West Virginia HIPAA Release Form for Insurance: Detailed Description and Types The West Virginia HIPAA release form for insurance is a crucial document that allows individuals to authorize the disclosure of their protected health information (PHI) by healthcare providers to insurance companies. This form ensures compliance with the Health Insurance Portability and Accountability Act (HIPAA) regulations and is essential for maximizing insurance coverage and facilitating claims processing. The form contains several key components to ensure that the release of PHI is done securely and with the explicit consent of the patient. It requires individuals to provide their full name, contact information, and insurance policy details. Additionally, the form outlines the specific purpose for which the PHI will be disclosed to the insurance company, such as claim processing, coverage determination, or utilization review. Furthermore, the West Virginia HIPAA release form for insurance specifies the types of health information that can be disclosed, ensuring that only essential data is shared. This may include medical records, test results, treatment plans, medications, and any other pertinent information related to the insurance coverage or claims. Patients have the option to limit the duration of this release or specify an expiration date to maintain control over their information. Different types of West Virginia HIPAA release forms for insurance may exist, depending on distinct settings or purposes: 1. General HIPAA Release Form: This standard release form allows the disclosure of PHI for insurance purposes in a comprehensive manner. It encompasses various insurance-related activities such as claims, coverage determination, appeals, and coordination of benefits. 2. Specific Purpose Release Forms: These forms are tailored to disclose PHI for specific insurance purposes, such as pre-authorization for a particular procedure, review of medical necessity, or disability claims. They focus on one specific aspect of the insurance process, providing targeted authorization and privacy protection. 3. Research Release Forms: In cases where health insurance data is required for research purposes, specialized release forms are used. These forms ensure compliance with both HIPAA regulations and additional guidelines for research data protection, enabling the disclosure of PHI for approved scientific studies while safeguarding patient privacy. It is important to note that the use of these West Virginia HIPAA release forms for insurance is essential for maintaining the privacy and security of patients' health information. By explicitly authorizing the disclosure and specifying the purpose, individuals can ensure that their PHI is shared with insurance companies as needed while still preserving their rights and ensuring confidentiality.

West Virginia Hippa Release Form for Insurance

Description

How to fill out West Virginia Hippa Release Form For Insurance?

If you need to comprehensive, acquire, or print out lawful papers themes, use US Legal Forms, the biggest selection of lawful types, that can be found on the Internet. Make use of the site`s simple and hassle-free lookup to get the documents you require. Different themes for enterprise and person uses are categorized by classes and states, or keywords and phrases. Use US Legal Forms to get the West Virginia Hippa Release Form for Insurance in a number of clicks.

Should you be already a US Legal Forms buyer, log in to the bank account and then click the Obtain switch to find the West Virginia Hippa Release Form for Insurance. You can even gain access to types you previously saved from the My Forms tab of your bank account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for that correct town/region.

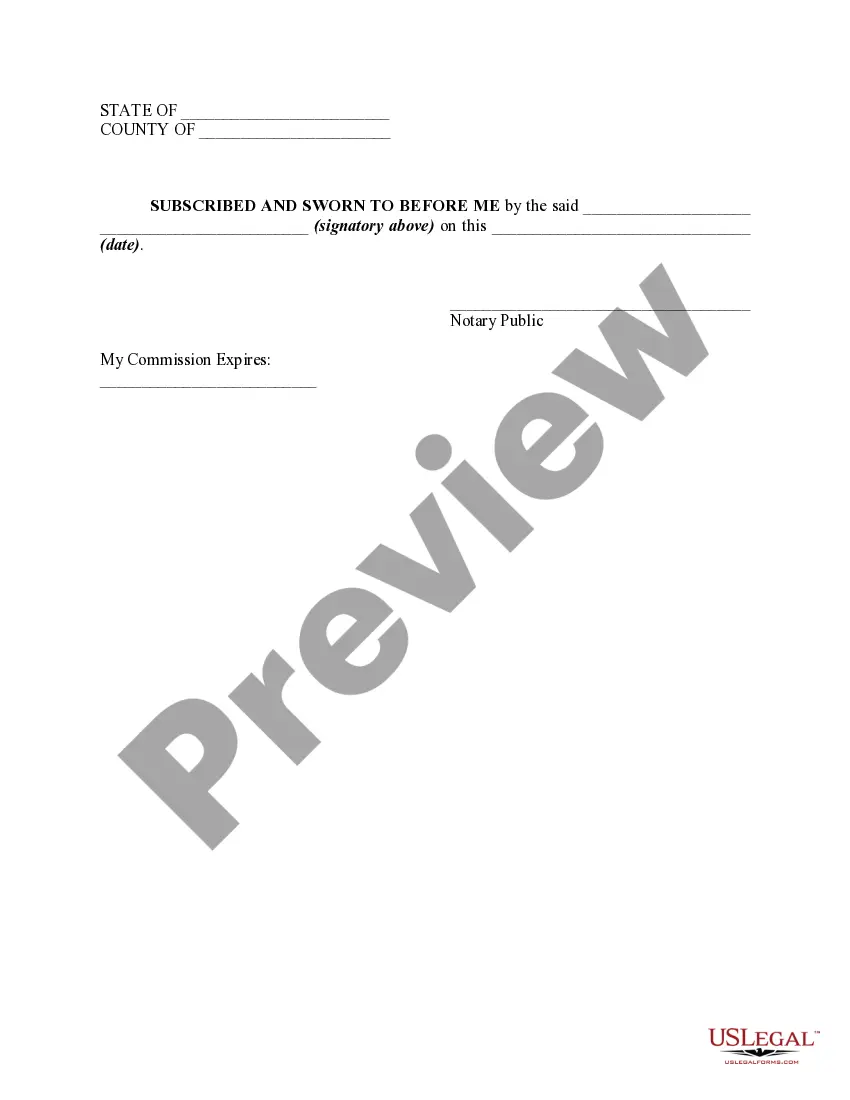

- Step 2. Make use of the Preview method to examine the form`s content material. Do not forget to see the outline.

- Step 3. Should you be not happy with the form, utilize the Lookup field near the top of the screen to get other versions from the lawful form design.

- Step 4. After you have identified the shape you require, click on the Get now switch. Select the pricing plan you choose and include your credentials to sign up to have an bank account.

- Step 5. Approach the financial transaction. You may use your charge card or PayPal bank account to accomplish the financial transaction.

- Step 6. Choose the file format from the lawful form and acquire it on your system.

- Step 7. Total, modify and print out or indication the West Virginia Hippa Release Form for Insurance.

Each and every lawful papers design you acquire is your own property permanently. You possess acces to every single form you saved with your acccount. Click on the My Forms segment and choose a form to print out or acquire once again.

Remain competitive and acquire, and print out the West Virginia Hippa Release Form for Insurance with US Legal Forms. There are many professional and status-certain types you may use for your personal enterprise or person demands.