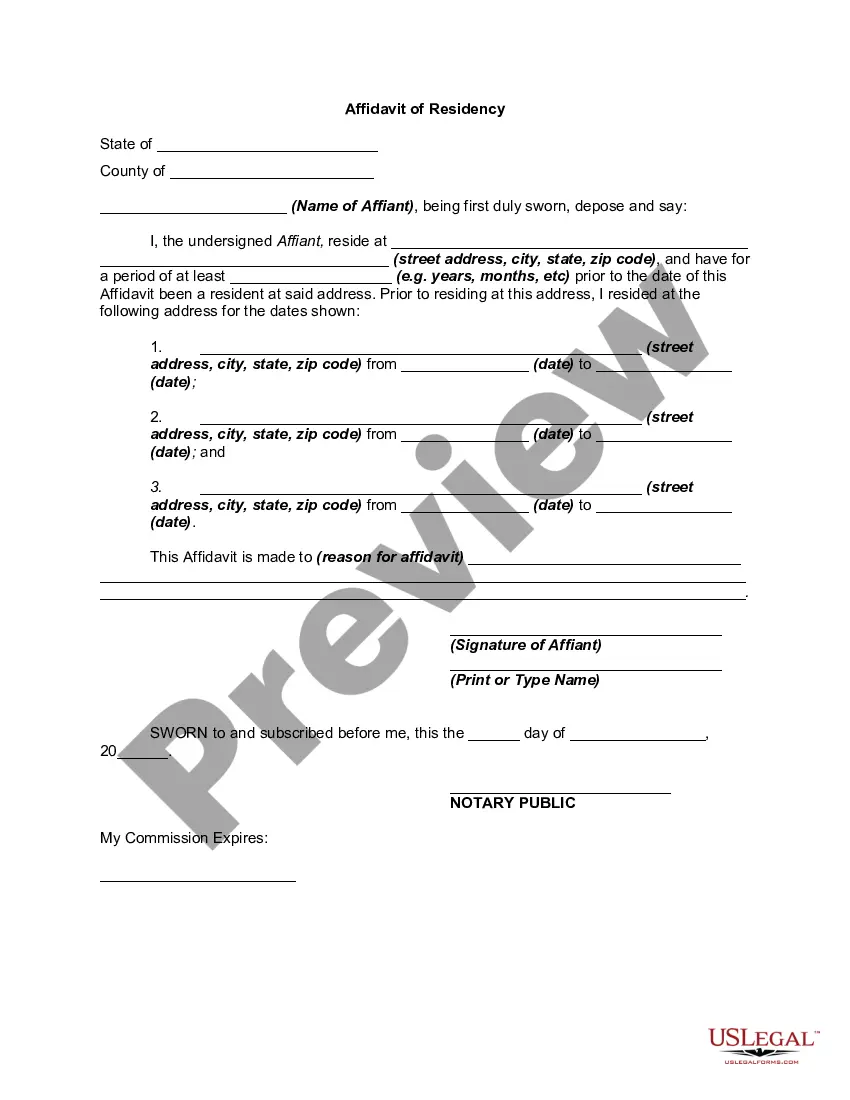

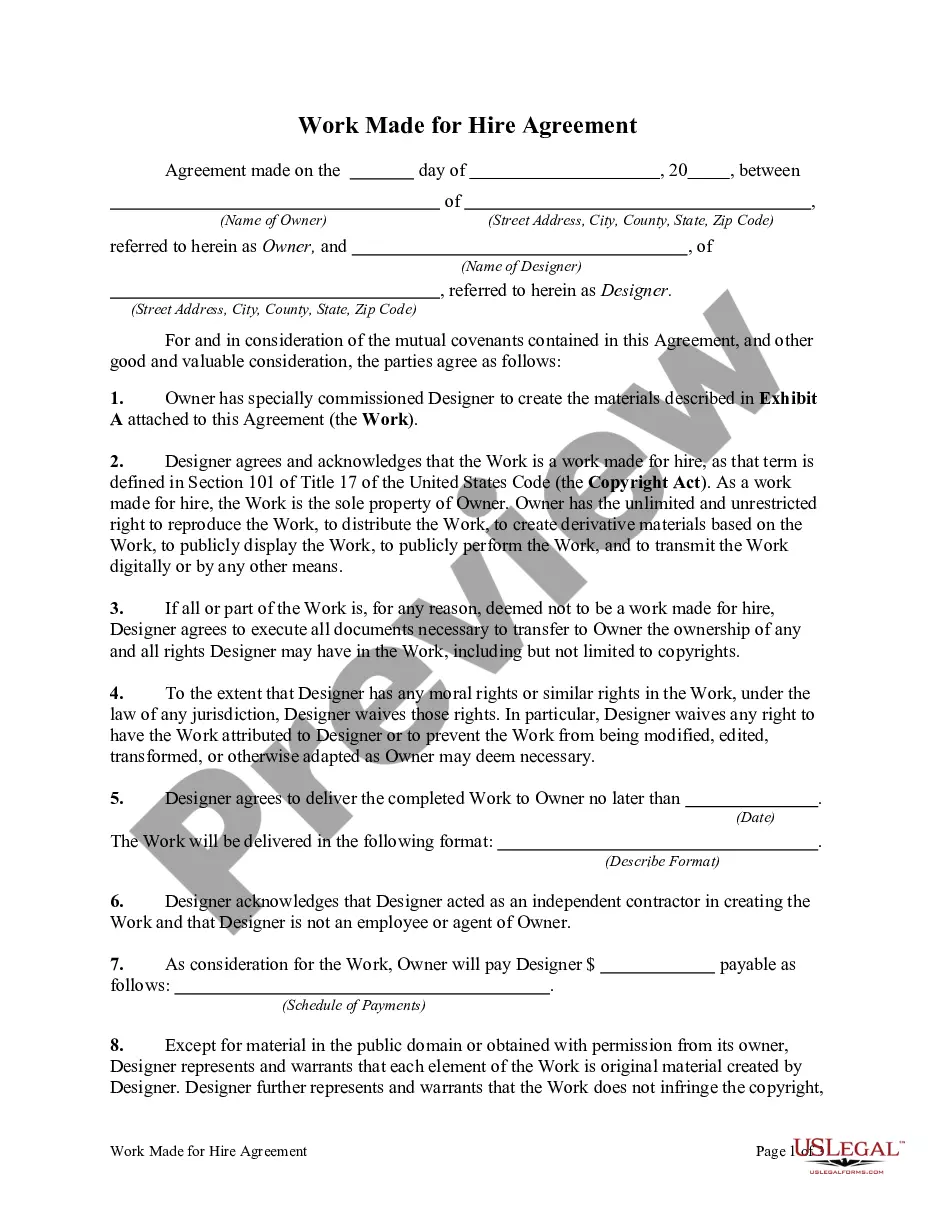

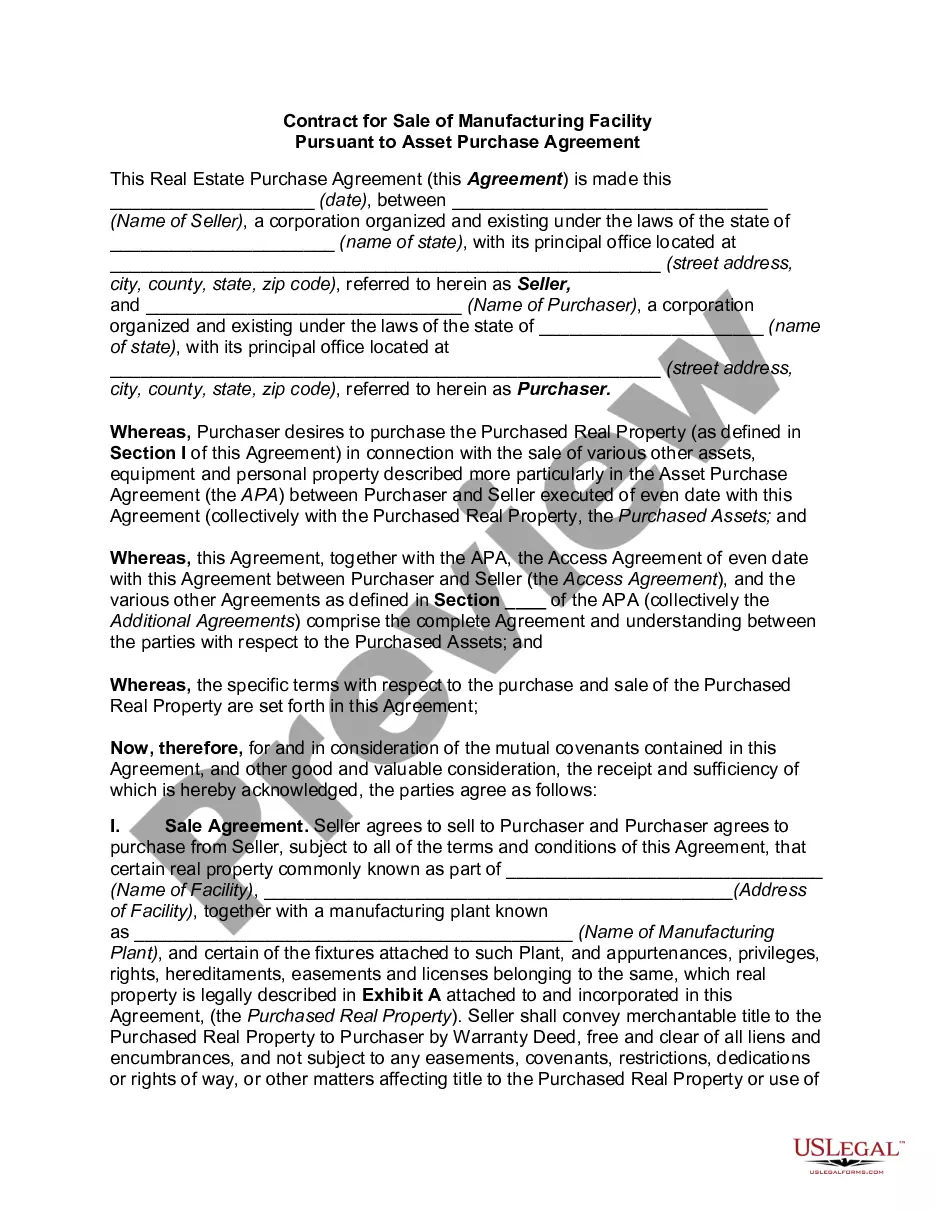

- Step 2. Use the Review feature to examine the form’s details. Don’t forget to check the summary.

- Step 3. If you are not pleased with the form, use the Search section at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

No execution shall be issued and no action brought on a judgment, including a judgment in favor of the Commonwealth and a judgment rendered in another state or country, after 20 years from the date of such judgment or domestication of such judgment, unless the period is extended as provided in this section.

Debt collectors can restart the clock on old debt if you: Admit the debt is yours. Make a partial payment. Agree to make a payment (even if you can't) or accept a settlement.

Unpaid credit card debt is not forgiven after 7 years, however. You could still be sued for unpaid credit card debt after 7 years, and you may or may not be able to use the age of the debt as a winning defense, depending on the state's statute of limitations. In most states, it's between 3 and 10 years.

In Virginia, there is a statute of limitations, also known as the length of time debt collectors have to recover the unpaid debt. In a written contract, debt collectors generally have a five-year period to try and collect or take legal action. However, a three-year period applies for oral contracts.

Making a payment: Making a payment on an old debt, whether in full or part, revives it, essentially restarting the clock on old debt. Agreeing to pay: If you acknowledge that the debt is yours and agree to pay, the statute of limitations on your debt will start over.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

Statute of Limitations in Virginia Oral debts (no written contract), 3 years. Auto loans, 4 years. Credit cards, 5 years.

It's possible in some cases to negotiate with a lender to repay a debt after it's already been sent to collections. Working with the original creditor, rather than dealing with debt collectors, can be beneficial.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.