This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

Are you in a circumstance where you will require documents for either organizational or personal purposes on a daily basis.

There are many legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, including the West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property, designed to comply with federal and state regulations.

When you find the right form, click Acquire now.

Choose your desired pricing plan, complete the required information to create your account, and finalize the purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/area.

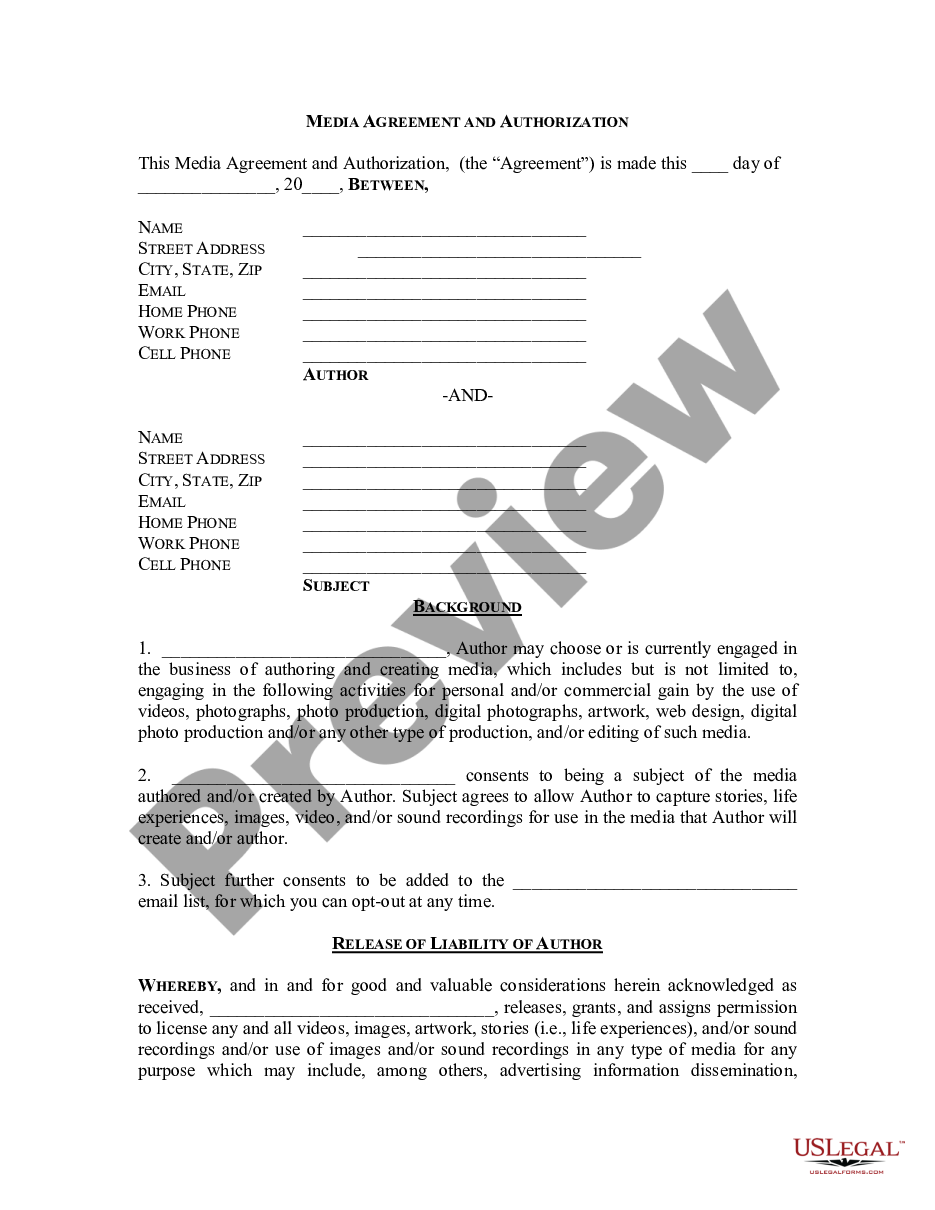

- Use the Preview button to review the form.

- Read the description to confirm you have selected the correct form.

- If the form isn’t what you are looking for, use the Lookup section to find the form that suits your needs.

Form popularity

FAQ

In West Virginia, anyone operating a business that sells goods or services typically requires a business license. This includes sole proprietors, partnerships, and corporations. Various professions may also have specific licensing requirements. If your business includes dealings with real property, be sure to consider the West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property for complete compliance.

Determining whether you need a business license in West Virginia depends on various factors, such as the type of business you operate and its location. It is advisable to check with local authorities or visit the West Virginia Secretary of State's website for specific requirements. If your business involves real property, understanding the West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property will also aid in your compliance.

To operate as a sole proprietor in West Virginia, you need to obtain any necessary licenses or permits for your specific business. Additionally, keeping accurate financial records is essential for tax purposes. If you plan to dissolve any business interests related to real estate, understanding the West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property will provide necessary insights.

Closing a sales tax account in West Virginia involves a few straightforward steps. You need to file a final sales tax return, indicating that you’re no longer in business. Once that is submitted, contact the West Virginia State Tax Department to confirm the closure. If your situation includes property interests, refer to the West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property for additional guidance.

Yes, a sole proprietorship is recognized as a legitimate business structure in West Virginia. It allows you to operate your business independently without forming a separate legal entity. However, as a sole proprietor, you should be aware of your legal obligations, including any requirements related to the West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property if your business involves property.

In West Virginia, a sole proprietor typically needs a business license to operate legally. This requirement can vary based on the type of service or product offered. Consider checking with your local government or the West Virginia Secretary of State's office for specific guidelines. Additionally, if your business involves real property transactions, a West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property may also be relevant to ensure compliance.

Upon dissolution, an LLC's property does not automatically belong to any individual member; it must be distributed according to the LLC’s operating agreement and state laws. The West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property can help clarify ownership issues regarding real estate. It’s crucial to document this process properly to avoid future disputes.

Dissolving an LLC may lead to the loss of business reputation and potential financial setbacks if not managed properly. Additionally, there may be tax implications based on asset liquidation. Engaging with the West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property can help mitigate risks related to real estate assets during dissolution.

Dissolving an LLC refers to the formal process of ending the business's existence, while terminating relates more to stopping business operations before the official dissolution. Utilizing the West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property clarifies the options during dissolution, especially regarding real property ownership. Understanding these terms helps members make informed decisions.

To dissolve a business in West Virginia, you must follow specific state procedures which include filing Articles of Dissolution with the Secretary of State. Additionally, addressing any outstanding obligations and distributing assets per the West Virginia Agreement Dissolving Business Interest in Connection with Certain Real Property is crucial. Completing these steps ensures that you wrap up your business affairs properly and legally.